Balance of trade adjustment in the euro area

The balance of trade of most crisis countries has improved substantially since the beginning of the financial crisis in 2007. The data shows that incr

The balance of trade of most crisis countries has improved substantially since the beginning of the financial crisis in 2007. The data shows that increasing exports at current prices as well as in volumes played an important role in the adjustment process. Furthermore, it is shown that price effects did not act in favor of the adjustment.

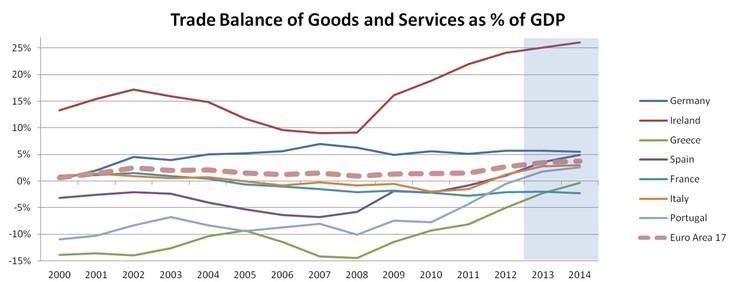

In 2007 Germany and Ireland were the only countries with a significant trade surplus. In 2013, it is predicted that all countries except France and Greece will.

Note: 2013, 2014 forecast

The export surplus of goods and services of the euro area 17 steadily increased from 1% of GDP in 2008, to a forecasted surplus of 3.5% of GDP in 2013. Until August, this year’s trade surplus in goods and services of the euro area amounted to 181.2 bn euro, which is an increase of 55% compared to the same period last year.

While in 2007 Germany and Ireland were the only countries with a significant trade surplus, the picture changed as it is predicted that all countries except France and Greece will reach a trade surplus this year. Furthermore, Greece, Italy, Portugal and Spain improved their trade balance of goods and services by more than 10 percentage points compared to GDP since the peak of the crisis, until this year.

1 Note that the case of Ireland is particular due to a large share of multinational companies in the Irish economy.

Greece reduced its deficit from -14.5% to -2.3% over the last five years, and it is forecasted to nearly close the gap by 2014. In 2007, Spain reported a trade deficit of -6.7%, while Portugal reported a deficit of over -10% of GDP in 2008. The year 2012 was the first in which exports exceeded imports in Spain. The country will reach a trade surplus of about 3.6% of GDP this year, while it is forecasted that Portugal will reach a small trade surplus of 1.8% at the end of this year. Moreover, for both countries, it is the first time ever since the introduction of the euro that they have a positive trade balance. Ireland’s trade balance is rising sharply since 2008 from +9.1% to more than 25% in the current year.1

Italy’s trade balance was always close to the balance over the last decade, and it rose to 2.7% of GDP in the current year. France experienced a constant decline of its trade balance over the last few years which stabilized at around -2%, being the only country with a significant deficit. In Germany there has also been little movement in the trade balance, which remained relatively stable around +6% of GDP.

Is the improvement in the trade balance export or import driven?

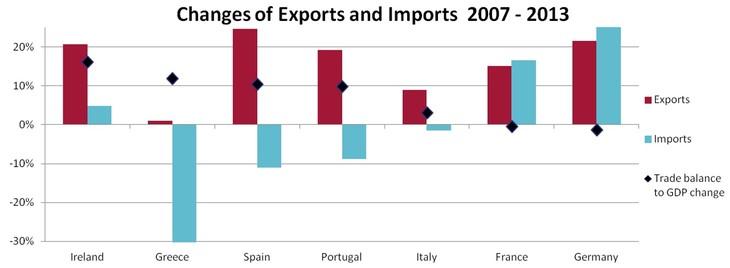

Since the beginning of the crisis, all countries of the euro area managed to increase the value of their exports of goods and services at current prices, while all stressed countries apart from Ireland decreased their imports.

Ireland, Portugal and Spain increased their trade balance by boosting exports, while at the same time imports fell moderately or increased slightly as in the case of Ireland.

Note: 2013 forecast

Ireland, Portugal and Spain increased their trade balance by boosting exports, while at the same time imports fell moderately or increased slightly as in the case of Ireland. The adjustment was most visible for Spain which increased exports by 25% more than Germany, while imports decreased by 11% since the beginning of the crisis. Greece is a notable exemption, as the trade deficit narrowed mostly due to a dramatic drop in imports by 32%. Germany as well as France reported raising exports as well as imports of goods and services, while exports grew slightly slower than imports.

What role do changing terms of trade play in the adjustment?

