The Italian referendum

What’s at stake: on 4 December, Italy will hold a referendum on a proposed constitutional reform approved by Parliament in April. The reform, which wa

Yes, or No, that is the question. Marco Simoni - who is currently an economic advisor to PM Renzi - argues that the proposed reform would address a number of key institutional weaknesses in the country. By improving the functioning of Italian democracy, it would help establish proper accountability and trust in the political system. Mattia Guidi also makes the case for voting in favour of the reform, arguing that much of the criticism of the reform is unfounded and that it would ultimately bring Italy closer to the parliamentary systems used in other European countries.

Fabio Bordignon argues that a Yes vote will potentially lead to a more presidential form of politics, while a No vote could generate substantial uncertainty over the country’s political trajectory. He argues that the victory of Renzi’s camp would lead to a majoritarian – and de facto presidential – democracy, inaugurating Italy’s ‘Third Republic’.

Gianfranco Pasquino and Andrea Capussela provide a comprehensive assessment of the proposed reforms, arguing that they would be unlikely to meaningfully improve Italian governance and could reduce levels of political accountability, thus concluding that the reform is ill-conceived and should be safely rejected.

Valentino Larcinese also makes the case for No, arguing that the proposed reform would remove much needed checks and balances on executive power in Italy, while the government’s approach having the reform enacted is also worthy of rejection in its own right.

The effect that this reform would have on reducing the cost of politics has been a prominent argument in the debate. Roberto Perotti - who has been economic counsellor to the Prime Minister from September 2014 to December 2015 - estimates that the reform would produce savings of maximum €140m two years after entry into force and €160m once fully implemented. The bulk of this comes from the reduction in the number of senators and the abolishment of their financial indemnity (savings of €107m in 2020 and €131m in 2030). The estimate is however subject to uncertainty, as the reforms also seem to increase some of the costs related to the Senate due to the re-definition its activities.

Earlier in the referendum campaign, Prime Minister Matteo Renzi linked the result to the fate of his government, suggesting he would resign in the case of a No vote. Céline Colombo, Andrea De Angelis and Davide Morisi illustrate that this “personalisation” strategy was not wise. The survey is based on a panel of 2,279 respondents, some of which were asked to read either an argument in favour or an argument against the reform, taken from the public debate on the referendum and concerning key elements of the reform. Other respondents did not read any arguments, but only a simple “government cue”, i.e. a sentence stating that “the reform was proposed by and represents one of the key points of Matteo Renzi’s government”.

Results suggest that pro arguments failed to increase support for the reform, while exposure to one of the main arguments against the reform significantly reduced support among the participants. However, support for the reform also declined when the participants did not read any arguments, but only a simple government cue. So voter support for the reform seem to decline when it is explicitly linked to the government, while a Yes campaign focused solely on the content of the reform may find consensus among a majority of voters on some of the key elements of the proposal.

Pierpaolo Barbieri instead says that in order to reform Italy, Renzi must resign no matter what the outcome of the referendum will be. He argues that Renzi’s critics may carp, but none of them could muster an alternative majority capable of delivering reform on the scale he did, and it is no wonder Italy’s trade unions are trying to use this referendum to get rid of him and preserve the status quo. Italy needs Renzi: with the center-right in disarray and the center-left jealous of his appeal, the only governing alternative might be the 5 Star Movement started by Grillo, a movement that openly eschews government experience.

Europe also needs Renzi: at the most recent elections to the European Parliament, he led his party to a larger share of the vote than Angela Merkel. Renzi is a constructive pro-European who can criticise Germany for its resistance to the deeper federalisation that the Continent needs for the monetary union to be sustainable. This, Barbieri argues, is why he should announce his intent to resign no matter the referendum outcome. He’s more important for Italy, both at home and abroad, than voters realise. Only by upping the stakes can he both depersonalise the referendum and reveal the vacuity of his opponents’ positions.

Mark Gilbert on Bloomberg Views looks at the market sentiment, and notices that Italy's 10-year borrowing cost has been steadily marching above that of Spain since the middle of the year and argues that the bond market is right to worry about the Italian vote. What's worrying investors isn't Renzi's failure to implement his institutional reform package, but what happens if the Prime Minister were to resign and there would an election.

