Addressing weak inflation: The European Central Bank's shopping list

Euro-area inflation has been below 1 percent since October 2013, and medium-term inflation expectations are well below 2 percent. Forecasts of the ret

See comments by the authors 'Addressing weak inflation: The ECB’s Shopping List' and comment 'Negative ECB deposit rate: But what next?'

1. Introduction

There are clear benefits to price stability. High inflation can distort corporate investment decisions and the consumption behaviour of households. Changes to inflation redistribute real wealth and income between different segments of society, such as savers and borrowers, or young and old. Price stability is therefore a fundamental public good and it became a fundamental principle of European Economic and Monetary Union. But the European Treaties do not define price stability. It was left to the Governing Council of the European Central Bank (ECB) to quantify it: "Price stability is defined as a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%"[1]. The Governing Council has also clarified that it aims to maintain inflation below, but close to, two percent over the medium term, though it has not quantified what 'closeness' means, nor has it given a precise definition of the 'medium term'[2]. The clarification has been widely interpreted to mean that the actual target of the ECB is close to, but below, two percent inflation in the medium term.

In the current European circumstances, low overall euro-area inflation implies that in some euro-area member states inflation has to be very low or even negative in order to regain competitiveness relative to the core. The lower the overall inflation rate, the more periphery inflation rates will have to fall in order to achieve the same competitiveness gains. Given that wages are often sticky and rarely decline, significant unemployment increases can result from the adjustment process. In addition, lower-than-anticipated inflation undermines the sustainability of public and private debt if the debt contracts are long-term nominal contracts. For governments, falling inflation rates often mean that nominal tax revenues fall, which makes the servicing or repayment of debt more difficult.

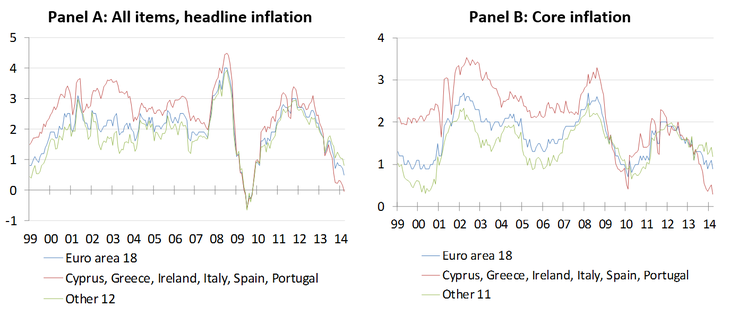

Inflation in the euro area has been falling since late 2011 and has been below one percent since October 2013. Core inflation, a measure that excludes volatile energy and food price developments, has developed similarly. Five of the 18 euro-area member countries (Cyprus, Greece, Portugal, Slovakia and Spain) are already in deflation. Even in the countries that are not in a recession, such as Belgium, France and Germany, inflation rates are well below the euro-area target of close to but below two percent. More worryingly, the ECB’s forecast suggests that inflation will not return to close to two percent in the medium term.

Given the need to regain competitiveness, lower-than-target inflation in the euro-area periphery can be expected and is even desirable. However, to facilitate adjustment and achieve the overall ECB inflation objective, inflation in the euro area’s core countries needs to stabilise and reach levels above two percent. A key question for policymakers is therefore why inflation rates are subdued in core countries despite very accommodative monetary policy conditions and the gradual revival of economic growth. Policymakers must also consider which monetary policies are suitable for increasing aggregate inflation in the euro area, while ensuring that the inflation differential between the core and periphery remains. Finally, unresolved banking-sector problems are making the task of the ECB more difficult.

It is against this background that we discuss monetary policy options to address low inflation in the euro area. Evidently, structural and banking policies, wage-setting mechanisms and fiscal policies also need to play a role in addressing the recession and the low-inflation problem. They are, however, not discussed in this Policy Contribution.

2. Heterogeneous inflation developments in the euro area

Panel A of Figure 1 shows that the euro-area headline inflation rate has been moving downwards since late 2011, while Panel B indicates a similar trend for core inflation[3]. Panels A and B also highlight major differences between euro-area countries. Countries in the euro-area periphery (which we define as Cyprus, Greece, Ireland, Italy, Spain and Portugal) had higher inflation rates than other euro-area counties before the crisis, persisting well into the crisis period. Only since 2013 has inflation in the periphery clearly fallen below that of the euro area as a whole[4].

Figure 1: Inflationary developments in the euro area (percent change compared to the same month of the previous year), January 1999 – March 2014

Source: Bruegel calculation using data from Eurostat’s Harmonised Index of Consumer Prices dataset. Note: core inflation is defined as the ‘Overall index excluding energy and unprocessed food’. Data for core inflation in Slovenia is not available for the full period and therefore this country is not included.

Several countries are already experiencing deflation. Cyprus, Greece, Portugal, Slovakia and Spain are in deflation, while the March 2014 inflation rates in the Netherlands (0.1 percent), Ireland (0.3 percent), Italy (0.3 percent) and Latvia (0.2 percent) are rather close to zero when measured by headline inflation. But even in Germany and France inflation has fallen below one percent.

Is there a risk that the euro area as a whole will fall into outright deflation?

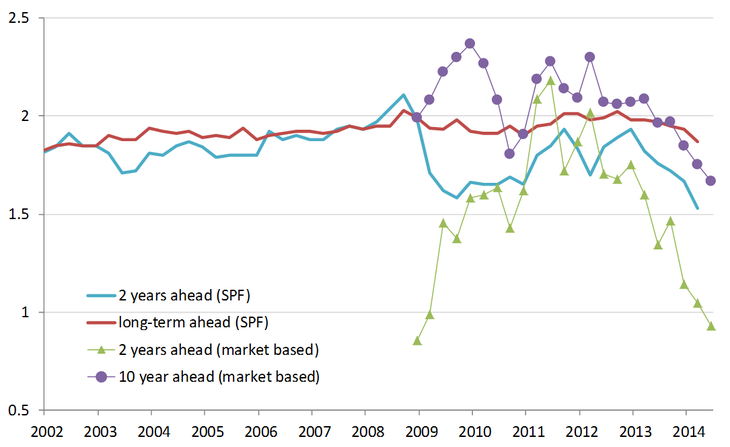

Inflation expectations have been falling since at least mid-2012. Figure 2 presents expectations from two sources (an ECB survey and a market-based indicator) and for two maturities. The two-year-ahead expectations are significantly below two percent and even below one percent according to the market-based indicator. In the period relevant for the ECB, inflation expectations have thus become de-anchored from 2 percent. Lack of ECB action when the ECB’s own medium-term inflation forecasts fell below the two percent threshold was a signal to markets that probably resulted in the downward revision of longer-term inflation expectations. The ECB is now less effective in anchoring longer-term expectations to, or close to, the 2 percent level.

Figure 2: Inflation expectations: ECB’s survey of professional forecasters (SPF) and market-based inflationary expectations in the euro area, 2002Q1-2014Q2

Source: ECB’s Survey of Professional Forecasters and Datastream. Note: In the ECB’s survey the horizon of “Long term” is not specified. Market-based expectations refer to zero-coupon inflation-indexed swaps, which can be used as a market based proxy for future inflation expectations. The 2014Q2 values of market-based expectations are the average during 1-23 April 2014, while the latest available values for the SPF are end of March 2014.

There are four further reasons suggesting that the ECB should already have adopted additional monetary stimulus:

- The cost of deviations from the current inflation baseline is asymmetric;

- The track record of inflationary forecasts and expectations suggests that significant changes in inflation are often unforeseen;

- The Japanese experience suggests that long-term market expectations can be persistently upward-biased;

- Earlier action can prevent being forced into much larger unconventional policy measures later, when inflation falls so much that no other option remains.

First, at a low level of inflation, the costs of deviation from the ECB’s forecast inflation are highly asymmetric. If inflation is higher than forecast, it would mean that inflation would be closer to the two percent threshold – a benign development. But if inflation is lower than forecast, then countries in the euro-area periphery would have to maintain even lower inflation or higher deflation, with risks for the sustainability of public and private debt.

