Greece budget update - August

The Greek finance ministry published last week the latest budget execution bulletin. The state budget primary balance increased significantly during J

On August 14th, Greece and its creditors finally reached an agreement on a third programme for Greece. Among other things, it foresees a new fiscal path with primary surplus targets of -0.25, 0.5, 1.75, and 3.5 percent of GDP in 2015, 2016, 2017 and 2018 and beyond, respectively. The trajectory of the fiscal targets reportedly aims at incorporating the expected deterioration of the Greek economy, and its impact on the feasibility of the previously established targets.

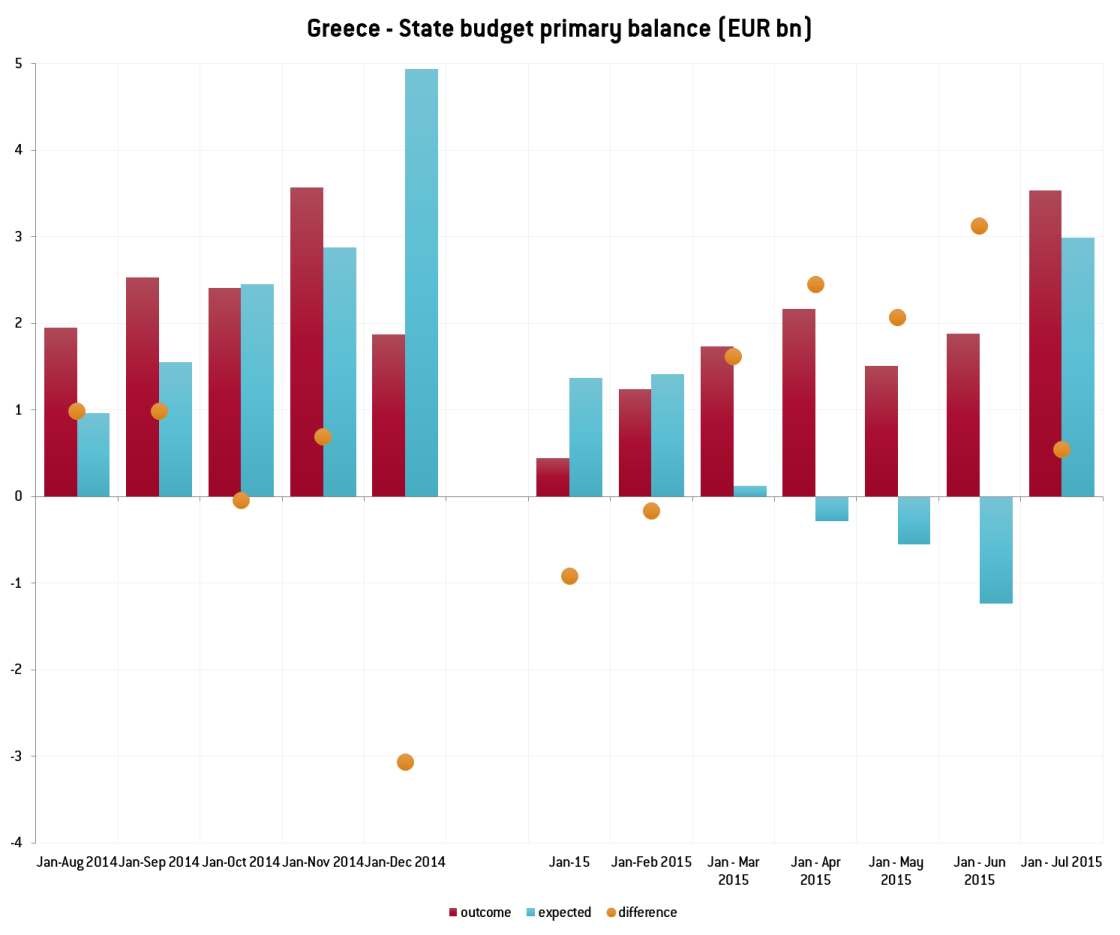

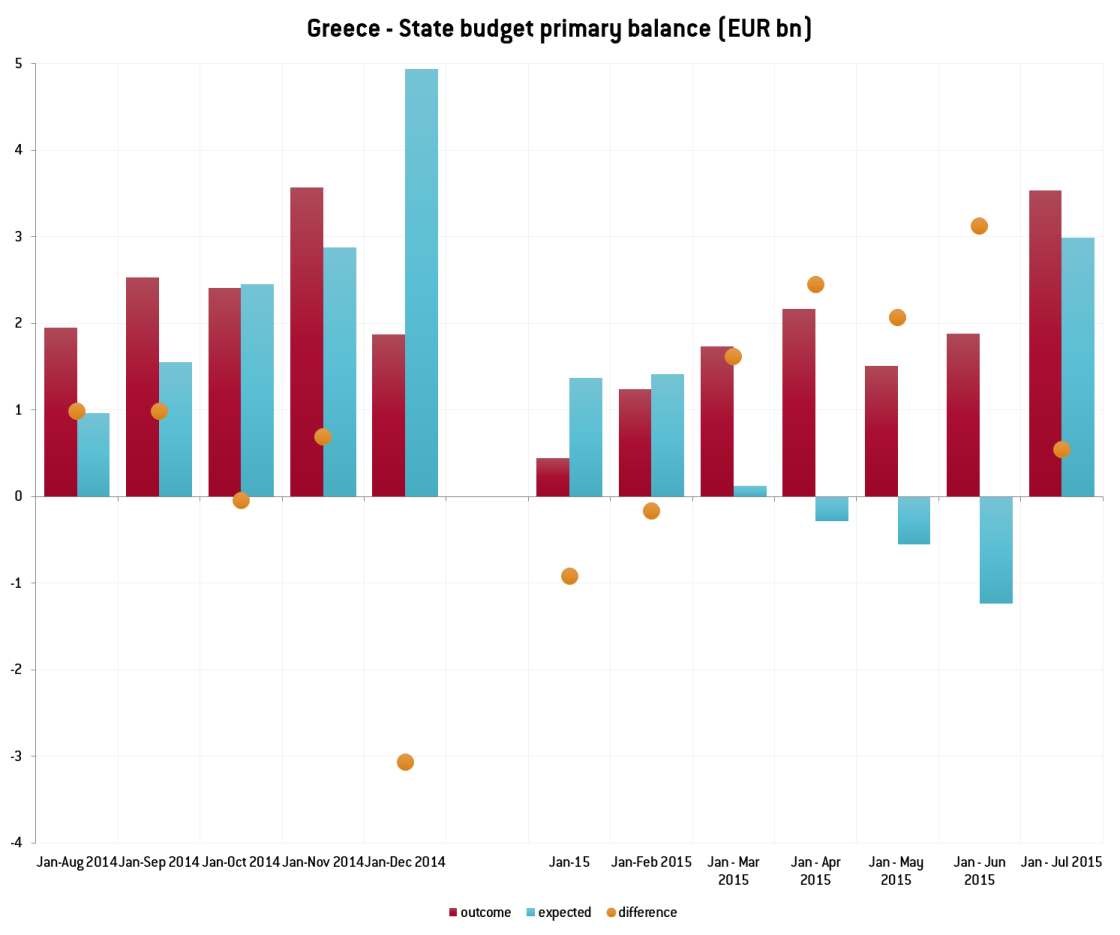

The Greek finance ministry published last week the latest budget execution bulletin. The state budget primary balance increased significantly during July. Greece recorded a primary surplus of 1.6 billion euros in July, which takes the cumulated primary surplus for the first six months of the year at 3.5 billion euros, against a primary surplus target of 2.99 billion euros. This is the highest monthly value for the primary surplus since August 2014.

Source: Ministry of Economy and Finance, Greece

As previously pointed out, July is a key month for assessing Greek fiscal performance. If we look back at 2014, the final primary surplus achieved at the end of the year was almost the same in absolute terms than the one reached in July. Last year, the cumulative primary surplus achieved as of July 2014 represented 80% of the cumulative primary surplus recorded in November 2014, which may be a better comparison, of we want to exclude potential downward bias due to elections, last year. This is due to the fact that in Greece July appears to be the most important month in terms of revenues collection.

