The convergence dream 25 years on

The 25th anniversary of the fall of the Berlin wall was widely celebrated – rightly so. The fall of communism opened the way for democracy, personal f

The 25th anniversary of the fall of the Berlin wall was widely celebrated – rightly so. The fall of communism opened the way for democracy, personal freedoms, security, lawfulness, fairness and economic efficiency, among others. The transition also raised hopes that the economies might converge to western Europe in income per capita. Such hopes were supported by efficiency gains related to the transformation to market economies, institutional development, the western-focused integration process and microeconomic factors such as the intellectual skills of the labour force, entrepreneurial abilities, and the capacity to accommodate new knowledge and technologies.

The fall of communism opened the way for democracy, personal freedoms, security, lawfulness, fairness and economic efficiency

After the dramatic economic collapse during the first years of transition, all countries in the region closed their income gaps relative to main trading partners, as documented by an IMF report. Yet as my colleague Marek Dabrowski warned some weeks ago, convergence in the 2000s has halted or even reversed since the global financial and economic crisis erupted, and there are questions about the future growth prospects of the region.

In this post I look back to 1989 (and before when possible) and consider whether the overall convergence since the mid-1990s has compensated for the dramatic reduction in per capita incomes during the transition. There are certainly data issues: the measurement of economic performance during the transition was uncertain and income levels were likely incorrectly measured during the communist era. In trying to address these concerns, I use income levels from Eurostat (for EU countries) and the IMF (for other post-communist countries) from the mid-1990s and use real GDP and population growth rates to trace back the level of per capita output in earlier years: I assumed that per capita real GDP growth relative to trading partners approximates the change in relative GDP per capita measured at purchasing power parity. Presumably, growth rates were better measured than income levels during the transition, while income levels from the mid-1990s onwards should be more reliable due to the adoption of improved statistical standards.

