Are financial conditions in China too lax or too stringent?

The pronounced slowdown in China’s GDP growth in recent years has raised the important question of what might be its principal causes.

The pronounced slowdown in China’s GDP growth in recent years has raised the important question of what might be its principal causes. The usual suspects are many and might include rebalancing pains associated with China’s domestic and external imbalances, less favourable demographics resulting in a stagnant labour force, fewer low-hanging fruits in market liberalisation, a less-accommodating global economy that no longer serves as a ready outlet for China’s surplus savings, and even the ongoing anti-corruption campaign that might have slowed government outlays and hit sales of luxury goods.

Could tighter Chinese financial conditions be another, unusual suspect contributing to the marked growth slowdown in recent years? If the recent economic slowdown was primarily structural, lax financial conditions would not help and might even worsen the structural problems that dragged down economic growth in the first place. Indeed, China over the past few years has witnessed concurrently weaker growth and rising credit as a ratio to GDP, in contrast to a ‘creditless recovery’ in the euro area.

I recently made a case for China to ease its monetary policy in the face of slowing economic growth and benign inflation. Moreover since the global financial crisis, the Chinese central bank until recently maintained a tighter monetary policy relative to its international peers such as the US Fed, the European Central Bank, the Bank of Japan and the Bank of England, on the basis of both the real policy rate and the real effective exchange rate.

However, whether a different monetary policy is to have a meaningful effect on economic agents depends in part on transmission channels. Europe’s half-asleep banking sector is a case in point.

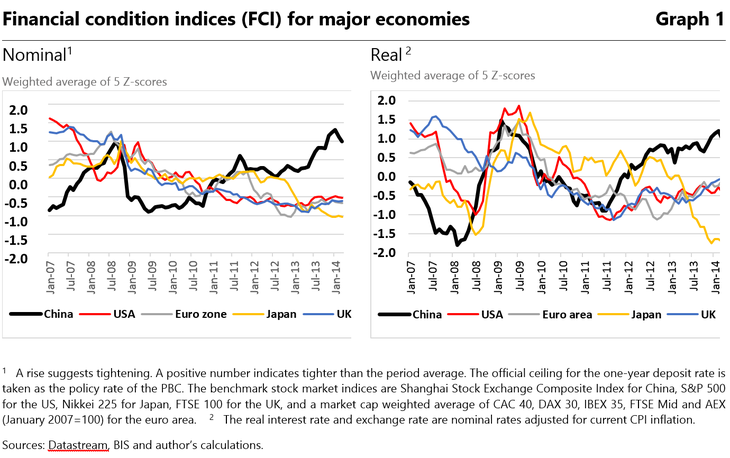

To better assess the financial environment that actually influences economic behaviour in China, I construct a crude ‘financial conditions index’ (FCI) that is a weighted sum of five key financial asset prices — policy rate, one-year treasury yield, ten-year treasury yield, effective exchange rate and benchmark stock market index. Higher readings denote tightness for the first three rates and the effective exchange rate, so I use the inverse of the stock market index to capture changes in equity prices.

I place an equal weight of 20 percent on each of the z-scores of these five financial prices. Thus, increases in interest rates, the effective exchange rate and the inversed stock market index all result in a rise in the FCI, indicating a tightening of financial conditions. I will focus on the post-crisis period from January 2007 to March 2014 before the latest Chinese monetary easing. A positive FCI reading suggests tighter financial conditions than the period average.

Let’s consider two versions of the FCI, one based on nominal interest rates and the effective exchange rate and the other on their real (ex post) counterparts. It is also useful to construct the FCIs for the US, euro area, Japan and Britain using the same consistent methodology, so that the Chinese FCI can be compared both over time and to its peers.

The central message from these FCIs is that China’s financial conditions have tightened the most among the major economies since the global financial crisis (Graph 1). Also, China started with relatively lax financial conditions, but post-2011 tightened considerably, at least until the second quarter of 2014. By contrast, financial conditions in the G4 generally became less stringent over the same period, as shown by both the nominal and real alternatives.

Moreover, all of the five asset prices underlying the Chinese FCI indicate an unmistakable financial tightening over this period — rising short- and long-term interest rates, a strengthening renminbi and a languishing Shanghai stock market that lost 27 percent of its value during this episode.

Finally, the paths of the nominal and real FCIs have differed somewhat for these big five economies in the post-2007 period, but all indicate tighter financial conditions in China both over time and relative to its international peers. While the real FCIs of the five major economies have shown noticeable swings, their nominal counterparts except China’s display steady, large and synchronised declines, indicating considerable easing of the financial conditions outside China.

In sum, China’s financial conditions have become unmistakably tighter since the global financial crisis. Intuitively, this revealed financial tightening, both over time and relative to its international peers, could have meaningfully contributed to China’s recent slower economic growth. Puzzlingly, our price-based FCI seems to sharply contrast with the observed Chinese credit boom in the wake of the global financial crisis.

In any case, Chinese policymakers ought to take notice of such marked, sustained and broad-based tightness of the financial conditions. A good starting point would be to better understand the underlying causes behind the tighter Chinese financial environment. For instance, a rigid 75 percent regulatory cap on the bank loan-to-deposit ratio and a punitive 20 percent reserve requirement both might have added to financial tightness, prompting policymakers in Beijing recently to tweak these rules in an attempt to loosen the domestic financial conditions.

Assistance by Giulio Mazzolini and Noah Garcia is gratefully acknowledged.