Too early to celebrate: What markets tell us about the credibility of the Paris climate agreement

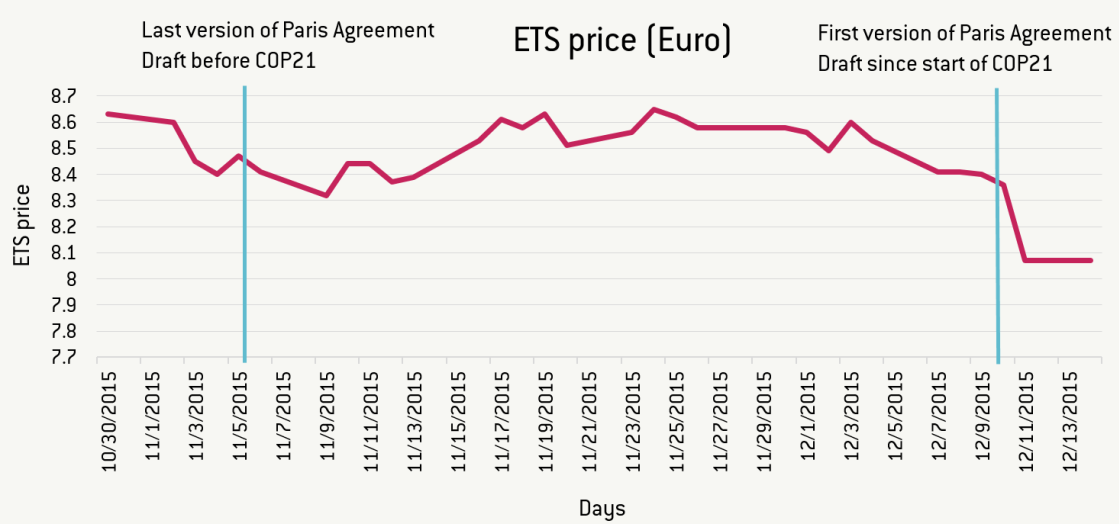

The price of carbon emissions has decreased markedly since the first draft of the Paris Agreement has been released. The decrease in the price of futu

The Paris Climate Conference COP21 has just ended and the Parties have found an agreement, approving the final draft of the Paris Agreement on Saturday morning. We would expect that a strong agreement should eventually lead to a reduction in greenhouse gas (GHG) emissions so as to reach the climate goals of limiting temperature increases to below 2°C. One of the main instrument that national and European governments have to trigger the necessary investments in renewables and green energy is the price of CO2 emissions. In the EU, this price is given by the emission trading system (ETS). A deal that would strengthen European efforts to limit GHG emissions should lead to an increase in prices for ETS certificates as companies want to buy permissions for future emissions at the currently low price.

The figure below shows the price of ETS certificates. The price of carbon emissions has decreased markedly since the first draft of the Paris Agreement has been released. The decrease in the price of futures is the largest observed over the last two months. This suggests that companies do not believe that more constraints will be put on them in the future as a result of the deal. On the contrary, market participants take the deal as a signal that there will be less reductions in available certificates in the future. Overall, this suggest that the credibility of the climate deal is still low. To trigger significant private investment in renewable energy, European policy makers will have to step up their game and increase the credibility of the governance of their CO2 reduction goals.