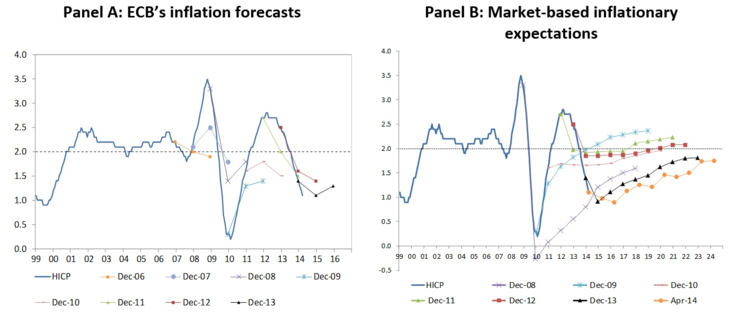

Second, the ECB’s inflation forecasts and market expectations have been unable to predict significant deviations from the two percent threshold (Figure 3). When there was a sizeable deviation, ECB forecasts and market expectations both predicted a gradual return to two percent, which happened in some cases (see, for example, the December 2011 forecast of the ECB), but most of the time did not.

Figure 3: Vintages of inflation forecasts/expectations and actual inflation in the euro area

Source: Datastream, ECB. Note: The HICP is defined as a 12-month average rate of change; in panel A, the ECB Staff projections indicate a range referred to as „the projected average annual percentage changes” (see here). For simplicity, we take the average of the given range. In panel B, Market-based expectations refer to overnight inflation swaps (OIS), which can be used as a proxy for future inflation expectations.

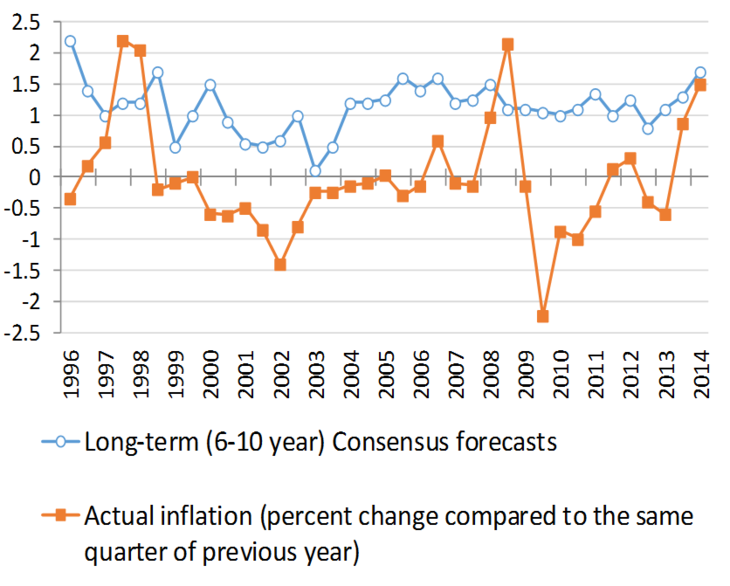

Third, the fact that long-term inflation expectations in the euro area have so far not deviated too much from two percent should not be taken as a guarantee that inflation will return to the two percent level without additional monetary policy measures. In Japan, long-term inflation expectations remained about one percent on average between 1996 and 2013, though actual inflation was slightly below zero (-0.1 percent, Figure 4). The average forecast error for the 6-10 year inflation forecasts made in Japan between 1996 and 2003 was 1.1 percentage points[5].

Figure 4: Long-term inflation expectations and actual outcomes in Japan

Source: Consensus Economics (2014) (expectations) and IMF (actual inflation). Note: this figure is reproduced using our data sources from Figure 7 in Antolin-Diaz (2014). There are two observations per year, in April and October. For actual inflation we plot the change in the all-items consumer price index compared to the same quarter of previous year in the quarter before the forecast was made.

At the same time, price developments in the euro area are still significantly different from Japan during the past two decades. In Japan, about half of the items in the consumption basket fell in price during the period when the average inflation rate was almost zero (Claeys, Hüttl and Merler, 2014). In the euro area there has been an increase in the share of items in the HICP basket that are already in deflation in recent months (to about 20 percent of the entire HICP basket), but this share is not very high (and similar to shares observed in 2005 when the inflation rate was close to two percent in the euro area) and is still significantly lower than in Japan.

Overall, inflation has been falling significantly and so have inflation expectations. Inflation forecasts have proved consistently too optimistic about the return of inflation to the two percent threshold in the euro area and the one percent target in Japan. The ECB’s own forecast suggests that euro-area inflation will not return to close to two percent in the medium term, and we see a substantial risk that it will not return to this level even in the longer term.

3. How to address low inflation in a heterogeneous monetary union?

3.1. Key constraints

The ECB's task is complicated by two very special circumstances. First, the euro area is a heterogeneous monetary union in which the process of relative price adjustment between its different parts is ongoing. This adjustment is a consequence of the very substantial past divergence in prices. To better understand the resulting problem for the ECB, it is useful to resort to a simple example of a two-country monetary union. In the monetary union, one region (say periphery) is depressed and runs a zero inflation rate, while the other region (say core) has an inflation rate of one percent, still below the two percent target, even though there is almost full employment. The monetary stimulus should result in aggregate inflation in the monetary union increasing to the two-percent target. However, since there has to be a relative price adjustment between the periphery and the core, the monetary stimulus should ensure that the inflation differential between the two regions remains in place.

The stimulus must therefore increase inflation and activity both in the core and the periphery. The necessary relative price adjustment implies that inflation in the core should increase to above the target, while inflation in the periphery has to stay below it. If the stimulus would not have an impact on the core, but only the periphery, then it would undermine the necessary price-adjustment process.

The second problem for the ECB is that the process of bank balance-sheet repair is ongoing. When several banks have vulnerable capital and liquidity positions, a monetary stimulus aimed at increasing bank lending to the private sector is less effective, similar to what happened after the three-year longer-term refinancing operations (LTRO) in late 2011 and early 2012, when banks increased lending to governments and accumulated reserves at the ECB. In addition, the ECB is dealing with the quality of banks’ balance sheets in the context of the asset quality review and stress test. Clearly, fixing the bank-lending channel cannot be done by monetary policy but requires action on the structural weaknesses of banks’ balance sheets. A key question is if possible monetary policy measures (like new long-term liquidity provision to banks, asset purchase programmes from banks and/or from other private sector asset holders, or negative ECB deposit rates for banks) would be conducive to increased inflation under current circumstances. An equally important question is whether such a monetary policy measure would remove the incentive to fix the structural problems in the banking system where necessary.

3.2. Policies to address low inflation in the special euro-area setting

Different policies could be deployed to increase inflation and inflationary expectations:

- Reduce the Main Refinancing Operation (MRO) rate to zero percent;

- Negative deposit rates for banks’ deposits at the ECB;

- Ending the sterilisation of bond holdings from the Securities Markets Programme (SMP);

- New long-term (eg three years or longer) refinancing operations, possibly made conditional on net lending to the private sector;

- Asset purchases:

- Purchase of euro-area or European debt (debts of various European rescue funds and the European Investment Bank);

- Purchase of sovereign debt of euro-area member states;

- Purchase of non-sovereign debt such as the debt of non-financial corporations, asset backed securities (ABS) or debt of financial institutions;

- Foreign exchange intervention: purchase of foreign assets, such as non-euro area sovereign debt or corporate debt. Given the G7 statement of February 2013 by central bank governors and finance ministers reaffirming the “longstanding commitment to market determined exchange rates and to consult closely in regard to actions in foreign exchange markets”, this policy measure is not discussed further[6].

