A Greek primary issue

On the 25th February, the Greek ministry of finance published the final data for the execution of the State Budget in January 2015. This data is

On the 25th February, the Greek ministry of finance published the final data for the execution of the State Budget in January 2015.

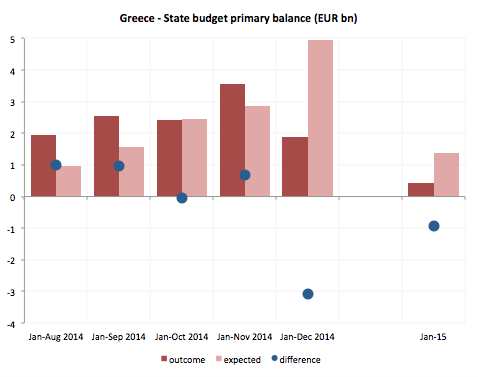

This data is available at monthly frequency and on cash basis, which makes it well suited to assess the situation of public finances from a short term financing perspective. Moreover, it allows comparing actual outcomes with expected ones.

Source: Greek Ministry of Finance - State Budget Execution Bulletins

Over the period January-September 2014, the State primary budget outperformed expectations. The actual outcome for the 9-months period was 2.5bn against. 1.6bn expected. This has remained the case up until November 2014, when the 11-months State primary balance amounted to 3.6bn against an expected 2.9bn.

Then came the elections, and the situation drastically reverted. For the 12-months period of January-December 2014, in fact, the outcome has been 1.9bn against 4.9bn expected, meaning that the State primary balance has undershot its target by 3bn.

A breakdown shows that the shortfall was due mainly to the underperformance of State budget net revenues, which came in at 51bn against about 55bn expected.

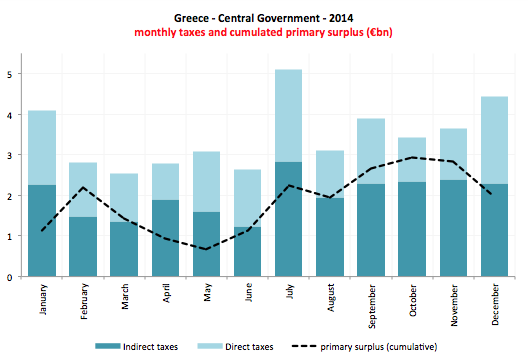

The final figures for January 2015 show that the underperformance has carried on in 2015. The primary balance was 443 millions in January against 1.4bn expected, with revenues still 935 millions short of the target. 1.4bn may look a very large value, but figure 2 shows that in 2014 a large part of the final primary surplus was built up in the first two months of the years, with January being one of the most important months for the collection of tax revenues.

Source: Greek Central Government

According to the Ministry of Finance, the underperformance in January 2015 was mainly due to the extension of a VAT payment deadline until the end of February 2015 and to the underperformance of the expected revenues from the settlement of arrears. Therefore, data released in February will be key to watch, for two reasons.

First, it has been previously been pointed out that March is one of the heaviest months for Greece in terms of financing needs, with 4.3bn of T-bills to roll over and 1.5 bn coming due to the IMF. After last Friday’s agreement, which includes the returning of the 11bn left over in the Hellenic Financial Stability Fund (HFSF) to the EFSF, the short term funding options for the Greek government have narrowed.

Second, it might be an important indicator for the negotiations over the target primary surplus for 2015, which is still not set. According to the European Commission forecasts released this month, the primary surplus in 2014 was expected to be 1.7% on an accrual basis, although the weaker end-2014 data suggest the actual figure might be lower. 1.7% is not far from the 1.5% target that Syriza would like the Eurogroup to agree to for 2015. Leaving aside the political considerations on this, budget data show that revenues in January 2015 were 17% lower than they were in January 2014, suggesting that if this trend does not revert, even 1.5% primary surplus may be hard to achieve.