Fact of the week: Norway is the safest place on Earth

Standard and Poor’s published its Global Sovereign Debt report for the second quarter of 2014 recently. The report ranks countries according

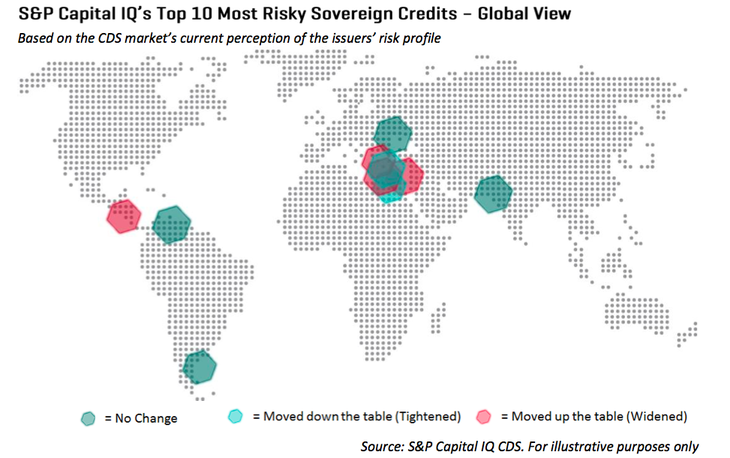

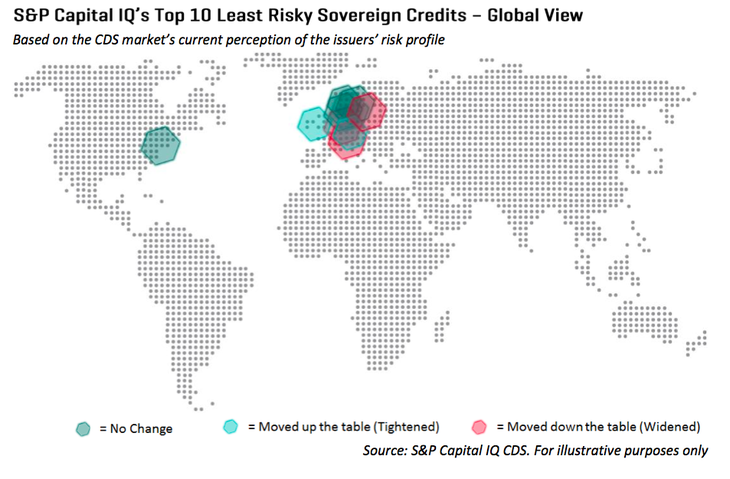

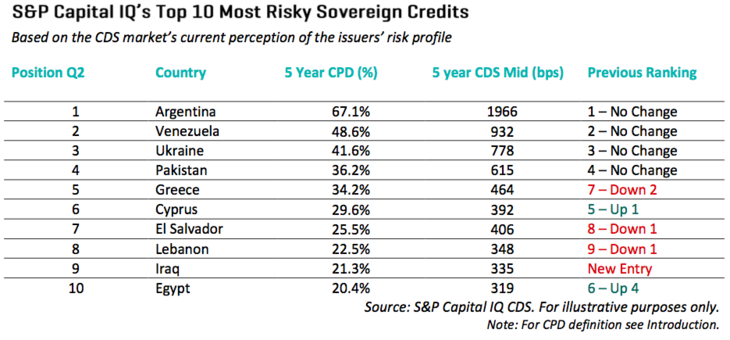

S&P Capital IQ’s published its Global Sovereign Debt report for the second quarter of 2014 recently . The report ranks countries according to the riskiness of their debt, depicting a North-South divide in creditworthiness, with Norway being the least and Argentina being the most risky.