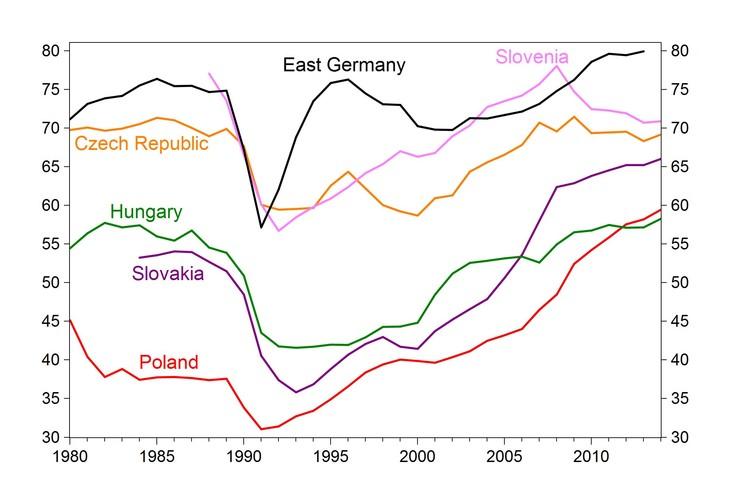

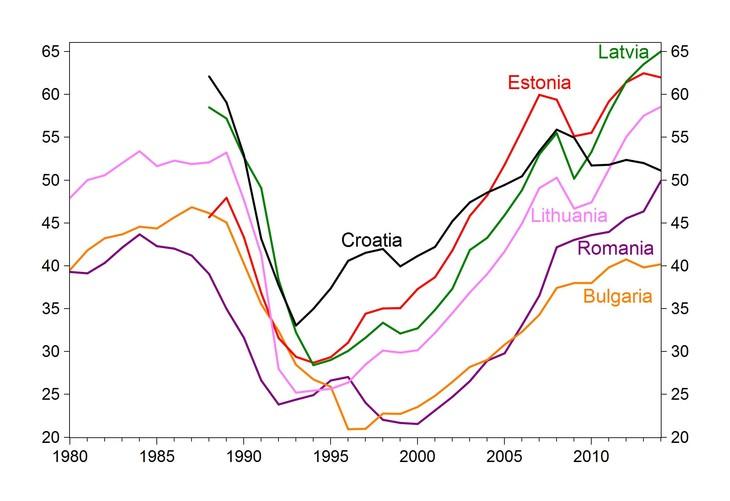

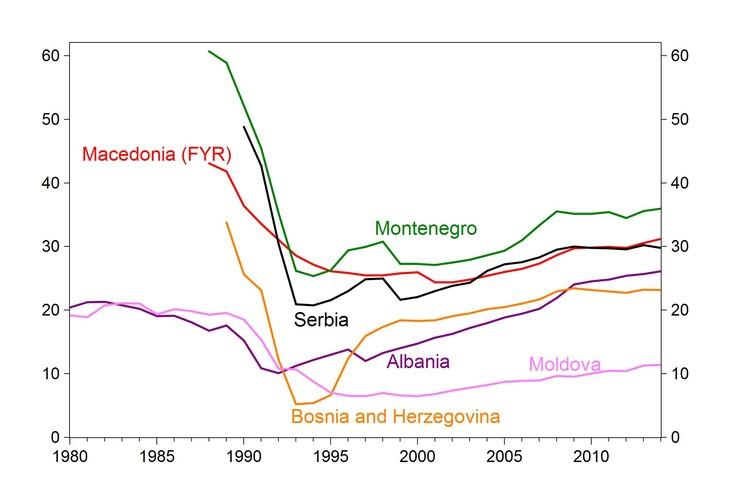

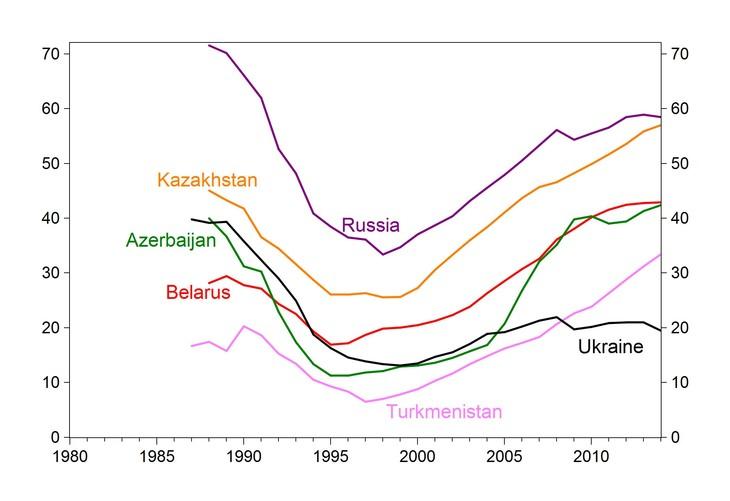

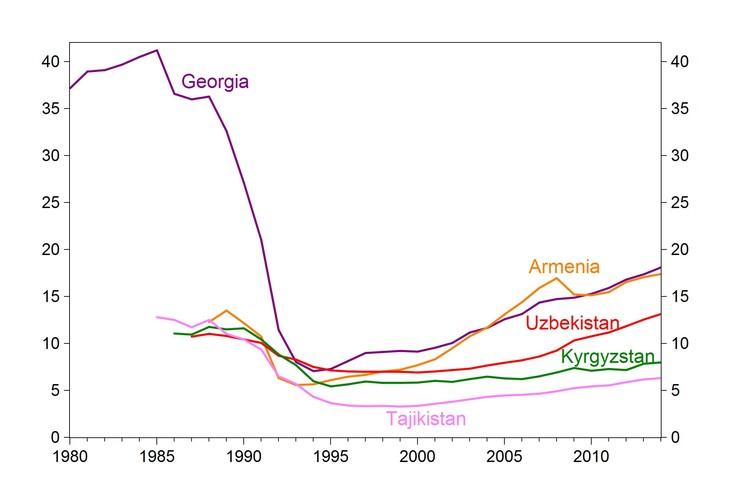

In the figures below I compare per capita income, measured at purchasing power parity, to the weighted average of 10 advanced EU countries. It delivers a surprising picture: of the 29 countries shown, only 14 had higher GDP per capita (at purchasing power parity) in 2014 relative to the 10 advanced EU countries as compared to before the transition, while 1 had similar and 14 had lower. I also include East Germany among the 29 countries: following the transition shock, there was a rebound from 1992-94, but this was short-lived . East German GDP per capita grew at practically the same rate as West German GDP per capita from 1996-2013, so in this period the ups and downs of East Germany indicated on the chart represent overall German development.

When I presented these charts at seminars, the typical critiques I received were that Trabants are not comparable to BMWs, and that these countries have changed and developed so much in the past two decades that it is inconceivable that in half of them relative per capita income is lower now than it was in the communist era. I have two responses.

First, per capita income of the 10 advanced EU countries grew by about 40 percent from 1989-2014. Thus, an unchanged relative per capita GDP implies an absolute growth of 40 percent. There was, therefore, improvement in income conditions even in most of those post-communist countries that did not converge during the past 25 years. The key exceptions are Georgia, Ukraine and Tajikistan, where the absolute level of real GDP per capita is still well below pre-transition values, and Montenegro, Moldova and Serbia, where GDP per capita is also somewhat below the pre-transition level.

Second, many BMW and Mercedes cars can indeed be seen in city centres and airport parking garages, where there are also many shining buildings. Foreign visitors mostly see these areas. But the suburbs of main cities, the smaller towns and villages and the countryside are not always that shiny. As I highlighted in a post I wrote for the 10th anniversary of the EU enlargement, capitals like Warsaw, Bratislava and Prague have even overtaken Vienna in terms of GDP per capita, but regional divergence has widened: there are many poor regions which converged very little in 2000-2011 (the period for which regional data is available).