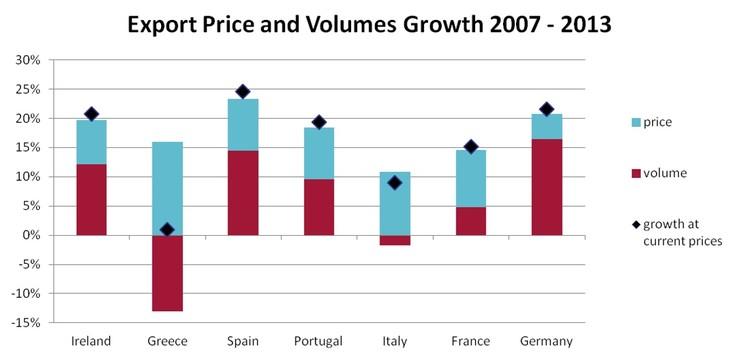

Interestingly, Germany had the slowest growing export prices (+4%), but also the fastest growing rate export volumes of all countries (+16%)

Note: 2013 forecast

The change of exports and imports can be decomposed into a price and a quantity component in order to identify different effects (see Figure 2 and 3). Notably Spain (+10%) and Portugal (+14%) could strongly improve their exports in volume terms since 2007, while the economies contracted as a whole. In Greece, the price effect played a major role as rising export prices (+16%), offset the decrease in export volumes (-13%). A similar effect occurred in Italy, where there was a slight reduction in export volumes since 2007. Interestingly, Germany was the country with the slowest growing export prices (+4%), while at the same time Germany’s export volume had the highest growth rate of all countries (+16%).

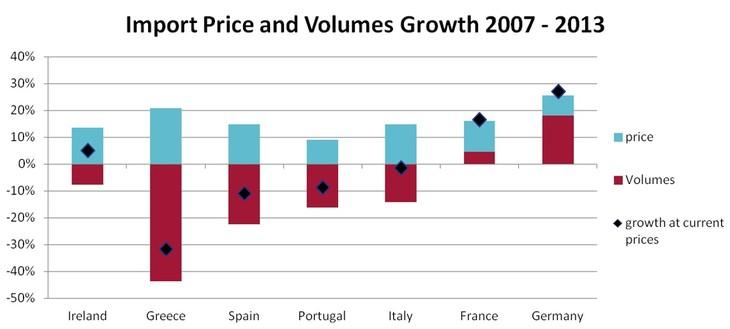

Greece had the fastest growing import prices (+21%) since 2007.

Note: 2013 forecast

It can be noted that the drop in Greek imports is even larger (-44%) considering constant prices. On the other hand, Greece was the country with the fastest growing import prices (+21%). Compared to nominal values, the reduction in imports cleaned for price effects was also substantially larger in Italy (-14%), Portugal (-16%) and Spain (-22%). Furthermore, it can be seen that Ireland’s volume of imports fell since the beginning of the crisis (-8%), compared to a nominal increase of 5%.

Taking into account price effects, the relationship of exports and imports is considerably different since price effects explain a significant share of the export improvements. In the case of Italy and Greece, separating these two effects actually shows that export volumes declined. Furthermore, decreases of imports are larger in real terms than in nominal terms, increasing the role of imports in the adjustment process. Hence, inflation drove up both export and import prices. In fact, Ireland is the only country with the percentage increase in export volumes exceeding the percentage decrease of imports.

Nevertheless, import price increases were larger than export price increases in all countries. Consequently, terms of trade changes were not the reason for the improved trade balance. In contrary, with regard to volume, the improvement of the trade balance is even larger for all countries.

Germany was still the exception with the slowest rise in prices of both exports and imports, while its export growth in volume terms was the strongest of all

However, significant differences across countries exist. Germany was still the exception with the slowest rise in prices of both exports and imports, while its export growth in volume terms was the strongest of all. On the other hand, it can be seen that Germany also had the highest growth rate of imports both in real as in nominal terms.

Why do exports or imports play the major role?

The data shows that domestic demand depression is not sufficient to explain the balance of trade adjustment, as this would imply mainly a reduction of imports. However Ireland, Spain and Portugal increased their exports significantly in both nominal and real terms while the overall economy was shrinking. A possible explanation would be that producers had to enter new markets abroad after their domestic business model lost its viability, due to the economic crisis. Thus, sluggish domestic demand worked as a push factor for exports, after the end of a longlasting consumption boom in the periphery countries, that discouraged companies from exporting. Hence, the adjustment of imports and exports might be caused by compressed demand.

This suggests that increases in exports might not have started without these new incentives created by the crisis. Yet, it can be interpreted as a positive characteristic of the economy, as it shows its international competitiveness and the ability to adapt, e.g. the Spanish Economy. Once these new markets are developed there is no obvious reason why companies should stop exporting, even after domestic demand eventually picks up. Since these economies are runnig below their potential output, there should be enough spare capacity not to crowd out exports once consumption revives.

This theory does not apply to Greece, which did not manage to substitue domestic demand by increasing exports. The underlying reason might be the absence of a strong tradeable sector. Therefore, wage adjustment does not necessarily help to support exports, since the economy is not able to shift towards an export orientated business model.

There has been a significant adjustment in the trade balance of goods and services of the crisis stricken countries over the last five years

In summary, it can be seen that there has been a significant adjustment in the trade balance of goods and services of the crisis stricken countries over the last five years. It has been shown that this was mostly export driven particularly in Ireland, Portugal, and Spain with the notable exemption of Greece, where a collapse of imports caused the trade adjustment. The role of imports for the adjustment was larger for all countries looking at volumes. Furthermore, import prices rose faster than export prices. Consequently, the balance of trade of goods and services adjustment is actually larger considering volumes. Nevertheless, Germany sustained its trade surplus, while having the slowest increase of both export and import prices. This led to an overall increase of the euro area balance of trade, rather than an internal adjustment of the euro area.

Update to this post