Regulation and growth

What’s at stake: A heated debate took place this week on the blogosphere on the link between regulation and growth following an op-ed by John Cochrane

The question of how much

Noah Smith writes that it’s easy to look around and find examples of regulations that protect incumbent businesses at the expense of the consumer -- for example, the laws that forbid car companies from selling directly to consumers, creating a vast industry of middlemen. You can also find clear examples of careless bureaucratic overreach and inertia, like the total ban on sonic booms over the U.S. and its territorial water (as opposed to noise limits). These inefficient constraints on perfectly healthy economic activity must reduce the size of our economy by some amount, acting like sand in the gears of productive activity. The question is how much.

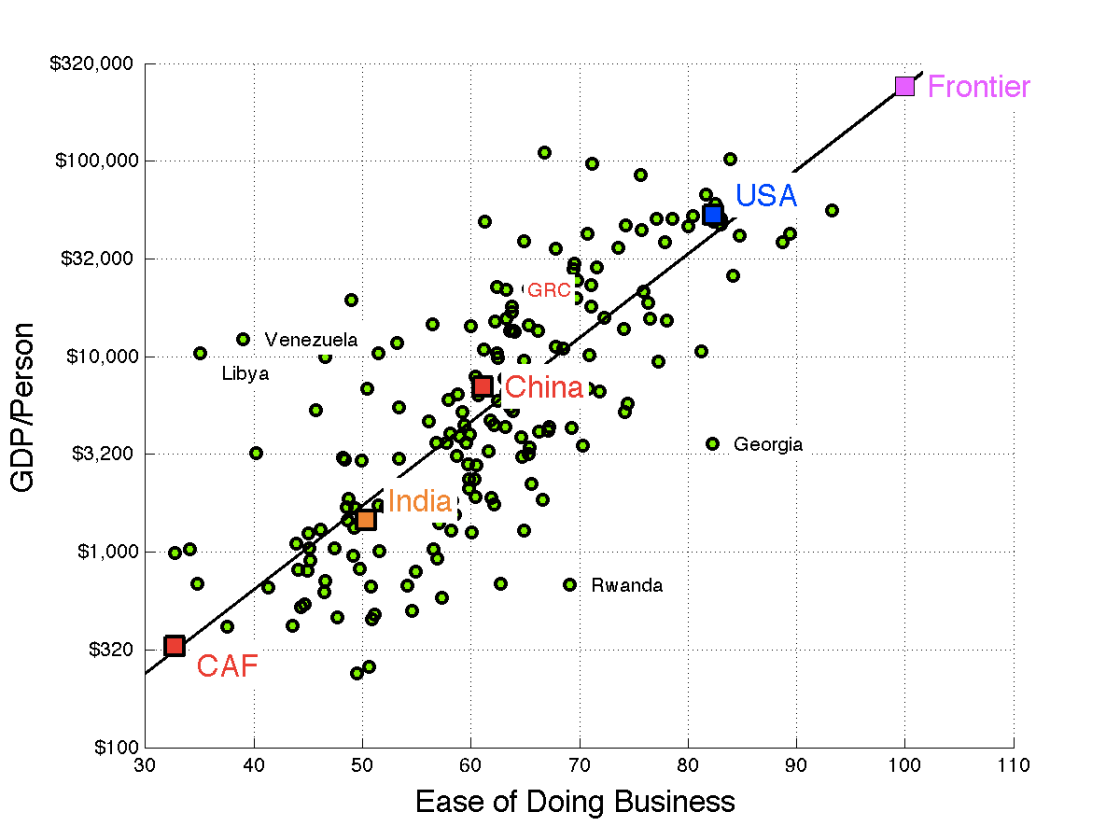

John Cochrane writes that much more growth is really possible from better policies. To get an idea, see the nearby chart plotting 2014 income per capita for 189 countries against the World Bank’s “Distance to Frontier” ease-of-doing-business measure for the same year. The U.S. scores well, but there is plenty of room for improvement. A score of 100 unites the best already-observed performance in each category. So a score of 100—labeled Frontier—is certainly possible. And, following the fitted line in the chart, Frontier generates $163,000 of income per capita, 209% better than the U.S., or 6% additional annual growth for 20 years. If America could improve on the best seen in other countries by 10%, a 110 score would generate $400,000 income per capita, a 650% improvement, or 15% additional growth for 20 years.

