Updated forecast for euro area trade adjustment

The adjustment of the forecast does not change the general picture of the adjustment process. Yet, there are significant revisions to the relativ

1 Special thanks to Frederico Teixeira for this hint.

Following my post on trade adjustment in the euro area, I have updated the calculations with the latest data released from the European Commission.1 The adjustment of the forecast does not change the general picture of the adjustment process. Yet, there are significant revisions to the relative performance of several countries’ export and import growth between 2007 and 2013.

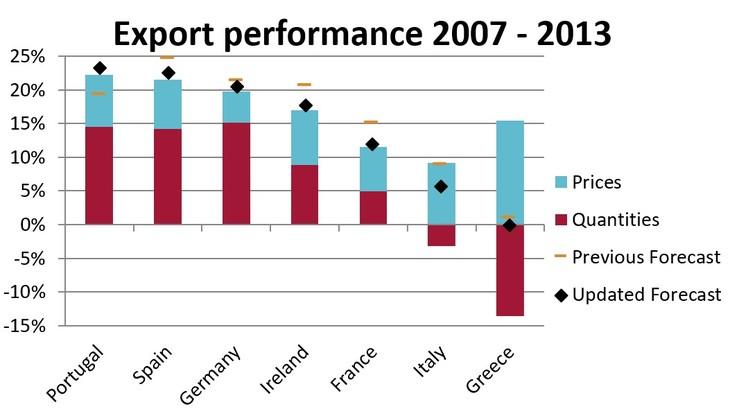

The key finding is that according to the latest data, Portugal’s projected exports at current prices increased compared to the previous forecast, to the point where Portugal’s export growth surpassed that of Spain, Ireland and Germany. Furthermore, the estimated price effects for both imports and exports were reduced for all countries.

Portugal’s projected exports at current prices increased compared to the previous forecast, to the point where Portugal’s export growth surpassed that of Spain, Ireland and Germany

Note: 2013 forecast

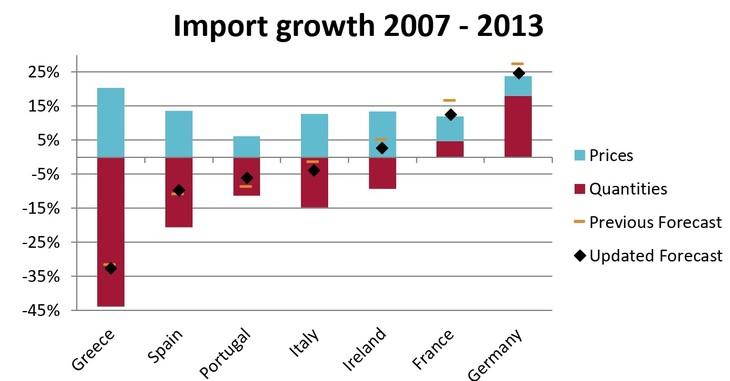

According to the new data, France’s import projection for 2013 was lowered by -3.7%, driven by lower import prices. Import prices were revised in all countries –on average by -1.7% compared to the previous forecast– resulting in lower import forecasts for most countries.

In Portugal, the 2013 forecast for import volumes was revised upwards by +6% resulting in an overall increase of Portugal’s foreseen imports by +3% compared to the last projection. The forecast for Spain was also slightly adjusted upwards by +1.3%.

Portuguese export growth for the period 2007-2013 has been adjusted upwards from 19.3% to 23.4% while the opposite happened to Ireland and to some extent Spain

Note: 2013 forecast

On the export side, Portuguese export growth for the period 2007-2013 has been adjusted upwards from 19.3% to 23.4% while the opposite happened to Ireland and to some extent Spain. While the 2013 expected exports of Portugal in term of volume were increased by more than 3%., the forecast for Ireland’s exports was decreased by 2%. As a result, Portugal outperformed Ireland and Spain in nominal and real export growth. Nevertheless, Germany still had the largest increase of export volume, though very closely followed by Portugal and Spain.

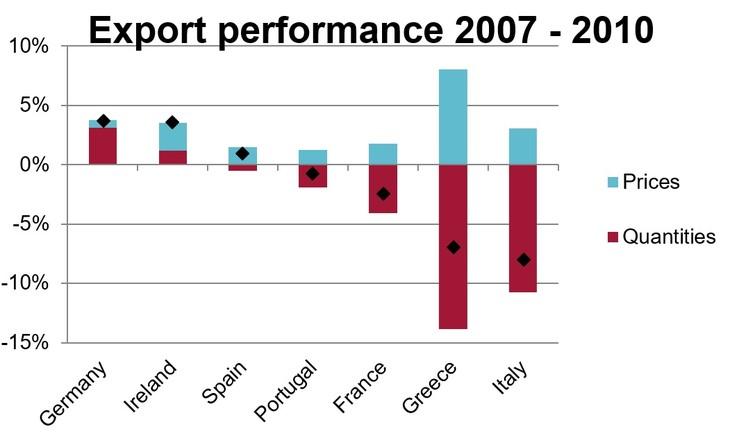

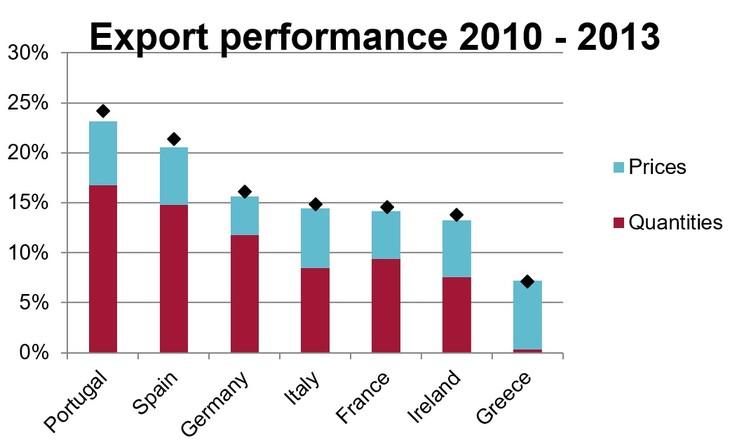

Sub dividing the time period shows Spanish and Portuguese export boost after 2010

Another interesting feature is dividing the time-span into two sub periods 2007-2010 and 2010-2013 which coincides with the start of the financial assistance programs in Greece and Ireland (Portugal followed 2011). It can be seen that export growth was sluggish between 2007 and 2010 with a large drop in Greece (-7%) and Italy (-8%). After 2010 export volumes and prices grew in all countries. Yet the relative performance is quite surprising. Portugal and Spain increased their exports very significantly (both by more than 20%). Ireland, on the other hand, was outperformed by Germany, Italy and France which all experienced increases between 14% and 16%.

Export growth was sluggish between 2007 and 2010 with a large drop in Greece (-7%) and Italy (-8%). After 2010 export volumes and prices grew in all countries

Note: 2013 forecast

Note: 2013 forecast

Original post