Tweaking China’s loan-deposit ratio rule

In the wake of the latest easing of Chinese monetary policy, the CBRC, China’s banking regulator, has recently modified a few details of how it c

In the wake of the latest easing of Chinese monetary policy, the CBRC, China’s banking regulator, has recently modified a few details of how it calculates the bank loan/deposit ratio, which is currently capped at 75 percent by the country’s banking law. This move, in combination with an easier monetary policy stance, aims to ease the tight Chinese financial conditions, allocate more credit to Chinese agriculture and SMEs, and adapt China to its rapidly changing financial landscape.

The newly announced changes to the computation formula of the loan/deposit ratio fall into three categories, all in an apparent attempt to make the 75% cap less of a constraint on bank lending.

First, the numerator of the ratio (‘loan’) is shrunk by excluding certain categories of bank loans extended to agriculture and SMEs or funded by non-puttable term debt securities.

Second, the denominator (‘deposit’) is widened to include new financing instruments such as certificates of deposits (CDs) issued to firms and households and net term deposits from foreign parent banks.

Third, the currency relevant for calculating the ratio is now restricted to local currency only (involving both ‘loan’ and ‘deposit’). Since the foreign-currency loan/deposit ratio is over 100 percent for China’s banking sector, the change helps ease the constraint system-wide.

Together, this CBRC move might manage to expand the aggregate lending capacity of Chinese banks by some 1 percent

Together, this CBRC move might manage to expand the aggregate lending capacity of Chinese banks by some 1 percent, easing the tight financial conditions while in theory favouring lending to agriculture and SME borrowers and bank loans funded by new instruments such as CDs, which are supposedly priced by market demand and supply.

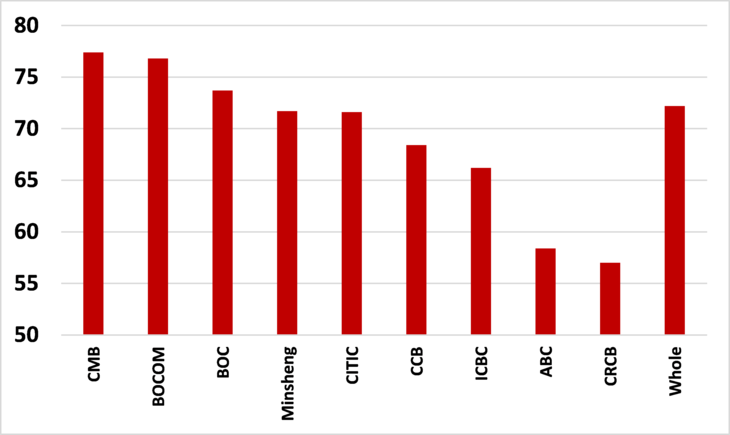

This is no doubt a positive policy move that may mitigate the prevailing tightness in Chinese financial conditions, as the overall banking sector has approached the 75 percent regulatory ceiling (Graph 1). The measure also may facilitate further interest rate liberalisation.

Graph 1: Loan-to-deposit ratios of Chinese banks listed in Hong Kong (In Percent, June 2014)

Note: CMB=China Merchant Bank; BOCOM=Bank of Communication; BOC=Bank of China; Minsheng= Minsheng Bank; CITIC=CITIC Bank; CCB=China Construction Bank; ICBC=Industrial and Commercial Bank of China; ABC=Agricultural Bank of China; CRCB= Chongqing Rural Commercial Bank.

So far, so good. But then why all the fuss for the CBRC to painstakingly refine technical calculation details of this loan/deposit ratio? Why not simply to raise the official 75 percent cap outright to say 90 percent or 100 percent?

That is because that the 75 percent cap on the loan/deposit ratio is precisely set in stone by the 1995 Chinese Banking Law that can only be changed by the Chinese national legislature. Indeed, the CBRC was not even born yet when this banking law first came into effect.

So there is nothing the CBRC can do but to enforce, tweak or wait at least until the Chinese national legislature convenes in the first quarter next year. In hindsight, it would be better if the Chinese banking law had simply stated that the bank regulator can impose and adjust some loan/deposit ratio as it sees fit.

The 75 percent cap on the loan/deposit ratio was introduced two decades ago, with good reasons. First, inflation was running at double-digit in 1994. Second, China did not yet embrace the Basel capital requirement then. Third, there was a forthcoming policy of abolishing official bank loan quotas at the time. Therefore, the Chinese government hastily formulated this blunt rule into a national banking law in early 1995, as a major policy tool to manage the banking sector.

This 20-year old regulatory rule has become essentially outdated

But by now, this 20-year old regulatory rule has become essentially outdated, also for good reasons.

First, it favours big state-controlled banks which have vast retail and corporate deposit bases and disadvantages the smaller banks that tend to lend more to SMEs, thereby adding to the financial tightness in the broader economy. Structurally, the ratio may also inhibit the growth of the more productive sectors.

Second, banks attempt to circumvent the rule by shifting some lending off balance sheet, thus fuelling excessive shadow banking in China, which is in part the product of regulatory arbitrage in response to a more binding loan/deposit ratio, high reserve requirements and partially regulated interest rates.

Third, the funding sources of Chinese banks have become more diversified over time, with more debt securities including CDs and the declining importance of deposits in the recent years.

Fourth, China’s banking regulatory regime has now supposedly more embraced the new Basel Accord III that features enhanced capital and liquidity requirements, thus possibly rendering the 75 percent cap on the loan/deposit ratio redundant.

While helpful both cyclically and structurally, the latest CBRC tweaking to the loan/deposit ratio is no more than a stopgap measure. Those who fancy that this tweaking can meaningfully boost SME financing would be very disappointed, if experience in other economies without such a regulatory cap is any guide.

In my view, the most underappreciated benefit of the latest tweak is to remind us the risk that greater competition for deposits among smaller banks facing this old cap may mix with the new interest rate liberalisation to produce the chemicals that could poison China’s financial system. Indeed, such a dated, rigid regulatory rule itself could become a potential source of financial instability in a more liberalised environment.

This also highlights the need for complementary institutional changes in order to enhance the potential benefits and mitigate the potential risks associated with rate deregulation. This strengthens the case for a financial liberalisation strategy of faster exchange rate liberalisation ahead of full interest rate deregulation in China.

While time is ripe for a removal of any specific numerical cap on the loan/deposit ratio from the Chinese banking law, a smart way going forward would be to keep the loan/deposit ratio as a supplementary policy instrument but grant the CBRC the full discretion to adjust its ceiling. A heavy, broken umbrella could turn out to be handy on a day of pouring rain.