Every saint has a past, every sinner has a future

The European Commission published yesterday the results of its in-depth reviews (IDRs) to assess the existence of macroeconomic imbalan

The European Commission published yesterday the results of its in-depth reviews (IDRs) to assess the existence of macroeconomic imbalances in EU Member States. The IDRs are based on a scoreboard of indicators, which includes macroeconomic variables such as the external accounts, savings and investment balances, effective exchange rates, export market shares, cost- and non-cost competitiveness, productivity, private and public debt, housing prices, credit flows, financial systems, unemployment and so on. The exercise is part of the recently introduced Macroeconomic Imbalance Procedure (MIP) which, together with the strengthened Stability and Growth Pact (SGP), forms the basis of the reinforced European framework for economic governance.

In particular, the MIP was born to remedy the absence of a mechanism to monitor and tackle the development of macroeconomic imbalances of non-fiscal nature, after the recognition that the latter played a major role in the build up and amplification of the euro crisis. This year’s in-depth reviews identified the existence of imbalances in 14 out of the 17 EU countries reviewed, i.e. Belgium, Bulgaria, Germany, Ireland, Spain, France, Croatia, Italy, Hungary, Netherlands, Slovenia, Finland, Sweden, and the United Kingdom. In particular, Croatia, Italy and Slovenia are found to be experiencing excessive imbalances. In Spain, were imbalances had been classified as “excessive” in 2013, the Commission finds that “significant adjustment has taken place over the last year and […] on current trends, imbalances will continue to abate over time”. As a consequence, Spanish imbalances are no longer considered to be excessive in the sense of the MIP, although “substantial risks are still present” (for a more accurate description of the red flags that were raised in the past years, see table in the appendix).

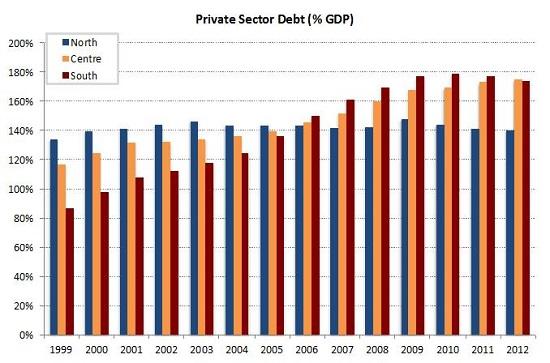

Figure 1 – Private and public debts

Bruegel based on Eurostat and AMECO. Note: Centre = Belgium, France; North = Austria, Finland, Germany, the Netherlands; South = Greece, Italy, Portugal, Spain. The aggregates are weighted.