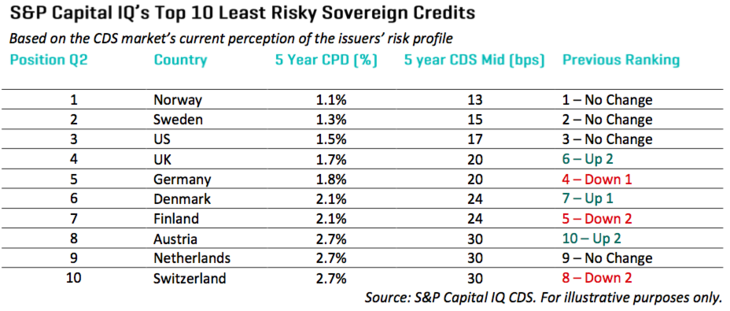

S&P Capital IQ’s Global Sovereign Debt report for the second quarter of 2014 rates Norway as the least risky sovereign and Argentina as the most risky one. Norway is followed by Sweden and the US, whereas the UK climbs up to to fourth place, which used to belong to Germany.

The four “eurozone core”’s members (Germany, Austria, Finland and the Netherlands) make up almost half of the top ten, whereas only two “eurozone periphery”’s countries are still among the worst ten. Greece and Cyprus are classified as the 5th and 6th most risky sovereigns, down 2 places and up 1 place respectively. The top three in terms of riskiness remain Argentina, Venezuela and Ukraine.

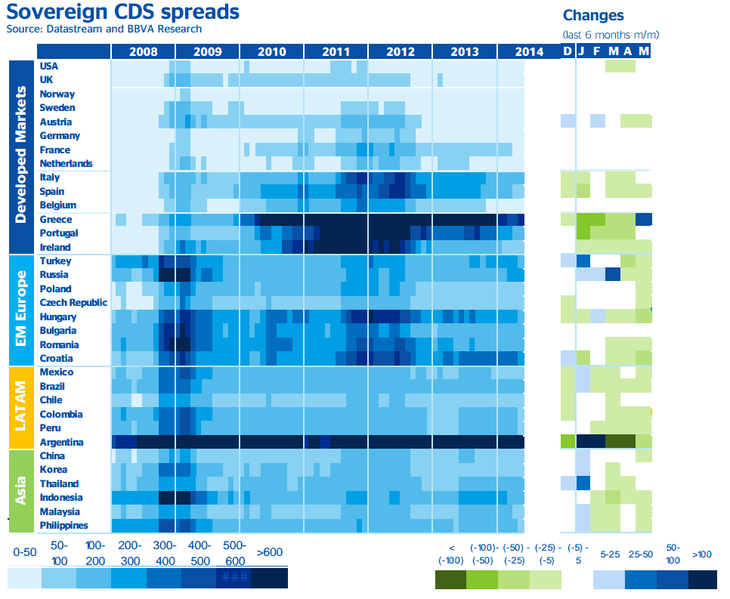

The issue with the S&P Capital IQ report is that all the rankings seem to be relying heavily on the implied risk profile inferred from Credit Default Swap (CDS) movement, more specifically five year mid PAR spreads. CDS are normally used as a proxy of the cost of ensuring against the default of a certain country. In that respect they should give an indirect indication of sovereign risk. However, the reliability of CDS as indicators of sovereign risk has been often questioned, importantly also by the IMF, because of the relatively low liquidity in part of the market. Moreover, where CDS data for the sovereign is not available S&P report uses a majority state owned national bank as proxy to derive CDS and consequently the CPD of the country. This is the case for India, for which data for the “State Bank of India” is used, and for Tunisia, for which the “Banque Centrale de Tunisie” is used. Figure 2 below (from BBVA research) shows the time series evolution of sovereign CDS spread across countries in the world suggesting that, apart from the case of Norway on the one hand and Greece and Argentina on the other, the CDS does not always yield an uncontroversial ranking.

Source: BBVA research

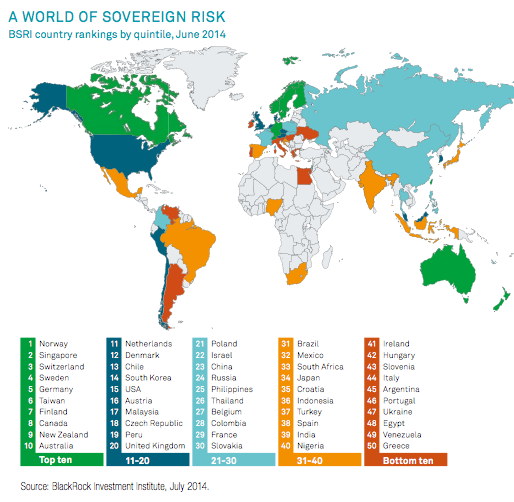

It is interesting to look complementary at another Sovereign risk indicator that has been recently updated, i.e. the BlackRock’s Sovereign Risk Index (see here for the methodology). This index is an aggregate of many indicators largely grouped in the following categories.

