The myth of a new housing bubble in Germany

On Wednesday, the IMF warned about a recent rise in global house prices. In various countries prices were well above their long-run average.

See also Guntram B. Wolff's post Easier monetary policy should be no worry to Germany.

On Wednesday, the IMF warned about a recent rise in global house prices. In various countries prices were well above their long-run average. Last week, Guntram Wolff wrote about the fear of a German house price surge which he did not find to be justified. Since both, credit and mortgage growth, were sluggish and leverage in household and corporate sector was rather weak, there was no reason for concern about financial stability linked to a house price bubble. The recent IMF data is confirming this findings.

In Germany, house prices were up by 5.1% on an annual rate in Q4 2013, which is the second highest growth rate among EU countries and well above the European average. What does this mean for the German economy? Speaking of house prices it is not enough to only look at the recent developments. We need to take a longer perspective to understand the price dynamics. To shed some light on the housing market, it is useful to assess the relation of prices to rents and income over time. If house prices are growing substantially faster than rents or incomes it could indicate an overvaluation in the housing market and suggest a growth in house purchases for investment instead of purchases for the use of housing

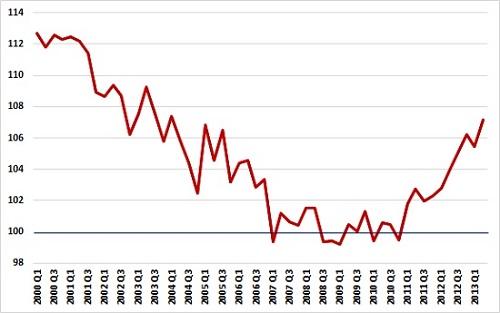

Looking at the relationship to rents we see that prices were growing faster than rents since 2011, yet, the price-to-rent ratio is more or less at the same level as 10 years ago (see Figure 1) and was around 13.4% below its long-run average in Q4 2013.

Figure 1: Price-to-rent ratio for Germany, 2010=100

Source: Bundesbank

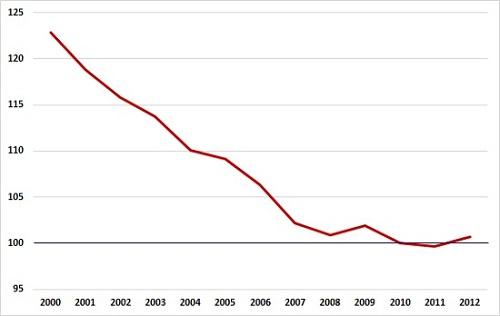

How are prices developing relative to the economic situation of German households? As you can see in Figure 2, the price-to-income ratio was falling for the last decade and only started to pick up slightly in 2012. According to the IMF, the ratio was still around 16.9% below its long-run average in the last quarter of 2013. Despite the rise in house prices, houses stay hence affordable in Germany.

Figure 2: Price-to-income ratio for Germany, 2010=100

Source: Bruegel calculation based on Bundesbank and AMECO, Note: the ratio is calculated using average gross disposable income of households