QE and investment

What’s at stake: Quantitative Easing has been criticized for generating inflation risks, financial stability risks, and distributional risks. The newe

QE is bad because…

Paul Krugman writes that in the eyes of critics, QE is the anti-Veg-O-Matic: it does everything bad, slicing and dicing and pureeing all good things. It’s inflationary; well, maybe not, but it undermines credibility; well, maybe not but it causes excessive risk-taking; well, maybe not but it discourages business investment, which I think is a new one.

Lawrence Summers writes that they blame the weakness of business investment during the current recovery on the Fed. Every major macroeconomics textbook teaches students that investment increases as real interest rates decline. This is motivated in a variety of quite compelling ways. It is noted that lower rates raise the present value of the returns from investment and so make them more attractive. It is observed that lower rates mean lower borrowing costs or lower costs of drawing-down liquid asset holdings, making the purchase of capital goods more attractive. For these reasons, millions of students have been taught that Hicks famous IS curve slopes downward. Hundreds of empirical studies have found that investment responds to capital cost as theory predicts, though the magnitude is open to debate.

The upward-sloping investment curve

Michael Spence and Kevin Warsh write monetary policy has created a divergence between real and financial assets. QE has redirected capital from the real domestic economy to financial assets at home and abroad. In this environment, it is hard to criticize companies that choose “shareholder friendly” share buybacks over investment in a new factory. But public policy shouldn’t bias investments to paper assets over investments in the real economy.

Michael Spence and Kevin Warsh write that QE created a preference for financial assets. The resulting risk-aversion from QE’s unwinding translates into a corporate preference for shorter-term commitments—that is, for financial assets. QE also reduced volatility in the financial markets, not the real economy.

QE, stock buybacks and reduced financial volatility

Lawrence Summers writes that he would have supposed that the choice between real investments and share repurchases would depend on their relative price. If, as Spence and Warsh assert, QE has raised stock prices, this should tilt the balance toward real investment. Joseph Gagnon writes that the statement “QE has redirected capital from the real domestic economy to financial assets at home and abroad” reveals a fundamental misunderstanding of what financial assets are. They are claims on real assets. It is not possible to redirect capital from financial assets to real assets, since the two always are matched perfectly. Equities and bonds are (financial) claims on the future earnings of (real) businesses.

Brad Delong writes that QE reduces volatility in financial markets by making some of the risk tolerance that was otherwise soaked up bearing duration risk free to bear other kinds of risk. That is what it is supposed to do. With more risk tolerance available, more risky real activities will be undertaken--and so microeconomic risk will grow. A higher level of activity with more risky enterprises being undertaken is the point of QE.

Robert Waldmann writes that it is actually possible to write down a simple economic model in which QE causes low nonresidential fixed investment. The argument is that the duration risk in long term Treasuries is negatively correlated with the risk in fixed capital. I think this is clearly true. The risk of long term Treasuries is that future short-term rates will be high. This can be because of high inflation or because the FED considers high real rates required to cool off an overheated economy. Both of these are correlated with high returns on fixed capital (someone somewhere keeps arguing that what the economy needs is higher inflation). This means that a higher price for long-term treasuries should make fixed capital less attractive — the cost of insuring against the risk in fixed capital is greater.

Nonresidential investment in the recovery

Joseph Gagnon writes that there is a deep puzzle as to why businesses have not responded even more strongly than they have to extraordinarily cheap finance at a time of solid profits.

Brad Delong writes that weakness in overall investment is 100% due to weakness in housing investment. The U.S. has an elevated level of exports together with depressed levels of government purchases and residential investment. Given that background, one would not be surprised that business investment is merely normal – and one would not go looking for causes of a weak economy in structural factors retarding business investment. One would say, in fact, that business investment is a relatively bright spot.

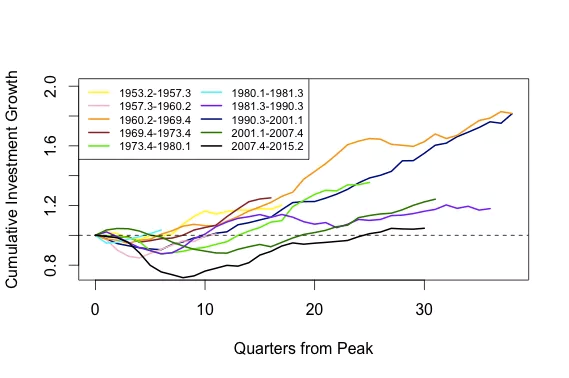

W. Mason (HT Nick Bunker) writes that if weak investment growth results in a lower overall level of economic activity, investment as a share of GDP will look higher. Conversely, an investment boom that leads to rapid growth of the economy may not show up as an especially high investment share of GDP. So to get a clear sense of the performance of business investment, its better to look at the real growth of investment spending over a full business cycle, measured in inflation-adjusted dollars, not in percent of GDP. And when we do this, we see that the investment performance of the most recent cycle is the weakest on record.

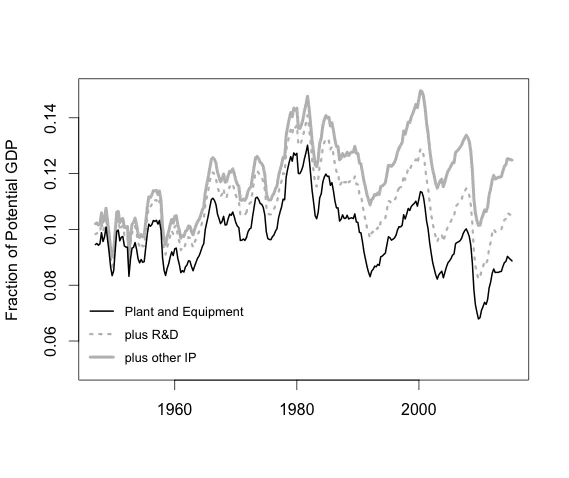

W. Mason (HT Nick Bunker) writes that the recent redefinition of investment by the BEA to include various IP spending makes historical comparisons problematic. If you count just traditional (GAAP) investment, or even traditional investment plus R&D, then investment has not, in fact, returned to its 2007 share of GDP, and remains well below long-run average levels.

Source: J. W. Mason