Financial risks and opportunities in the time of climate change

The current unsustainable use of our environment can lead to financial crisis. To address this risk, financial institutions should measure their exp

Real economic imbalances can lead to financial crisis. The current unsustainable use of our environment is such an imbalance. Financial shocks can be triggered by either intensified environmental policies, cleantech breakthroughs (both resulting in the stranding of unsustainable assets), or the economic costs of crossing ecological boundaries (eg floods and droughts due to climate change). Financial supervisors and risk managers have so far paid little attention to this ecological dimension, allowing systemic financial imbalances resulting from ecological pressures to build up. Inattention also leads to missed economic and financial opportunities from the sustainability transition.

Policy Challenge

To address the risk, financial institutions should measure their exposure to ecological imbalances using methodologies such as carbon and natural capital accounting. The European Union should develop and implement standards for this. Financial supervisors require financial institutions to conduct risk analysis on the basis of these exposures (stress tests). A Finance and Sustainability Risk Forum could develop and promote best practices in this field. To grasp the opportunities of green finance, financial institutions should move to long-term investing with active ownership. The European Commission and member states could create the conditions for financing the transition to a sustainable economy through an EU Green Capital Markets Plan.

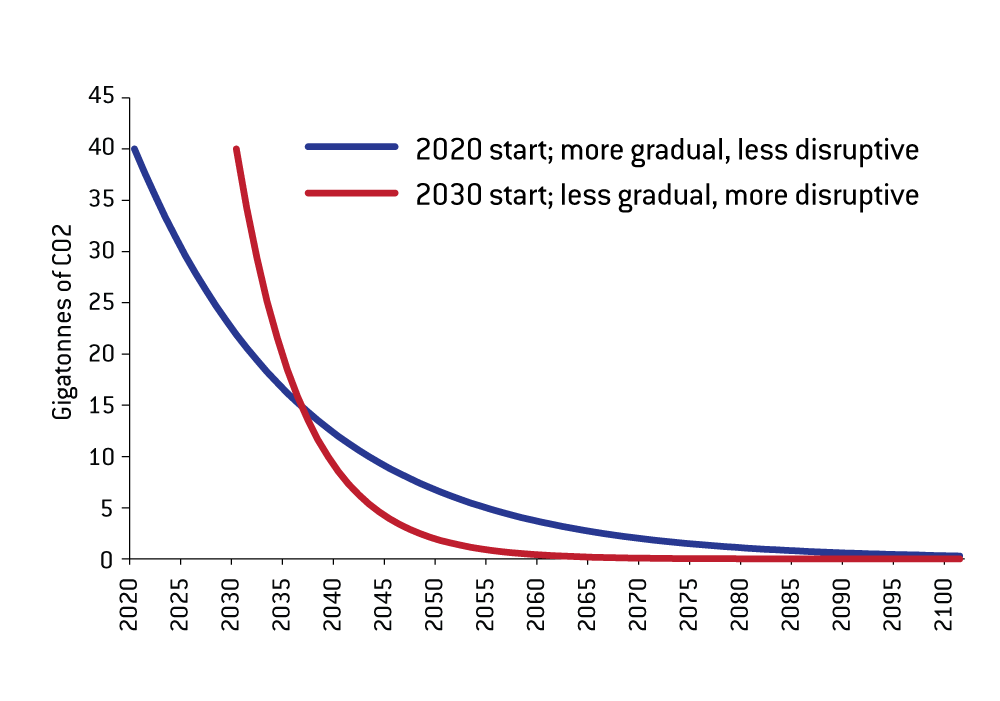

Transition pathways to stay within a 2°C global temperature rise

Source: IPCC (2014).

For references and footnotes, please download the PDF version of this Policy Brief.

