The decline of U.S. labor under-utilization

What’s at stake: Slack in the American labor market is being absorbed quickly, but the actual size of the gap remains an open question. While mos

The FOMC’s upgraded language on slack

Business Insider write that Fed-watchers noticed that a word was missing from the most recent characterization of the labor market. Back in September, the FOMC wrote in its statement that “a range of labor market indicators suggests that there remains significant underutilization of labor resources”. On Wednesday, the FOMC upgraded its language to “underutilization of labor resources is gradually diminishing”. The exclusion of the word "significant" was no accident, and for monetary policy experts it was a signal that the labor market has improved so much that an initial interest rate hike would come sooner than later.

Brad DeLong writes that the Federal Reserve policy right now is reasonable only if the unemployment rate is taken as a sufficient statistic for the state of the labor market. Jan Hatzius writes that the explicit phrase in the FOMC statement that 'underutilization of labor resources is gradually diminishing' is factually correct, but the implicit notion that underutilization is no longer 'significant' — the term used in the July and September statement — looks inconsistent with the employment and wage data. Specifically, the focus on the drop in the unemployment rate below 6% ignores two important aspects of labor market slack—labor force participation and involuntary part-time employment. Looking at the July 2013 – September 2014 trend of the unemployment rate U6 and the total employment gap, Goldman economists find that these measures are only on track to normalize by early/mid-2016.

Gavyn Davies writes that until recently the focus for was mainly on the falling participation rate as the chief reservoir of under-utilized labor, but the center of gravity of Fed thinking on this now seems to have changed towards the more hawkish view that most of this decline is structural. However, this shift is more than compensated by increasing conviction that another reservoir of under-utilized labor exists, in the form of people who are forced to work part time when they would prefer to work full time.

Mark Zandi writes that the perspective that the amount of slack is still considerable because we don’t see wage growth is challenged by recent data collected from payroll processing records for about one-fifth of all US workers, which show a definitive, broad acceleration in wage growth. The hourly wage rate for jobholders is the most telling. It is up 4.5% from a year ago in the third quarter, a strong and steady acceleration from its low two years ago.

Tim Duy writes that the upgraded language of the Fed on underutilization and the fact that the 2% inflation target looks more and more like a ceiling rather than a symmetric target raises the possibility that labor data will trump inflation data in policy considerations.

The uncertainty in slack measures

Cleveland Fed economists write that Estimates of labor market slack can diverge a great deal depending on how slack is defined. There are different ways to measure slack, and they don’t always give the same answer. Indeed, some of these differences are reflected in the minutes of that same FOMC meeting: “Participants generally agreed that … labor market conditions had moved noticeably closer to those viewed as normal in the longer run. Participants differed, however, in their assessments of the remaining degree of labor market slack and how to measure it.”

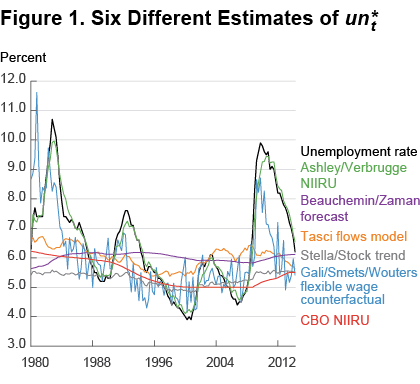

Cleveland Fed economists write that the seemingly simple question of how much slack is in the labor market is not so easy to answer. Even when we focus exclusively on the unemployment rate as the sole measure of the state of the labor market, slack estimates can differ greatly depending on the way the natural/long-run unemployment rate is estimated. One method calculates it as a function of long-run trends market flows both into and out of unemployment. Another method follows Gali, Smets and Wouters (2012) to calculate the “flexible wage counterfactual”. A third approach follows Stella and Stock (2012) to decompose the unemployment series into a trend part, a cyclical part, a seasonal part, and a random noise part. A fourth approach involves forecasting as in Beauchemin and Zaman (2011). A fifth approach relies on the connection between inflation and labor slack. The figure below illustrates these different methods give different answers.

The Labor Market Conditions Index

Business Insider writes that the index was first "made famous" by Fed Chair Janet Yellen in her speech at Jackson Hole, when she said, "This broadly based metric supports the conclusion that the labor market has improved significantly over the past year, but it also suggests that the decline in the unemployment rate over this period somewhat overstates the improvement in overall labor market conditions."

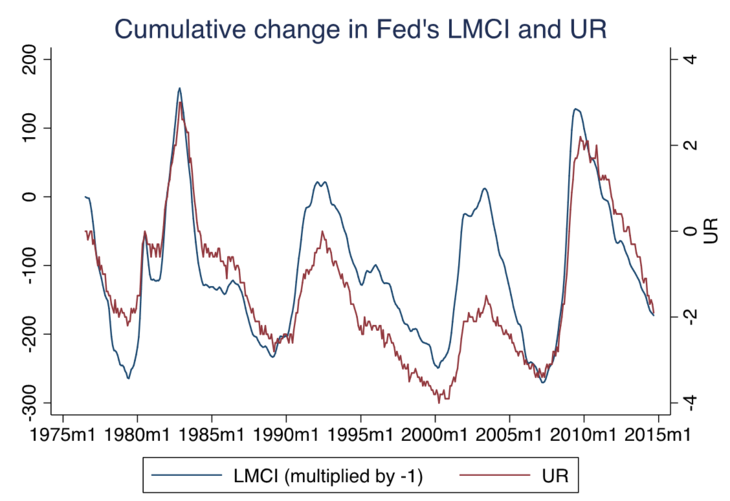

Tim Duy writes that Yellen's claim that it provides information above and beyond the unemployment rate is questionable with a simple look at the cumulative change of the index compared to that of unemployment. And her halfhearted claims are even more telling given that she was the impetus for the research. If it was policy relevant, you would think she would be a little more enthusiastic (think optimal control). Moreover, the faster pace of recovery of the index compared to previous recessions - as clearly indicated by the Fed - seems completely at odds with the story it is supposed to support. Simply put, the press and financial market participants should be pushing the Fed much harder to explain exactly why this measure is important.