How tight is China’s monetary policy?

There have been definite signs of monetary loosening in China in recent weeks. Nevertheless, for almost a year, the debate continues to rage over whet

See also China's financial liberalisation: interest rate deregulation or currency flexibility first? Part one and Part two.

There have been definite signs of monetary loosening in China in recent weeks. Nevertheless, for almost a year, the debate continues to rage over whether the People’s Bank of China (PBC) should loosen its monetary policy more meaningfully in a situation of weakening domestic demand (see Chinese reports by Caijing). Has China’s monetary policy stance been too restrictive lately? If so, how should the PBC ease monetary policy?

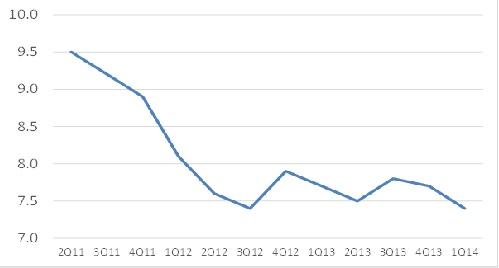

There is little doubt that China’s growth has been losing momentum in recent years (Graph 1). The past few quarters have witnessed clear signs of rising inventories, slumping property sales, producer price deflation, declining consumer price inflation, weakening corporate earnings, slowing investment and anaemic industrial production. Fortunately, private consumption is still holding up.

Graph 1: China’s GDP growth (year-on-year %)

Sources: Datastream

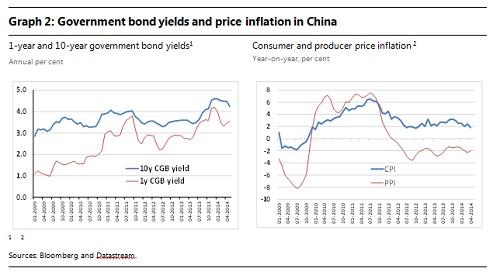

Meanwhile, oddly, the real interest rates and funding costs facing most Chinese companies and home buyers have been on the rise. This is caused by a combination of rising nominal interest rates and slowing inflation (Graph 2). Between 2012 and 2014, the 10-year Chinese government bond yield rose from 2.5 percent to 4.5 percent, as CPI fell from 4 percent to 2.5 percent. While inflation could be weighed down by weaker domestic demand, higher nominal interest rates might in part relate to partial interest rate deregulation and a tight monetary policy.

Thus one immediate question is whether Chinese monetary policy has been too tight. Too tight relative to what? Most economists and central bankers use the well-known Taylor rule to assess the central bank policy stance.

A simple Taylor rule essentially links a short-term nominal policy rate to two gaps for a given real long-run equilibrium interest rate and inflation target: the gap between actual and targeted inflation (“the inflation gap”) and the gap between actual and potential output (“the output gap”). A positive output or inflation gap, or both, suggests a need to tighten by hiking the policy rate. If the actual policy rate is below that implied by the Taylor rule, the policy stance is considered too accommodating. If the actual policy rate is above that implied by the Taylor rule, the policy stance is considered too restrictive.

Obviously, many possible factors, some trickier than others, help shape this “Taylor rate”. Hence the controversy in China over how tight PBC monetary policy has been. In this light, three questions are worth highlighting.

First, how important is the inflation target relative to other policy objectives? The Chinese CPI in the first four months of 2014 averaged 2.2 percent, down from 3 percent plus in late 2013 and way below the official 2014 target of 3.5 percent set out by Premier Li Keqiang. Producer prices even registered outright deflation for more than two years. So China has a negative inflation gap. According to the Taylor rule, the PBC therefore ought to ease monetary policy.

Unless, of course, financial stability concerns dominate, calling for a continued tight monetary policy stance. The rationale is that lower interest rates might fuel shadow banking expansion, excess leverage and asset price booms in China. Thus an accommodative policy could add to the already growing financial imbalances. But tight monetary conditions could also run the risk of a disorderly deleveraging. In any case, the standard Taylor rule might help inform the weights on inflation and output but is silent on the relative weight attached to the policy goals of price and financial stability.

Second, is the Chinese economy operating near full employment? While the observed economic slowdown is beyond dispute, it might simply reflect lower potential output growth, which possibly arises from rebalancing pains, demographic headwinds, less low-hanging fruit in market liberalisation and a less accommodating global economy (see Ma and McCauley 2012). Some Chinese labour statistics, while of questionable quality, suggest that employment has held up well hitherto. Thus weaker growth might not mean a widening negative output gap, and hence there is no need for policy easing.

However, slower potential growth, if true, should point to a lower real equilibrium interest rate. This in itself would justify an easier policy stance of the PBC within the Taylor rule framework. A less stringent policy stance is therefore called for, whether the recent growth slowdown is structural or cyclical.

Puzzlingly, most Chinese companies and home buyers have faced rising borrowing costs in the context of slowing potential growth, at least until the latest monetary easing in the past weeks. Do higher interest rates in the wake of the recent partial deregulation reflect a shift towards equilibrium or mostly the impact of other distortions in the Chinese economy?

Third, how can one tell whether the PBC has or has not loosened? The Taylor rule takes the policy rate as representative of the monetary policy stance. Yet, the policy rate, if there is one, is only one of many instruments in the PBC’s toolkit and might not capture well its overall policy stance. Unlike most OECD central banks, the PBC deploys multiple tools, including administrative moves, regulatory rules, quantity measures and interest rates, both market and administered, to manage both price and quantity targets and to serve multiple policy objectives of price stability, full employment, balance of payments and financial stability (see Giradin et al, 2014). Moreover, monetary policy measures are often not officially announced but are unveiled in bits and pieces. Hence gauging the Chinese policy stance is far from straightforward.

However, there have been plenty of signs of easing in recent weeks. After the bumpy ride in June 2013, the PBC has tried hard to guide interbank rates lower and steadier. No more menacing warnings of punishment for misbehaving banks. The PBC has also selectively lowered the reserve requirements, extended loans to both small banks and policy banks via its refinancing facility, and directly bought treasury bonds to fund government projects. It has even leaned on commercial banks to lend more to first-time home buyers at reasonable mortgage rates.

While these targeted policy moves are sensible, the PBC can still act with greater confidence by cutting outright both interest rates and lowering reserve requirements. In recent months, the PBC appeared to stealthily keep the benchmark overnight and 7-day interbank rates low. It should be more forthright in communicating its desire to hit a lower short rate even if there is so far no official policy target rate.

Also, lowering the benchmark 20 percent reserve requirement ratio and/or raising the 75 percent loan/deposit ratio ceiling would add more permanent liquidity into the system to nudge down the long yields, and would also go some way to mitigate distortions and to contain shadow banking by bringing some off-balance-sheet lending back onto the books (see Ma et al, 2012).

Most importantly, by acting swiftly and decisively now, the PBC can be in a stronger position to tighten again when the cycle eventually turns.

Read more on China

China seeking to cash in on Europe’s crises

China's financial liberalisation: interest rate deregulation or currency flexibility first?

Review: The China slowdown effect

Financial openness of China and India: Implications for capital account liberalisation

Developing an underlying inflation gauge for China

Are financial conditions in China too lax or too stringent?

The Dragon awakes: Is Chinese competition policy a cause for concern?

How loose is China’s monetary policy?

China gingerly taking the capital account liberalisation path