We face large and growing ecological imbalances. The overuse of the environment as a sink for greenhouse-gas emissions and pollution and over-exploitation of water and raw materials have led to climate change, depletion of natural resources and loss of biodiversity. The development of these ecological imbalances is partly linear and thus predictable, but is partly also highly unpredictable, especially as imbalances become larger, with sudden tipping points and feedback loops after which recovery is no longer possible (IPCC, 2014). A set of nine planetary boundaries has been identified within which there is a “safe operating space for humanity” (Rockström et al, 2009). Three boundaries have already been passed (climate change, biodiversity and the nitrogen cycle) and two are coming close to being passed (ocean acidification and the phosphorus cycle).

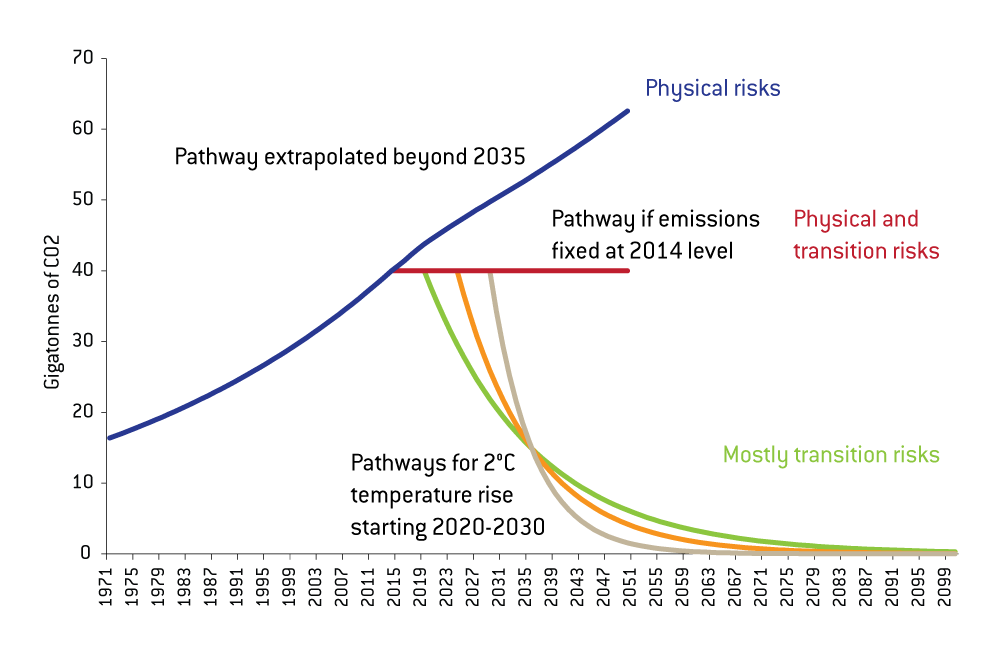

In the Paris Agreement on climate change, concluded at the end of 2015, countries reconfirmed the target of limiting the rise in global average temperatures relative to those in the pre-industrial world to two degrees Celsius, and to pursue efforts to limit the temperature increase to 1.5°C (UNFCCC, 2015). Doing this would ensure that the stock of carbon dioxide and other greenhouse gases in the atmosphere does not exceed a certain limit. The Intergovernmental Panel on Climate Change (IPCC) estimates that the remaining carbon budget amounts to 900 gigatonnes of CO2 from 2015 onwards. The speed with which the limit is reached depends on the emissions pathway. If current emissions are not drastically cut, the 2°C limit would be reached in less than two decades (Figure 1)1.

Figure 1: Possible carbon emission trajectories

Source: UK Prudential Regulation Authority (2015).

The risk of late and sudden transition

There are many uncertainties about climate change. Will the world succeed in limiting global warming to 1.5-2°C? If so, what will the energy system look like? What role will energy saving, carbon capture and storage and the different forms of renewable energy play? The future of technological innovation is inherently uncertain (Weitzman, 2013) as is the political will globally to address climate change. The technological uncertainties are compounded by policy uncertainty. Policy is also a driver of technological change, for instance through the amount of investment in research, and as a market maker for cleantech.

