Monday blues for Italian banks

On Sunday, the ECB and EBA published the results of their comprehensive assessment of banks balance sheets, and Italian banks where the worst performe

On Sunday, the ECB and EBA published the results of their comprehensive assessment of banks balance sheets, and Italian banks where the worst performers. The stress tests singled out 25 banks that would be falling short of the 5.5% minimum CET1 threshold, based on data as of end 2013. But once the measures already enacted in 2014 are taken into consideration, the number of banks failing the test is reduced to 13. Of these, 4 are Italian.

Banca Monte dei Paschi di Siena, Banca Carige, Banca Popolare di Vicenza and Banca Popolare di Milano will need to raise respectively 2.1bn, 0.81bn, 0.22bn and 0.17bn, for a total of 3.31bn. It is the largest share of the total net (of capital raised in 2014) shortfall of 9.5bn identified from the test.

13 banks are found to effectively fail the ECB stress tests. 4 of them are Italian

Markets gave Italy a very rude awakening on Monday morning. Milan stock exchange closed on Monday at -2.4%. By the end of the trading session MPS had lost 21.5% and was valued at 0.79 euros, whereas Carige ended the trading day down by 17% at a value of just under 0.08 euros per share.

But leaving the market reaction aside, the truth is that beyond capital some long-lived problems of the Italian banking sector have by now been known for a while but not addressed. In this respect, the comparison with a country like Spain - where the banking system has been subject to a deeper monitoring and restructuring during the financial assistance programme of 2012-13 - may yield striking insights.

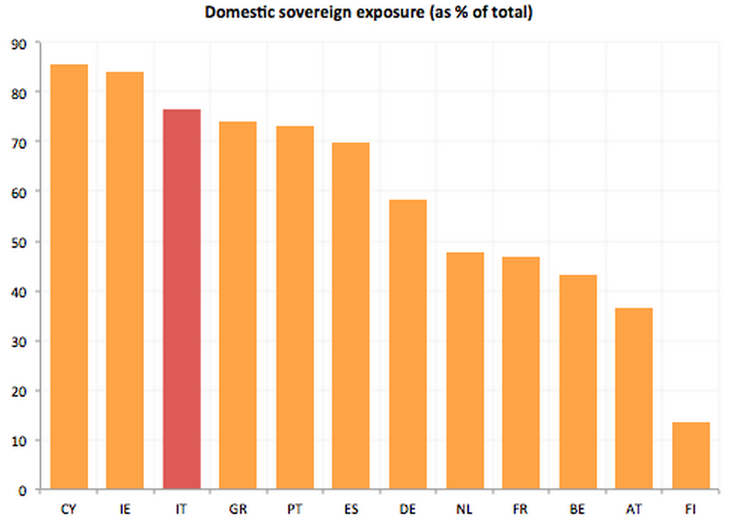

First, the Italian banking system is still keeping in place a strong liason dangereuse with the (huge) government debt. This is not at all a special feature of Italian banks (as Figure 1 shows) but with almost 80% of their sovereign long direct gross exposures concentrated on Italy, Italian banks are found in this supervisory exercise to be among the most exposed to the sovereign debt issued by the domestic sovereign. Actually, if one excludes the countries that have been or are under a EU/IMF macroeconomic adjustment programme, Italian banks are the most exposed in the Eurozone (Figure1 and Figure 2 left).

Note: Long Direct Gross Exposure

Sovereign debt accounts for 10% of Italian banks asset on average and the home bias in debt portfolio seems to have increased since the last EBA test