Reducing ECB interest rates

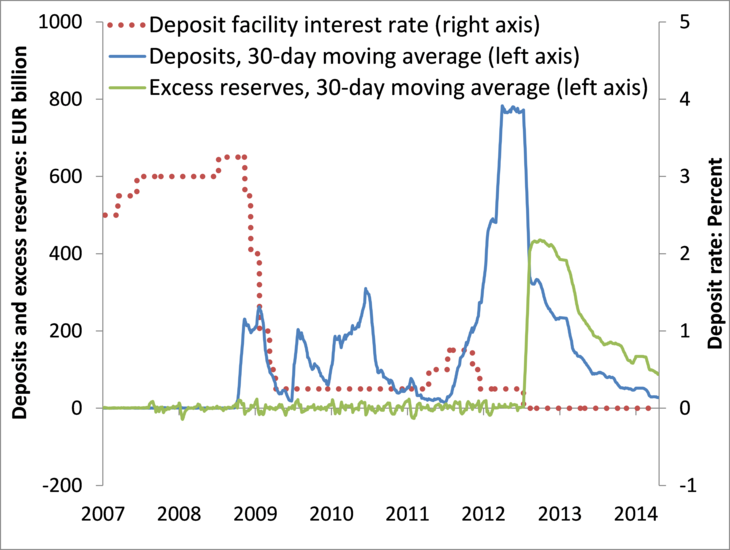

The current 0.25 percent ECB main refinancing rate could be marginally reduced, but the impact of such a small reduction is unlikely to significantly change inflation expectations. In addition, the ECB could reduce the deposit rate, which banks receive when depositing liquidity at the ECB, from zero currently to negative territory. Since currently banks can hold excess reserves on their current account at the ECB at zero interest, a negative deposit rate should be accompanied by the same negative interest rate on excess reserves, to avoid the shifting of all deposits to excess reserves (Figure 5 shows that banks shifted half of their deposits to excess reserves when the deposit rate was reduced to zero). A negative deposit rate would mean that banks pay interest for placing a deposit at the central bank. This would reduce the incentive for banks to hold deposits and excess reserves at the central bank and should therefore promote other uses by the banks of liquidity, such as greater lending to the rest of the economy. However, the sum of banks’ deposits and their excess reserves at the ECB is declining fast (Figure 5), and with the normalisation of money markets they may return to their pre-crisis close-to-zero values. This implies that the direct impact of a negative deposit rate, in terms of changing the incentives to hold deposits and excess reserves, would be minimal.

Figure 5: The ECB’s interest rate on the deposit facility, banks’ deposits at the ECB’s deposit facility and banks’ excess reserves at the ECB, January 2007 – April 2014

Source: Bruegel calculation based on ECB data. Note: banks’ excess reserve is the reserves banks hold at their current account with the ECB minus the minimum reserve requirement.

It is difficult to assess the quantitative impact of a negative deposit rate on credit and inflation, but the example of Denmark does not suggest strong effects. In July 2012, the Danish central bank reduced its deposit rate for banks to -0.2 percent and kept a negative rate until the 24 April 2014. The main motivation for the negative deposit rate was to discourage the inflow of capital into Denmark, because with the intensification of the euro crisis, investors searched for safe assets. The most direct effects were the reduction of Danish treasury-bill yields below zero and a depreciation of the Danish Krona against the euro by about half a percent from 7.43 to 7.46. This change was quite sizeable for Denmark, where the euro exchange rate is kept very stable. A negative ECB deposit rate may lower treasury-bill yields especially of core euro-area countries and weaken the exchange rate of the euro, which would increase inflation.

Some commentators (eg Papadia, 2013) have argued that banks would in fact increase loan interest rates in order to compensate for the loss from their deposits at the ECB. However, the Danish experience also showed that a negative deposit rate does not necessarily have any impact on banks’ loan rates to their clients. Another concern is the impact of negative deposit rates on money-market activity. The ECB’s decision to cut the deposit rate to zero has already led to the closure of various money-market funds and could drain liquidity in the money markets[7]. In Denmark, however, money-market volumes decreased only slightly after the introduction of the negative central bank deposit rate. Investors exiting money-market funds would need to find other investments, pushing liquidity to markets with characteristics similar to money markets.

Stopping the sterilisation of SMP holdings

Another possible measure would be stopping the sterilisation of the ECB’s Securities Market Programme (SMP) holdings. Under the SMP, the ECB bought about €220 billion of Greek, Irish, Portuguese, Italian and Spanish government bonds. At present, there are €175.5 billion of SMP bonds left, the maturities of which are not publicly disclosed by the ECB. The bonds are held to maturity and the purchases are entirely sterilised. Stopping their sterilisation would inject €175.5 billion into euro-area money markets.

However, the SMP was launched to address the malfunctioning of securities markets and restore an appropriate monetary policy transmission mechanism, while not affecting the stance of monetary policy[8]. A key feature of the programme was sterilisation. Falling short of that commitment and changing the objective at this point would be problematic, because it might undermine trust in the ECB’s other commitments. Importantly, the Outright Monetary Transaction (OMT) programme is also designed to be sterilised[9]. In the ongoing judicial discussions on the OMT[10], stopping the sterilisation of SMP holdings would give a powerful argument to the plaintiffs, who could say that the ECB’s OMT commitments are unreliable.

New long-term (eg three years or longer) refinancing operations

In normal times, central banks do not engage in long-term liquidity operations. One reason for this is moral hazard: long-term central bank financing at rates below what banks could get from the market might encourage excessive risk taking and keep insolvent banks alive. However, when the interbank market became dysfunctional during the crisis, several countries in the euro-area periphery underwent a sudden stop in external financing. To address the problem, the ECB provided ample liquidity. The maturity of the ECB’s liquidity operations were then extended from three months to six and twelve months. In December 2011 and in February 2012 the ECB also conducted two extraordinary Longer Term Refinancing Operations (LTROs) with maturities of three years, from which banks in the euro area borrowed almost €1 trillion.

The ECB also introduced a policy of ‘full allotment’ for all ECB liquidity operations. Under this procedure, the control of central bank liquidity is effectively moved from the central bank to the banking system, because banks can access all the central bank liquidity they need at a variable rate (if they provide sufficient eligible collateral).

These operations, along with the revised collateral policy (expanding and changing assets’ eligibility requirements in order to mitigate possible constraints arising from collateral shortage) allowed liquidity-strained banks to refinance a large portion of their balance sheets through central bank lending, available at a low interest rate and long-term maturity. In a heavily bank-based system, such as the euro area, these measures were essential to avoid a financial and economic meltdown[11].

However, these operations did little to trigger additional lending to the private sector (even though they may have helped to prevent a collapse of existing lending). To a great extent, banks either deposited the cheap central bank funding at the ECB for rainy days, or purchased higher yielding government bonds. Thereby, the LTROs in effect supported liquidity, ensured stable long-term (three-year) financing of banks, subsidised the banking system and helped to restore its profitability, and temporarily supported distressed government bond markets. Considering the alternative of a potentially escalating financial crisis, these developments were beneficial. However, the LTROs might have delayed bank restructuring and prolonged the existence of non-viable banks.

For two main reasons, the current situation is very different from the situation when the two three-year LTROs were adopted.

First, one reason for the failure of the 2011-12 LTROs to foster lending was the weak balance sheet of the banks and uncertainty about the integrity of the euro area. With the ECB’s Comprehensive Assessment, the structural weaknesses of the banking sector are gradually being mended. In addition, speculation about the break-up of the euro area has become less relevant. Therefore, a new LTRO might be more effective, in particular if ECB financing is made conditional on banks increasing their net lending to the non-financial private sector economy (similar to the Bank of England’s Funding for Lending Scheme; see Darvas, 2013; Wolff 2013). Such conditions, by definition, would exclude the use by banks of ECB liquidity to purchase government bonds. With collateralised lending to banks, the ECB exposure to credit risk is minimal. In addition, the central bank would not replace the banking system in supplying and allocating credit to the non-financial private sector. A new LTRO could therefore be a good option to foster credit growth.

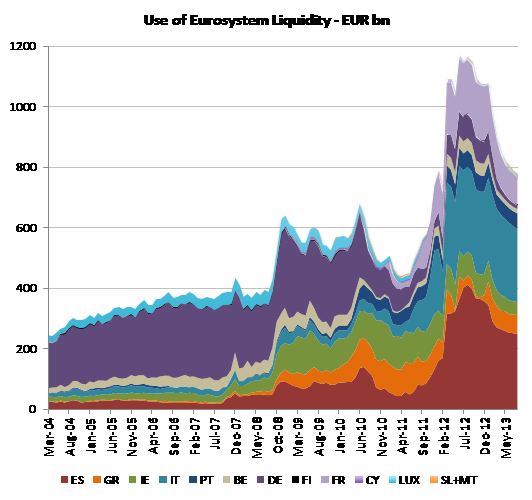

Second, the current situation is different because there is no longer a liquidity crisis. In fact, some banks are repaying their loans from the ECB early (Figure 6), even though they have to replace that funding at a higher cost from other sources. The take-up of LTRO liquidity might therefore be limited and the programme could be ineffective in triggering lending and inflation.

Figure 6: Use of Eurosystem liquidity (€ billions), January 2003-February 2014

Source/note: the ECB does not provide a country breakdown of the use of its facilities. Data come from National Central Banks but the reporting standards differ. Therefore the length of the time series is not the same for all countries and for some countries data does not seem to be publicly available.