If governments make an early start a ‘soft landing’ is more likely. The transition to a low-carbon economy would be orderly, allowing enough time for the physical capital stock to be replenished and for technological progress so that energy costs are kept at bearable levels (Stern, 2015).

However, there is a risk of late adjustment, resulting in a hard landing. In this adverse scenario, the underlying political economy – the short-term political costs of the transition, combined with the need for global coordination of emission cuts – would lead to belated and sudden implementation of constraints on the use of carbon-intensive energy. This back-loaded policy intervention would force more severe immediate reductions in emissions.

The economic impact of the energy transition

On the economics of climate change, Stern (2008) calculated that starting the transition sooner rather than later is preferable2 – a finding recently confirmed by the Global Commission on the Economy and Climate (2014). It calculated that in the next 15 years, when around US$90 trillion is likely to be invested in infrastructure in the world’s urban, land-use and energy systems, an estimated US$270 billion a year extra is needed to do this in a sustainable way. These higher capital costs could be fully offset by lower operating costs, for example from reduced expenditure on fuel.

Sustainability is also one of the main goals in the European Union’s Europe 2020 competitiveness strategy. The dependence on fossil fuels leaves the EU vulnerable to price shocks and dependent on supplies from unstable regions. Meeting its 2020 energy goals could save the EU annually €60 billion on oil and gas imports. The sustainability transition also offers major opportunities if the EU maintains its early lead in green solutions, such as recycling and energy efficiency where the EU has global market shares of 50 percent and 35 percent respectively. The sustainability transition could also create jobs3.

The financial impact of the carbon bubble

One of the most studied risks to the financial system stemming from ecological imbalances is the so called ‘carbon bubble’ (Carbon Tracker, 2011), or the overvaluation of fossil-fuel reserves and related assets should the world manage to tackle global warming. Staying within a 2°C temperature rise puts a limit on future carbon emissions and hence on the amount of fossil fuels that can be burned, requiring a sharp bending of the current trend (Figure 1)4.

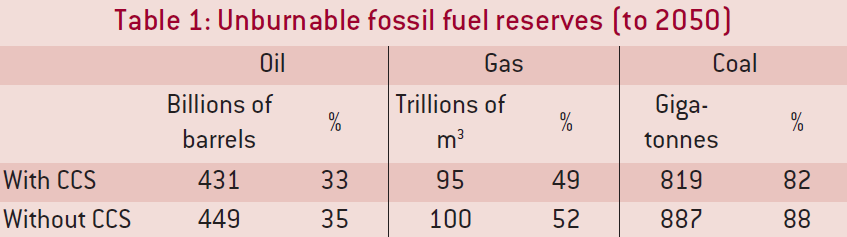

This could strand many existing fossil fuel reserves. Without carbon sequestration, McGlade and Ekins (2015) estimate that if global warming is to be kept below 2°C up to 2050, approximately 35 percent of known oil reserves, 52 percent of gas reserves and 88 percent of coal reserves are unburnable (Table 1). The numbers are slightly lower if carbon is sequestrated.

Source: McGlade and Ekins (2015). Note: The first column shows absolute amounts of

unburnable reserves and the second column shows unburnable reserves as a percentage

of current global reserves. CCS = carbon capture and storage.