Source: John Cochrane

John Cochrane writes it is amazing that governments can do so much damage. One might dismiss the correlation a bit as reverse causation. But look at North vs. South Korea, East vs. West Germany, and the rise of China and India. It seems bad policies really can do a lot of damage (Hall and Jones 1999 control for endogeneity in this sort of regression by using instrumental variables.) But if bad institutions can do such enormous harm, it follows inescapably that better institutions can do enormous good.

Log-linear models and functional forms

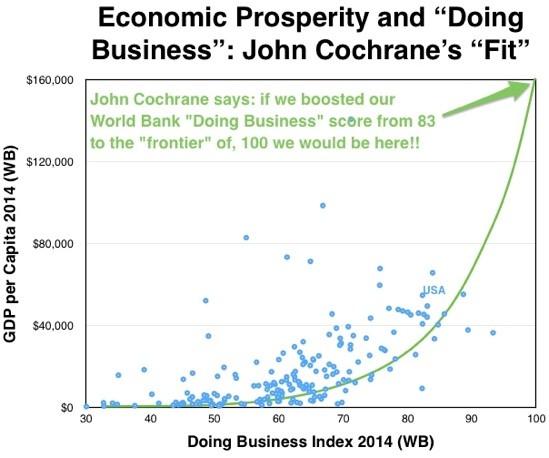

Evan Soltas writes that DeLong challenges Cochrane, pointing out that his conclusions rely on a rather extreme extrapolation of a log-linear model. You can see the essence of the controversy in the dueling graphs above and below. The first, Cochrane's, makes the large growth claims look somewhat reasonable; the second, DeLong's, makes them look ludicrous. The only difference is the scale of the y-axis: Cochrane uses a logarithmic scale, and DeLong does not.

Source: Brad DeLong

Noah Smith writes that DeLong shows that even if Cochrane is right that countries can move freely around the World Bank ranking graph, the policy conclusions are incredibly sensitive to the choice of functional form. DeLong notes that this looks more than a little bit crazy, and decides to do his own curve-fitting exercise. Instead of a linear model for log GDP, he fits a quadratic polynomial, a cubic polynomial, and a quartic polynomial. Cochrane's conclusion disappears entirely! As soon as you add even a little curvature to the function, the data tell us that the U.S. is actually at or very near the optimal policy frontier.

Noah Smith writes that Cochrane claims that this graph essentially represents a menu of policy options - that if we boost our World Bank ranking slightly past the (totally hypothetical) "frontier", we can make our country five times as rich as it currently is. This always seemed like the exact same fallacy that Lucas et al. pointed out with respect to the Phillips Curve. You can't just do a simple curve-fitting exercise and use it to make vast, sweeping changes to national policy. John Cochrane writes that his graph is an illustration of a conclusion reached by hundreds, if not more, papers in the academic literature. It is not The Evidence. My graph is just a quick graphical illustration of the conclusions of much growth economics, including much work by Jones, Acemoglu, Barro, Klenow, and many many others. Institutions matter to economic growth.

Other approaches to estimate the impact of deregulation on growth

Evan Soltas came up a with simple trick to identify reforms directly from the World Bank data since there's no event dataset that lists the names and years of countries that implement large pro-business reforms. The idea is to look at big jumps in the World Bank's index. With this approach, Soltas finds that he can bound the effect of pro-business reforms quite precisely around zero, with a 95-percent confidence interval for the effect of a 10-point reform on the level of per-capita output of -1.4 percent to 3.5 percent. That is far away from the claim that such a reform could double per-capita output.

Using a panel of 22 industries observed annually between 1977 and 2012, Bentley Coffey, Patrick McLaughlin, and Pietro Peretto find that economic growth in the United States has, on average, been slowed by 0.8 percent per year since 1980 owing to the cumulative effects of regulation: If regulation had been held constant at levels observed in 1980, the US economy would have been about 25 percent larger than it actually was as of 2012. The authors write that the buildup of regulations over time leads to duplicative, obsolete, conflicting, and even contradictory rules, and the multiplicity of regulatory constraints complicates and distorts the decision-making processes of firms operating in the economy.