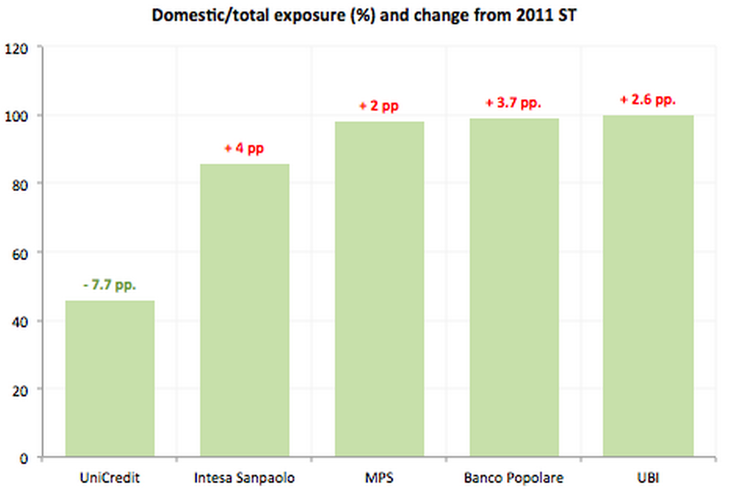

More interestingly, the exercise shows that this “home bias”, which is deeply at the root of the sovereign-banking vicious circle that characterised the euro crisis, has even worsened over the last three years. Domestic exposure has grown (rather than decreased) as a percentage of total sovereign exposure on the books of all those banks that were already tested in 2011 with the exception of UniCredit (Figure 2).

Note: Long Direct Gross Exposure

Sovereign debt accounts by now for around 10% of total assets of Italian banks, on average. The carry trade on these holdings might have kept banks afloat over the last 3 years, but these gains are actually concealing deeper structural issues that Italian banks have - until now - never been forced to facein full.

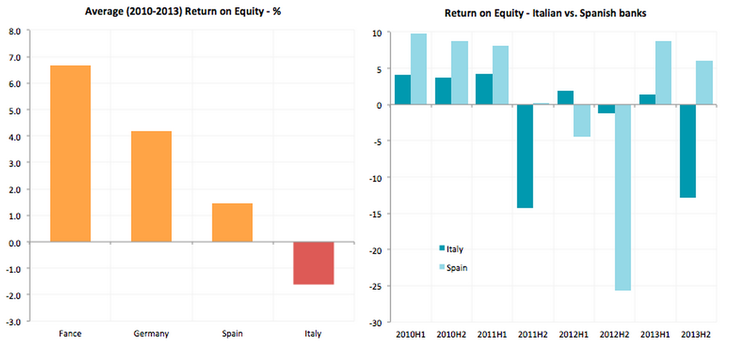

One such long-known problem of the Italian banking system is profitability, which is (and has been for quite a while now) very low. According to ECB data, average return on equity has been negative over the period 2010-2013 and the comparison with Spanish banks is especially striking. After the huge drop in return on equity during 2012, Spanish banks recovered, whereas Italian banks seemed to have never done it (Figure 2).

After the huge drop in return on equity during 2012, Spanish banks recovered, whereas Italian banks seemed to have never done so

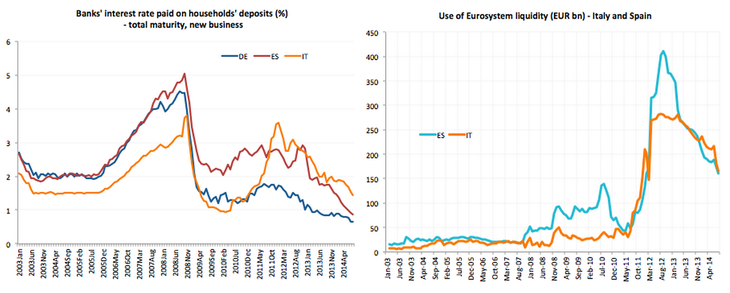

Differences between Italy and Spain are evident also in the reliance on Eurosystem liquidity and the pace of reimbursement, which until very recently has been significantly slower in Italy than in Spain (Figure 3 right). Italian banks have borrowed less - in absolute terms - from the ECB facilities, but have been sticking to the central bank liquidity for longer, accelerating reimbursements only in recent months. This may be explained by the fact that their alternative funding is relatively more expensive than it is for Spanish banks. Interest rates paid by Italian banks on retail (households’) deposits is in fact still significantly above those paid by their Spanish equivalents, not to mention German banks. More interestingly (and worryingly) deposit interest rates in Italy have only very recently started to drift downwards, contrary to Spain, where convergence has started earlier and moved faster.