- Fiscal Space (40% weight), trying to assess if the fiscal dynamics of a particular country are on a sustainable path.External Finance Position (20% weight), trying to measure how leveraged a country might be to macroeconomic trade and policy shocks outside of its control.

- Financial Sector Health (10% weight), assessing the degree to which the financial sector of a country poses a threat to its creditworthiness, were the sector were to be nationalized, and estimates the likelihood that the financial sector may require nationalization.

- Willingness to Pay (30% weight), grouping political and institutional factors that could affect a country’s ability and willingness to pay off real debt.

This index has the advantage to also tell what are the roots of sovereign risk, which is the most interesting part, taking account of countries’ specificities (you can build your own rankings here).

Norway is again top of the list, thanks to extremely low absolute levels of debt, an institutional context that is perceived to be strong and very limited risks from external and financial shocks. Germany, Netherlands and Finland still make it in the top 10, whereas Portugal, Ireland Italy and Greece make it to the top wors. Greece is actually the bottom of the list, although this ranking was done in june so admittedly Argentina might have taken over in July.

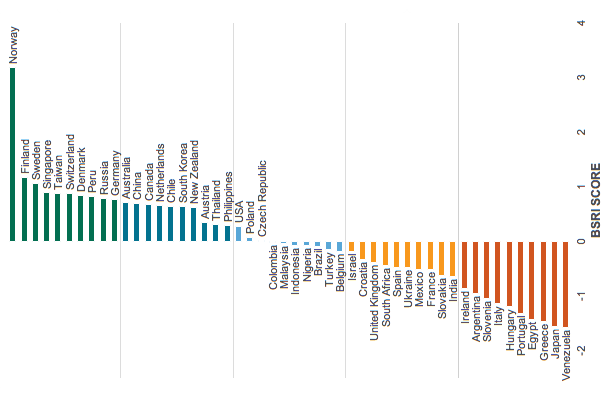

Fiscal space rating

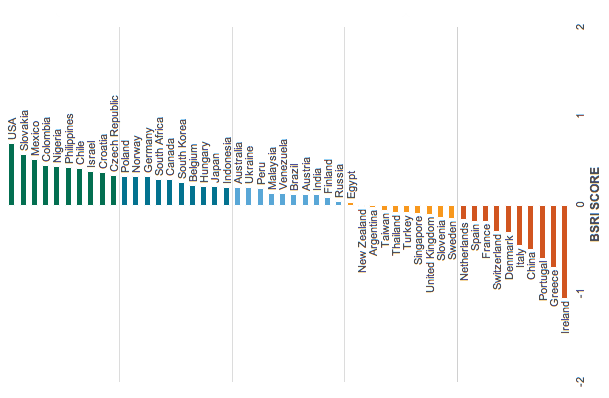

Financial sector risk

What is interesting is looking at the relative positions on the different subcategories, which can vary even considerably with respect to the overall score. As an example, lets compare the relative rankings in terms of fiscal space and financial sector risk - which can interact in unpleasant way during crises. Norway is a clear outlier in terms of fiscal space ranking (figure 1) whereas it performs less well in terms of financial sector health. The same is true for Germany and Finland, which rank high on fiscal space and significantly lower in terms of financial sector health. Netherlands is strikingly, 14th in terms of fiscal space and in the worst top ten in terms of financial sector heath. China too ranks high in fiscal space and low in financial risk as well.

The relative ranking is extremely interesting, as it clearly visualises that fiscal sustainability (and sovereign risk with it) is far from exact science and there’s nothing more relative in this world as the definition of a “safe debt”.