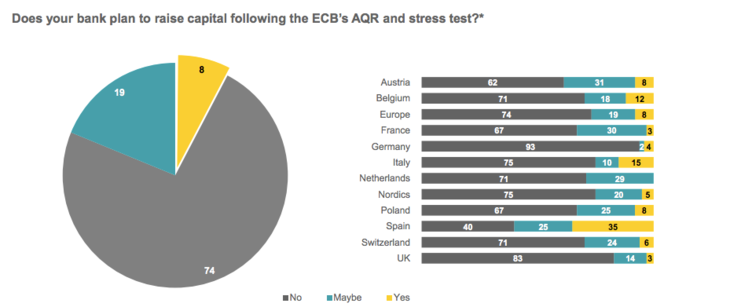

Fact of the week: Only 8% of banks says they will need to raise capital after AQR

The European Banking Barometer for the first half of 2014 gives a very interesting snapshot of the banking sector’s perceptions about macroe

In December, we wrote a paper about the ECB’s comprehensive assessment and its aftermath. We identified significant uncertainty about the recapitalisation needs that would be identified by the ECB’s comprehensive assessment. Ernst and Young has published this week their European Banking Barometer for the first half of 2014, which gives a very interesting snapshot of the banking sector’s perceptions about macroeconomic outlook as well as an indication of their priorities for the next moths. Among other issues, it also includes interesting insights on banks perception of the capital needs that will result from the ECB’s assessment. Findings confirm that uncertainty still prevails.

Source: E&Y EBB – 2014 H1

The EBB builds on a survey of 294 interviews with senior bankers across 11 markets: Austria, Belgium, France, Germany, Italy, the Netherlands, the Nordics, Poland, Spain, Switzerland and the UK. To ensure that the cross-countries differences in banking systems are taken into account, a range of bank types was interviewed including universal banks (large-scale banking group/major bank); corporate and investment banks; private bank/wealth managers; specialist (e.g., consumer credit, savings, or a bank that doesn’t offer a current account) and retail and business (e.g. SME business banking).

Interestingly, this edition includes questions on the ECB’s Asset Quality Review and Stress Tests. Few months ago, we published a paper on recapitalization and restructuring after the ECB’s exercise, pointing out that – at that time – one of the most important elements of uncertainty was in fact the amount of expected recapitalisation needs. At that time, a survey of market research and academic papers revealed very divergent view, ranging from an optimist 50bn to a pessimist more than 600bn. E&Y analysis shows that uncertainty about the results of the ECB’s investigation still prevails in the industry, despite the recent waves of capital raises by banks[1]. While only 8% of respondents anticipate raising additional capital following the exercise, there is an additional 19% of respondents who a capital raise “might” be necessary.

Source: E&Y EBB – 2014 H1

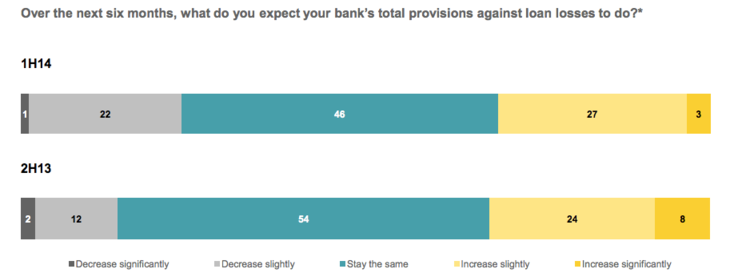

While being more optimistic on the economic outlook, banks remain worried about Non-Performing Loans (NPLs), with almost one third of respondents still expecting to raise Loan Loss Provisions in anticipation of the AQR. The report highlights that this is particularly true in Spain, where banks have been required to revalue their real estate portfolios, and in Austria where banks have significant exposure to Eastern Europe.

Source: E&Y EBB – 2014 H1

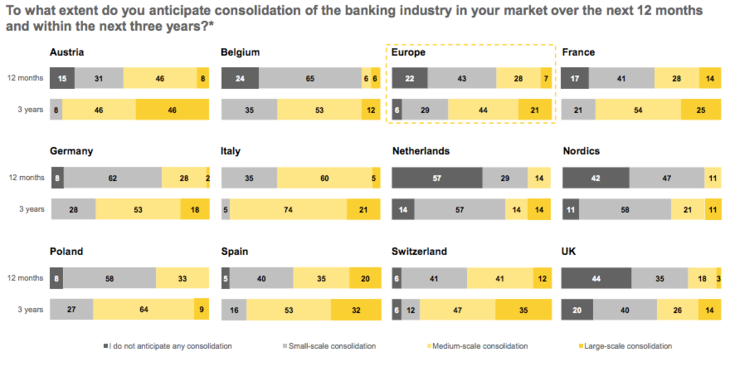

Banks also anticipate that the sector will undergo structural changes in a not-so-far future. 65% of respondents expect medium-to-large consolidations within three years, with Italian banks expecting the greatest consolidation of their sector – both in the short and medium term.

Concerning the prospects for corporate lending, the survey shows an improvement over time in most sectors. The outlook seems particularly positive for SMEs, where 45% of respondents expect lending to be less restrictive. If realistic, this would certainly be an encouraging signal about the potential take-up of the recently announced TLTRO and for the participation in any SME-related asset-purchase programme that the ECB were to announce.

[1] Several banks have already raised capital levels ahead of the AQR and stress tests. According to Thomson ONE, by the time we completed fieldwork for this survey, Eurozone banks had already raised over US $11 billion of equity this year, compared with just over US $2 billion in the same period in 2013. Since we completed the fieldwork, banks have raised an additional US $24 billion, bringing the total equity raised this year to over US $35 billion.