The spillovers of fiscal and monetary policies

What’s at stake: Policymakers in emerging economies have repeatedly complained over the spillover effects of advanced economies’ policies in the

What’s at stake: Policymakers in emerging economies have repeatedly complained over the spillover effects of advanced economies’ policies in the Great Recession. As the Federal Reserve normalizes its policy, while the Bank of Japan and the ECB contemplate further easing, it remains unclear whether emerging economies possess the tools to limit undue fluctuations associated with these adjustments.

Spillovers and coordination

Olivier Blanchard, Luc Laeven and Esteban Vesperoni write that the understanding of transmission channels of spillovers has become essential, not only from an academic perspective, but also policymaking.

In a globally integrated economy, national economic policies generate international spillover effects

Anton Korinek writes that in a globally integrated economy, national economic policies generate international spillover effects. In a theoretical paper, Korinek finds that the first theorem of welfare applies and that spillovers are efficient if three conditions are met: (i) national policymakers act as price-takers in the international market, (ii) national policymakers possess a sufficient set of policy instruments, and (iii) there are no imperfections in international markets. If any of the three conditions is violated, spillover effects generally lead to inefficiency, and global cooperation among national policymakers can generally improve welfare.

David Wessel writes that if the central bank is pursuing policies that are demand-augmenting, it’s kosher. If these policies are demand-diverting, it is not. Although it’s an easy question conceptually, it’s a tougher question in practice. And it’s not only about looking at whether a government is intervening in the currency markets. When fiscal authorities are excessively tight fisted, there’s a temptation to cheer a depreciating currency and perhaps see it as a substitute for expansionary domestic policies. One might describe the recent behavior for ECB, unable to move fiscal policy and unable to move quickly on QE, as relying heavily on rhetoric to push down the euro.

Spillovers from asynchronous exit strategies

In its 2014 Spillover report, the IMF writes that normalization proceeding at different times in different advanced economies can have wider implications for interest and exchange rate movements. More-synchronized tightening cycles in the past were characterized by higher global interest rates and risk aversion, as well as modestly higher stress in sovereign bond and stock markets in emerging market economies. A less-synchronized tightening cycle this time would partly counteract the impact of higher interest rates from normalization elsewhere. Asynchronous adjustment may result in larger swings in exchange rates of major currencies that could cause problems for some economies with balance sheet vulnerabilities and foreign exchange exposures.

Normalization proceeding at different times in different advanced economies can have wider implications

Barry Eichengreen and Poonam Gupta write that the ‘tapering talk’, which started in May 2013, had a sharp negative impact on economic and financial conditions in emerging markets. Based on a cross-country empirical exercise, the authors find that there is little evidence that countries with stronger macroeconomic fundamentals (smaller budget deficits, lower debts, more reserves, and stronger growth rates in the immediately prior period) were rewarded with smaller falls in exchange rates, foreign reserves, and stock prices starting in May.

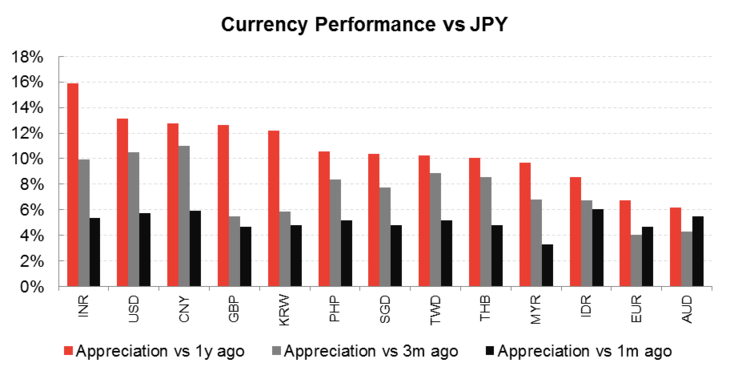

Variant perception writes that the BOJ is putting pressure on other Asian central banks. Their trade openness coupled with a strong appreciation of their currency is going to drag heavily on their growth prospects. Other Asian countries may soon start intervening more aggressively in managing their own exchange rates as a response.

The macroprudential view of capital controls

Julien Bengui and Javier Bianchi write that central banks in emerging markets have responded to the recent surge in capital inflows by pursuing active capital flow management policies. The hope is that current efforts to curb capital in flows will reduce the vulnerability of the economy to sudden reversals in capital flows. While this macroprudential view of capital controls has gained considerable ground in academic and policy circles, the debate about their effectiveness remains unsettled. In fact, a growing empirical literature argues that there are important leakages in the implementation of capital controls, casting doubt on the effectiveness of such policies in fostering macroeconomic and financial stability. Their analysis indicates that while leakages create risk-shifting in the unregulated sphere, a planner may, nonetheless, find it optimal to tighten regulation on the regulated sphere in order to achieve higher stabilization effects.

The magnitude of fiscal spillovers is likely to depend heavily on how exchange rates respond to fiscal shocks

Barry Eichengreen and Andrew Rose write that we have little empirical knowledge of how the economy will operate if capital controls are adjusted at high frequency, since controls have historically been adjusted infrequently. Governments have rarely imposed or removed capital controls in response to short-term fluctuations in output, the terms of trade, or financial-stability considerations. Once imposed, controls stay in place for long periods. Once removed, they are rarely restored. Rather than fluctuating at a business cycle frequency, the intensity of controls tends to evolve over long periods in line with variables like domestic financial depth and development, the strength of democratic checks and balances, and the quality of regulatory institutions, which similarly evolve slowly over time.

The exchange rate response to fiscal shocks

Alan J. Auerbach and Yuriy Gorodnichenko write that the magnitude of fiscal spillovers is likely to depend heavily on how exchange rates respond to fiscal shocks. Using daily data on U.S. government military spending, they find hat unanticipated shocks to announced military spending, rather than actual outlays on military programs, lead to an immediate and tangible appreciation of the U.S. dollar. This finding is broadly consistent with a variety of workhorse models in international economics and it suggests that fiscal shocks can have considerable spillovers into foreign economies. At the same time, this finding contrasts sharply with the results reported in previous studies. Specifically, the earlier work routinely documented that the domestic currency depreciates in response to government spending shocks, which is hard to square with the predictions of classic and modern open-economy models. We argue that this difference in results is likely to arise from the mis-timing of shocks in previous papers and their use of actual spending rather than news about spending.