Fact of the week: Lithuania changes the ECB’s voting system

Lithuania will become the 19th member of the Euro area on the 1st of January, following Wednesday’s Council endorsement. The most important part of th

Lithuania’s accession to the euro area will be effective on the 1st of January 2015. This will bring the number of eurozone members to 19 and the Governing Council’s members to 25 (6 members of the executive board and 19 National Central Bank governors). Enough to trigger a change in the ECB’s Governing Council’s voting system, which will start rotating.

Actually, the statutes of the European System of Central Banks and of the ECB already envisaged the switch to a rotating system when the number of euro area countries exceeded 15 (which has been the case since quite some time). However, in December 2008, the Governing Council decided to defer the decision until the number of governors exceeded 18. This was an exception possible under the letter of the Treaty, but no other escape clause is offered and the rotation is therefore unavoidable.

The idea behind the rotation is to ensure the effectiveness of the ECB’s decision making even with an increased number of participants. The Federal Open Market Committee (FOMC) of the US Federal Reserve uses a similar system, with 12 voting members, 7 of whom are members of the Board of Governors and hold permanent voting rights. Differently from the ECB’s case, in the US specific regional governors enjoy special treatment. The President of the New York Fed has a permanent voting right, the Presidents of the Federal Reserve Banks of Chicago and Cleveland vote every other year and the Presidents of the other nine Federal Reserve Districts vote every third year.

At present, the ECB governing council works under the principle of “one man, one vote” and decisions are taken with simple majority. Under the new regime, voting rights will invariably rotate every month. Only 15 (out of 19) governors will be given the right to vote every month, based on a rotating selection. 6 votes will come from the members of the ECB’s Executive Board, which will retain the voting right permanently, bringing the total number of votes to 21 (3 less than at present).

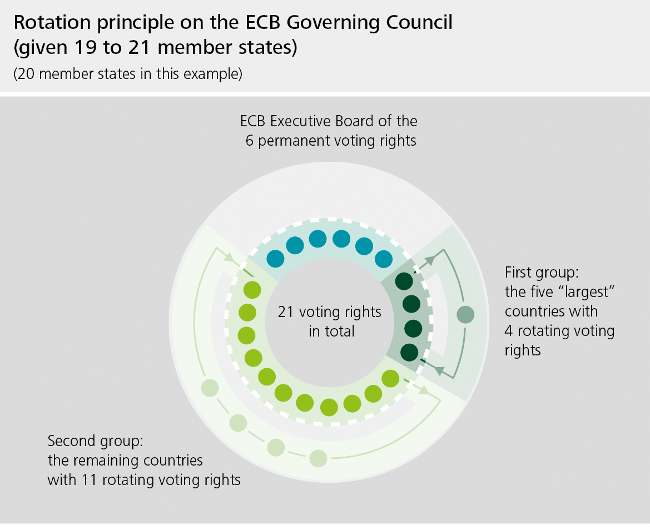

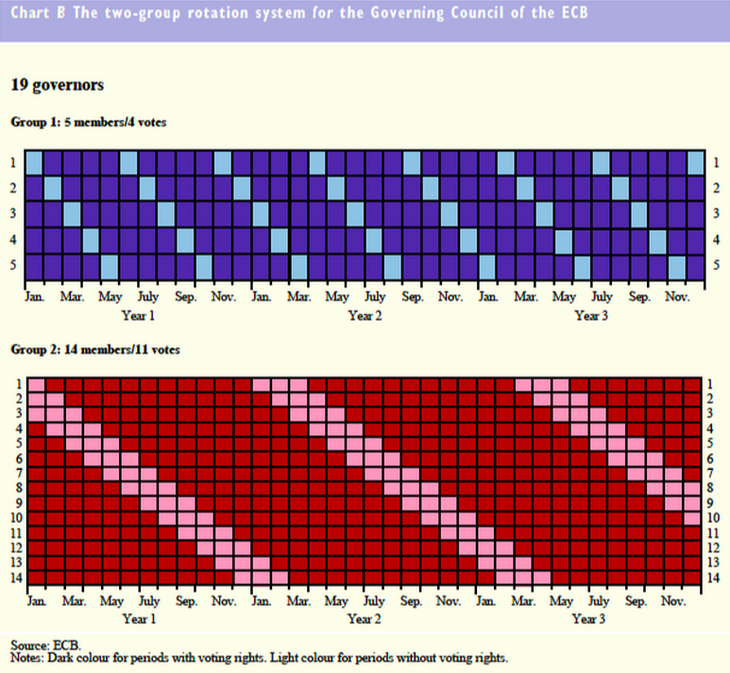

On top of that, votes will not be completely independent on the size of the countries anymore. The member of the Governing Council will in fact be assigned to groups, depending on the respective weight of their countries in the euro area economy (GDP at market prices, weighted for ⅚) and financial sector (MFIs’ aggregated balance sheet, weighted ⅙). The aggregate reference measure will be adjusted either every five years or when the number of EMU member states changes. Based on this ranking and as long as the number of governors does not exceed 21, the groups will be as follows (figure 1):

- Group 1: will comprise the governors of the NCBs of the 5 countries with the largest weight in the euro area. At present, members would be Germany, France, Italy, Spain and the Netherlands. This countries will share 4 votes, so each country will miss one vote every five.

- Group 2: includes the rest of the world, i.e. the governors of the NCBs of the remaining countries. These are 14 countries and will share 11 votes.