4. Asset purchases

For any central bank, asset purchases always involve difficult choices about what and how much to buy. The central bank becomes an important buyer in financial markets and therefore can be subject to pressure from politicians and companies. This is a powerful argument for central banks to act early in order to avoid a low-inflation trap, in which standard monetary policy measures become less effective. The longer an asset-purchase programme is delayed in a situation in which inflation is already very low, the greater the risk that an even larger purchase programme will ultimately be needed.

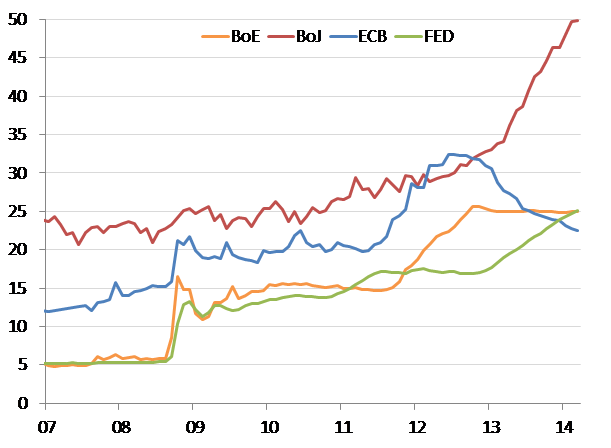

In response to the global financial and economic crisis and its, the Federal Reserve, Bank of England and Bank of Japan engaged in large-scale asset purchase programmes, or quantitative easing (QE)[12]. From the beginning of 2009 to March 2014, the Federal Reserve purchased $1.9 trillion (11.9 percent of US GDP) of US long-term Treasury bonds and $1.6 trillion (9.6 percent of US GDP) of mortgage-backed securities. Between January 2009 and November 2012, the Bank of England purchased £375 billion (24 percent of GDP) of mostly medium- and long-term government bonds. The Bank of Japan started a new round of asset purchases in March 2013 and plans to buy per year 50 trillion yen of government bonds (10.4 percent of 2013 GDP), 1 trillion yen of exchange-traded funds (0.2 percent of GDP) and 50 billion yen of Japanese real estate investment trusts (0.01 percent of GDP), in order to double the country’s monetary base in two years. In addition to such asset purchases, these central banks also implemented programmes to support liquidity in various markets. The ECB has made few asset purchases so far but reacted to the crisis by providing liquidity to the banking system. The size of the balance sheets of the central banks therefore increased for different reasons (Figure 7).

Figure 7: Size of balance sheets of various central banks (in % of GDP)

Source: FRED, IMF.

Asset purchases can be used if interest rates reach the zero lower bound and refinancing operations are ineffective, as discussed above. There are a number of channels through which asset purchases can influence monetary conditions and thereby economic activity and prices:

- Money multiplier: if the money multiplier (the ratio of broad monetary aggregates to the monetary base) is stable, then the asset-purchase-induced increase in the monetary base will increase monetary aggregates, through more credit to non-financial corporations and households, which can boost demand.

- Altering yields: purchase by the central bank of a particular asset will reduce the net supply of that asset to the private sector and increase its price and thereby reduce the return that it yields.

- Portfolio rebalancing: Unless the purchased asset is a very close substitute for cash (such as short-term treasury bills), investors who sold the asset will search for other investment opportunities, pushing up prices and reducing yields in other markets too.

- Exchange rate: via portfolio rebalancing, previous asset holders could invest in assets denominated in other currencies and thereby depreciate the home currency. This in turn might increase import prices and thereby inflation, but could also boost export production and thereby economic activity.

- Wealth effect: the increase in asset prices can lead to a wealth effect for the asset holders, which can also increase consumption or investment[13].

- Signalling: asset purchases by the central bank when the zero lower bound on interest rates is reached could signal to market participants that the central bank is serious about further easing monetary conditions. This can have an impact on inflation expectations and the expected future path of policy rates, which would lead to a reduction in real interest rates today.

4.1. How would these channels work in the euro area, and in particular, in core and periphery countries?

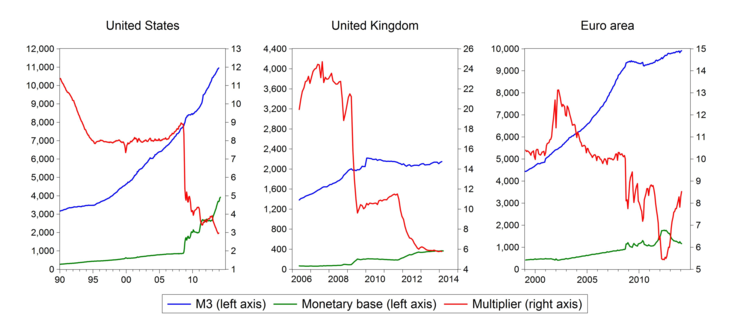

The experience of the past few years in countries that have implemented asset purchases is that the money multiplier is unstable and fell significantly in parallel to the expansion of the monetary base. Figure 8 shows that the in the US and the UK, M3 kept growing at about the same rate even when the monetary base doubled, thus halving the money multiplier. Most likely the money multiplier would be similarly unstable in the euro area after asset purchases, so the money multiplier channel would not be effective.

Figure 8: Monetary aggregates and money multipliers

Source: FRED, ECB, BOE.

The ECB’s balance sheet increased by 112 percent between September 2008 and June 2012, and has decreased by 30 percent since then primarily because of the repayment by banks of the LTROs. The decline in the balance sheet as such is not an indication of tighter monetary conditions, but rather reflects the fact that liquidity conditions in the inter-bank market have normalised.

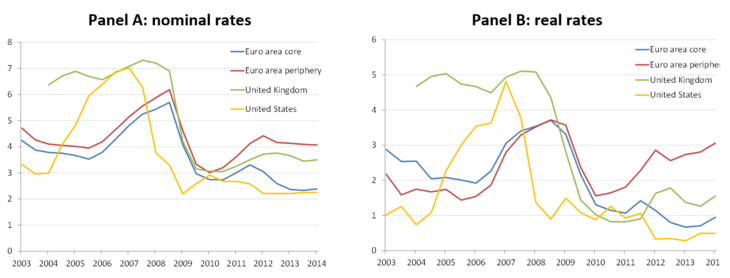

The lowering of nominal yields is unlikely to be a powerful channel in the core, while it might have a somewhat greater impact in the periphery. In core euro-area countries, both government bond yields and private-sector borrowing costs are currently very low. The yield on the 10-year German bund is about 1.5 percent per year, but even in Italy and Spain 10-year yields are about 3.1 percent, close to yields of the US government. In terms of corporate lending rates, nominal private sector borrowing rates are lower in the euro-area core than in the UK and just slightly higher than in the US – these two countries that have already implemented large-scale asset purchases (Panel A of Figure 9). Since inflation is also expected to be lower in the euro-area core than in the US, real lending rates are slightly higher in the euro area than in the US, but still well below their pre-crisis values. Therefore, lowering real yields by shifting inflation expectations could be somewhat more effective in the core, but the decline in real rates is likely to be limited.

For the periphery, nominal lending rates to non-financial corporations are higher than in the core, and because of even lower inflation expectations than in the core, real interest rates are significantly higher. To what extent the yield differential between the lending rates in core and periphery countries reflects financial fragmentation and greater credit risk in the periphery remains an open question. At the height of the euro crisis in the summer of 2012, both factors likely played major roles. Since then, fragmentation within the euro area has eased. To the extent that financial fragmentation continues to play a significant role, ECB measures to limit fragmentation, such as asset purchases impacting either directly or indirectly the borrowing costs of non-financial corporations, are justified. At the same time, asset purchases can have an indirect impact on credit risk via improved economic conditions.

A major question is the importance of changes to real interest rates for the ongoing relative price adjustment between the euro-area core and periphery. Taylor (1999) estimated the semi-elasticity of consumption and investment with respect to the real interest rate in G7 countries. He found that interest sensitivity was significantly higher in France and Germany than in Italy. Therefore, the same decline in real interest rates (either because of an increase in inflationary expectations or a lower nominal yield) would be more expansionary in core countries than in Italy (and probably in other periphery countries too). As we have argued, the scope for a decline in real rates is less in the core than in the periphery. Therefore, cutting real rates to the private sector could be broadly neutral for the ongoing relative price adjustment within the euro area, because in the core, limited scope for reduction is accompanied by large interest rate sensitivity, while in the periphery, greater scope for reduction is accompanied by small interest rate sensitivity.

