Indebted ASEAN companies will feel Fed's rate rise

While the markets could not have been surprised about the U.S. Federal Reserve's decision to raise interest rates after a series of warnings since mid

This op-ed was originally republished in Nikkei Asian Review.

Low interest rates and booming consumption have fueled a credit binge in the loan and bond markets of emerging Asia, especially those of the Association of Southeast Asian Nations.

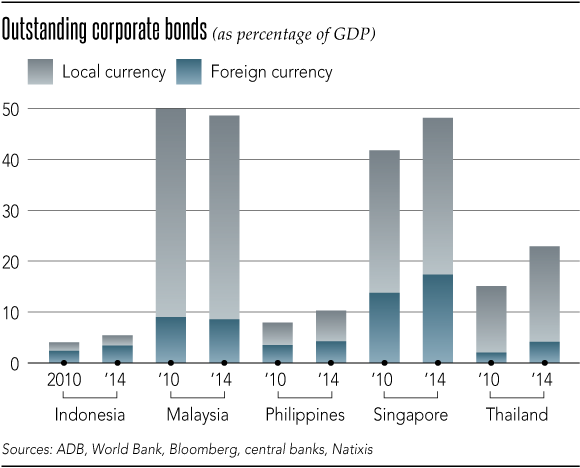

ASEAN companies account for much of the increase in leverage, with the region's governments and households behaving much more prudently. With corporate debt now at a level equivalent to about 80% of ASEAN gross domestic product, the real question is whether these companies can withstand two major shocks: a fall in revenue due to a slowing China and a rise in interest burdens due to the Fed's tightening. The latter is especially problematic, given the relatively high reliance on offshore borrowing in corporate financing strategies over the last few years.

Getting at corporate vulnerability for the five largest ASEAN economies -- Indonesia, Malaysia, the Philippines, Singapore and Thailand -- requires digging down to a micro level. On the surface, Singapore's corporate sector looks set for trouble as it is by far the most leveraged in ASEAN. Corporate debt there is already at over 250% of GDP and has been growing the fastest in ASEAN over the last five years; as a share of GDP, corporate debt has risen 50 percentage points since 2010.

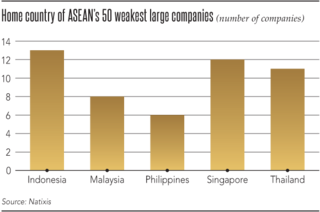

Indonesia has the lowest corporate debt-to-GDP ratio among the five economies, but the finances of its companies are comparatively dire. Looking at ASEAN's 250 largest companies in terms of key financial indicators such as ratios for debt-to-equity, short-term to total debt, interest expenses to earnings before interest, tax, depreciation and amortization, and interest expense to total debt, there are as many as 13 Indonesian companies among the 50 weakest. As many as seven Indonesian companies are among the 10 most vulnerable; there are comparatively few Malaysian or Philippine companies among the ranks of the weakest.

A higher share of the borrowings of Indonesian companies has been in U.S. dollars, compared with elsewhere in ASEAN, making them more exposed to the Fed's rate moves; Singaporean companies have taken on far more U.S. dollar debt than their Indonesian counterparts, but their local currency borrowings have been even greater. Also, many Singaporean borrowers of U.S. dollars are financial companies. Thai companies have notably deleveraged over the past year.

More surprises

Indonesian companies are the most exposed to the negative revenue shock from a slowing China and a related fall in commodity prices, as 60% of Indonesia's exports are commodity-related. Also, Indonesian corporate debt is proportionately high when compared against the country's foreign reserves.

In terms of sectors, energy as well as capital goods stand out as particularly risky in ASEAN. These categories again include quite a few Indonesian names in coal, steel, and oil and gas. Given their dependence on China and commodities, it will be difficult for Indonesian companies to export their way out of the current malaise, even with the help of a cheaper rupiah. Some coal miners have already sought debt restructuring.

Tumbling revenues from excessive exposure to China's overcapacity have brought some Indonesian companies to a difficult point. Fed tightening cannot but make the situation even harder for them, so there could be more negative surprises from some of these companies if capital outflows accelerate.

The fact that Indonesian companies may be the hardest hit does not mean that other ASEAN companies should rest on their laurels, as they are all generally over-leveraged compared with counterparts in other markets, in particular the U.S. This means more bad news is likely ahead for the ASEAN corporate world, especially in the energy and capital goods sectors.