Figure 1

Source: Deutsche Bundesbank

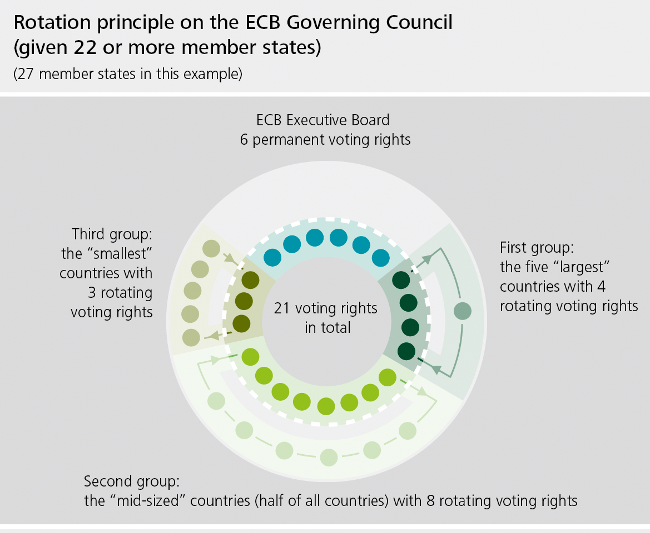

This system will hold until the number of euro area member countries reaches 22. At that point, rotation will become more complex and it will be structured around three groups, based on the size of the economies. The first group will still be composed by the 5 governors of the national central banks of the main euro area economies, still with 4 votes. The second group will half of the total number of governors, with 8 voting rights and the third group is made up of the residual countries which will share 3 voting rights (Figure 2).

Figure 2

Source: Deutsche Bundesbank

All governors will nevertheless take part to the discussions. The decision making process will still follow the “one man one vote” principle, but this time majority will be computed only among those voters who have the right to vote at a given meeting. And the frequency at which countries will be given the right to vote will depend on the group they are in, which in turn depends on their relative size.

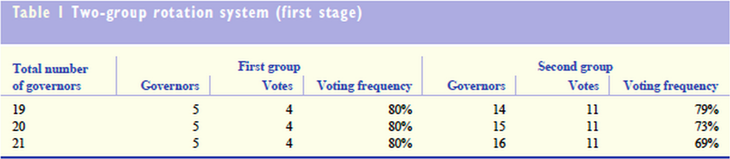

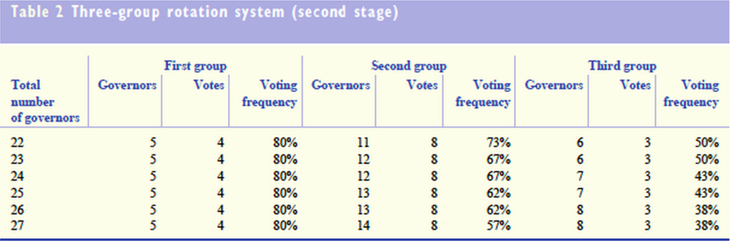

Tables I and II - from ECB’s monthly bulletin of July 2009 - clarifies the point. Countries in Group 1 (the biggest countries) will always retain 80% voting frequency, no matter how many countries were to eventually join the monetary union. Countries in Group 2 will see their voting frequency decrease potentially down to 57%, as long as new members join. Countries in Group 3 (if ever the number of euro area members were to surpass 22) will be allowed to vote at most 50% of the time, less than 40% in the “worst” case scenario. In other words, this means that the biggest 5 can consider themselves in a rather secure position, whereas small countries are likely to see their influence decrease over time, if bigger members were to join.

To avoid excessively long periods of suspension of the voting rights, the rotation will be monthly. In the first group, one governor will join/leave at each rotation. For the second and third groups, things are more complicated. The number of governors gaining voting rights at the start of each month will be equal to the difference between the number of governors allocated to the group and the number of voting rights assigned to it, minus two. (e.g. with 19 governors as in 2015, 14-11-2 = 1). This means that not all of the governors without a vote in a given month will regain their voting rights in the subsequent rotation period. With this system, the length of suspension of the voting rights will be one month in the first group and three months in the second group in 2015 (assuming less than 22 governors).

What will be the effects of this change?

First, the power of the Executive Board will potentially rise, since it will have 29% of the votes at each session and in a permanent way. Second, in terms of voting rights balance, not much changes. The 5 biggest countries will have under this system 19% of the voting power against 20% in the non-rotating system. The small countries will instead have 52% of the votes against 56% at present. Third, the influence of biggest countries will be maintained - the period of rotation is one month, so no one will be excluded for a long period of time - and most importantly it will be secured in the long term, as they the voting frequency within the group of five will always be 80%. Moreover, since all governors (also those who cannot vote in a given section) are present to the discussions and since this voting is by definition a sort of repeated game, it seems unlikely that decisions will be taken “behind the back” of any big country.

Last but not least, after explaining how it works, there is another “small” issue to point out. This system of rotation is built with a monthly frequency, with rotation occurring at the beginning of the month. The ECB in its Monthly bulletin of July 2009 clarifies that “as a rule, two physical Governing Council meetings take place every month. The first is dedicated exclusively to monetary policy decisions, and the second generally deals with all other issues to be decided by the Governing Council. The one month rotation period allows governors to exercise their voting rights in both types of meeting.” But ECB President Draghi recently communicated that from January 2015 onwards the Governing Council will make monetary policy decisions once every six weeks rather than once every month. Which means that the length of each “voting-right cycle” would be not match (will be shorter) than the “monetary policy decision cycle”.

Unless the ECB wishes to change the rotating voting system again, of course.