There is a lot to celebrate at the 25th anniversary but one should keep in mind that convergence to western living standards is not automatic

Let me mention a few statistics on passenger cars, because Trabants are indeed not comparable to BMWs. In 2011, there were 490 cars per 1000 people on average in the 10 advanced EU countries, 379 in the 11 new EU member states, 179 in non-EU Balkan countries and around 200 in the former Soviet Union (data source: World Development Indicators of World Bank). In 2012, the share of cars older than 10 years was 36 percent in Germany, 33 percent in France and 25 percent in the United Kingdom, while in the Czech Republic it was 54 percent, in Hungary 55 percent and in Poland 71% (data source: Eurostat transport database).

In non-EU transition countries (for which I do not have data) the share of old cars is presumably very high too. Therefore, even if Trabants hardly can be seen on the streets of central and Eastern Europe now, people on average possess fewer and much older cars than citizens in Western Europe.

While half of the countries did not converge from 1989-2014, the other half did, such as Poland, Albania, Slovakia, the Baltic countries and most resource-rich former Soviet Union countries (except Russia). Clearly, some countries better exploited the opportunities offered by transition and subsequent European integration. Therefore, there is still a lot to celebrate at the 25th anniversary, even in economic terms, but one should keep in mind that convergence to western living standards is not automatic and half of the post-communist countries did not converge during the past 25 years.

GDP per capita at purchasing power parity (% of 10 advanced EU countries), 1980-2014

Source: calculations using data form Eurostat, IMF, EBRD, World Bank, Statistisches Bundesamt and DIW.

Note: the reference group of 10 advanced EU countries include Austria, Belgium, Denmark, Finland, France, Germany, Luxembourg, the Netherlands, Sweden and United Kingdom. These countries represent major trading and financial partners of post-communist countries. I did not include southern Europe and Ireland in the reference group, because they were also converging and/or diverging to the average of the other 10 former EU members.

Read more:

Central and eastern Europe: uncertain prospects of economic convergence