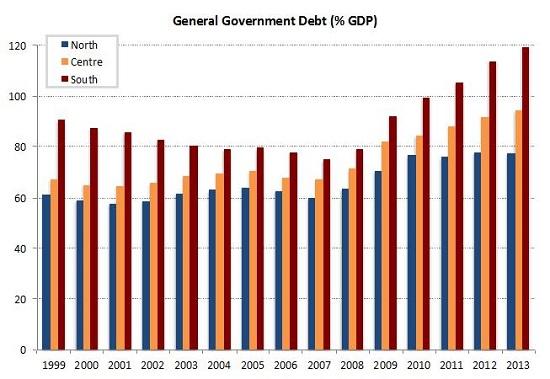

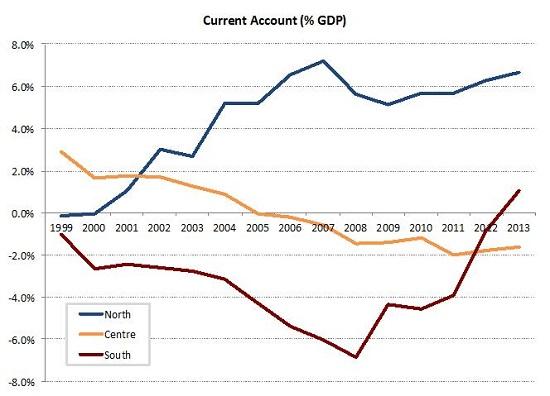

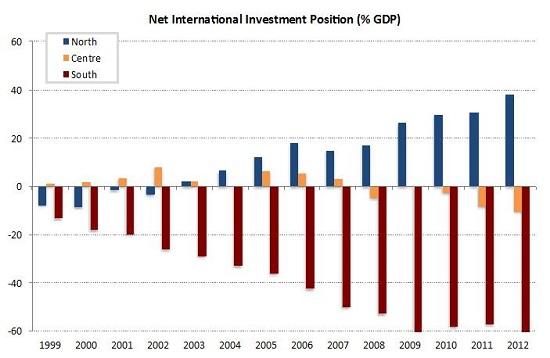

Overall, the Commission seems of the opinion that the size of imbalances is gradually receding. What is more interesting is the recognition that the nature of the imbalances that have to be dealt with is changing deeply. During the ten years preceding the crisis, the economic positions of euro area countries’ diverged steadily and markedly. De facto, the reassuring aggregate euro area numbers were hiding the coexistence of two economic models, opposite and extreme. In the “South”, the unprecedentedly low interest rates coupled with losses in competitiveness resulted generally into large current account deficits and the build-up of sizable private indebtedness, most times linked to real estate bubbles. In the “North”, the situation was almost specular, with domestic demand and investment stagnating and competitiveness boosting buoyant exports. The imbalances that countries are confronted with at present are the product of this past decade. The Commission stresses in fact that while 'flow' imbalances – like the current account deficits – have been overcome, the point is now about dealing with the 'stock' imbalances, which accumulated over an entire decade. Figure 2 shows for example that while the current account deficits of the “South” have been reverted, the large and negative net international position has barely moved. The main challenges identified in a cross-country dimension are now about managing deleveraging pressures and ensure private and external debt sustainability in a very low-inflation and low-growth environment. Figures 1 and 2, showing public, private and external indebtedness across the euro area, makes clear why this is a titanic challenge. On top of that the Commission acknowledges the need to deal with “the implications of the euro area shifting to a relatively large current account surplus” and “to provide credit to viable investments in the vulnerable economies, under a fragmented financial system”.

Figure 2 – external stocks and flows

Bruegel based on Eurostat and AMECO. Note: Centre = Belgium, France; North = Austria, Finland, Germany, the Netherlands; South = Greece, Italy, Portugal, Spain. The aggregates are weighted.

What I find more interesting about this year’s exercise is a certain shift in the language of the European Commission. Until 2013, imbalances were presented as a sort of “private sins” of each individual country. This year, the Commission’s assessment focuses explicitly on the collective dimension of imbalances. This is also evident in the publication (for the first time) of a summary documents that brings together the main findings of the individual exercises. In this document, the accent is set over the fact that policy responses should not forget the euro area dimension of imbalances. “Macroeconomic imbalances are, first and foremost, harmful for the economies of the Member States concerned”, says the Commission. “However, the interdependence among the economies implies that imbalances spill over across countries, and the losses in efficiency in one Member State also lead to foregone welfare in its partners”. Four dimensions where challenges needs to be seen in a euro-area-wide context are explicitly singled out, i.e. (i) Policies for growth; (ii) Financial fragmentation; (iii) Indebtedness and very low inflation; (iv) Rebalancing in a difficult economic context.

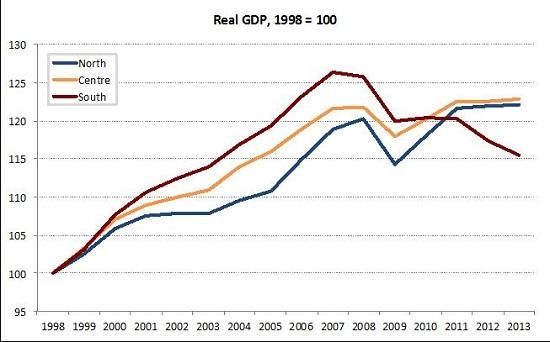

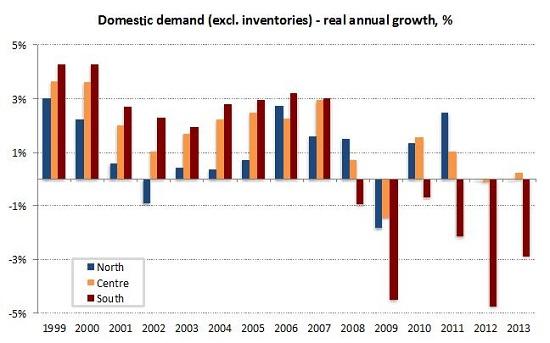

Figure 3 – Real GDP and Domestic demand

Bruegel based on Eurostat and AMECO. Note: Centre = Belgium, France; North = Austria, Finland, Germany, the Netherlands; South = Greece, Italy, Portugal, Spain. The aggregates are weighted.

