Is there a risk of deflation in the euro area?

Even though the euro area as a whole has not yet entered into deflation, this picture is worrying. Low inflation rates will make the relative price ad

This is a policy question of high relevance as low inflation rates can undermine the sustainability of public and private debt, make relative price adjustment in the euro area more difficult, and eventually risk creating negative economic dynamics. We review some of the recent evidence and focus in particular on the heterogeneity of inflation developments in the euro area, the expectations of inflation measures and a measure recently used by Mario Draghi, namely the number of items in the HICP basket that are in deflation. We draw a parallel to Japan, where this measure was a useful indicator of deflation.

Inflation developments in the euro area

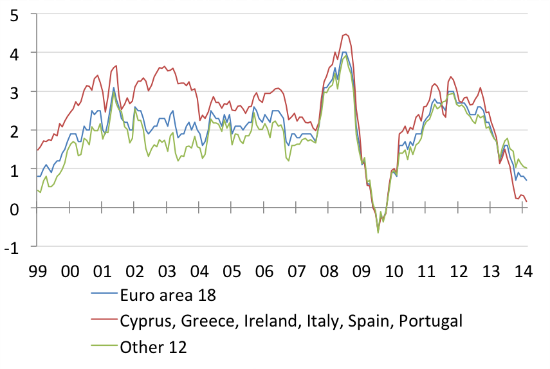

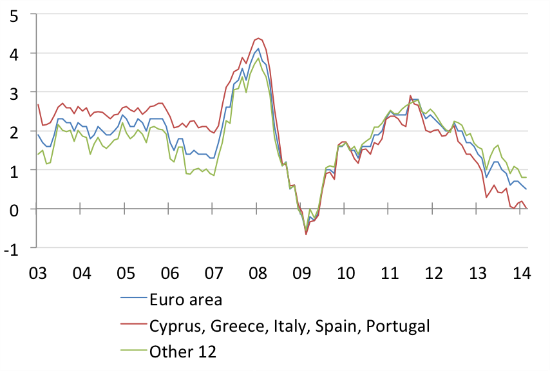

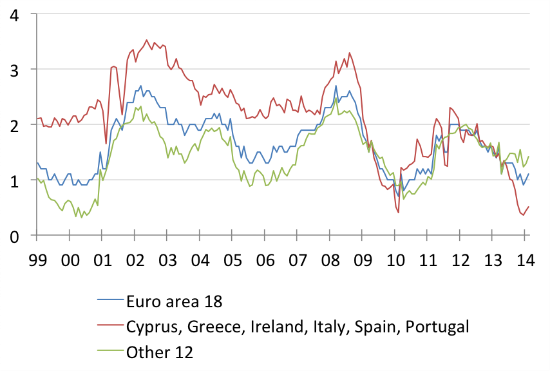

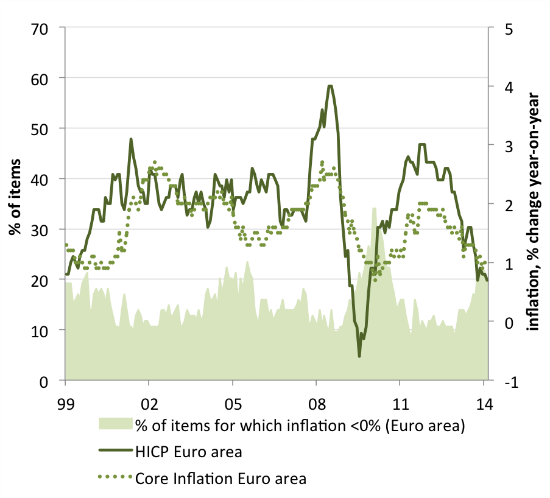

Panel A of Figure 1 shows that headline inflation has been on a downward trend in the euro area since late 2011. Core inflation – which excludes more volatile components of HICP, namely unprocessed food and energy – shows the same tendency (Panel C).

