The uncertain decline of the natural rate of interest

What’s at stake: Controversies over whether and by how much the natural rate of interest – the rate compatible with full employment and stable prices

Wicksell, Woodford and Greenspan

Martin Sandbu writes that there is a simple idea that frames some of the biggest economic questions of our time and helps to clarify the positions and the stakes in the deepest disagreements over policy.

Thomas A. Lubik and Christian Matthes write that the usage of the natural interest rate concept dates back to the Swedish economist Knut Wicksell, who in 1898 defined it as the interest rate that is compatible with a stable price level. An increase in the interest rate above its natural rate contracts economic activity and leads to lower prices, while a decline relative to the natural rate has the opposite effect. A century later, Columbia University economist Michael Woodford brought renewed attention to the concept of the natural rate and connected it with modern macroeconomic thought. He demonstrated how a modern New Keynesian framework, with intertemporally optimizing and forward-looking consumers and firms that constantly react to economic shocks, gives rise to a natural rate of interest akin to Wicksell’s original concept.

Brad DeLong writes that on July 20, 1994, Alan Greenspan announced that the Fed was no longer asking in a Friedmanite mode “do we have the right quantity of money?”, but rather was asking in a Wicksellian mode “do we have the right configuration of interest rates”.

The natural rate after the Great Recession

The Economist writes that a long list of factors should, in theory, affect the equilibrium real rate. Top of the list is economic growth. If the economy is expanding quickly, people will expect higher incomes in future, causing them to spend more and save less today. That pushes up the equilibrium real rate. Similarly, weak growth should depress the equilibrium real rate. A whole lot of other stuff matters for the real rate too, such as productivity, demographics, and conditions in financial markets.

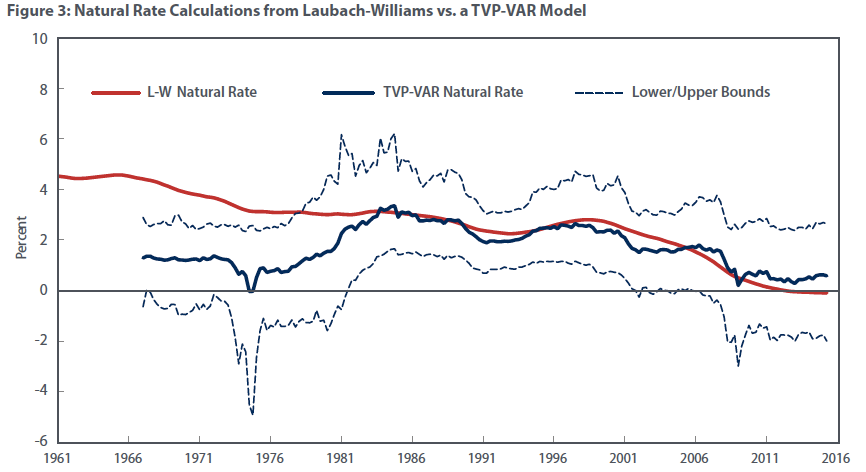

Martin Sandbu writes that Thomas Laubach and John Williams have been in the game of estimating the US natural rate for a long time, and have recently updated their model. They find that the natural rate of interest dropped dramatically in the global financial crisis, and has remained low, indeed slightly negative, ever since.

Thomas Laubach and John Williams write that although it is relatively straightforward to define the natural rate of interest, it is more challenging to pin it down quantitatively. In the Laubach-Williams (LW) model the natural rate is assumed to depend on the estimated contemporaneous trend growth rate of potential output and a time-varying unobserved component that captures the effects of other unspecified influences on the natural rate. The LW estimates of the natural rate of interest display two periods of significant declines: a moderate secular decline over the two decades preceding the Great Recession, and a second, more substantial decline during the Great Recession. The estimate of the natural rate was about 3-1/2 percent for 1990. It fluctuates over time but exhibits a downward trend, reaching about 2 percent in 2007, on the cusp of the Great Recession.

Carola Binder writes that the authors' earlier paper noted the imprecision of estimates of the natural rate. They reported 70% confidence interval around the estimates of the natural rate. The more commonly reported 90% or 95% confidence interval would of have certainly included both 0% and 6% in 2000. The newer paper does not provide confidence intervals or standard errors for the estimates of the natural rate. While the decline they report is robust to alternative assumptions made in the computation, robustness and precision are not equivalent. If you were to draw confidence bands from the older paper on the updated figure from the newer paper, they would basically cover the whole figure. In a "statistical significance" sense (three stars***!), they would in fact not be able to say that the natural rate has fallen.

Natural uncertainty and monetary policy normalization

James Hamilton and three co-authors write that given the uncertainty surrounding the equilibrium rate, the Federal Reserve should build some inertia into their decision-making by placing less weight on the estimate of the equilibrium rate than on the widely cited Taylor Rule and more on the lagged federal funds rate. When there is more uncertainty over the equilibrium rate, raising rates later, but at a slightly faster rate, can keep output growth closer to potential than the "shallow glide path" often referred to by the Fed. Although this strategy would take the peak federal funds rate slightly above the estimated equilibrium, it would reduce the risk of raising rates prematurely due to incorrect estimates of the equilibrium rate.

Thomas Laubach and John Williams write that if sustained, real short-term interest rates will be lower on average in the future than was typical in the postwar period. A lower average real interest rate in turn implies that episodes of monetary policy being constrained at the effective zero lower bound are likely to be more frequent and longer. While the use of large-scale asset purchases appears to have been a powerful policy tool when short-term rates were constrained by the zero lower bound following the financial crisis, it is unclear whether a permanent expansion of the central bank’s balance sheet would permanently reduce longer-term interest rates and thereby increase the natural rate of interest.