Those Member States that are “largest” among their euro area peers are explicitly reminded the responsibilities that their size implies. In particular, it is stressed that “the policy priorities should be on strengthening domestic demand and medium-term growth in Germany, addressing bottlenecks to medium-term growth while working on structural reforms and fiscal consolidation in France and Italy, and continuing the orderly deleveraging and structural transformation of the economy that will contribute to sustainable growth, and addressing social issues in Spain.” In this respect, this year’s IDRs seem to mark a shift towards the idea that imbalances - especially in a monetary union – are a collective phenomenon and they have to be treated as a collective phenomenon in the policy responses as well. This ultimately implies that the process of adjustment should be more symmetric. Some of the messages should perhaps have been stronger – such as for example on the issue of inflation differentials, which is key (see Merler and Pisani-Ferry 2012) and where no explicitly forceful position is taken. But the change in the language is nevertheless positive. It seems at least to mark a (long overdue) shift in the conception of imbalances, towards a more realistic representation of the situation in the euro area. Figures 1, 2 and 3 show synthetically and quite strikingly that in the euro area, a sinner’s imbalance is the reflection of a saint’s imbalance of opposite sign. It follows logically that the adjustment of such imbalances would need to be more symmetric as well. It is good to see a more explicit call towards collective responsibility. The big question for the future is whether the acknowledging collective responsibility will lead to collective action or rather to collective inaction. So, stay tuned.

|

|

2012 |

2013 |

2014 |

|

Belgium |

External competitiveness; public debt, |

External competitiveness; public debt, |

External competitiveness |

|

Bulgaria |

External debt; corporate deleveraging; labour markets |

Adjustment of external positions; corporate deleveraging; labour markets; competitiveness |

Labour market |

|

Germany |

X |

X |

Size and persistence of the current account surplus |

|

Denmark |

External competitiveness; household debt |

External competitiveness; adjustment in housing market; household/private sector debt |

X |

|

Ireland |

PROGRAMME |

PROGRAMME |

Financial sector; private and public debt; high gross and net external liabilities; labour market |

|

Spain |

Private sector debt, external position and the financial sector, influenced by housing market |

Very high domestic and external debt levels |

High domestic and external debt levels |

|

France |

Export performance and competitiveness |

Deterioration in trade balance & competitiveness, driven both by cost and non-cost factors, against a background of deteriorating external position and high public debt |

Deterioration in trade balance & competitiveness; implications of high level of public sector indebtedness |

|

Cyprus |

Current account, public finances and financial sector |

PROGRAMME |

PROGRAMME |

|

Italy |

Export performance; external competitiveness; growth potential (given high level of public debt) |

Export performance; loss of competitiveness; high public debt in environment of subdued growth |

Very high level of public debt and weak external competitiveness; sluggish productivity growth |

|

Hungary |

Highly negative size of the net international investment position and public debt |

On-going adjustment of the highly negative net international investment position; private sector deleveraging; high public debt; weak business environment |

On-going adjustment of the highly negative net international position; high public and private debt; fragile financial sector; deteriorating export performance |

|

Luxembourg |

X |

X |

|

|

Malta |

|

X |

X |

|

Netherlands |

X |

Private sector debt and deleveraging, also coupled with remaining inefficiencies in the housing market |

Private sector debt and ongoing deleveraging; remaining inefficiencies in the housing market |

|

Slovenia |

Corporate deleveraging; banking stability; unfavourable but less pressing development in external competitiveness |

Risk to financial sector stability from corporate debt and deleveraging including through interlinkages with the level of sovereign debt; limited adjustment capacity in labour/capital markets; economic structure dominated by state-ownership |

Weak corporate governance; high level of state involvement in the economy; losses in cost competitiveness; corporate debt overhang; increase in government debt |

|

Finland |

Competitiveness |

Current account position and the weak export performance; cost and non-cost competitiveness |

Weak export performance during the last years; cost and non-cost competitiveness |

|

Sweden |

Private sector debt and housing market |

Private sector debt and deleveraging; inefficiencies in housing market |

Household indebtedness; inefficiencies in housing market |

|

UK |

Household debt and housing market; unfavourable but less pressing developments in external competitiveness |

Household debt, high levels of mortgage debt and characteristics of housing market; unfavourable developments in external competitiveness, especially goods exports and weak productivity growth |

Household debt, high levels of mortgage debt and structural characteristics of housing market; unfavourable developments in export market shares |