Figure 9: Lending rates to non-financial corporations in the euro area, UK and US

Source: Bruegel calculations based on ECB (lending rates in EU countries), IMF (inflation forecasts) and St. Louis FRED (US nominal interest rates). Note: Two data points per year are shown, one corresponding to the spring publication of the IMF’s World Economic Outlook (WEO, published typically in April) and the other corresponds to the autumn WEO (published typically in October). The nominal interest rate is the average over six months before the publication of the WEO. The real lending rates were calculated using a 2-year ahead inflation forecast from the WEO databases up until October 2007 (due to lack of forecasts for longer horizons), while a 5-year ahead forecast average was used starting from April 2008. Inflation forecasts were relatively stable in pre-2008 WEOs but showed larger variations after 2008 and therefore our choice for considering different time horizons for inflation forecast before 2008 and from 2008 may not distort much the comparability of the two periods. The latest data for the US is Q1 2014, and Feb 2014 for the Euro area and the UK. The Euro area core and periphery is calculated as a GDP weighted average with fixed weights.

Portfolio rebalancing would probably work both in the core and the periphery. For example, investors holding long-term German government bonds probably have a preference for safe long-term assets. If the net supply of such assets to the private sector declines, previous asset owners would most likely search for other fixed-income instruments with similar characteristics, such as bonds of major banks or non-financial corporations headquartered in Germany or other core countries. Such a rebalancing would favour the financing of these corporations, which might have an impact on their investment decisions, in particular for companies that finance investment through credit.

A weaker euro exchange rate could directly help to lift inflation because of its impact on import prices. The exchange-rate effect through exports would likely favour both the core and periphery, but would have different impacts. Since core countries with large trade surpluses have bigger tradable sectors, their export performances would likely be boosted more than the exports of periphery countries. Since labour markets are tighter in core countries, an export expansion would more likely translate into wage increases, while this is less likely to happen in the periphery because of high unemployment rates. A weaker euro exchange rate could thus help maintain the inflation differential between the core and periphery. However, we also acknowledge that a weaker exchange rate would mean that the euro area’s current account surplus would increase further. It would mean a sort of beggar-thy-neighbour policy, yet the mandate of the ECB is to maintain price stability in the euro area and not to safeguard global imbalances, which have many other causes.

Finally, asset purchases could also have a ‘signalling’ impact on financing conditions in the euro area. Buying assets would show the determination to act, which would affect inflation expectations and the anticipated path of policy rates. How this would work in different countries is uncertain.

4.2. Size of the asset purchase programme

Working out the appropriate size of asset purchases is far from easy. Some analysis considered the total amount of asset purchases by the Bank of England and the Fed and suggested similar magnitudes for the euro area (20 to 25 percent of GDP, ie €1.9 trillion to €2.4 trillion). In our view, that is an inadequate benchmark, because a large share of asset purchases by the Fed and Bank of England were crisis-response measures, and the assets were accumulated over five years. The ECB dealt with the crisis in a different way (using liquidity operations) and the situation in the euro area is very different now.

A more relevant benchmark could be the amount purchased by the Federal Reserve in its third round of quantitative easing (QE3). This round of QE was announced in light of the weak economic situation of the US economy at a time when the acute phase of the financial crisis was over – a situation that is similar to the current euro-area situation. In September 2012, the Fed announced it would purchase $40 billion (€29 billion) of agency mortgage-backed securities per month, increased to $85 billion (€61 billion) in December 2012 (by adding $45 billion per month of Treasuries). Given that the euro area’s economy is about 30 percent smaller than the US economy, the same size, as a share of GDP, would be between €20 and €40bn per month in the euro area.

The ideal way to select the size of asset purchases in the euro area would be through assessing its expected impact on inflation. However, it is rather difficult to measure this impact even in the US and the UK, where large-scale asset purchases have been conducted, and it even more difficult to assess in the euro area.

Joyce et al (2012), Gagnon et al (2011) and Meier (2009) argued that asset purchase programmes have had a strong direct effect by reducing long-term government bond yields by about 50-100 basis points in the UK and US. Hancock and Passmore (2011) and Krishnamurthy and Vissing-Jorgensen (2013) reported similar findings for the Fed's mortgage-backed security (MBS) purchase programme in the US.

Conclusions on the impact on GDP and inflation differ in magnitude, though all research papers report positive impacts. For the US for instance, Chung et al (2012) estimated that the combination of QE1 and QE2 raised the level of real GDP by three percent and inflation by one percent (an impact equivalent to a cut in the federal funds rate of around 300 basis points). Chen et al (2012) found that QE2 increased GDP growth by 0.4 percent, but had a minimal impact on inflation (equivalent to an effect of a 50-basis point cut in the federal funds rate). In a recent paper Weale and Wieladek (2014) estimated that asset purchases equivalent to one percent of GDP led, respectively in the US and the UK, to a 0.36 and 0.18 percentage-point increase in real GDP and to a 0.38 and 0.3 percentage-point increase in CPI after five to eight quarters.

The share of capital markets is smaller in the euro area than in the US and the UK, the health of euro-area banks has not been restored and nominal interest rates are rather low in core euro-area countries. It is therefore difficult to estimate the impact of asset purchases on inflation in the euro area, but most likely the effects are different from those in the US and UK. Assuming a 0.20 percentage point inflation effect of a one percent of GDP asset purchase in the euro area, a yearly asset purchase of about four percent of euro area GDP (~€400 billion) would lead to an inflation increase of approximately 0.8 percentage points after 18 months. Since core inflation in the euro area is about 1.0 percent now, such an increase would move it close to two percent. Since we do not know the exact size of the impact, we propose to commence with €35 billion of asset purchases per month, which would be close (as a share of GDP) to the $85 billion per month purchase of the Fed under QE3. Starting with a much lower volume could be seen as too timid to have a substantial effect. Due to the uncertainty in the transmission, we propose that the size of the purchases should be reviewed after three months. The relevant criteria for the review should be the impact on actual (headline and core) inflation as well as on inflation expectations. Tapering should start only once inflation and inflation expectations have increased substantially.

4.3. Design principles for an asset-purchase programme

How could an ECB asset-purchase programme be designed and what would the purchase of different assets mean for monetary conditions in the periphery and the core, given the potentially different quality of bank balance sheets? What are the limits of the different instruments? In our view, the ECB will have to choose which assets to buy using five main criteria.

- First, the ECB should buy assets that will be most effective in terms of influencing inflation, through the channels we have described.

- Second, there should be sufficient volumes of assets available, to ensure that the ECB can purchase enough while not buying up whole markets.

- Third, the ECB should try to minimise the impact on the private-sector financing process. While QE by definition changes relative prices, the ECB should avoid buying in small markets in which its purchases would distort market pricing too much. The more the ECB becomes a player in a market, the more it can be subject to political and private sector pressures when it wants to reverse the purchases.

- Fourth, the ECB should buy only on the secondary markets in order to allow the portfolio-rebalancing channel to work effectively. Purchasing on the primary market would imply the direct financing of entities, which should be avoided.

- Fifth, the assets should only originate from the euro area and be denominated in euros, because of the 2013 G7 agreement noted in section 3.2.

In principle, the ECB could decide to buy any asset, except government securities on the primary market, which is clearly ruled out by the Treaty. In practice, the ECB’s task will be more complex than it has been for the Fed, the Bank of England and the Bank of Japan given the peculiarities of the euro area:

- Bank lending is much more important than in the UK and the US;

- There is no euro-area wide sovereign asset (beyond the limited amounts of securities issued by the European Financial Stability Facility (EFSF) and European Stability Mechanism (ESM) and the EU-wide bonds of the European Investment Bank and European Commission); instead, each member state issues sovereign debt and there are major differences in public debt levels (and thereby in their perceived sustainability) in different member states;

- The outstanding stock of privately-issued debt securities is smaller (relative to GDP) than in the US and the UK, and the roles of privately-issued debt securities vary widely in different euro-area member states.

4.4. Should there be a credit rating requirement for the assets to be purchased?

An important question is to what degree the ECB should care about risk. A number of points need to be considered:

- The risks in purchasing asset are fundamentally different from the risks inherent in collateralised central-bank lending. In the latter case, the risk to the ECB is well contained by the high haircuts applied and the fact that the bank is the counterparty, which remains liable for repayment even if there is a default on the collateral. In the case of a purchase, the haircut to the face value is determined by the markets and the risk is taken directly onto the ECB’s balance sheet.