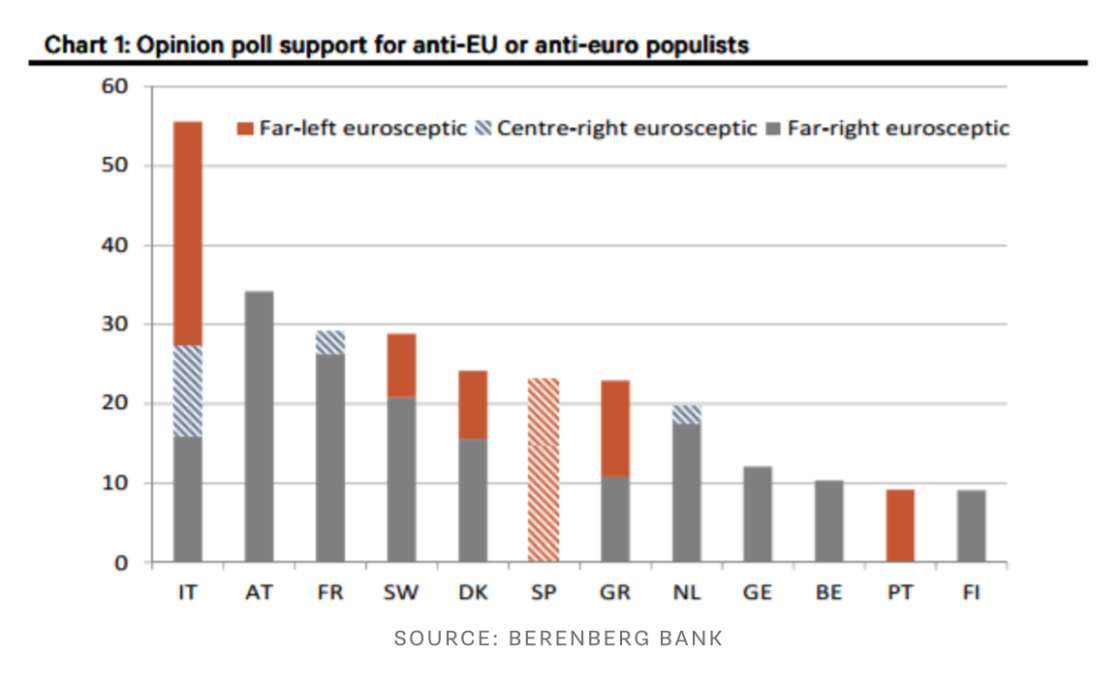

The problem with this scenario is that political parties either calling for a referendum on Italy's euro membership or expressing ambivalence to the project might command more than 50 percent of the vote in the case of early elections, as it is strikingly evident in the chart below (from Berenberg Economics).

Carmen Reinhart notices that after the surprise victory in June of the “Leave” campaign in the Brexit referendum, and of Donald Trump in the United States’ presidential election, no one has much faith in polls in advance of the Italian vote. However, she argues that there is a disquieting real-time poll of investors’ sentiment: the fact that capital flight from Italy has accelerated this year. She compares this to the precedent of the Greek referendum, saying that the two countries share similarities, particularly long periods of low growth and problems in the banking sector.

Erik Nielsen points out that on top of facing uncertainty regarding the outcome of the referendum, Italy also faces uncertainty with respect to the future of the electoral law (the so-called “Italicum”), which entered into force in July. The Italicum was designed and passed, with a view to the expected constitutional change that will be voted shortly. It changes the electoral law for the lower house from a proportional system to a “winner take all” system that grants a large number of bonus seats (340 seats out 630) to the party winning at least 40% of the votes, or to the party winning a second round between the two biggest parties.

The constitutionality of the Italicum has been challenged in court, and Nielsen thinks that it is likely to be changed because it is too dangerous in a multi-party system with an out-of-mainstream radical party (Five Star) in the running. Nielsen sees two main scenarios: a yes-vote, which would usher in a system of simpler governance and a more powerful government; or a no-vote, which may mean the formation of a caretaker government in charge of changing the Italicum and then call elections, essentially meaning a continuation of the past (and present) state-of-affairs.

Lorenzo Codogno and Mara Monti write that while some observers have pointed to the risk of the Five Star Movement getting into power, or even Italy leaving the euro, these are unlikely developments, at least in the short term. The real issue is not about political instability, but about financial stability: the combination of still modest economic expansion, vulnerability in the public finances and, more importantly, ongoing problems in the banking sector may ultimately lead to a dangerous mix.

The healing of the banking sector is conditional on the end-year MPS operation going smoothly and positively, thereby providing a positive backdrop for all other smaller operations. A positive conclusion needs a stable political environment to provide investors sufficient confidence to invest. In turn, failure in the MPS operation would trigger government intervention, and this may prove difficult if there is no government in place or the new government is weak and has a limited mandate. In Italy’s already upside-down political world, the referendum would sentence Italy’s banking sector to death by “murdering the time” needed for its recovery.