These few elements depicts a gloomy Italian banking system which has been spared - until now - from the deeper monitoring and restructuring that have been undergoing in Spain and other programme countries, but at the cost of finding itself stuck in a limbo where lack of capital (in some cases), low profitability (in general) and rising bad loans are hindering credit and therefore further harming the potential recovery.

Even if the economic cycle were to improve and bad loans to subside, the low profitability will stick due to structurally high costs and inefficiencies

As pointed out, among others, by RBS’ Alberto Gallo, this is not a sustainable situation. Even if the economic cycle were to improve and bad loans to subside, the low profitability will stick due to structurally high costs and inefficiencies (such as Italy’s very high concentration of bank branches and length of the judicial process, for example).

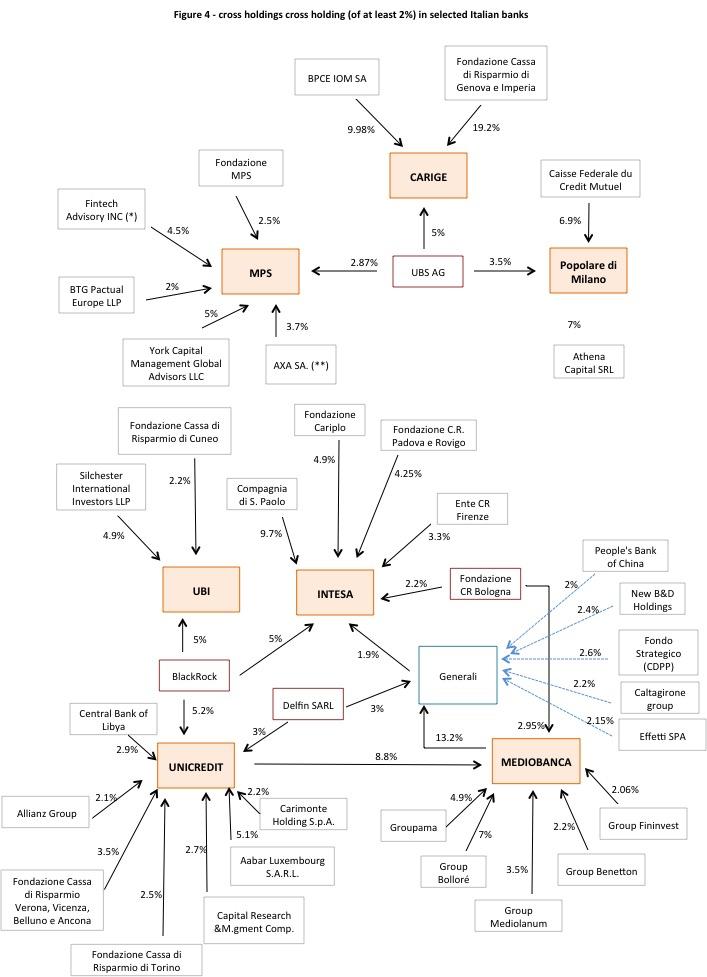

One possible answer to these issues could be consolidation, which has been important in Spain but basically absent in Italy. This is partly due to specific features of the Italian banking structure, which make such reform very difficult. In particular, as shown in figure 4, banks are closely bound together by equity cross holdings in which bank foundations play often a significant role. And bank foundations are often dominated by local politics (see for example this summary account of professional politicians presence in Italian banks’ foundation boards), which may hinder consolidation on the bases of various (not necessarily economic) interests. This suggests that a meaningful reform process in the Italian banking system can hardly go separate from a deep restructuring of this governance structure.

Needed consolidation is made difficult by a corporate governance structure that is strongly tied with local politics

All these problems are long known, but have not yet been addressed. In our (Italian) language, there exists a fascinatingly peculiar expression: La Bella Figura. While it is impossible to appropriately convey all the nuances of its meaning, it could be broadly translated with “nice appearance” and it fits well also to the attitude that has until now been kept about the Italian banking system’s need for reform. Hopefully the stress test results will act as a wake up call, forcing some to finally acknowledge the importance of substance over form.

Read more on the ECB's "comprehensive assessment