- The ECB would take on board significant risk via asset purchases under three circumstances: (a) systemic risk, ie risk when all asset classes are highly correlated, (b) when the purchased portfolio is not diversified enough and concentrated on a few assets in large volumes, and (c) when market prices are distorted and therefore do not reflect well the riskiness of assets.

- Systemic risk: it is the role of a central bank to address systemic risk and the ECB would in any case be heavily exposed to it also via normal central bank operations.

- Diversification: given the quantities that would be bought under an asset purchase programme and assuming a proper diversification of risk, the ECB could make a profit on its portfolio if it buys assets at non-distorted prices. Buying many high-risk assets is therefore not problematic as such, because high returns would on average compensate for defaulting assets.

- Distorted market pricing: market prices can be distorted because of market failures (eg the pricing of US subprime securities before the crisis) or because of central bank intervention in markets. To reduce the magnitude of the latter, it is imperative that the ECB does not buy up whole markets, but limits its purchase in each market to a small share. The less the ECB buys in any given market, the less risk it will take on board because the market distortion would be kept to a minimum. If market-pricing mechanisms are fundamentally wrong or if the ECB’s purchases (including the anticipation of such purchases) materially changes the market pricing of the asset, only then would the ECB risk significant losses.

- The Treaty gives a mandate to the ECB to maintain price stability, not to protect its balance sheet.

Given these considerations, we recommend a reasonably low threshold for credit risk, but suggest that some criteria on riskiness should be adopted, because the ECB should not turn itself into a high-risk investment fund. Restricting asset purchases only to the eligible collateral (without any additional eligibility criterion) is an appropriate threshold and therefore this is our recommendation[14]. The pool of eligible collateral has also the great advantage that the ECB already has a well-defined list of eligible assets and therefore the use of this list would limit lobbying activities for what the ECB should buy. It is important to highlight that our suggestion differs from the ECB’s revealed preference, because during the 2009-12 Covered Bond Purchase Programmes (CBPPs), the only previous examples of ECB unsterilised asset purchases, the criteria for purchases was the eligibility of the assets as collateral for refinancing operations with the ECB and a minimum rating of AA or equivalent, awarded by at least one of the major rating agencies[15].

4.5. The pool of eligible assets

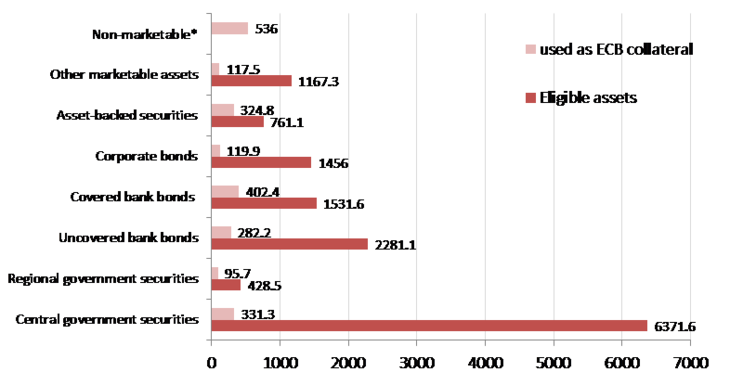

According to the ECB, total marketable assets eligible as collateral represented almost €14 trillion at the end of 2013, equivalent to 146 percent of euro-area GDP[16]. Figure 10 shows that about half of the Eurosystem’s eligible collateral pool at the end of 2013 comprised government bonds, with €6.37 trillion of central government securities and €0.42 trillion of regional government securities. The other half was split between uncovered bank bonds (€2.28 trillion), covered bank bonds (€1.53 trillion), corporate bonds (€1.46 trillion), asset-backed securities (€0.76 trillion) and other marketable assets (€1.17 trillion). Other marketable assets include European debt (the debts of EU rescue funds and the European Investment Bank). On top of those marketable assets, the ECB also accepts as collateral non-marketable assets, mostly credit claims[17]. Being non-marketable, such assets cannot be within the scope of an asset-purchase programme, unless they are securitised.

Part of the eligible collateral has already been pledged in the context of the ECB’s refinancing operations and is therefore not available for purchase for the moment (Figure 10). With the repayment of the three-year LTRO, at the latest on its terminal date of February 2015, a considerable part of the currently-used collateral pool will be freed. It is difficult to compare the size of the total eligible assets to the pool of assets already used as collateral, because the former is available in nominal terms whereas the latter is only available in net terms, ie taking into account the haircut applied by the ECB.

Figure 10: Eligible assets and assets used as ECB collateral (EUR bns)

Source: ECB; Note: Eligible assets are in nominal values; assets used as ECB collateral are after haircuts and valuation issues. Latest data available: 2013 Q4

4.6. What to buy? A shopping list for the ECB

European debt

A natural starting point for an ECB asset-purchase programme would be euro-area wide government bonds, which do not exist. The closest existing asset, which could be bought without creating too many distortions, would be bonds issued by the EFSF and the ESM. The bonds of the European Union (issued by the European Commission) and the European Investment Bank (EIB) represent EU-wide supranational assets, but since the ECB is an EU institution, it could also consider EU assets. The total available euro-denominated pool of these bonds is around €490 billion (€230 billion for EFSF/ESM, €60 billion for EU, €200 billion for EIB).

Buying such pan-European assets would not affect the relative yields of euro-area sovereign debts and would not distort the market-allocation process within the private sector, which would be advantages. While the transmission channel through lower yields may be weak, other channels (portfolio rebalancing, exchange rate, wealth and signalling) would probably work well. We therefore recommend that the ECB buys from this pool of assets.

Government bonds

National sovereign debt offers the largest pool for ECB purchases. The portfolio rebalancing effect would work well, as would the exchange rate, wealth and signalling channels. The purchases would not distort the market allocation process within the private sector. In principle, the case for a government bond purchase programme is therefore strong. However, the purchase of national government debt would be more complicated for the ECB as a supranational institution without a supranational euro-area treasury as counterparty, than it was for the Fed or the Bank of England. Several relevant issues should therefore be discussed carefully to decide if government debt should be purchased by the ECB.

The first issue is practical. Since there are 18 different sovereign debt markets, the ECB would have to decide which sovereign debt to buy. A proposal often made is to purchase government debt based on the share of each national central bank in ECB capital (which reflects the size of the countries in terms of GDP and population). However, to the extent that debt-to-GDP ratios are different and the demand for sovereign debt is different in different countries, the ECB purchase would alter the spreads between countries and change the relative price of sovereign debt. Even though probably all ECB measures have different implications for different euro-area members (eg the SMP directly benefitted only five governments, the three-year LTROs were primary used by euro-area periphery banks), influencing relative yields may expose the ECB to political pressure by individual countries to increase or decrease the speed of purchases or change its portfolio. It could also lead to moral hazard as market pressure for reforms would be altered.

Second, the Treaty on the Functioning of the European Union prohibits extension of any kind of ECB credit facility to public bodies, or the purchase of government securities on the primary markets by the ECB (the same applies to national central banks). This treaty provision was agreed in order to avoid the monetary financing of government debt that could result in cross-border transfers between taxpayers. Therefore, a purchase of government debt is allowed in the secondary bond markets only if it is done for monetary policy purposes and without the risk that it would lead to the financing of government debt. Since the goal of asset purchase will be to meet the ECB’s primary objective of price stability, purchase of government bonds would be allowed if the risk of monetary financing could be excluded.

Third, the ECB has a well-defined sovereign bond purchase programme, the OMT programme, which we support (Darvas, 2012; Wolff, 2013). The basic idea of the OMT programme is to give the ECB a tool to buy government bonds in order to improve monetary policy transmission in countries under financial assistance. It is debatable whether a QE programme based on ECB capital keys would undermine the logic of the OMT programme. However, we note that a purchase based on capital keys would lead to small purchases relative to what an OMT programme would require. For example, buying €17.5 billion of EU sovereign debt (one-half of our proposed €35 billion purchases) based on capital keys, would imply that the ECB buys €3.1 billion Italian debt per month. Conditionality as required by the OMT programme may therefore be less relevant in a QE programme. If a country was under an OMT programme, its bonds could be excluded from the broader QE programme. On the other hand, buying government debt of countries with uncertain debt dynamics without the political OMT agreement could expose the ECB to greater political pressures when it wants to exit.

Fourth, experience shows that an ECB government-bond purchase programme would be politically controversial. So far, the ECB has had two government-bond purchasing programmes (SMP and OMT). Both were introduced under severe stress and both were motivated by the goal of restoring the monetary transmission mechanism. Both programmes were and are highly controversial, not least because of different assessments of to what extent they constitute monetary financing of government debt.