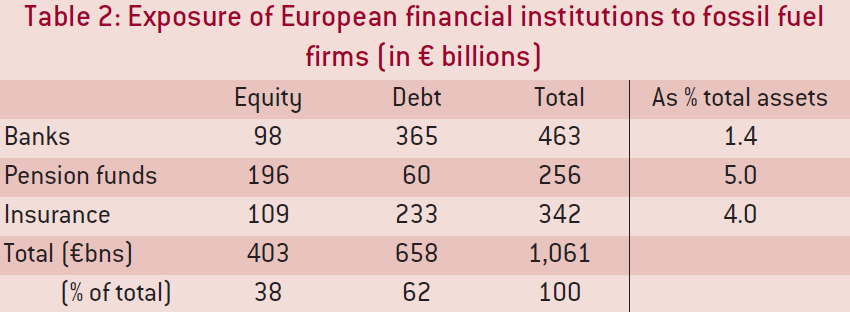

Private oil, gas and coal mining companies own about a quarter of fossil fuel reserves; sovereigns and their oil, gas and coal companies own the remainder. If a large part of these reserves cannot be extracted or extraction becomes commercially unviable, the valuation of these companies and their ability to repay their debt is reduced. The equity, bond and credit exposures of EU financial institutions to firms holding fossil-fuel reserves and to fossil-fuel commodities are substantial. Table 2 shows that the total exposure of €1,061 billion is 38 percent equity financed and 62 percent debt financed (Weyzig et al, 2014). Such large numbers raise concerns about the potential consequences of these investments if a large part of the oil, gas and coal reserves ends up stranded.

Source: Weyzig et al (2014). Notes: a) sum of bonds (62) and loans (303); b) sum of

equities (118) plus commodities (78).

The costs of late transition go well beyond The energy sector

Though these exposures and potential losses are large, on their own they will probably not cause a systemic crisis in a healthy economy and financial sector. However, the effect of the bursting of the carbon bubble will not be limited to the oil, gas and coal sectors alone. A sudden transition will be a shock to all sectors that use fossil fuels as an input, either in the production or in the use of their products and services. There are potentially major implications between sectors (electricity powered high speed trains versus fossil fuel jet planes) and within sectors (car manufacturers that specialise in electric cars versus heavy car manufacturers). The financial impact will therefore be much greater than the numbers here indicate.

If the transition is sudden and late, the financial system could be affected by its exposure to carbon-intensive real and financial assets. Moreover, reduced energy supply and increased energy costs would impair macroeconomic activity, as the hard landing forces a rapid transition away from fossil-fuel based energy production.

While a gradual transition would allow for a gradual write-down of long-lasting carbon-intensive infrastructures and assets, a rapid transition would force more radical write-downs because of the negligible scrap value of stranded assets and not fully anticipated losses. Current market pricing might reflect both a lack of awareness of the challenges posed by climate change and uncertainty about the path of policy (ASC, 2016).

Policy challenges

The ever-increasing environmental imbalances are material, including for the EU financial sector. The EU is home to many pioneering sustainable finance initiatives, both industry-led and public, that are setting the agenda internationally on topics including green bonds, climate disclosure and risk and responsible investment (UNEP, 2016). But the EU currently lacks a strategy that ties all these strands together, enables synergies and identifies gaps. A coherent EU-level sustainable finance strategy should be connected with the Europe 2020 sustainable growth agenda for a resource efficient, greener and more competitive economy. A strategic approach would also allow the EU to become much more effective on the international stage and maximise the economic potential of the EU frontrunners in the sustainability transition5. The global momentum is likely to intensify, with China’s launch of the new G20 Green Finance Study Group, co-chaired by the United Kingdom. This G20 Study Group will identify institutional and market barriers to green finance and, based on country experiences and best practices, analyse options on how to enhance the ability of the financial system to mobilise private green investment.

