Deflation in France, hidden behind tax hikes?

The significant divergence between the core inflation measures for France reported respectively by Eurostat and the national statistical office (

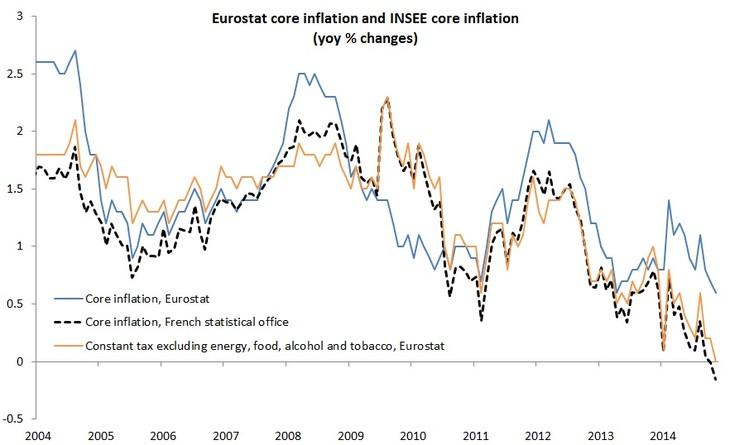

The release last week of the French inflation data for November revealed that core inflation had dropped into negative territory (at -0.2% year-on-year) for the first time since the French national statistical office (INSEE) started collecting this data in 1990. It also illustrates a clear downward trend of inflation since the beginning of 2012 (see dashed black line on the chart below). On the contrary, a look at Eurostat numbers shows a less worrying picture with core inflation still at a positive 0.7% yoy and a less clear trend, at least since 2013 (blue line).

Source: INSEE and Eurostat

This significant divergence between the two core inflation measures is due to the use of different definitions by the French statistical office and Eurostat. While the latter defines core inflation simply as the overall inflation index excluding energy and unprocessed food, the INSEE defines core inflation as inflation excluding public sector prices, the most volatile consumer prices and tax measures.

The different behaviour of the Eurostat ‘core’ compared to the French ‘core’ inflation can be explained mainly by changes in taxes. Indeed, the Eurostat constant tax core inflation [1] (orange line) tracks quite closely the core inflation provided by the French statistical office.

Actually, France experienced a significant tax hike in January 2014, when the standard and reduced VAT rates increased from 19.6% and 7% to 20% and 10%, respectively. The chart above illustrates clearly that the last tax hike blurred the picture concerning the underlying trend of inflation in France and that the situation may be even more worrying than the one visible in the headline and core inflation measures usually reported by the media.

[1] Inflation at constant tax excludes the potential impact of consumption tax (value added and other duties) increases on prices by assuming a full pass through of these taxes to consumer prices.