Figure 1: Inflationary developments in the euro area, January 1999 – February 2014 (percent change from the same month of previous year)

| Panel A: Headline inflation | Panel B: Constant tax inflation | Panel C: Core inflation |

|---|---|---|

|

|

|

Source: Eurostat. Note: core inflation is defined as the ‘Overall index excluding energy and unprocessed food’. Data for core inflation in Slovakia is not available for the full period and therefore this country is not included in the second group. The constant-tax inflation rate is not available for Ireland and Finish data starts only in 2006.

Figure 1 also indicates the existence of major differences across euro-area countries. Countries in the so-called euro area periphery (defined here as Cyprus, Greece, Ireland, Italy, Spain and Portugal) recorded higher inflation rates than the other euro-counties before the crisis and most of them have been experiencing lower inflation rates since 2012. Panel B of Figure 1 shows inflation at constant tax rates, i.e. excluding the potential impact of the increase in consumption taxes (value added taxes and other duties). Correcting for tax-hikes points to more marked deflationary tendencies in the most vulnerable countries since 2012.

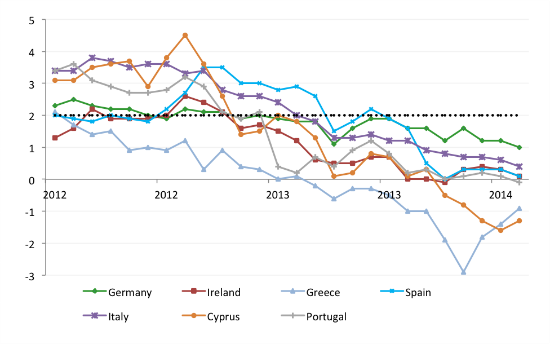

Country-level inflation data (figure 2) indicates that some countries are already experiencing outright deflation. Greece and Cyprus entered deflation in March 2013 and October 2013 respectively, and stayed in negative territory thereafter. In February 2014, the Spanish and Irish HICP rates dropped to 0.1%, while Portugal and Slovakia (not shown in the graph) entered negative territory (-0.1% respectively). And the first estimate for the Spanish inflation in March indicates that the country may have also entered deflation, with the HICP rate estimated to fall to -0.3% (INE, March 2014) . Overall, a downward trend in inflation rates is clearly visible, even in the core countries.

Figure 2 – Inflation developments in selected countries, Jan 2012 – Feb 2014 (percent change from the same month of previous year)

Source: Eurostat

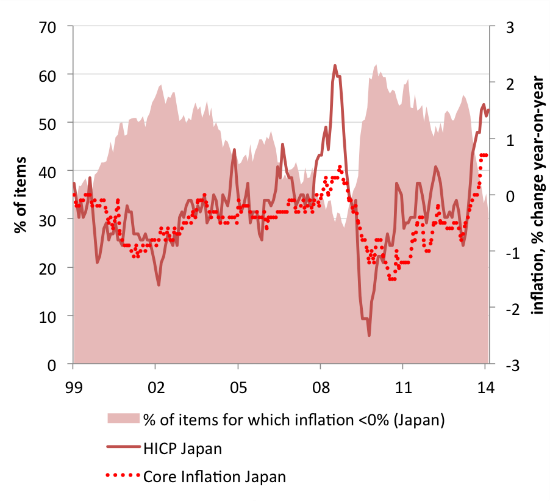

During the February 2014 monthly press conference, ECB’s President Draghi pointed out that the ECB does not see “much of a similarity with the situation in Japan in the 1990s and early 2000s” as “during the period of deflation in Japan, over 60% of all commodities experienced a decline in prices” while “the percentage for the euro are much lower”. The data show that the number of items considered for the calculation of the harmonised index of consumer price index (HICP) that are in deflation has increased significantly in recent months to about 20%. This share is much lower than the Japanese share of about 50-60% between 2000 and 2004 and between 2009 and 2012. Interestingly, in 2004-2005 also approximately 20% of the items were in deflation in the euro area, at a time when the headline inflation was about 2%. From this perspective, the euro area seems to be still far away from a Japanese scenario, where deflation was broad-based, as Mario Draghi pointed out.