The cumulative primary surplus achieved as of July 2015 would amount to about 2% of Greece’s 2014 GDP. If we were to draw a parallel based on the data for 2014 and assume that - absent elections and the related turmoil - the primary surplus achieved as of July represents about 80% of the final reading, then the end-year number could come in around 4.4 billion euro (2.5% of 2014 GDP).

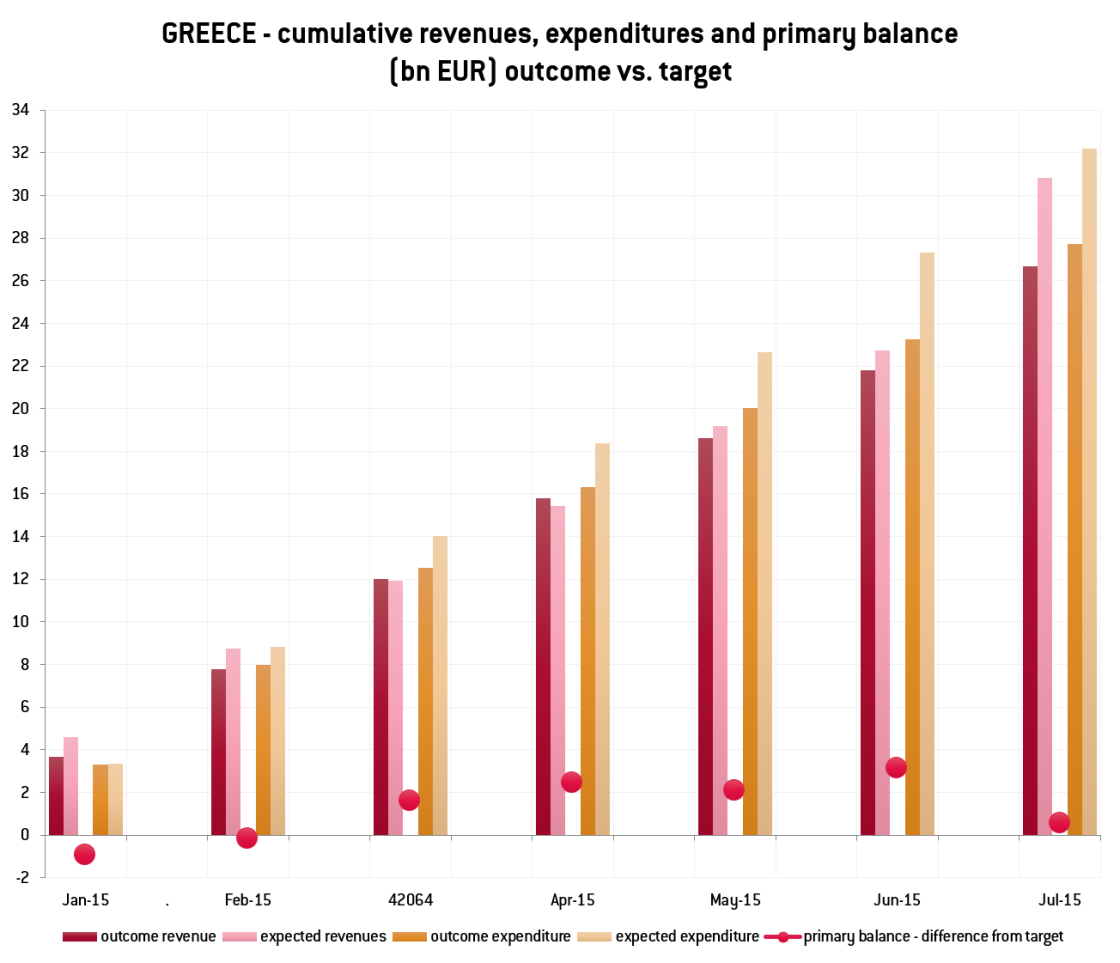

There are however significant downside risks. First, risk remains on the revenue side (Figure 2). Revenues increased on a monthly basis in July. For the month of July alone, net revenues amounted to 4.9 billion euros, with the cumulative number for the period January-July 2015 at 26.7 billion euro. But even so, July recorded the largest underperformance with respect to revenues targets, both on a monthly and a cumulated basis. Monthly revenues underperformed their target by 3.2 billion (40%), meaning that cumulative revenues were 4 billion below target.

