The deflation naysayers

What’s at stake: As the euro area experiences decreasing prices for the first time since 2009, not all economists are aboard the anti-deflation bandwa

What’s at stake: As the euro area experiences decreasing prices for the first time since 2009, not all economists are aboard the anti-deflation bandwagon, arguing that the worries expressed about mild deflations are misguided. In this review, we explore the empirical and theoretical arguments put forward by the deflation naysayers.

John Cochrane notes that The Economist recently proclaimed deflation a “pernicious threat” and “the world’s biggest economic problem.” Christine Lagarde even called deflation an “ogre” that could “prove disastrous for the recovery.” Eurointelligence reports, on the other hand, that the German press was dismissive about the latest euro area wide decline in consumer prices. Suddeutsche Zeitung carried the story of the Eurostat numbers on the bottom of page 3 of its business section. Frankfurter Allgemeine said don't panic, this is no deflation.

The empirical argument

Charles Plosser writes that despite the incredible amount of attention given to the purveyors of fear regarding deflation, neither the historical record nor economic theory provide much reason to justify all the trepidation. Except for the Great Depression, the historical record and recent experience show that most periods of mild deflation are associated with economic growth, not stagnation or decline. The Great Depression is the exception rather than the rule. Even the recent experience of Japan provides little support for the idea that deflation itself is a source of declining output.

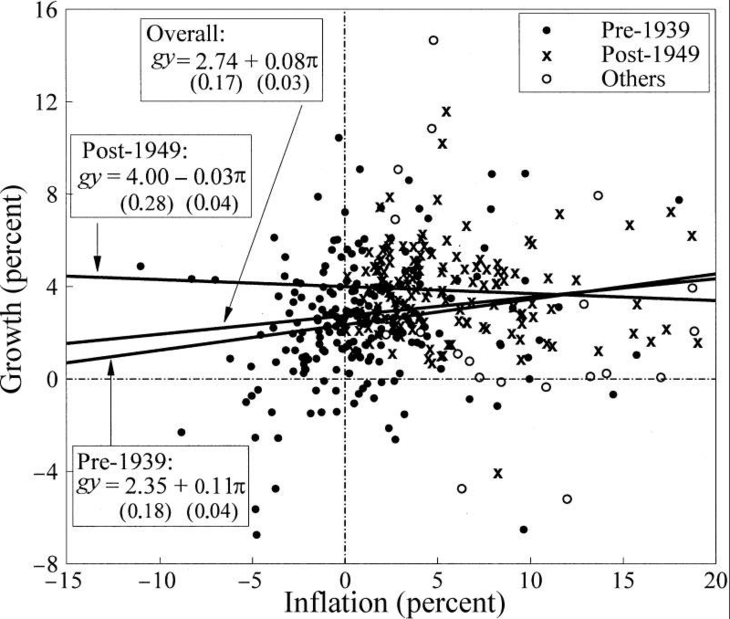

Andrew Atkeson and Patrick J. Kehoe write that overall, the data show virtually no link between deflation and depression. A broad historical look finds many more periods of deflation with reasonable growth than with depression, and many more periods of depression with inflation than with deflation. Outside the depression, the authors find only eight episodes with both deflation and depression. There are 65 episodes of deflation without depression and 21 of depression without deflation.

Note: Average inflation and real output growth in 17 countries in all five-year periods, 1820-2000.

Source: Atkeson and Kehoe (2004)

Bilal Hafeez does a similar empirical exercise based on 30 countries and concludes that so far as growth is concerned, two centuries’ worth of data provide no reason to prefer inflation over deflation. The story is not the same everywhere you look. Asia has grown much more rapidly in times of inflation than deflation. North American economies have shrunk during the average deflationary year. By contrast, Europe has seen higher growth during deflations than inflations. In the past, Germany has done especially well out of falling prices, growing at 2.6 per cent during deflations against a measly 0.6 per cent when prices were going up.

Eurointelligence writes that this is the kind argument that gives a bad name to empirical research. During the industrial revolution, growth rates were structurally larger than they were today. The world economy also had numerous regime shifts during that period. You should not average a 200 yearlong data series, and then arrive at policy conclusions for today.

The theoretical argument

John Cochrane writes that a common story is that employers are loath to cut wages, so deflation can make labor artificially expensive. With product prices falling and wages too high, employers will cut back or close down. Sticky wages would be a problem for a sharp 20% deflation. But not for steady 2% deflation. A typical worker’s earnings rise around 2% a year as he or she gains experience, and another 1%—hopefully more—from aggregate productivity growth. So there could be 3% deflation before a typical worker would have to take a nominal wage cut.

Charles Plosser writes that it is often claimed that consumers will postpone purchases, anticipating that prices will be lower in the future. This argument fails to take into account that with anticipated deflation, nominal interest rates will be lower as well and this reduced reward for saving just offsets the gains from delaying purchases. The net effect on real aggregate demand is zero. Michele Boldrin, Giovanni Federico and Giulio Zanella add that this argument should also apply to supply driven deflations but the data suggests that it wasn’t the case. So why did an American put off the purchase of a durable good in 1931, expecting lower prices in 1932, while his grandfather didn’t do the same thing in 1874 when it was sensible to expect that prices would be lower in 1875?

John Cochrane writes that another story here is that deflation will push debtors, and indebted governments especially, to default, causing financial crises. When prices fall unexpectedly, profits and tax revenues fall. Costs also fall, but required debt payments do not fall. A sudden, unexpected 20% deflation is one thing, but a slow slide to 2% deflation is quite another. A 100% debt-to-GDP ratio is, after a year of unexpected 2% deflation, a 102% debt-to-GDP ratio. You’d have to go decades like this before deflation causes a debt crisis.

John Cochrane writes that nowhere, ever, has an economy such as ours or Europe’s, with fiat money, an interest-rate target, massive excess bank reserves and outstanding government debt, experienced the dreaded deflation spiral. There are good reasons to believe it can’t happen. Most of all, government solvency fears that don’t matter for 2% deflation kick in and stop a deflation spiral. If prices fall 20%, or 30%, bond-holders will see that governments cannot pay back debts. They try to get rid of their bonds before the coming default. They buy things or other currencies, nipping the deflation spiral in the bud.