The decline in market liquidity

Has it become harder for buyers and sellers to transact without causing sharp price movements?

What’s at stake: There has been a plethora of stories on the apparent decline in trading or market liquidity over the past few months with a growing number of analysts pointing out that it has become harder for buyers and sellers to transact without causing sharp price movements. While the Fed remains unimpressed with these developments, several commentators have argued that the next crisis might come from an abrupt and dramatic re-rating of stocks and bonds.

The problem with illiquid markets

Robin Wigglesworth writes that Wall Street’s latest obsession is bond market liquidity. Lael Brainard writes that these concerns are highlighted by several episodes of unusually large intraday price movements that are difficult to ascribe to any particular news event, which suggest a deterioration in the resilience of market liquidity.

Nouriel Roubini writes that investors’ fears started with the “flash crash” of May 2010, when, in a matter of 30 minutes, major US stock indices fell by almost 10%, before recovering rapidly. Then came the “taper tantrum” in the spring of 2013, when US long-term interest rates shot up by 100 basis points after then-Fed Chairman Ben Bernanke hinted at an end to the Fed’s monthly purchases of long-term securities. Likewise, in October 2014, US Treasury yields plummeted by almost 40 basis points in minutes. The latest episode came in May 2015, when, in the space of a few days, ten-year German bond yields went from five basis points to almost 80. These events have fueled fears that, even very deep and liquid markets – such as US stocks and government bonds in the US and Germany – may not be liquid enough.

Charlie Himmelberg and Bridget Bartlett write that market liquidity is the extent to which investors can execute a fixed trade size within a fixed period of time without moving the price against the trade (which should not be confused with monetary liquidity, access to short-term funding, or liquid assets held on company balance sheets). Steve Strongin writes that one $10 million trade that historically may have taken a day to get done now needs to be split into 20 $500,000 trades that take a week or two to execute. From an investor’s standpoint, that is very uncomfortable because we live in a 24-hour news cycle so information is flowing much faster, but your ability to execute trades is now much slower. It also means that certain types of investment strategies—such as arbitrage strategies that rely on the ability to quickly identify and act on market dislocations—no longer work nearly as well, if they work at all.

Has liquidity decreased?

In its latest monetary report to Congress, the Federal Reserve writes that despite these increased market discussions, a variety of metrics of liquidity in the nominal Treasury market do not indicate notable deteriorations.

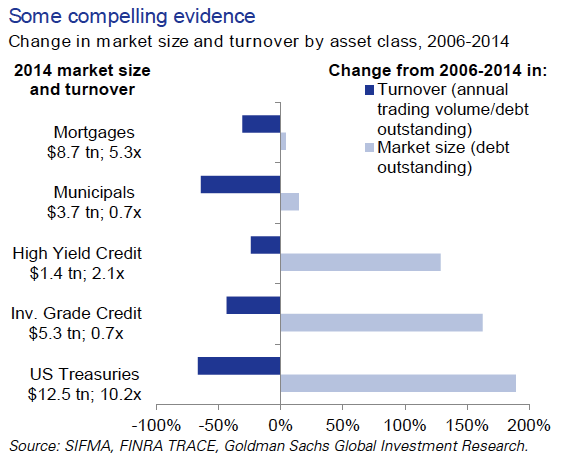

David Keohane writes that measuring liquidity is by necessity slippery — pick your preferred measure of liquidity (bid-ask, price impact, decline in net-dealer inventories) and we are pretty sure we can point you to a problem with it. But the chart below, on growing market size versus declining turnover, is tantalizing.

Technology, regulations and liquidity

Source: Goldman Sachs

Technology, regulations and liquidity

Matt Levine writes that Volcker, capital requirements, etc., drive up the cost of immediacy, but they don't increase the risk of a crash, because bond dealers were never in the business of buying all the bonds all the way down. Lael Brainard writes that reductions in broker-dealer inventories occurred prior to the passage of the Dodd-Frank Act, suggesting that factors other than regulation may also be contributing. In assessing the role of regulation as a possible contributor to reduced liquidity, it is important to recognize that those regulations were put in place to reduce the concentration of liquidity risk on the balance sheets of the large, highly interconnected institutions that proved to be a major amplifier of financial instability at the height of the crisis.

Nouriel Roubini sees several reasons why the re-rating of stocks and especially bonds can be abrupt and dramatic. First, when high-frequency traders are inactive, equity markets are in fact illiquid with few transactions. Second, fixed-income assets are illiquid because they’re mostly traded over the counter and are held in open-ended funds that allow investors to exit overnight. Before the crisis, banks used to hold large inventories of these assets, thus providing liquidity and smoothing excess price volatility. But, with new regulations punishing such trading (via higher capital charges), banks and other financial institutions have reduced their market-making activity. So, in times of surprise that move bond prices and yields, the banks are not present to act as stabilizers.

Risks of amplification

Lael Brainard writes that a reduction in the resilience of liquidity at times of stress could be significant if it acted as an amplification mechanism, impeded price discovery, or interfered with market functioning. For instance, during episodes of financial turmoil, reduced liquidity can lead to outsized liquidity premiums as well as an amplification of adverse shocks on financial markets, leading prices for financial assets to fall more than they otherwise would. The resulting reductions in asset values could then have second-round effects, as highly leveraged holders of financial assets may be forced to liquidate, pushing asset prices down further and threatening the stability of the financial system.

Robin Wigglesworth writes that scarred by the financial crisis, retail investors gravitated towards the supposed safety of fixed income. But their funds have bought increasingly illiquid bonds while still offering investors the opportunity to pull out whenever they want. If losses spook investors to do that, asset managers will sell bonds in order to pay investors their money back, the type of scenario that can quickly become a fire sale.