Oil and stock prices

What’s at stake: The recent positive link between oil and stock prices has been puzzling for most observers. While a decrease in the price of oil was

Greg Sharenow writes that oil prices have fallen by about 20% this year for a myriad of reasons: Concerns over Chinese growth, a deceleration of manufacturing in the U.S., extremely mild winter temperatures in key Northern Hemisphere oil-consuming regions and the impending return of Iranian oil production.

Olivier Blanchard writes that the headlines are now about low oil prices leading to low stock prices. Traditionally, it was taken for granted that a decrease in the price of oil was good news for oil importing countries such as the United States. Consumers, with more money to spend, would increase consumption, and increase output. We learned in the last year that, in the short run, the adverse effect on investment on energy producing firms could come quickly and temporarily slow down the effect, but this surely does not undo the general conclusion.

Oil prices, inflation expectations and the real interest rate

Paul Krugman writes that we used to believe that oil price declines were expansionary because they reduced inflation, freeing central banks to loosen monetary policy — not a relevant issue at a time when inflation is below target almost everywhere. Gauti Eggertsson writes that these falls in oil prices are generating an overall pull downward in current and expected inflation, thus effectively making monetary policy more restrictive around the world by increasing real interest rates. It seems that inflation expectation are falling across the board in industrialized countries, at least by some measures. It is hard to see how further deflationary pressure are helpful at this stage. So perhaps the current collapse in oil prices will prove to be a nice laboratory experiment for the paradox of toil.

The non-linearity of oil price declines

Paul Krugman writes that there’s an important nonlinearity in the effects of oil fluctuations. A 10 or 20 percent decline in the price might work in the conventional way where falling oil prices redistribute income away from agents with low marginal propensities to spend toward agents with high marginal propensities to spend. But a 70 percent decline has really drastic effects on producers; they become more, not less, likely to be liquidity-constrained than consumers. Saudi Arabia is forced into drastic austerity policies; highly indebted fracking companies find themselves facing balance-sheet crises. Or to put it differently: small oil price declines may be expansionary through usual channels, but really big declines set in motion a process of forced deleveraging among producers that can be a significant drag on the world economy, especially with the whole advanced world still in or near a liquidity trap.

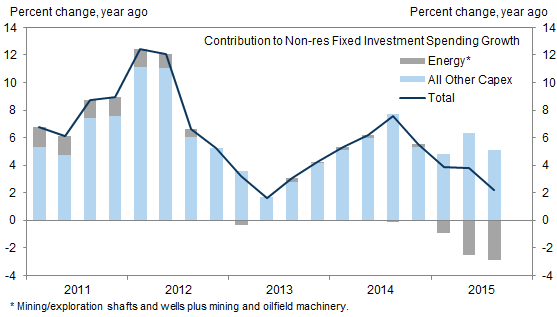

David Mericle and Daan Struyven write that cutbacks in energy sector capital spending in the structures and equipment categories reduced investment growth over the last year by about 3 percentage points. Olivier Blanchard writes that some countries and some companies will indeed be in serious trouble; indeed, some already are. I can also think of ways in which low oil prices also change the geopolitics of the Middle East, with uncertain effects on oil prices. I find it difficult to think that these will dominate the direct real income effects for US consumers.

The signaling value of oil prices

Olivier Blanchard writes that another explanation is that low prices reflect a yet unmeasured decrease in world growth, much larger than is apparent in other hard data, and that the price of oil is telling us something about the state of the world economy that other data do not. There is no historical evidence that the price of oil plays such a role. But suppose, for the sake of argument, that, indeed, the low price told us that China is really slowing down. (The fact that non-oil commodity prices, for which China plays a bigger role than for oil, have decreased much less than oil does not support this interpretation.) Then, we would be back to the previous conundrum. It is hard to see how this could have such an effect on the US economy and in turn on the US stock market. Another variation on the theme, which has been raised in some columns, is that the low oil price reflects a slowdown in the United States far beyond what the other current data are telling us. There is zero evidence that this is the case.

Larry Summers writes that market signals should be taken especially seriously when they are long-lasting and coming from many markets, as is the case with current indications that inflation will not reach target levels within a decade in the United States, Europe or Japan. Especially ominous are moments when news fails to rally markets as would be expected such as with the U.S. stock market and the decline of oil prices in the face of heightened Middle East tensions.