Overall, government-bond purchases would be a natural step because the bond market is very large and the positive effects of such a QE would be significant. However, in a monetary union with 18 different treasuries, such purchases are difficult for the economic, political and legal reasons we have outlined. Purchases of private sector assets – if well designed – would achieve similarly beneficial effects on euro-area inflation and would protect the ECB better from political pressure. We therefore do not recommend the purchase of government bonds at this stage.

Bank bonds

The second largest asset class is bank bonds, with €3.8 trillion available in eligible covered and uncovered bonds. Purchasing bank bonds could have an effect through all the major channels we discussed: portfolio-rebalancing, lowering yields, exchange rate, wealth and signalling. In particular, the previous holders of those bonds would have to find other assets to buy, while the reduction in market yields would also reduce the yields on newly issued bank bonds, thereby allowing banks to obtain non-ECB financing at a lower cost. This would improve bank profitability and may improve the willingness of banks to lend. However, bank bonds should be excluded from the ECB asset-purchase programme until the ECB’s Comprehensive Assessment is concluded. Until then, any ECB purchases would lead to serious conflicts of interest at the ECB and would make a proper assessment by the ECB more difficult. Moreover, those banks for which the outcome of the Assessment will be unsatisfactory should continue to be excluded from the ECB’s asset purchases until they have implemented all the required changes in their balance sheets. This might take several months after the completion of the Comprehensive Assessment.

Corporate bonds

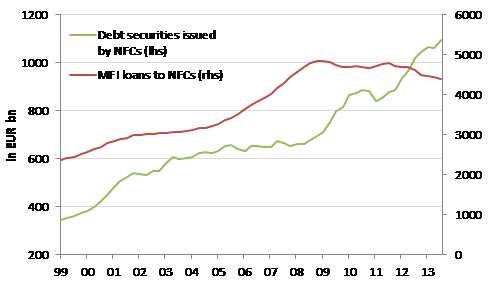

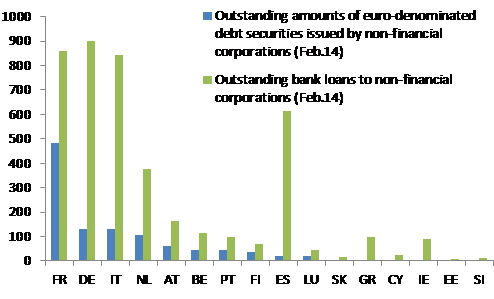

Figure 11, Outstanding stock of debt securities and loans of non-financial corporations (EUR billions)

Source: ECB.

Eligible corporate bonds comprise the third largest asset class with almost €1.5 trillion outstanding. However, this amount also includes non-euro area corporate bonds and euro-area bonds issued in other currencies. European corporate bonds are behaving well in terms of default: Moody’s default report for February 2014 – which included a prediction of the forward trend for defaulters – shows that the baseline expectation is on a downward path towards levels rarely seen since 2008, for Europe and globally, and that the pessimistic forecast is also less severe than it was in 2013.

While there is no precise data on their magnitude, we estimate that the lower bound of eligible euro-area corporate bonds would be €900 billion. In addition, the supply of corporate bonds in the euro area has grown considerably since 2009 (Figure 11).

Figure 12 shows the heterogeneity of corporate bond markets in the euro area. The euro-area corporate bond market is highly concentrated. The main issuers of corporate bonds are French companies, whose bonds make up 44 percent of the total outstanding (ie €466 billion). German and Italian corporate bonds follow at significant distance with each about 12 percent (or around €126 billion) of the outstanding corporate bonds. The Netherlands comes fourth with 9.6 percent of the outstanding (€107 billion). But thanks to the portfolio rebalancing effect, the origin of the corporate bonds is of less importance. The beneficial effect would come from the fact that the current owners of the corporate bonds would sell their bonds and use the cash for different purposes throughout the euro area. The origin of the bond says little about the owners of bonds, which are in some cases US funds. In any case, the ECB should not choose its purchases according to geographic origin, similar to the way it implemented the LTRO/MRO, which led to large amounts of liquidity going to some countries only. In addition, the purchases would encourage new issuance of corporate bonds everywhere and lead to a diversification of the sources of funding (Sapir and Wolff 2013). Lower funding costs for corporations should induce more corporate investment.

Figure 12: Bonds vs. loans – financing of EU non-financial corporations (EUR bns)

Source: ECB. Note: The difference between the amount reported in this figure and the total eligible corporate bonds shown on Figure 10 comes from the fact that here we only consider corporate bonds issued by euro zone corporations, whereas eligible collateral include corporate bonds issued in the whole European Economic Area (EU countries and Iceland, Liechtenstein and Norway); see https://www.ecb.europa.eu/paym/coll/standards/marketable/html/index.en.html

Asset-backed securities

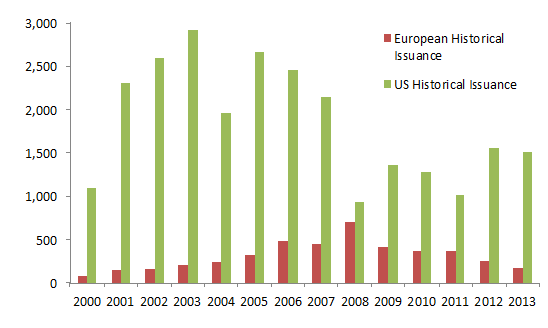

Another class of assets that could be bought by the ECB is asset-backed securities (ABS). Yearly EU securitisation issuance – which peaked in 2008 – is much lower than in the US and has been decreasing since 2008 (Figure 13).

Figure 13: European and US historical issuance of securitised products (€ billions)

Source: AFME – SIFMA.

The total outstanding stock of securitised products has been stagnating at around €1.06 trillion for the euro area compared to €2.5 trillion in the US (AFME, 2014). Products eligible as collateral for the ECB amount to about €761 billion, but some of them originate from outside the euro area. We estimate that the lower bound of eligible euro area ABS would be €330 billion.

It is worth highlighting that defaults on ABS in Europe have ranged between 0.6-1.5 percent on average, against 9.3-18.4 percent for US securitisations since the start of the 2007-08 financial crisis[1]. The regulatory landscape for securitised products has also changed considerably since the crisis and made the products safer and more transparent[2].

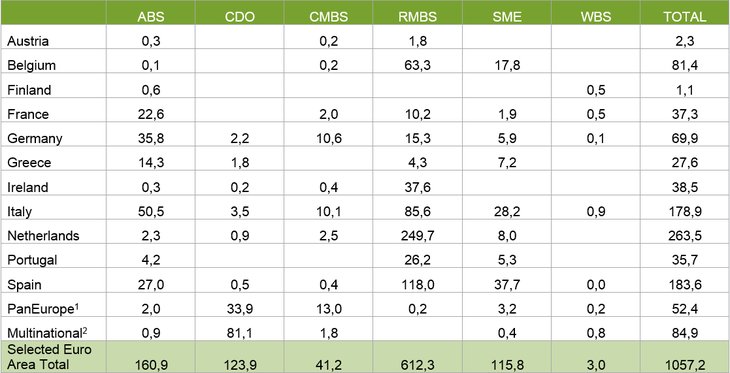

Considering the total amount of European ABS, more than half (€612 billion) is based on residential mortgages (see Table 1 below), which were among the best performing category of securitised products (S&P, 2013) and would therefore be a natural target for ECB asset purchases. SME ABS constitute a smaller part (€116 billion). The ABS stock outstanding is unequally distributed across countries, with the main issuers being different from the main issuers of corporate bonds. ABS purchases would be concentrated on the Netherlands, Spain and Italy, and could therefore be a good geographical complement to corporate-bond purchases, which would be concentrated in France, Germany and Italy.

Table 1: Securitisation in Europe, outstanding stock in 2013Q4 (€ billions)

Source: AMFE (2014). Note: All volumes in Euro. ABS: asset-backed securities for which collateral types include auto loans, credit cards, loans (consumer and student loans) and other. CDO: Collateralised Debt Obligations denominated in a European currency, regardless of country of collateral. CMBS: Commercial Mortgage Backed Securities. RMBS: Residential Mortgage Backed Securities. SME: Securities backed by Small- and Medium- sized Enterprises. WBS: Whole Business Securitisation: a securitisation in which the cash flows derive from the whole operating revenues generated by an entire business or segmented part of a larger business. 1. Collateral from multiple European countries is categorised under 'PanEurope' unless collateral is predominantly (over 90 percent) from one country. 2. Multinational includes all deals in which assets originate from a variety of jurisdictions. This includes the majority of euro-denominated CDOs.

