Despite lower yields, euro-periphery is not yet out of the woods

Do these undoubtedly benign developments suggest that the three euro-periphery countries have reached a sound and robust fiscal situation? Unfortunate

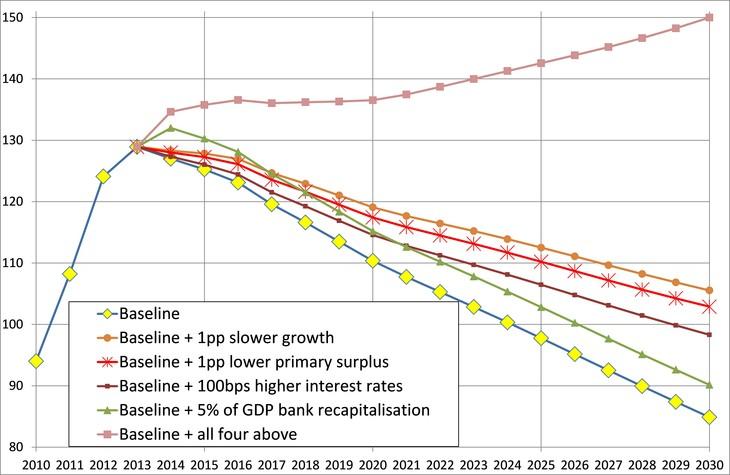

Following Ireland, Portugal has also exited its financial assistance programme in a clean way, namely without any follow-up credit line. Greece has successfully issued €3 billion 5-year maturity bonds in April 2014 at a yield of 4.95 percent and the issuance was largely oversubscribed. Even the 10-year government bond yields have declined significantly in the three countries and are now at a level close to, or even below, the 2008-09 yields (Figure 1).

Figure 1: 10-year government bond yields, 2 January 2008 – 11 June 2014

Source: Datastream.

Do these undoubtedly benign developments suggest that the three euro-periphery countries have reached a sound and robust fiscal situation? Unfortunately, the answer is no, as we conclude in our working paper published today, which assesses public debt dynamics by updating the February 2014 debt simulations done in Darvas, Sapir and Wolff (2014).

On the one hand, our findings continue to suggest that the public debt ratio is set to decline in all three countries under the maintained assumptions and in fact their future levels are now projected to be slightly lower than in our February simulations (eg for 2020 our new results are 2-3 percent of GDP lower). But on the other hand, the debt trajectories remain highly vulnerable to negative growth, primary balance and interest rate shocks, especially in Greece and Portugal, though also in Ireland.

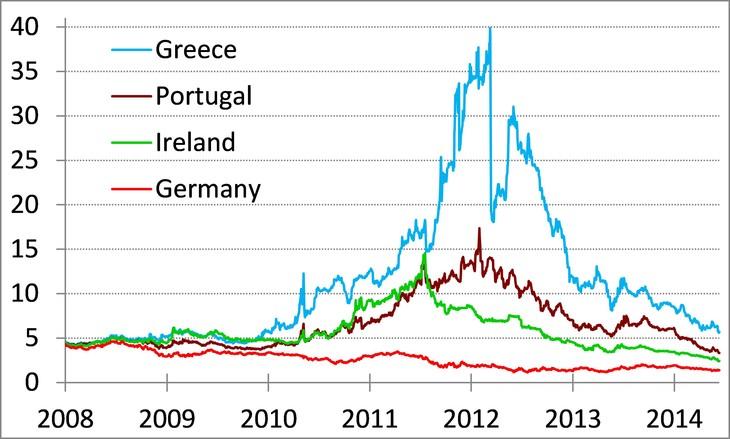

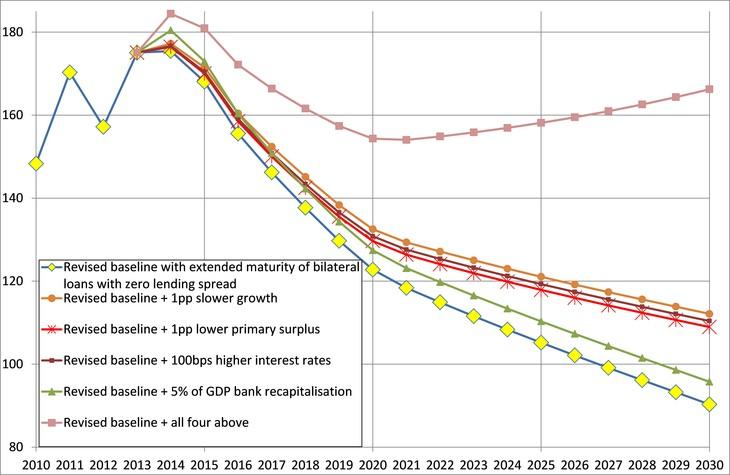

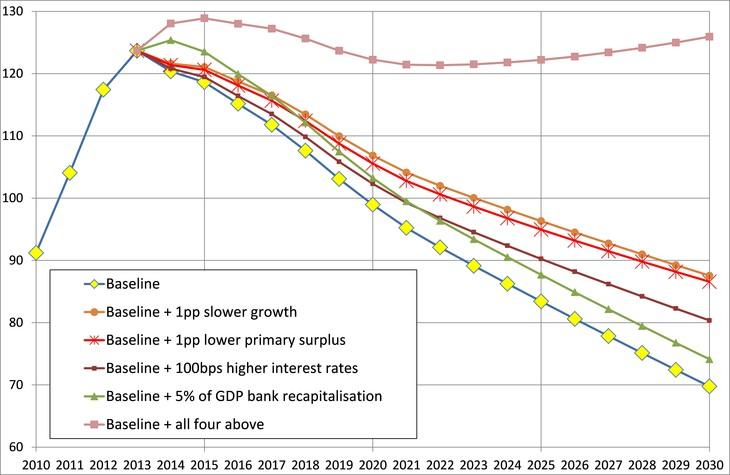

For example, if nominal GDP growth turned out to be 1 percentage points lower than in our baseline scenario (either due to weaker real growth or lower inflation), Greek public debt would still be 133% of GDP in 2020 and 113% in 2030, the Portuguese debt ratio would be 119% in 2020 and 106% in 2030, while the Irish debt ratio would be 107% in 2020 and 87% in 2030. The sensitivity to a 1 percentage point of GDP lower primary budget surplus and to a 1 percentage higher interest rate is similar, as indicated in the three panels of Figure 2.

Under the combined shock of 1 percentage point slower growth, 1 percent of GDP smaller primary budget surplus, 1 percentage point higher interest rate and 5% of GDP additional bank recapitalisation of the banking sector by the government (which is not an extreme scenario), the debt ratio would explode in Greece and Portugal and stabilise at a high level in Ireland (Figure 2).

Furthermore, we highlight that our goal with the debt simulation was not the calculation of a baseline scenario which best corresponds to our views, but to set-up a baseline scenario which broadly corresponds to official assumptions of the IMF and the European Commission and current market views and to assess its sensitivity to deviations from these assumptions.

We think that today’s markets may be overly optimistic, while meeting the IMF projections for primary balance will remain a challenge when there is an austerity-fatigue in most periphery countries. Also, the weak euro-area growth and too-low inflation do not favour debt sustainability of the euro-periphery.

Therefore, the expected steady decline in debt/GDP ratios under our baseline scenarios should be assessed cautiously because of both the uncertainty surrounding the baseline and its sensitivity to negative developments.

Figure 2: Debt ratio scenarios (% GDP)

A: Greece

Source: author's calculations

B: Ireland

Source: author's calculations

C: Portugal

Source: author's calculations