The 'dos and don'ts' of a growth-friendly policy mix for the Euro area

Carlo Altomonte and Tommaso Aquilante highlight some clear ‘dos’ and ‘don’ts’ when looking at the fiscal/structural side of a growth-friendly policy m

When looking at possible ways out of the euro area crisis, there is a growing consensus that it will require “a policy mix that combines monetary, fiscal and structural measures at the union level and at the national level”, as Mr. Draghi recently put it. However, stipulating the details of this policy mix is far more controversial. On the monetary side, there is a debate on the extent to which the TLTRO operations of the ECB would achieve the desired goal of reactivating the credit flow in the euro area (Claeys, 2014; Merler, 2014). Similarly, it is not clear whether the ECB should push its expansionary monetary policy into the realm of ‘non-conventional measures’ to fight the risks of deflation (Claeys et al., 2014; Altomonte and Bussoli, 2014). On the fiscal / structural side, the status of the debate is in even more dire straits. No clear consensus exists on the direction of the fiscal stance, often summarized through the ‘flexibility vs. austerity’ controversy; at the same time the implementation of the national reforms’ agenda keeps facing many internal political obstacles, especially at a time of stagnation and high unemployment.

And yet, leaving aside the (relatively more mature) monetary debate outlined above, recent results from a research line on competitiveness, based on previously unavailable micro-level data (e.g. EFIGE, available here, and the ECB CompNet), allow us to point to some clear ‘dos’ and ‘don’ts’ when looking at the fiscal/structural side of a growth-friendly policy mix for the euro area.

2 To grasp this idea, think at the 80-20 rule, in which 80 per cent of a given phenomenon (e.g. the total number of people living in cities in the world, or the total exports of a country) is explained by just 20 per cent of the concerned observational units (e.g. the top 20% largest cities or exporting firms). In a ‘normal’ distribution these figures would be 50-50.

The key starting point of this line of research is the recognition that competitiveness is essentially a firm-level phenomenon. Often, competitiveness policies are designed at sector or country level, but targeting the sector or country means targeting the “average firm” of a given sector/country. The idea is that what is good for the average firm is good for all the firms. Nevertheless, this might reveal itself to be highly problematic as the “average firm” does not exist; rather, firms are very heterogeneous in their performance. Indeed, like the length of rivers in the world, or the size of cities, where it is possible to observe a large number of relatively short rivers (or small cities), and a few very long rivers (or very large cities), firm performance across countries and industries is typically characterized by many relatively ‘bad’ firms performing below the average, but also a certain number (although less numerous) of particularly good firms. Technically, we can thus claim that firm level data on a given performance index (e.g. productivity) are typically characterized by a distribution ‘skewed to the right’, i.e. what is known as a ‘Pareto’ distribution, versus an assumed symmetric normal distribution (see Altomonte et al., 2011 for a detailed discussion, and Altomonte et al., 2012 for some evidence from EFIGE data).[2]

3 In emerging economies these within industry differences in performances are even larger, with the best firms making up to five times more than the worst firms, always controlling for the same amount of inputs (Hsieh and Klenow, 2009).

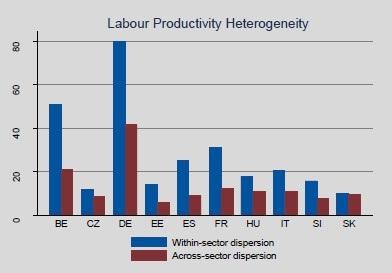

This evidence is there even for firms observed within narrowly defined (4-digit SIC) industries, i.e. firms producing essentially the same product. In the US, for example, the best firms producing a given product make twice as much output with the same amount of inputs (i.e. their total factor productivity (TFP) is twice larger) with respect to the worst firms in the same industry (Syverson, 2004).[3] Recent data now available for Europe thanks to the CompNet project (see ECB WP 1634, 2014) convey essentially a similar message, as reported in Figure 1.

Figure 1: Heterogeneity in Firm Performance Within and Across Sectors

Source: ECB WP 1634

There it is shown how, for all the reported EU countries, the average difference (here summarized by dispersion of industry mean productivity) in performance across firms within the same industry (the ‘within-sector’ dispersion) is larger than the average difference in performance across industries (the ‘across-sector’ dispersion). Hence, if one considers two industries in any European country (e.g. Textiles and Bio-tech, with the first on average less productive than the other), the best Textiles firms in a country are likely to be much more productive than the ‘average’ Textile firm, with a dispersion so large that they are actually likely to dwarf also the ‘average’ Bio-tech firm in the same country in performance. This implies that the potential gains derived from a reallocation of economic activity from low to high productive firms within the same industry might be at least comparable, in terms of performance gains, to a change of the ‘average’ performance of firms across industries.