1. Increase transparency of exposure to environmental imbalances

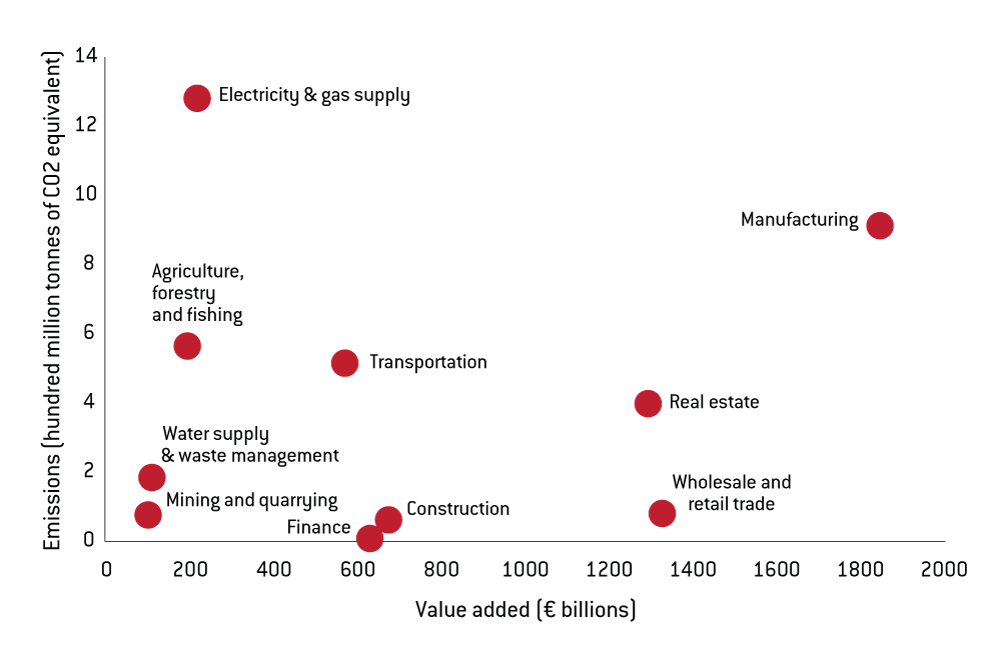

Much has been done to develop accounting methodologies for natural capital, specifically in the field of carbon6. Figure 2 shows greenhouse-gas emissions by sector. The financial sector generates very low emissions, largely from use of buildings and office equipment. The financial sector’s real carbon exposure comes from indirect emissions through its investments and lending, looking at the full value chain (the so-called scope 3 emissions).

Figure 2: Emissions and value added, selected EU sectors, 2011

Source: Bruegel based on Eurostat. Note: Real estate emissions include household

heating and cooling.

The challenge for the financial sector is to have the data available on natural capital (including carbon) of its clients and investments and to attribute these to the specific financial institutions or portfolios7. Corporate disclosure of greenhouse-gas emissions is now mandatory in a number of EU member states, including Denmark, France and the UK. All EU member states must transpose by the end of 2016 the Non-Financial Reporting Directive (2014/95/EU), which requires large companies to disclose material information on environmental matters.

Even though the methodology is still developing, carbon accounting by financial institutions is already widespread. More than 120 investors with $10 trillion in assets under management have committed to annually measure and publically disclose their carbon footprints (the Montreal Pledge; PRI, 2014). Reporting by financial institutions is increasingly being made mandatory. Pension funds in seven EU member states are required to report on environmental, social and governance factors. In France, financial institutions are now obliged to disclose “their exposure to climate-related risks, including the greenhouse-gas emissions associated with assets owned”8. The IORP II Directive draft (Institutions for Occupational Retirement Provision) published by the European Commission in January 2016 requires pension funds to assess new emerging risks related to climate change, use of natural resources and the environment, and to disclose this information to beneficiaries.

Supervisors are using the data thus generated in their supervisory work. Examples are the Climate Change Adaptation Report by the UK Prudential Regulation Authority (2015), the Chinese Green database9, and the announcement of the Netherlands Bank (Elderson, 2015) that sustainability will be an explicit theme in its supervision of the pension sector.

The international Financial Stability Board has established an industry-led Task Force on Climate-related Financial Disclosures (FSB, 2015) that will consider the physical, liability and transition risks associated with climate change and what constitutes effective financial disclosures in this area.

