How to make the single market more inclusive after Brexit

The creation of the single market generated winners and losers. Yet redistribution remains first and foremost a competence of national governments.

The single market has been the cornerstone of European integration since 1957. With over 500 million consumers and €13 trillion GDP, it is considered the largest market in the world. Recent estimates suggest that EU GDP per capita would be as much as 12% lower without European integration. In addition, Mariniello et al (2015) illustrate how these benefits could be even greater, if integration were deepened in areas such as services, public procurement and free movement of workers, just to mention a few. Crucially, a complete and functioning single market would help foster productivity growth – something the EU sorely needs in order to preserve its long-term prosperity at a time of challenging demographic prospects.

Following the Brexit vote, the EU loses one of its evergreen champions of free trade, meaning that some single market initiatives might lose momentum. More importantly, the British referendum revealed an image of a country highly fractured along the lines of age, education, and geographical location. Former Commission President Jacques Delors once notoriously stated that “it is difficult to fall in love with the single market”. Nowadays, it seems like it is quite easy to be drawn into disaffection with the single market, especially when you belong to certain social cleavages.

Darvas (2016) quantitatively analysed the socio-economic characteristics of leave voters, coming to the conclusion that high inequality and poverty contributed significantly to shaping voting behaviour. Either at a personal or regional level, these leave voters are now being called the ‘losers of globalisation’.

To be sure, the single market – which is a spearhead example of globalisation – was always expected to increase overall welfare but indeed, in the process, generate winners and losers (see Terzi et al, 2015). For example, Burstein and Vogel (2016) showed how high-skilled workers are likely to disproportionately benefit from market integration. Furthermore, Egger and Kreickemeier (2009) illustrate in a theoretical model how market integration, and the consequent selection of the best firms into export status and exit of the least productive producers, might lead to an increase in wage inequality, even for workers with similar skill-sets.

The ‘harmonious development of economic activities’ was an EU objective straight from the Treaty of Rome, and in 1975 regional funds were set up in order to promote regional development. Together with cohesion policy, launched in 1988, these tools aimed to counteract some of the centrifugal forces unleashed by the creation of a single market. However, given the tiny size of the EU budget, these funds remain limited. For the period 2014-2020, overall regional policy has been allotted €351.8 billion – equivalent to 0.4% of EU GDP per year. As a matter of comparison, when Germany decided to promote regional development in the East following reunification, it introduced transfers of roughly 4% of West German GDP.

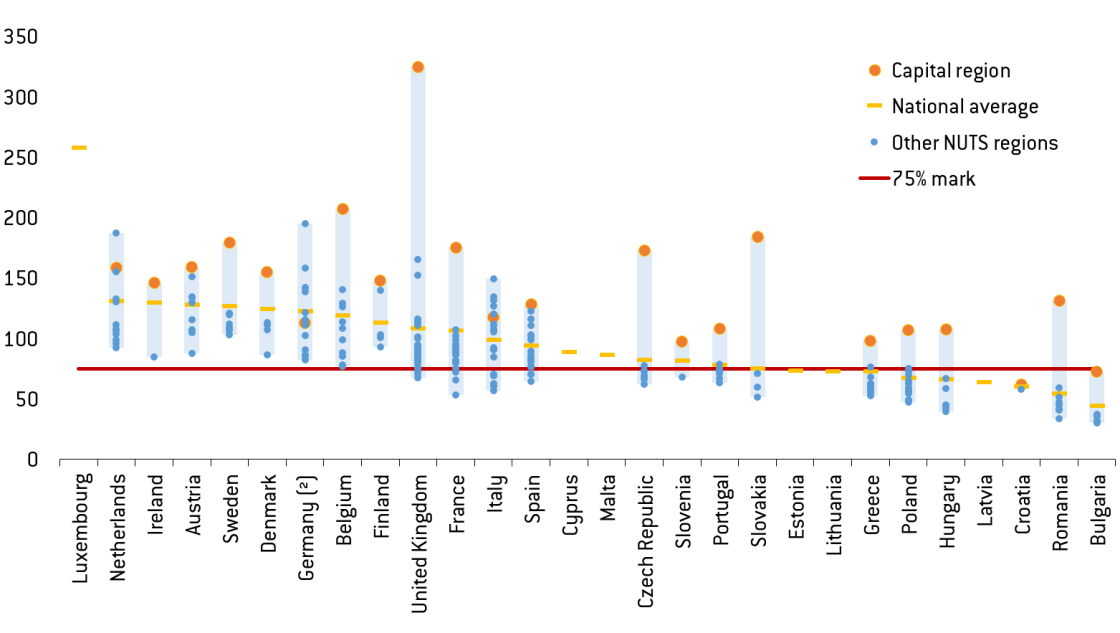

Redistribution, both across regions and between individuals, remains first and foremost a competence of national governments. Poverty and inequality played a prominent role in the Brexit referendum. It is thus fair to state that a failure in national, more than European, policies and welfare systems can be partly blamed for current discontent with the EU and the single market. This is particularly true in the UK, where territorial heterogeneity is far greater than in any other EU country. (Figure 1).

Figure 1. GDP per capita in PPP by NUTS2 region, EU28=100, 2013

Note: Regions below 75% of the EU’s GDP per capita receive funds under the Cohesion Policy, the largest programme under the EU’s Regional policy.

Source: Eurostat, Bruegel

Going forward, it is evident that more effective corrective mechanisms are needed to cushion the negative effects of the single market and, in doing so, prevent a further popular backlash against globalisation and the European Union. While many commentators are now calling for stronger redistribution, the key will be to strengthen welfare and regional support without hampering the inherent mechanics of the single market, or else do so at the expense of productivity developments, long-term growth and overall prosperity.

At the core of the single market is the concept of Schumpeterian creative destruction: once countries open their borders to European competition, some firms (the most unproductive) will exit the market, allowing for a redistribution of resources to the most competitive. This will allow countries to develop and focus on their competitive advantages. National policies should not hamper this process, while ensuring that destruction is indeed ‘creative’ and does not merely result in long-term unemployment, permanent migration, and disinvestment.

At the national level, in order to alleviate poverty and inter-personal disparities, tax systems can surely be made more redistributive, particularly in some countries. However, this should be seen only as the first step of a wider strategy. Addressing the problem for the long term will require also significant investments in education and skills. At the same time, territorial cohesion calls for projects aimed at increasing the interconnectedness of marginalised regions, linking them to the wider European or global economy. In the 21st century, more than extending bridges and roads, this might take the shape of expanding high-speed internet connections, or widening the use of tools such as distance learning, 3D printing, or e-commerce.

At the European level, regional policy seems appropriately targeted - focussing on infrastructure, education, employment, research and innovation - but poorly funded. Because globalisation, combined with technological innovation, seems to be augmenting agglomeration effects within Europe, a case could be made for substantially expanding the funding of these instruments, while at the same time ensuring their local take-up and good use. Ultimately, if the ‘losers of globalisation’ turn against the European project, this will have repercussions for the whole Union and, as such, the heavy-lifting cannot be left only to national policies and welfare states.