The evidence shown above suggests a number of ‘dos’ and ‘don’ts’ of a policy agenda aimed at fostering growth.

First of all, given the evidence on the role of reallocation in fostering productivity growth, among the ‘don’ts’ there is the idea of trying to achieve competitiveness through ‘internal devaluations’ in times of crisis. In fact, the latter might prove unreasonably painful and somehow relatively ineffective. Painful because, at a time of crisis, the attempt would very likely result in a demand compression that might further compress the investment opportunity of firms, and thus their restructuring as a reaction to the crisis. Ineffective because the policy, by lowering prices and wages across the board, would necessarily work on the ‘average firm’, rather than triggering the beneficial effects of resources reallocation from less to more productive firms. Of course, this does not imply that, in a situation of escalating public (or private) debt, the necessary deleveraging through appropriate austerity policies does not have to be promptly achieved in order to restore sustainability in public finances; only, we should avoid selling this as a ‘competitiveness’ strategy.

Rather, in terms of actual growth-friendly strategies, activating policies able to foster the reallocation of resources towards the most productive firms is of paramount importance. In particular, reforming labor markets to link individual wages to the productivity of the firm more closely, coupled with additional flexibility of workers across firms, should top the list of the ‘dos’ in the policy agenda of every country in which growth is lagging behind. Together with this line of action, this micro-based line of research has also identified a further set of specific policies that would allow firms to acquire the characteristics that are associated with productivity growth:

- Innovation, e.g. tax credit schemes for R&D expenditures (Altomonte et al., 2013);

- Finance, e.g. via the liberalization and simplification of a cross-border pan European market for private equity and venture capital (Altomonte et al., 2012);

- Management, e.g. a system of incentives internal to the firm that remunerates more the best performing workers (Bloom and Van Reenen, 2007; Altomonte et al., 2012);

- Ownership and international exposure, e.g. fostering the attraction of foreign investment (Barba Navaretti et al., 2011; Altomonte et al., 2012) and the participation of domestic firms to global value chains (ECB WP 1634, 2014).

References

- Altomonte C. & Aquilante T. & Békés G. & Ottaviano G.I.P (2013). "Internationalization and innovation of firms: evidence and policy," Economic Policy, CEPR & CES & MSH, vol. 28(76), pages 663-700, October.

- Altomonte C. & G. Barba Navaretti & F. di Mauro & G.I.P. Ottaviano, (2011)."Assessing competitiveness: how firm-level data can help," Policy Contributions 643, Bruegel.

- Altomonte C. & Aquilante T. & Ottaviano G.I.P. (2012). "The triggers of competitiveness: The EFIGE cross-country report," Blueprints, Bruegel, number 738, December.

- Barba Navaretti, G., M. Bugamelli, F. Schivardi, C. Altomonte, D. Horgos and D. Maggioni, (2011) “The global operations of European firms”, Blueprint 12, Bruegel.

- Bloom N. & J. Van Reenen (2007). "Measuring and Explaining Management Practices Across Firms and Countries," The Quarterly Journal of Economics, MIT Press, vol. 122(4), pages 1351-1408, November.

- ECB Working Paper No. 1634.

- http://www.efige.org/

- Foster, L., Haltiwanger, J and C. J. Krizan, (2006): "Market Selection, Reallocation, and Restructuring in the U.S. Retail Trade Sector in the 1990s," The Review of Economics and Statistics 88(4): 748-758.

- Hsieh, C. T. and P. J. Klenow (2009), “Misallocation and Manufacturing TFP in China and India”, The Quarterly Journal of Economics, 124(4): 1403-1448.

- Krugman, P. (1997), “Pop Internationalism”, Cambridge MA: MIT Press.

- Marc J. Melitz & Ottaviano G.I.P. (2008). "Market Size, Trade, and Productivity", Review of Economic Studies, Oxford University Press, vol. 75(3), pages 985-985.

- Syverson, C. (2004), “Market Structure and Productivity: A Concrete Example”, Journal of Political Economy, 112(6): 1181-1222.