Despite the progress, major challenges remain. Bloomberg Data shows that of 25,000 companies surveyed, 75 percent do not produce even one data point on sustainability (Aviva, 2014). We recommend that the European Commission further develops the methodology, standard setting and reporting requirements for all financial and non-financial institutions building on recent steps taken in this field for companies and investors10.

2. Methodologies for risk analysis and reduction

To make data on carbon exposure strategically meaningful, the financial risks that originate from these exposures need to be mapped. The main risk is basically a policy risk that governments will suddenly take drastic actions (ie the scenario of intensified environmental policies). There is also a scenario of crossing the ecologic boundaries leading to floods and droughts due to climate change.

The vulnerability of financial institutions to these risks can be analysed through a stress test. Some financial institutions already have experience of such stress testing, using different scenarios mostly focused on oil, gas and coal. More granular studies that include all carbon-intensive sectors are needed to enhance the analysis of carbon-related exposures. Also, on the supervisory front, the capacity to develop new methodologies for carbon stress tests is uneven across the EU, with some supervisors overstretched.

A new Finance and Sustainability Risk Forum, which has also been proposed by the United Nations Environment Programme (UNEP, 2016), could share best practices on environmental disclosures and carbon stress testing between the EU’s various financial supervisors. Because of its financial system-wide mandate, the European Systemic Risk Board could host this Finance and Sustainability Risk Forum. This forum would also increase the EU’s ability to shape the G20’s agenda on green finance, as international coordination is crucial.

Next, credit rating agencies play an important role in analysing corporate risk. We suggest embedding sustainability in credit ratings by requiring credit rating agencies to consider long-term environmental, social and governance matters over the full duration of a bond on a ‘comply or explain’ basis.

Risk reduction

Recent reductions in energy consumption can be mostly attributed to the slowdown in economic activity, rather than structural shifts in energy consumption (Eurostat, 2015). Although worldwide emissions seem to be levelling off, we are not heading towards a soft landing with deep cuts (see Figure 1). Also, current low energy prices are not helpful in terms of embarking on energy savings. The most efficient way of bending the trend towards a more benign scenario would be through pricing for greenhouse-gas emissions. To this end, the EU has introduced the Emissions Trading System (ETS). However, the current ETS carbon price fluctuates around €5 per tonne11, which is too low to have a meaningful impact on operational and investment decisions within industry. A full analysis of a major reform of the ETS or the implementation of a carbon tax is beyond the scope of this paper12.

On the supervisory front, if supervisors find through the carbon stress tests that financial risks from ecological risks are material, they can activate their supervisory instruments. Supervisors are typically worried about large imbalances building up, because these imbalances can wipe out the equity capital of financial institutions. If the carbon stress test results show that multiple financial institutions are at risk, we can speak of a common risk factor leading to systemic imbalances. The most appropriate supervisory instrument would be to impose large exposure limits for material exposures related to climate change (Schoenmaker et al, 2015). That would mean that financial institutions would be obliged to sell off carbon-intensive assets and/or to reduce lending to carbon-intensive sectors.

We do not propose higher risk weights, because environmental policies are the domain of the government (as we have discussed). Finally, the outcome of carbon stress tests can also highlight opportunities for financing the transition to a low-carbon economy.

3. Seize the green finance opportunity

Financial firms are increasingly adopting environmental, social and governance criteria, in addition to financial and economic criteria, in their investment strategies. These criteria can be used to avoid over-exposure to ecological risks. A more ambitious strategy is to not only reduce carbon-intensive investments, but also to seize the opportunity of green finance.

Some financial institutions are also setting targets to reduce financing of carbon emissions. Through the Portfolio Decarbonisation Coalition, 25 investors with a total of $600 billion in assets under management have pledged to gradually reduce their carbon exposures (UNEPFI, 2015). Individual financial institutions are setting themselves even more ambitious targets. The two largest Dutch pension funds, PFZW and ABP, set themselves reduction targets of 50 percent and 25 percent respectively before 2020 (PFZW, 2015). Allianz and Aviva, major European insurers, are another example of institutional investors with explicit climate objectives in their long-term investment strategies (Allianz, 2015). Finally, Dutch SNS Bank pledged to become climate neutral across its investment portfolio in 203013.