The ministry of Finance says that the (rather expected) shortfall for the period January-July 2015 is due partly to extension of submission of declarations and first installment payment of Personal Income tax (PIT), Corporate Income Tax (CIT) and property tax (ENFIA), which Macropolis estimates at 1.8 billion. The rest of the shortfall is the result to missed ANFA & SMP revenue by 1.7 billion Euros. While the latter was mostly due to deadlock in negotiations and could be easily reverted after an agreement is reached, the problem with revenues collection appears to be more structural and could persist. As a reminder, the delays in submission/payments of CIT was already quoted as a reason for the big shortfall recorded in May, and the deadline has now been further extended.

Source: author’s calculations based on MEF bulletin

After seven months of watching closely the Greek budget, we have grown used to see the significant expenditure contraction recorded month after month. From the beginning of the year till June 2015 the primary surplus has been mostly the result of expenditures being significantly below target. For the month of July, state budget expenditures amounted to 4.5 billion euros, 388 million below target, with ordinary budget expenditures under performing by 62 million. Over the period January-July 2015, cumulative state budget expenditures amounted to 27.7 billion euros, 4.5 billion lower than the target. Ordinary Budget expenditures amounted to 26.5 billion euros and decreased by 3.1 billion against the target, again mostly due to the reduction of primary expenditure by 2.9 billion euros. Macropolis suggests that this is mainly the result of the government’s decision to delay payments of non-payroll expenses to improve the state’s cash flow position and that the state would most likely start fulfilling its payments after the disbursement of the first instalment of the new 3-year program. The impact of repaying arrears on the primary surplus will obviously depend on how revenues will behave over the next months.

Source: Ministry of Economy and Finance, Greece

Overall, the Greek budget execution bulletin for July sends a mixed message. The primary surplus increases, but revenues recorded the worst underperformance both on a monthly and a cumulative level, partly due to problems of revenues collection that appear persistent and that could result into arrears at the end of the year, when significant fiscal pressure will be concentrated on potentially cash-strained taxpayers.

On the other hand, the outcome is heavily influenced by growth. The GDP estimates for Q2 2015 released last week by the Greek Institute of Statistics partially defy initially bleak forecasts, as they foresee nominal GDP growth of +0.1% year-on-year and real GDP growth at +0.8% quarter-on-quarter and +1.4% year-on-year. This positive readings were widely unexpected across markets, and if they were to continue in the following month they would ease the achievement of the new targets.

The nominal numbers were less reassuring though, as nominal GDP grew +0.1% year-on-year and -0.7% quarter-on-quarter. Analysts suggest that a possible explanation for this divergence is that consumers frontloaded their purchases ahead of the full imposition of capital controls, thus inflating the numbers for June. The full impact of banks’ closure and capital controls on demand will most likely become visible in the data from July on, because these measures didn't come into full effect until June 29th.

A range of other data suggest caution: Greek industrial production decreased 4.5 percent in June of 2015 over the same month in the previous year, while the most recent manufacturing PMI survey reading came in to a record low of 30.2 in July from 46.9 in June. Bloomberg reports that business confidence in both the industrial and service sectors has collapsed since the start of the year, wiping out most of the gains from both 2013 and 2014. These being the premises, it looks like it’s definitely too early to draw optimistic conclusions.

Overall, the Greek budget execution bulletin for July sends a mixed message. The primary surplus increases, but revenues recorded the worst underperformance both on a monthly and a cumulative level, partly due to problems of revenues collection that appear persistent and that could result into arrears at the end of the year, when significant fiscal pressure will be concentrated on potentially cash-strained taxpayers.