The distributional effect of quantitative easing

What’s at stake: The notion that ultralow interest rates and central-bank asset purchases have fueled a surge in asset prices, which mostly

A prominent source of debate

Cardiff Garcia writes that the difficult question of how unconventional monetary policies affect inequality has become a prominent source of debate. Olivier Coibion, Yuriy Gorodnichenko, Lorenz Kueng and John Silvia write that the prevalence of “End the Fed” posters at Occupy wall Street demonstrations surely reflects, at least in part, the influence of those who argue that the Fed has played a key role in driving up the relative income shares of the rich through expansionary monetary policies. The notion that expansionary monetary policy primarily benefits financiers and their high-income clients has become quite prevalent.

ECB Board Member Benoit Coeure writes that complaints about the ECB favoring borrowers over savers with its low-interest-rate policy are getting ever louder. In countries such as Germany there is even talk of a “cold expropriation” of those who save money for their old age.

Low interest rates and savers’ income

Paul Krugman writes that the claim the hit to interest was a major factor depressing incomes at the bottom is just false. The Survey of Consumer Finances shows that three-quarters of the wealth distribution basically has no investment income. The people in the 75-90 range have some. But even in 2007, when interest rates were relatively high, it was only 1.9 percent of their total income. The overall impact on the income of middle-income Americans was, necessarily, small; you can’t lose a lot of interest income if there wasn’t much to begin with.

ECB Board Member Benoit Coeure writes that the current low returns for savers are mainly an ongoing result of the recent deep recession and of the fragmentation of the financial market in the euro area. BoE Deputy Governor Ben Broadbent argues in a recent speech that rather than causing the decline themselves, central banks have instead been accommodating a deeper downward trend in the “natural” or “equilibrium” rate of interest.

Asset prices and inequality

William Cohan writes that the Fed’s balance sheet has grown to $4.5 trillion, from around $800 billion before the crisis. That’s a whole lot of securities bought at high, profitable prices and paid directly to Wall Street traders. The Fed might as well have been paying the traders’ seven-figure bonuses directly.

BoE Deputy Governor Ben Broadbent writes that autonomous changes in monetary policy can affect asset prices. If the central bank decided to lower interest rates arbitrarily, for no other reason than that it wanted to, real asset prices would rise. But it’s unlikely the effect would endure for a very long time. James Bullard, president of the St Louis Fed, said in June that the increase in equity prices was not sufficient proof of QE’s guilt in raising inequality because equity valuations are more normal now than they were in 2008 and 2009.

Paul Krugman suspects that the impression that QE has involved a massive redistribution to the rich come from the fact that equity prices have surged since 2010 while housing has not — and since middle-class families have a lot of their wealth in houses, this seems highly unequalizing. We expect monetary policy to have differential effects on asset prices based on longevity. This time was, however, different for housing because it had an immense bubble in the mid-2000s, so that it wasn’t going to come roaring back. Meanwhile, stocks took a huge beating in 2008-9, but this was financial disruption and panic, and they would probably have made a strong comeback even without QE.

The net effect of monetary policy on inequality

Boston Fed President Eric Rosengreen says that there is no doubt that asset prices are one of the mechanisms on which this is transmitted, so people that own stocks are going to do better than people that didn’t own stocks. But that’s not the only measurement. The net effect is substantially weighted towards people that are borrowers not lenders, towards people that are unemployed versus people that are employed. Wealthy people are both employed and tend to lend. The people at the lower end of the distribution tend to borrow.

Jared Bernstein writes that a full analysis would have to net out the difference relative to a counterfactual–what would have happened absent the Fed’s actions. Olivier Coibion, Yuriy Gorodnichenko, Lorenz Kueng and John Silvia write that there are 5 channels through which monetary policy can affect inequality:

- Heterogeneity in income sources (wages vs. profits)

- Financial intermediaries and their high income clients

- Portfolio effects

- Heterogeneity in labor income responses during business cycles

- Borrowers vs. savers

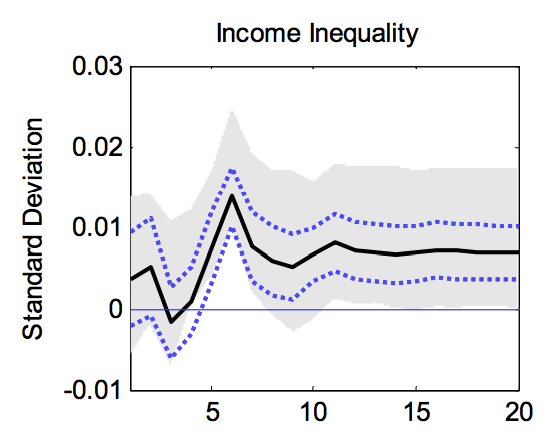

While there are several conflicting channels through which monetary policy may affect inequality, the authors find that between 1980 and 2008 in the US, expansionary monetary policy lowered rather than increased economic inequality.

Explanation: Effect of a contractionary monetary shock

Ayako Saiki and Jon Frost look at how a decade of unconventional monetary policy in Japan affected inequality among households using survey data. Our vector auto regression results show that UMP widened income inequality, especially after 2008 when quantitative easing became more aggressive. This is largely due to the portfolio channel.

Brad DeLong writes that figuring out what we expect QE to mean for income and wealth inequality is difficult because we are not sure what QE is supposed to do for the macroeconomy. Is it a way of credibly committing to lower nominal interest and higher inflation rates in the long run by goosing the monetary base at the zero lower bound? Is it a way of reducing the supply of assets subject to risk and thus reducing the risk premium? If the first, it is the government imposing--relative to the baseline--a transfer from those who are going to save to those who are going to borrow and to those who have saved in the past. If the second, it is the government imposing--relative to the baseline--a transfer from those who are going to supply risk-bearing services to those who will lay off risks into the future and those who have already committed to bearing risk in the past. In either case, it is bound to be the rich today who have born risk in the past (and been lucky) or who have saved in the past. So today's inequality should, we think, rise.