Understanding HM Treasury’s Brexit analysis

What’s at stake: The UK will hold a referendum on its membership of the EU on June 23rd 2016. Her Majesty’s Treasury released an assessment of the imp

The general approach

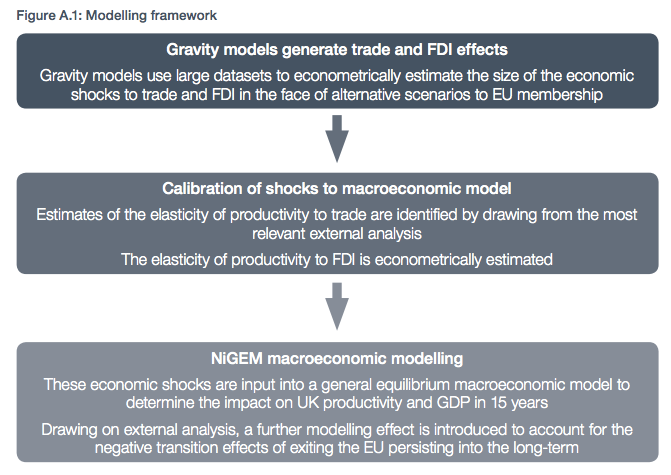

The LSE Center for Economic Performance writes that the Treasury studies the long-run effects of Brexit using a three-step process:

- Step 1: how Brexit would affect trade and foreign direct investment (FDI);

- Step 2: how the reduction in trade and FDI following Brexit would affect productivity;

- Step 3: the results of Steps 1 and 2 are combined with a global macroeconomic model to predict how Brexit would affect overall UK national income.

Gravity models and the causal impact of trade on GDP

The HM Treasury analysis uses a widely adopted gravity modelling approach, which distinguishes the specific effect of EU membership and the alternatives from all the other influences that determine trade and foreign direct investment.

The most straightforward and widely used method to quantify the impact of EU membership is to incorporate a set of dummy variables (Martin Sandbu discusses two alternative approaches: structural models and synthetic controls). The equation below shows a very simple form where dummy variables are included to capture the impact of different trading relationships.

In the HM Treasury analysis the following dummy variables have been included:

- EU membership (where both trade partners are in the EU)

- EU trade diversion (where only one trade partner is in the EU)

- FTA membership (where both trade partners are in the FTA

- EEA membership (where both trade partners are in the EEA, which includes all EU member states)

HM Treasury writes that there is an endogeneity issue when assessing the impact of trade policy on trade flows. Trade agreements are more likely to be formed between countries that already trade extensively. Consequently it is not straightforward to establish the direction of causality, which can make it unclear whether FTAs increase trade or if countries that already trade extensively form FTAs. Fixed effects help allay this problem as they control for the average differences across countries in both observable and unobservable factors. Head and Mayer (2013) note that country fixed effects can, for example, account for countries that consistently trade disproportionate amounts relative to their GDP. This is the case with Belgium and the Netherlands owing to the major ports at Antwerp and Rotterdam.

Trade and productivity

The HM Treasury describes the major channels through which greater openness to both trade and investment increases productivity in the UK. Access to a larger market allows the most productive UK firms to expand, taking advantage of economies of scale in production and expanding the range and variety of products that can be produced. Greater openness increases competition between firms, enhancing their incentives to improve productivity in order to maintain and improve their market share. Greater openness to trade also increases incentives for domestic firms to innovate or adopt new technology. Greater openness to international flows of factors of production can improve the allocation of resources, resulting in capital being allocated to better projects.

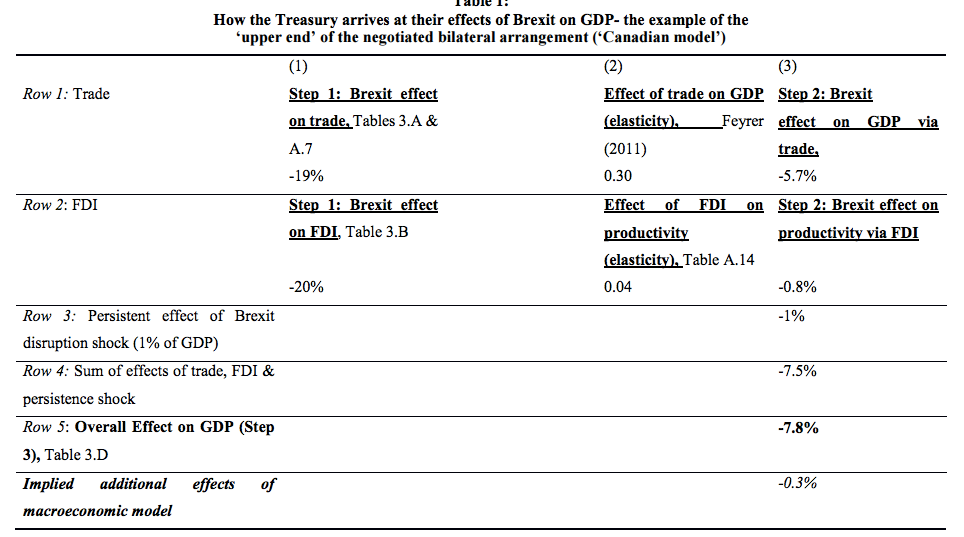

The LSE Center for Economic Performance writes that the effects of Brexit on UK productivity are obtained by combining the changes in trade and FDI from Step 1 with estimates of how these changes affect productivity. Step 2 captures the dynamic effects of Brexit on productivity. Estimating the exact relationship between trade or FDI and productivity is tricky. For trade, the Treasury survey a range of estimates and settle on those from Feyrer (2011), who finds elasticities of 0.2 to 0.3 – that is, a 10% fall in trade reduces productivity by 2% to 3%. Below is an example of how HMT comes to the final figure for the Canadian example.

Migration and population growth

Anthony Reuben writes that it is a bit odd that the Treasury has used ONS forecasts for what will happen to population by 2030, without considering what difference leaving the EU would make. Given that one of the key points of leaving the EU is supposed to be to tighten up the UK's borders, it seems a mistake not to take into account that effect.

Jonathan Portes writes that the HMT analysis simply omits one of the central issues in the referendum campaign – immigration and in particular free movement of workers within the European Union. Why did the Treasury ignore immigration? Not because it is any harder to model, or more uncertain, than trade. Unlikely because it is less important economically since a typical number for the productivity loss resulting from a large, but not inconceivable, change in migration is actually quite similar to the loss resulting from changes to trade (0.3% a year is similar to the negative productivity impact found in the Treasury’s central scenario). Unlikely because it would not support the government’s case for Remain as the analysis might well have shown that a sufficiently “liberal” migration policy post-Brexit would have economic benefits. Most likely, however, is that it was simply a political decision not to talk about immigration and free movement at all.