The “Plucking Model” of recessions and recoveries

The speed of economic recoveries is generally attributed mainly to economic policies. While this view might be true, a theory suggested by Milton Frie

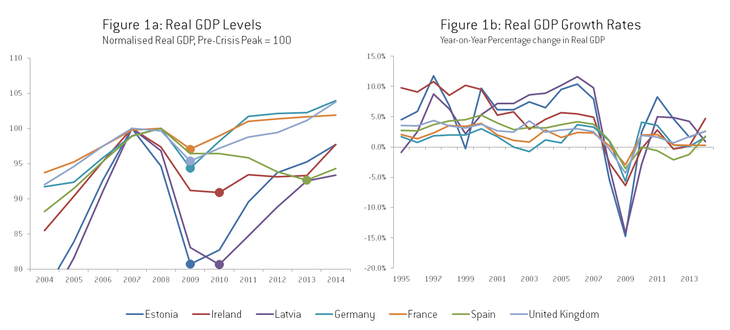

European GDP first estimates for Q4 2014 were published on February 13. They reveal that some countries that were severely hit by the crisis are now growing at a rate near or even higher than 2% yoy (Estonia 2.6%, Latvia 1.9%, Spain 2.0%, the UK 2.7%).

Since the crisis, growth rates in recovering European countries have been extremely uneven as can be seen in the right hand side of Figure 1. The recovery in certain economies (particularly in the Baltics and more recently in the UK or Spain) is often attributed to decisive economic policies (e.g. quick structural adjustment in Latvia, quantitative easing in the UK or labour market reforms more recently in Spain). While this view may be true, a theory suggested by Milton Friedman in 1964 (and revisited in 1993) proposes a complementary hypothesis: these strong recoveries are just natural after particularly deep recessions (that can be observed on the left hand side of Figure 1 below).

If it’s true that Estonia and Latvia stand out today in terms of real GDP growth, achieving much higher rates in the years since 2010 (5% per year on average in both cases) than other European countries, Friedman’s “plucking model” predicts exactly this kind of recovery – the harsher the recession, the swifter the revival of growth during the recovery (when it eventually comes) – irrespective of the policies followed.

Source: AMECO, Feb 5, 2015 edition.

The plucking model theory vs. the natural rate theory

Milton Friedman’s 1964 “plucking model” is a simple story about how economies fluctuate, and the nature of recessions. It provides an alternative theory to the natural rate theory, which is by far the dominant view of how the economy works among macroeconomists today.

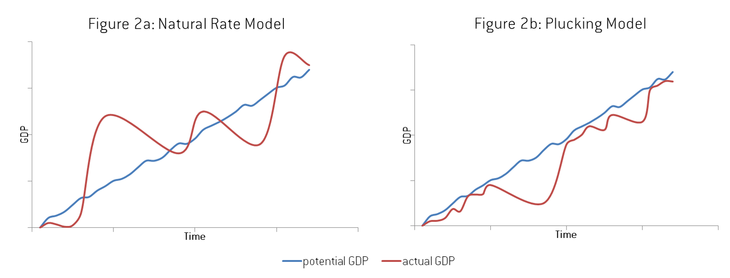

According to the natural rate theory, output fluctuates around an equilibrium trend. This equilibrium or natural level (the blue line on the left hand side of Figure 2 below) is consistent with an inflation rate that is neither collapsing nor exploding. An overheating economy producing more than its natural level (when the red line is above the blue line) will experience inflation, and conversely persistent spare capacity will start to push prices in the other direction (blue below red).

On the contrary, Friedman’s model assumes that output can only move along a ceiling value (the blue line on the right hand side of Figure 2 below), corresponding more or less to the full utilization of capital and labour, or be plucked downwards. Plucking shocks are temporary demand shocks, whereas fluctuations of the ceiling itself are determined by supply shocks (technologic, demographic, regulatory, etc.).

Source: Bruegel drawings (inspired by Mark Thoma’s 2006 blog post explaining the plucking model)

The two theories make some interesting and more importantly testable predictions:

If the natural rate view is correct, the bust should be directly proportional to the boom that preceded it, as it should bring output back towards its natural level. In the natural rate world, the size of the boom predicts the size of the bust.

The plucking model, on the other hand, says that recessions are not dependent on the size of the preceding booms but are mainly the result of infrequent events (such as financial crises). Moreover, it suggests that, like a guitar string, the harder the string is plucked down, the faster it should come back up. Bigger recessions should lead to faster growth rates during the recoveries, to get the economy back to the pre-recession level of activity. In the plucking model world, the size of the recession predicts the growth rate in the recovery.

Friedman never explained precisely what he had in mind concerning the mechanism at work behind the plucking model. However, Simon Wren-Lewis’s simple example about shutting down half of the economy for a year, and then turning it back on again, therefore generating a 100% growth rate illustrates how growth rates can be misleading after large collapses in GDP.

In addition, given that the previous boom does not predict the size of the bust, the plucking model says nothing about when growth comes back. The contraction is not a mere correction of previous imbalances but can be self-perpetuating (because the economy may be stuck in a bad equilibrium for instance). The plucking model only foresees that when growth comes back it should be proportional to the previous contraction. In the case of Greece for example, the plucking model does not really help us in forecasting when the return of growth will take place. Nevertheless, it has the optimistic prediction that growth rates could be quite strong when the economy starts recovering (even if after such a long depression the ceiling itself may have been affected by years of underinvestment and an immense loss of human capital).

Can the plucking model explain the last European boom-bust-recovery cycle?

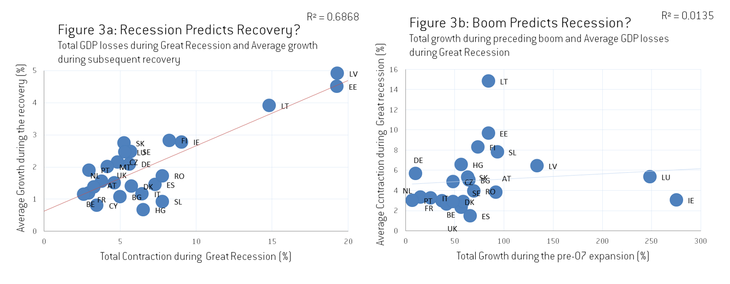

Let’s take a look at all European countries that entered recession around 2007-2009, and have made some gains towards recovery since then. Our sample contains all EU countries except the ones that didn’t experience a recession (Poland) or a recovery (Croatia and Greece), using annual GDP data from the AMECO database.

Source: Ameco, Bruegel calculations

As can be seen in Figure 3a above, our very simple regressions suggest that the size of the contraction is predictive of growth rates during the recovery (the P-value is 0.000). On the other hand, the size of the boom that precedes the recession – Figure 3b – is not predictive of the yearly average GDP contraction in a way that is statistically different from zero (P-value of 0.598).

These results appear to validate the plucking theory predictions made by Friedman. In other words, the strong recoveries observed in European countries like Latvia and Estonia seem to be directly proportional to the size of their GDP-losses during the crisis. If these quick recoveries are the natural counterpart of the previous recessions, it makes it difficult to infer anything on the success or failure of the policies implemented since the beginning of the crisis, and therefore to use these countries as role model in order to recommend similar policies to other European countries.