The economics of P2P lending

Lending Club has captured the attention this week as it became listed on Thursday on the NY Stock Exchange and its share spiked nearly 70% in trading

What’s at stake: Lending Club has captured the attention this week as it became listed on Thursday on the NY Stock Exchange and its share spiked nearly 70% in trading debut. While the growth of marketplace lenders has been exponential over the past few years, questions remain as to whether P2P lenders will manage to move beyond the niche of middle-class credit card borrowers and will be able shoulder the next recession.

Tracy Alloway and Eric Platt write that Lending Club, the San Francisco start-up that set out to bypass traditional banking, captured the attention of Wall Street on Thursday as it listed on the New York Stock Exchange and shot to a valuation of $8.5bn. The listing is widely viewed as a coming of age moment for the entire peer-to-peer, or marketplace lending, industry. Already two other alternative lenders — OnDeck and SoFi — are waiting in the wings for their own IPOs.

The basics of P2P lending

Ian Galloway writes that P2P lending sites match individual borrowers with individual lenders. Borrowers share information about themselves—both personal and financial—and lenders decide whether or not to contribute to their loan request.

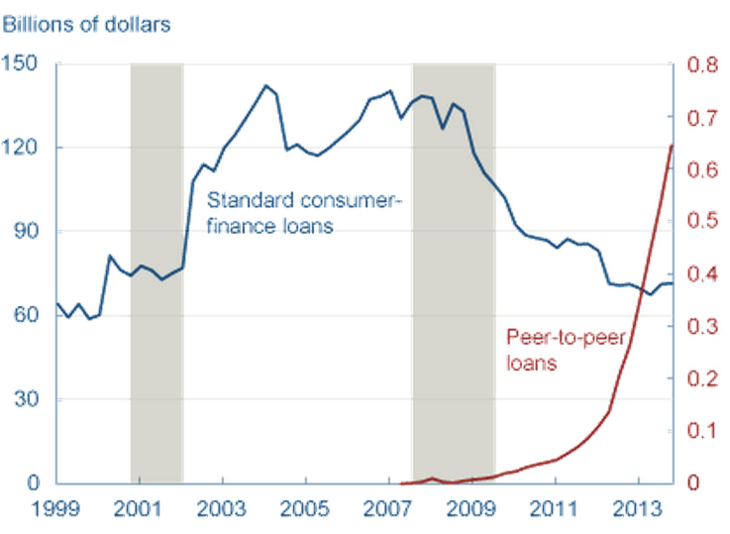

The Economist writes that the growth of marketplace lenders has been exponential. Doing banking without the expensive bits of the industry—branches, creaking IT systems and so on—means that peer-to-peer loans offer lower rates, reflecting their reduced costs (see chart). Most borrowers are refinancing their credit-card debt, swapping a loan on which they paid 16-18% for 12% or so at Lending Club. The company’s focus has been on smaller loans (up to $35,000) to individuals with decent credit ratings, although it is also catering to businesses now.

In its registration statement to the Securities and Exchange Commission, Lending Club writes that a technology-powered online marketplace is a more efficient mechanism to allocate capital between borrowers and investors than the traditional banking system. Consumers and small business owners borrow through Lending Club to lower the cost of their credit and enjoy a better experience than traditional bank lending. Investors use Lending Club to earn attractive risk-adjusted returns from an asset class that has historically been closed to individual investors and only available on a limited basis to institutional investors.

Jonathan Ford writes that peer-to-peer lending is often described in the same breath as disruptive new web technologies such as Uber. But the way mainstream banks have responded to the P2P challenge is much more laid back than the response of taxis. What the bankers seem ultimately to be betting is that P2P will struggle to scale its business. It may be easy to arbitrage a few old credit card loans. But when it comes to riskier advances, whatever whizzy algorithm-based underwriting systems P2P lenders have concocted will prove no match for their own — which are based on a deep knowledge of a full range of a customer’s financial transactions.

The Risk/Return tradeoff

Felix Salmon writes that Lending Club’s most valuable innovation, it turns out, wasn’t its mechanism for matching borrowers with lenders; instead, it was its uncanny ability to use proprietary algorithms to identify which prospective borrowers were most likely to repay their loans. Lending Club wasn’t the first peer-to-peer lender—that honor goes to its main competitor, Prosper, which was launched by entrepreneur Chris Larsen in 2005. Prosper was, however, soon overrun by people who would take out loans and never pay them back. It also had to close down for six months after it ran into trouble with the SEC. Into the breach stepped its biggest competitor.

The Economist writes that P2P lenders use credit scores as a starting-point to establish a borrower’s creditworthiness in the same way as banks and credit-card companies do. But they say their snazzy credit-scoring algorithms will enable them to weed out probable defaulters better than conventional financial firms do, leading to smaller losses. That is plausible but unproven. Doling out cash in good times is far easier than getting it back in a recession, as seasoned bankers know. Elaine Moore and Tracy Alloway write that unlike banks rates are largely determined by the people who lend the money.

Jonathan Ford writes that publicly available credit data has allowed Lending Club to cherry pick middle-class credit card borrowers. Its lack of expensive branches and legacy IT systems then allowed it to refinance their debts at lower cost, while still generating juicy returns for lenders. But as the P2P business expands, operators will need to find riskier borrowers to lend to. The industry is already doing so, moving into areas such as small business lending where there is an appreciable need.

Calculated Risk looks at the average Lending Club loan (that they call "quality"): it’s an unsecured personal loan to an individual so they can pay off $14,000 in credit card debt with interest rate at 17%. The person has a 15-year credit history, a FICO score of 699, an annual income of $73,000 and a DTI of 17% (excluding mortgage debt). Maybe I'd consider helping for a close friend or family member if I knew all the circumstances. However, for everyone else, my answer isn't no, it is Hell No!

Patrick Jenkins writes that the interest rates on offer to investors in this lightly regulated industry probably look too good to be true because they are. A 15 per cent interest rate can only mean you are in grave danger of losing your money altogether. Historic P2P loan default rates look flattering because they only go back a few years.

Lending Club writes that they make payments ratably on an investor’s investment only if they receive the borrower’s payments on the corresponding loan. If they do not receive payments on the corresponding loan related to an investment, the investor will not be entitled to any payments under the terms of the investment. Further, investors may have to pay them an additional servicing fee of up to 35% of any amount recovered by their third-party collection agencies assigned to collect on the loan.

The Economist writes that funds placed with P2P lenders are not covered by the state-backed guarantees that protect retail deposits in banks. Some platforms offer something of a substitute. Zopa and most other British companies have started “provision funds”, which aim (but do not promise) to make good on loans that sour.