Figure 3, HICP basket, items count

|

|

|---|

Source: Bruegel calculations based on Statistics Bureau of Japan, Eurostat, OECD

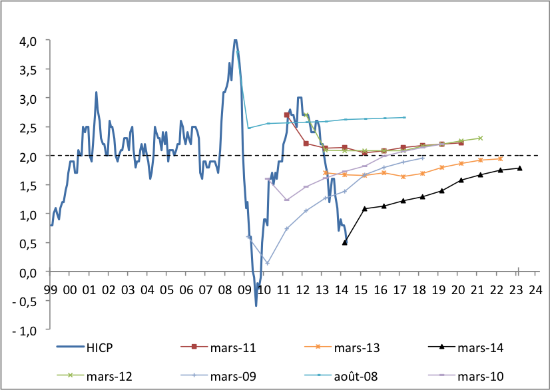

Inflation expectations

Over the recent months, the ECB has continually stressed that inflation expectations remain well anchored at 2%, and that more forceful action is therefore not needed. Indeed, Figure 4 shows that inflation expectations for the long-term fell only slightly, but this is less true for the shorter term. Professional forecasters have been revising their forecasts downward, reflecting negative surprises in the behaviour of inflation.

Figure 4, Survey of Professional forecasters, 2 year and long-term inflation expectations

Source: ECB

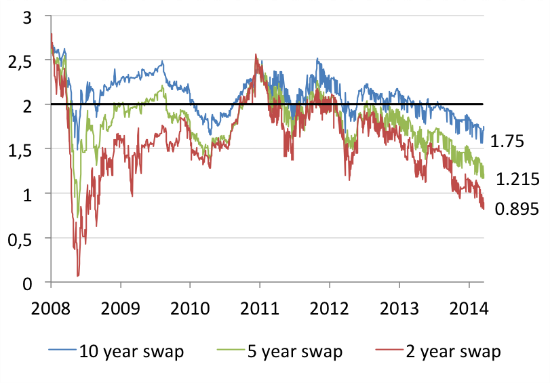

Market-based measures of inflation expectations built from inflation swaps (Panel A of Figure 5) confirm that inflation expectations are well below 2% in the short- and medium term and do not point to a revival in inflation for the near and medium term. More importantly, the fact that long-term inflation expectations have remained anchored around 2%, until now, should not be taken as a fully reassuring. In Japan, long-term inflation expectations(see figure 7 in Antolin-Diaz, 2014) remained around 1% on average between 1999 and 2013, despite actual inflation being negative (-0.2%).

Moreover, Panel B of figure 5 suggests that inflation expectations could have a backward-looking component (i.e. economic agents could use past data to form their expectations on future inflation, especially for the long term). The recent drop in headline inflation could therefore explain why inflation expectations at a ten-year horizon have been falling from 2.5% in 2012 to 1.75% in April 2014. This could be dangerous as a prolonged period of low inflation could dis-anchor inflation expectations, which might become a problem for the ECB in the long run.

Figure 5

| Panel A: Market expectations on inflation | Panel B: OIS Inflation linked swaps |

|---|---|

|

|

Source: Datastream

Today, Eurozone inflation is at 0.5%, i.e. its lowest level since November 2009. Inflation expectations and inflation forecasts, including the ECB staff projections, do not suggest a quick return to an overall euro-area inflation rate that can be regarded to being close to two percent in the next few years. Despite this, the ECB has not announced any new measure since last November’s monthly press conference. Even though the euro area as a whole has not yet entered into deflation, this picture is worrying. Low inflation rates will make the relative price adjustment in the euro area more difficult, complicate debt deleveraging and put the sustainability of debt at risk.

A more difficult question is which monetary and/or structural measures would be best suited to increase inflation rates. We address this question in a forthcoming paper that we write together with Zsolt Darvas and Guntram Wolff.