Blogs review: House of debt

What’s at stake: The recent release of the book “House of Debt”, by Amir Sufi and Atif Mian, has generated an important discussion on the ro

The banking view vs. the levered losses view

The Economist writes that the notion that financial crises are transmitted to the broader economy by the “bank-lending channel” has dominated subsequent policymaking. It is why Bernanke fought so hard to stop the panic in 2008 and to recapitalize the banking system afterwards. David Dayen notes that Sufi and Mian pinpoint the growing belief, which has taken hold among economists and policymakers that saving the banks equals saving the economy.

Lawrence Summers writes that House of Debt is important because it persuasively demonstrates that the conventional meta-narrative of the crisis and its aftermath, which emphasizes the breakdown of financial intermediation, is inadequate. It then goes on to provide a supplementary and in some ways alternative explanation focusing on the deterioration of household balance sheets. Their story of the crisis blames excessive mortgage lending, which first inflated bubbles in the housing market and then left households with unmanageable debt burdens. These burdens in turn led to spending reductions and created an adverse economic and financial spiral that ultimately led financial institutions to the brink.

Atif Mian and Amir Sufi (p.22-23) write that from 2006 to 2009, house prices across the country fell by 30%. But since poor homeowners were levered, their net worth fell by much more. In fact, because low net-worth homeowners had a leverage ratio of 80%, a 30% decline in house prices completely wiped out their entire net worth.

The household wealth channel and the slow recovery

Mark Thoma writes that the need for households to rebuild their balance sheets is one of the reasons it takes so long to recover from a balance-sheet recession. When the value of assets like housing equity, stocks and bonds fall while liabilities -- the high debt levels households accumulated prior to the crash -- remain, households begin trying to restore what was lost by reducing consumption and increasing saving.

Brad DeLong writes that to explain a deep, long, persistent downturn you need more than a big shock. You need: (a) a big shock, and (b) forces that make that shock persistent, and (c) an absence of damping mechanisms elsewhere in the system, and (d) an absence of recovery mechanisms elsewhere in the system. Mian and Sufi, I believe, do an excellent job of tracing the household wealth channel via (a) and (b)–how the overleverage followed by the collapse of the housing bubble delivered not juts a construction shock but a consumption shock, and how the failure to resolve underwater mortgages made the consumption shock persistent. But to explain (c) and (d) we need more than Mian and Sufi can give us: we need the banking, monetary, and fiscal policy stories as well.

The Obama administration and mortgage relief programs

Amir Sufi writes that failure to more adequately address the housing crisis was the biggest policy mistake. Straightforward policies were on the table, and they would have helped. Letting bankruptcy judges write down mortgages and providing an ambitious mortgage-refinancing plan would have reduced foreclosures. For example, Geithner could have pushed for a policy to give bankruptcy judges the ability to write down mortgage debt in a Chapter 13 bankruptcy – “mortgage cram down.” He could also have put forth an ambitious plan to allow solvent underwater homeowners to refinance into lower interest rates.

David Dayen writes that Sufi and Mian emphasize that the Great Recession response to debt forgiveness was a historic outlier. During the Panic of 1819, when falling commodity prices squeezed indebted farmers, state governments immediately put a moratorium on foreclosures, and Congress easily passed a debt-forgiveness law for farmers who had credit with the federal government. In the Depression, the Home Owners Loan Corporation bought up failing mortgages and restructured them so borrowers could make cheaper payments.

Real time Economics writes that Summers offers 5 reasons why the Obama administration did not push more for broad principal forgiveness:

- large-scale principal write-downs could have damaged the banking system

- forced write-downs could chill new lending

- more aggressive aid wouldn’t have saved some of the worst-off borrowers but would have instead ended up “delaying inevitable foreclosures,” in turn prolonging the housing market’s problems

- the administration looked at potentially buying up delinquent and underwater mortgages, but found banks carried those assets on their books at prices above current market value

- designing policy is easier than implementing it. Shared-appreciation mortgage plans, in which a lender forgives some debt in exchange for a stake in the home’s equity, for example, sound good on paper but are hard to implement quickly.

A European House of Debt

Wolfgang Münchau writes that one of the more important insights about the state of the European economy right now comes from postcode data in the US. Atif Mian and Amir Sufi find that what is outwardly disguised as a credit crunch is in reality a fall in demand for loans. Moritz Kraemer came up with corroborating evidence last week, when he did the maths on private sector debt in Europe. His analysis reads like a European version of House of Debt. The Europeans have barely begun to deleverage. In Spain and Ireland the process has at least started. But it will take years, maybe decades, until it is completed.

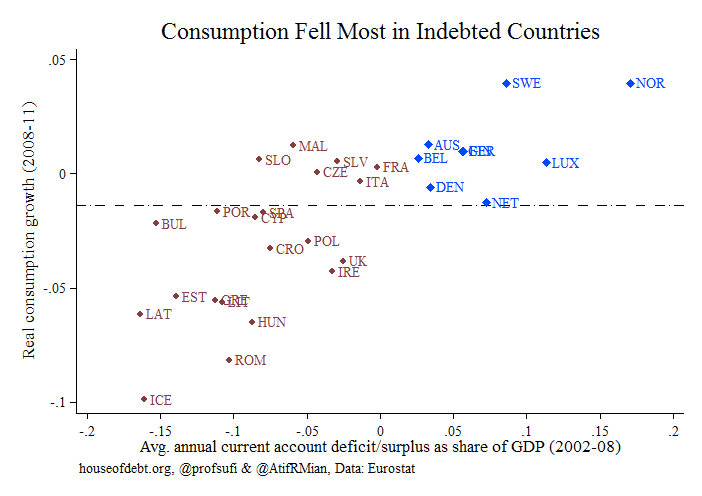

Atif Mian and Amir Sufi write that the pattern between debt accumulation and subsequent contraction in consumption for Europe is remarkably similar to what we document for the United States. One can simply replace European countries with states or cities within the United States and get the same picture.

Adair Turner writes that the prevailing view has usually stressed supply constraints and the policies needed to fix them. The policy focus remains on fixing the credit-supply problem, through the AQR and stress tests, and through the ECB’s own version of a funding for lending scheme, announced on June 5. An impaired banking system, it is argued, starves businesses, particularly small and medium-size enterprises (SMEs), of the funds they need to expand. But for SMEs, a shortage of customers, not a shortage of credit, constrained borrowing, employment, and output. And the customers were absent because the pre-crisis credit boom had left them over-leveraged.

In his Sunday Wrap email, Erik Nielsen writes that Eurozone households had none of those Anglo-Saxon explosions in debt up until 2008. Rather, here we saw a gradual increase from about 75% of disposable income in 2000 to a peak of 100% at the beginning 2011, followed by a bit of deleveraging to about 97% now. Of course, that Eurozone average of just below 100% of disposable income disguises great differences between countries, ranging from a whopping 250% in the Netherlands, to a tad below 200% in Ireland, to 120% in Spain and Portugal, to about 80% in Austria, France and Germany, and 65% in Italy.