Blogs review: QE and central bank solvency (continued)

What’s at stake: Our previous review suggested reasons for believing that central bank financial strength was a non-issue, even within the partic

What’s at stake: Our previous review suggested reasons for believing that central bank financial strength was a non-issue, even within the particular institutional set-up of the euro area. Yet central banks tend to display a strong aversion to financial weakness. And as this week ECB’s decision (that QE risks won’t be fully mutualized) illustrates, this aversion is even higher within in a currency union. In this review, we explore potential reasons for this aversion.

Central Banks aversion to negative equity

The Economist writes that under European QE each of the 19 national central banks, which together with the ECB constitute the Eurosystem, will buy the bonds of its own government and bear any risk of losses on it.

The BIS notes that up until the passage of the Dodd-Frank Act in 2010, Section 13(3) of the Federal Reserve Act provided the Federal Reserve with the authority to lend to individual non-depository financial institutions (such as AIG, but more generally also to individuals, partnerships and corporations) in “unusual and exigent circumstances”, subject to a qualified majority of Board members voting to do so. With the passage of the Dodd-Frank Act, that independent authority has been curtailed. Such lending is now required to be in a manner “consistent with sound management practices” that protects taxpayers from losses, and subject to the authorization of the Treasury Secretary. According to records of the Congressional debate, the motivation for the restriction was to limit the ability of the Federal Reserve to put taxpayer money at risk through emergency lending.

In its 2010 Convergence Report, the ECB writes that ``any situation should be avoided whereby for a prolonged period of time an NCB’s net equity is below the level of its statutory capital or is even negative, including where losses beyond the level of capital and the reserves are carried over […] the event of an NCB’s net equity becoming less than its statutory capital or even negative would require that the respective Member State provides the NCB with an appropriate amount of capital at least up to the level of the statutory capital within a reasonable period of time so as to comply with the principle of financial independence.”

Recapitalization through base money issuance, inflation and signals

Peter Stella writes that losses for a central bank become an immediate problem when they interfere with the conduct of monetary policy. As losses either lead to an injection of reserve money or portend future cash injections if they’re unrealized, they have either an immediate impact on domestic liquidity or influence expectations about future monetary growth.

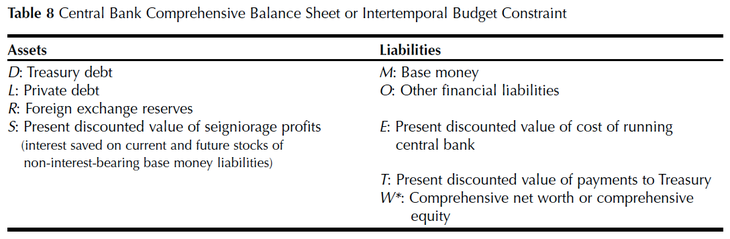

Willem Buiter writes that it should be obvious that the central bank can make the nominal present discounted value of current and future seigniorage pretty much anything it wants it to be. While a central bank can always recapitalize itself through the issuance of base money, doing so may not be optimal or even acceptable, even though it is feasible: self-recapitalization through seigniorage may generate undesirably high rates of inflation. Marco Del Negro and Christopher A. Sims write that whether a can manages to recapitalize through base money issuance and respect its policy objectives depends on the policy rule, the demand for its non-interest-bearing liabilities, and the size of the initial net worth gap.

Source: Willem Buiter

Jaime Caruana writes that the problem is that not everyone appreciates that a central bank’s accounting equity can be negative without any reason for alarm bells to ring. Markets may instead react badly in the false belief that losses imply a loss of policy effectiveness. Politicians may also object, if they leap to the conclusion that bad decisions have been made at the taxpayer’s expense, or that the central bank now depends on the government for a rescue. Such harmful self-fulfilling prophecies are in nobody’s interest.

Economists at the Czech National Bank write that the link from CB financial strength to inflation is far from straightforward. There are historical examples of countries where central bank financial weakness has led to clear problems, but there are also central banks that have successfully delivered price stability for many years irrespective of their negative equity. Economists at the Bank of Thailand write that four central banks which are commonly referred as successful central banks with weak financial status are Czech National Bank (CNB), Central Bank of Chile (CBC), Bank of Israel (BOI) and Bank of Mexico (BOM). Mojmír Hampl writes that the Czech National Bank has indeed lived for years with negative equity of up to some 5% of gross domestic product without experiencing any ill effects on its reputation or operation. The Slovak central bank adopted the euro comfortably with an uncovered loss and is still functioning happily within the euro area.

QE and fiscal transfers redux (on Paul de Grauwe)

Monetary Realism writes that the standard central bank strategy for QE includes the assumption that it is temporary – that there will be an exit sometime down the road, anticipating the prospect that central banks will be returning policy interest rates to more normal positive levels. Given that goal and expectation, QE related excess reserves (and related liability forms) will have to pay a positive rate of interest in order to support a policy rate structure above the zero bound – until the completion of QE exit. QE related liabilities must pay a positive interest rate as floor support if the central bank’s policy rate is set sufficiently above zero.

Monetary Realism writes that De Grauwe has overlooked the fiscal effect linked to the charge for any future interest expenses on the ECB liabilities that were created as the result of QE purchases of bonds that have now defaulted. This is relevant considering the real possibility that the world may return to more positive interest rates at some future point. In that case, under De Grauwe’s proposed treatment, any Eurozone country that has defaulted on bonds will have escaped its respective share of ECB liability costs for which it has been responsible by direct QE association. Such a country will have obtained perpetual free funding courtesy of the ECB and its remaining capital holders. That is an unambiguous fiscal transfer that De Grauwe has either not recognized or assumed away.