T-LTRO: variation on a (ECB’s) theme

Last Thursday the ECB unveiled its “big bazooka plan” to fight the threat of deflation in the Euro area. Among the measure announced, there is a varia

Last Thursday the ECB unveiled its “big bazooka plan” to fight the threat of deflation in the Euro area. Among the measure announced, there is a variation on a theme that by now is a classic for the ECB, i.e. the Long-Term Refinancing Operation (LTRO). The 2014 version of the LTRO will be Targeted (TLTRO), spicing the usual LTRO up with a flavor of Bank of England-like “funding for lending”. The scheme works in two steps, with a first phase linked to the outstanding amount of bank loans to the non-financial private sector and a second phase linked to the flow of net lending. However, important details remained to be clarified.

Phase 1

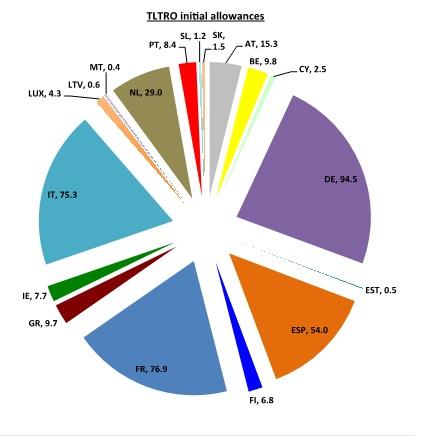

Two TLTRO operations conducted in September and December 2014 will allow banks to borrow up to an initial allowance. The latter is defined as 7% of the amount of banks’ outstanding loans to the euro area non-financial private sector (excluding households’ mortgages) as of end-April 2014. Funds will have 4 years maturity and a fixed rate equal to the MRO rate +10 basis points.

In terms of size, 7% of the euro area outstanding loans to the non-financial private sector amounts to roughly 400bn

In terms of size, 7% of the euro area outstanding loans to the non-financial private sector amounts to roughly 400bn. As a comparison, the deleveraging occurred in credit (with the definition used by the ECB for the TLTRO) amounts to 531bn in the euro area as a whole since fall 2011, i.e. when deleveraging really kicked in in Europe. Due to the exclusion of mortgages – which make up to 74% of total credit to households as of April 2014 – this is mostly corporate deleveraging. Considering only the corporate sector, outstanding loans have in fact decreased by 426bn between November 2011 and April 2014. Therefore, at the aggregate level the initial allowance under the ECB TLTRO is almost equal to the decrease in loans observed since fall 2011.

At the country level things are very different. The bulk of corporate deleveraging between November 2011 and today has occurred in Spain (-264bn) followed by Italy (-91bn) and Portugal (-22bn). In France outstanding loans to corporates decreased by 15bn and in Germany by only 7bn. The TLTRO initial allocation however will not follow this ranking, and will be concentrated mostly in Germany (95bn or 24% of the total), France (77bn or 19% of the total), Italy (75bn or 19% of the total) and Spain (54bn or 14% of the total).

Phase 2

Between March 2015 and June 2016, banks will be able to borrow additional amounts in a series of TLTROs conducted quarterly and depending on banks’ net lending to the real economy. In fact, these additional amounts can cumulatively reach up to three times each bank’s net lending to the euro area non-financial private sector (excluding households’ mortgages) provided between 30 April 2014 and the respective allotment reference date in excess of a specified benchmark. The benchmark will be determined “by taking into account each counterpart’s net lending recorded in the 12-month period up to 30 April 2014”. The rate will again be fixed and equal to the MRO rate +10 basis points.

This second component of TLTRO is very important because it allows “leveraging” of the measure beyond the initial allowances and it explicitly introduces a link with the flow of net lending, thus going in the direction to address a major flaw of the previous LTROs where funds were largely used to buy government bonds.

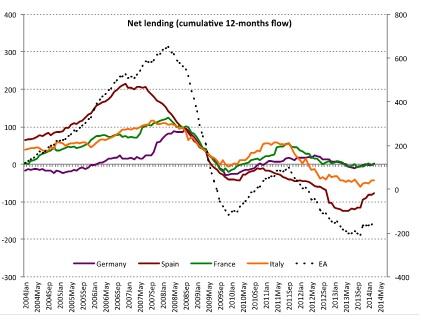

How tight is the net-lending criterion for TLTRO funds? In practice, not so much

But how tight is the net-lending criterion? In practice, not so much. Figure 3 shows a 12-month cumulative flow of lending to the non-financial private sector (excluding households mortgages) for the euro area, as well as the four biggest countries. During the twelve months up to April 2014 (i.e. the period that will be used for the benchmark) net lending has been negative in the euro area, as well as in Italy and Spain, and almost inexistent in Germany and France. As noted among others by Frederik Ducrozet of Crédit Agricole, this means it should be rather easy for banks to meet the net lending benchmark. De facto in Italy and Spain, net lending will “just” need to be “less negative”, i.e. the pace of deleveraging in the corporate loan portfolio will just need to be slowed and not necessarily reversed. This is what can be said based on the current information available, but the ECB has mentioned that further details (possibly clarifying this point) will be released at a later stage.

All TLTROs will mature in September 2018, meaning that liquidity injected under the type-one operations will have maturity of four years whereas liquidity injected under the type-two operations will have maturity of three/two years. Starting 2 years after each TLTRO, counterparties will have the option to repay any part of the amounts at a six-monthly frequency.

The ECB must be very careful in clarifying these “details” as soon as possible. Otherwise it would just be the same music over again

Quite obviously, the most important and delicate part of the scheme is the safeguard mechanism to ensure that the funds are actually used for the purpose they are intended to, i.e. lending to the real economy. At the moment, this is not yet entirely clear. The ECB press release says that banks will be required to pay back the funds borrowed under phase 1 of the TLTRO as early as September 2016 (i.e. 2 years before maturity), if their net lending will be below the benchmark during the period from 1 May 2014 to 30 April 2016. However, as noticed by market analysts, nothing explicitly prevents banks from using the funds of the TLTRO to buy government bonds. According to the information available up to this point, Spanish and Italian banks could use part of the funds borrowed in Phase 1 to buy government bonds and still qualify for Phase 2, as long as their loan portfolio does not shrink faster than it has been shrinking over the last 12 months. And even in case they were not to qualify for Phase 2, the only consequence at the moment appears to be that they would be forced to repay the funds earlier but could still enjoy the profits of a carry trade in the meantime. ECB’s president Draghi has said in the Q&A that “there are going to be additional reporting requirements”, which are probably part of the “details” the ECB will publish at a later stage. The TLTRO can be a positive improvement on an established ECB instrument, potentially remedying its major flaw. For this to be the case, however, the ECB must be very careful in clarifying these “details” as soon as possible. Otherwise it would just be the same music over again.