An ECB purchase could promote the development of securitisation in the euro area. The potential for securitisation is relevant, because many loans would qualify for securitisation. In March 2014, the outstanding amount of loans in the EU to non-financial corporations stood at €4.2 trillion, and to households at €5.2 trillion[1]. From a monetary policy perspective, it would be very beneficial to create ABS that are based on a portfolio of European assets. Ideally, the credit risk should be pooled at the level of the private sector, thereby deepening cross-border financial integration. However, the ECB should not wait for developments in the ABS market before it starts buying securitised products.

5. Conclusions

Low inflation in the euro area is particularly dangerous, given high private and public debt levels in several euro-area countries and the need for relative price adjustment between the euro-area core and periphery. According to recent ECB forecasts, average euro-area inflation is not expected to return to close to two percent in the medium term. The ECB’s commitment to its communicated objective of keeping inflation "below but close to two percent inflation in the medium term" has therefore been undermined. In our view, it was a major mistake not to ease monetary conditions at the time that the ECB’s own forecast signalled that inflation will not return to two percent in the medium turn. Also, government policies, including on bank restructuring and public investment, should have been implemented some time ago as a safeguard against the disinflationary process.

We also demonstrated that inflation forecasts and expectations about the return to normal inflation rates have proved to be too optimistic, both in the euro area recent years and in Japan for almost two decades. To effectively address the risk of persistently low inflation, the ECB should act. Cutting ECB interest rates further and reducing the ECB’s deposit rate for banks below zero would help but is unlikely to have a sizeable impact. Designing a new very long-term (eg three years or longer) refinancing operation would not be very effective either, because liquidity conditions have normalised and banks now have a preference for paying back three-year LTROs earlier. Stopping the sterilisation of the government bond holdings from the Securities Markets Programme (SMP) would be unwise, because that programme had a specific purpose with the stated feature of sterilisation.

The best option for the ECB, with the greatest potential to sizeably influence inflation and inflationary expectations, is an asset-purchase programme. We recommend that the ECB starts an open-ended programme of €35 billion per month of asset purchases and reviews this amount after three months to see if its size needs to be changed. Using empirical estimates from the literature and our assessment, €35 billion per month of purchases over the course of a year could lift inflation by 0.8-1.0 percentage points. The asset-purchase programme should only start to be cut back when inflation has increased and medium-term inflation expectations are anchored at two percent. When inflation has stabilised close to but below two percent, the purchased assets should be sold gradually at a pace that does not undermine inflationary expectations. However, if inflation expectations rise significantly above two percent, the sale of assets should be accelerated and standard monetary policy tools should also be deployed to fight inflation.

In terms of available assets, we recommend that the ECB purchases privately-issued debt securities and EFSF, ESM, EU and EIB bonds, but not government bonds. The purchase of government bonds can be problematic if there is a government solvency risk, and would be politically controversial. The combined stock of EFSF/ESM/EU/EIB bonds suitable for purchases is €490 billion. In terms of private debt instruments, we advise that the whole range of assets that are eligible as collateral at the ECB without further credit rating requirements should be considered. The total pool of such assets is €7 trillion. Of these, corporate bonds (for which we estimate that at least €900 billion are suitable for purchases) and asset backed securities (ABS, at least €330 billion suitable for purchases) are preferable, while the bonds of sound banks could be considered only after the ECB’s comprehensive assessment of the banking system has been completed. We therefore recommend that before the completion of the comprehensive assessment, the ECB starts monthly purchases of €15 billon of corporate bonds, €8 billon of ABS and €12 billion of EFSF/ESM/EU/EIB bonds.

Given the relative size of the purchases compared to the total size of the respective markets, the mispricing of risk would be limited and the ECB would not take on board much risk if a sufficiently diversified portfolio of assets is purchased. We also highlight that the ECB’s Treaty-based primary mandate is maintaining price stability and there is no prohibition of monetary operations that exposes the ECB to potential losses and profits. However, it is also clear that the ECB should avoid exposure to unchecked political and private sector pressures that could result in delays to the reversal of asset purchases, which would undermine the bank’s price stability mandate.

References

- Antolin-Diaz, Juan (2014) ’ Deflation risk and the ECB’s communication strategy’, Fulcrum Research Papers, available at: http://www.fulcrumasset.com/files/frp201402.pdf

- Bank of England (2012) ‘The Distributional Effects of Asset Purchases’, 12 July 2012 http://www.bankofengland.co.uk/publications/Documents/news/2012/nr073.pdf

- Chen, Han; Cúrdia, Vasco and Ferrero, Andrea (2012) ‘The macroeconomic effects of large-scale asset purchase programs’, The Economic Journal, vol. 122(564), pp. F289–315, November

- Chung, Hess; Laforte, Jean-Philippe; Reifschneider, David and Williams, John C. (2012), ‘Estimating the macroeconomic effect of the FED’s asset purchases’, FRBSF Economic Letter 2001/03, January

- Consensus Economics (2014)

- Claeys, Hüttl and Merler (2014), ‘Is there a risk of deflation in the euro area’, Bruegel Blog, April 3

- Darvas, Zsolt (2012) ‘The ECB’s magic wand’, Intereconomics: Review of European Economic Policy, Springer, vol. 47(5), pages 266-267, September

- Darvas, Zsolt (2013), ‘Banking system soundness is key to more SME’s financing’, Bruegel Policy contribution 2013/10, July

- ECB (2009), ‘Decision of the European Central Bank of 2 July 2009 on the implementation of the covered bond purchase programme’, Official Journal of the European Union, ECB/2009/16, July

- ECB (2013), ‘Collateral eligibility requirements – A comparative study across specific frameworks’, July

- Gagnon, Joseph; Raskin, Matthew; Remache Julie and Brian Sack (2011), ‘The Financial Market Effects of the Federal Reserve’s Large- Scale Asset Purchases’. International Journal of Central Banking 7, no. 1: 3–44.

- Hancock, Diana and Wayne Passmore (2011), ‘Did the Federal Reserve’s MBS purchase program lower mortgage rates?’, Journal of Monetary Economics, vol.58 no.5, pp.498-514

- Krishnamurthy, Arvind and Annette Vissing-Jorgensen (2013) ‘The Ins and Outs of LSAPs’

- Joyce, Michael; Miles, David; Scott, Andrew and Vajanos, Dimitri (2012), ‘Quantitative easing and unconventional monetary policy – an introduction’ The Economic Journal, 122, pp. F271-288, November

- Meier (2009) ‘Panacea, Curse, or Nonevent? Unconventional Monetary Policy in the United Kingdom.’ IMF Working Paper 09/163, August

- Moody’s (2014), ‘EMEA Non-Financial Corporates: Positive Credit Trends Likely to Continue Through 2014’, February

- Papadia, Francesco (2013) ‘Should the European Central Bank do more and go negative?’, Blog post: Money matters? Perspectives on Monetary Policy http://moneymatters-monetarypolicy.blogspot.be/2013/11/should-ecb-go-negative.html

- Sapir, André and Wolff, Guntram B. (2013), ‘The neglected side of banking union: reshaping Europe’s financial system’, Note presented at the informal ECOFIN, September

- S&P (2014) - Transition Study: Six Years On, Only 1.5% of European Structured Finance Has Defaulted

- S&P (2014) - 2013 Annual European Corporate Default Study And Rating Transitions

- Tabakis, Evangelos and Kantaro Tamura (2013) ‘The use of credit claims as collateral for Eurosystem credit operations’, ECB occasional paper, no. 148, June

- Weale, Martin and Tomasz Wieladek (2014), ‘What are the macroeconomic effects of asset purchases?’, Bank of England, External MPC Unit, Discussion Paper no. 42, April

- Wolff, Guntram (2013), “The ECB’s OMT programme and German constitutional concerns”, in Brookings, The G20 and Central Banks in the new world of unconventional monetary policy

[1] According to the calculation in Darvas (2013), out of these €4.2 trillion, the stock of SME loans in the EU in 2010 represents approximately €1.7 trillion and the largest stocks of SME loans were in Spain (€356bn), followed by Germany (€270bn), Italy (€206bn) and France (€201bn).