Bond markets remaining calm

Following on from our blog on Monday, we take another look at the intra-day developments in the sovereign bond markets. So far, there appear to be no

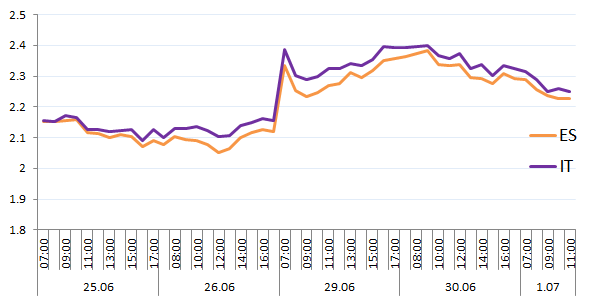

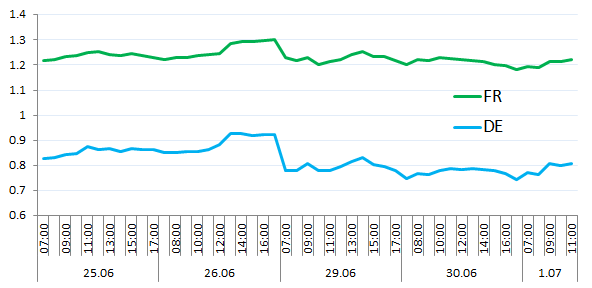

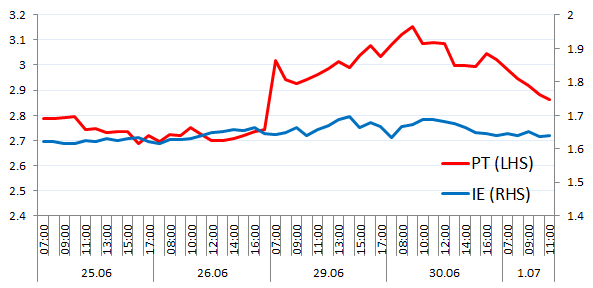

Following on from our blog on Monday, we take another look at the intra-day developments in the sovereign bond markets. So far, there appear to be no signs of any major stress in the markets.

Source: Thomson Reuters Eikon, most recent data 17:00 CET (16:00 GMT)

Figure 1: The Hourly developments in sovereign yields (%)

Source: Thomson Reuters Eikon, most recent data 17:00 CET (16:00 GMT)

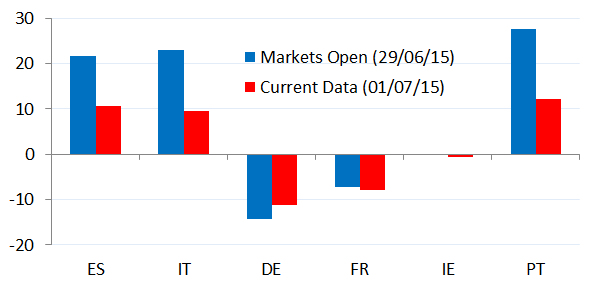

Figure 2: The change in yields since market closing on Friday 26/06/15

For those countries that did experience a small uptick in yields on Monday morning, we can see that yields are well on their way to reverting back to previous levels seen last week.

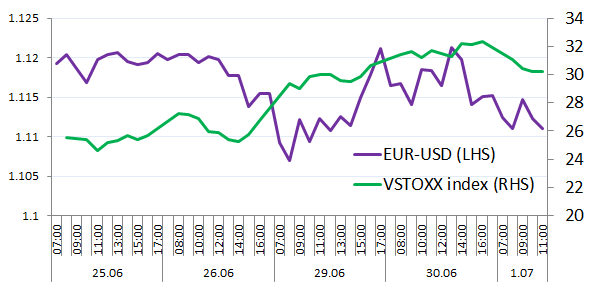

Figure 3: The Euro-Dollar Exchange rate (USD per EUR) and Volatility Index

Looking at markets more broadly, we can see that since Monday’s opening, volatility (as captured by the VSTOXX index) is up slightly from 26, peaking at about 32 and returning to around 30 at the time of writing and tending down recently.

The Euro quickly made up the losses incurred at market opening on Monday (29.06), however it has once again slid down against the dollar slightly.