The policy challenge is to overcome the short-term incentives in the investment chain by making investors active owners, engaging with their companies to reduce transition risks and grasp the opportunities. There are several initiatives to shift the focus to long-term value creation, stimulating investors to manage and reduce environmental risks with a pay-off in the medium to long term14.

We propose to adopt a co-ordinated strategy and action plan on sustainable capital markets for Europe. In its Action Plan on a Capital Markets Union (CMU)15, the European Commission should in partnership with industry and the wider financial community develop a Green Capital Markets Plan16.

A first tenet of this Green Capital Markets Plan would be to tackle inefficiencies in the structure of capital markets. A key element for the Commission is the creation of comparative benchmarks for environmental, social and governance performance in partnership with the private sector and other stakeholders. As capital markets operate internationally, the International Organisation of Securities Commissions should be encouraged to develop a standard for non-financial data to be incorporated in stock exchanges’ listing rules. Next, the Commission could provide greater stability through an EU-wide definition of fiduciary duty and join investors in their call to the Organisation for Economic Cooperation and Development to consider a Convention on Fiduciary Duty and Long-Term Investing. It is important that long-term sustainable development be incorporated into the legal duties of market participants including, in particular, the fiduciary duty of asset owners and the duty of care of asset managers and investment consultants (Aviva, 2014). Also templates for long-term investment mandates and remuneration structures need to be developed in order to get the incentive structure oriented to the long term, including stewardship, throughout the investment chain.

A second tenet is to secure green investment in infrastructure, as part of the Juncker Investment Plan. The CMU Action Plan refers already to the possible creation of green bond standards. The Commission and the European Investment Bank (EIB) should take this forward as soon as possible at EU level to encourage wider market understanding and transparency. Next, the Commission and EU countries should look to develop national capital raising plans informing the Commission how they intend to finance the delivery of a zero-carbon economy and meet the Paris Agreement and its Intended Nationally Determined Contributions (INDCs). This could be done ahead of the next United Nations climate conference (COP22) in November 2016, and should outline capital needs and how the private sector will be involved.

International coordination

Reducing carbon emissions is a global challenge. The UNEP Inquiry (2015) found that globally a “silent revolution” has taken place in which policymakers, regulators and private financial institutions are bringing sustainability to the core of the financial decision-making process. The EU should engage pro-actively in these international organisations, such as the FSB and the G20 Green Finance Study Group.

Finally, the IMF and World Bank can employ their environmental expertise in their surveillance work, for example in their Financial Sector Assessment Programme (FSAP)17. With ecological risks as an integral part of the financial stability assessment, a common standard can be set and policed. The carbon stress test can thus become an integral component of the FSAP, because it is important to judge the vulnerability of the financial sector in an international setting.

Conclusion

In the scenario of a late and sudden transition to a low-carbon economy, the financial sector can be heavily exposed to environmental risks. Methodologies are being developed to measure the carbon intensity of investments. The next step is to develop carbon stress tests to get a better picture of the exposure of the financial sector. We propose a Finance and Sustainability Risk Forum in which European financial supervisors can share best practices and coordinate their input to the Financial Stability Board.

The Capital Markets Union offers an opportunity for green finance. The European Commission could boost the various efforts through a Green Capital Markets Plan. This plan would advance environmental benchmarks for investors, set standards for green bonds, and develop national capital raising plans for green infrastructure investment. In that way, the financial sector could help the transition towards a low-carbon economy.

This paper was prepared for the informal ECOFIN, 22-23 April 2016. The authors thank Simon Zadek, Nick Robinson, Simone Tagliapietra and Guntram Wolff.