Are capital markets the only friend of innovation?

Intangible assets are the key to growth in the knowledge economy, but innovative entrepreneurs can find it hard to secure the financing to kick-start

Intangible assets are the key to growth in the knowledge economy, but innovative entrepreneurs can find it hard to secure the financing to kick-start their projects. The role of capital and credit markets in procuring funds for innovation is therefore crucial. Twitter is a case in point: financial support offered by early seed investors and venture capitalists in its first years permitted young entrepreneurs to grow a company around the simple idea of a microblogging platform. Started in 2006, after only seven years the microblogging platform went public last November. This is all the more impressive given that Twitter’s most valuable assets are not buildings or equipment, but patents and software or even more ethereal resources such as the interface design, customers data and its 2,000 employees’ human capital. Twitter’s stock market performance since it floated is an indication that these assets are crucial in the knowledge economy [1]. It is probably no coincidence that Twitter was born in the US: the US capital markets, arguably the most developed in the world, make it a favourable location to start up innovative companies.

Twitter’s story is telling on the merits of the capital markets for innovation, but could credit markets also play a role? In principle, innovative entrepreneurs benefit from the progress made by banks in monitoring borrowers: risky projects become easier to track while less-tangible forms of capital are increasingly used as collateral. Thus, a developed credit market should also be a friend of innovation. It is then interesting to see how capital and credit markets compare in supporting innovation in different countries.

Intangible assets and the capital market

The economic literature suggests that innovative firms might find it hard to raise external financing for intangible assets [2]. Adverse selection and moral hazard become more acute when firms are younger, projects are inherently riskier, and investment returns cannot be easily appropriated. A general case in favour of development of financial systems is made the literature: improvements in the monitoring of borrowers and the diversification and management of risk can mitigate these potential market imperfections. These factors then play out differently in the capital and credit markets. We start out with the capital market, because its relationship with innovation is the most commonly made in the literature.

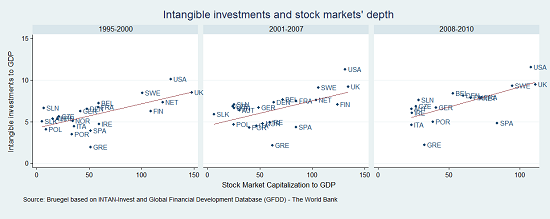

Quantitatively speaking, the depth of the capital market is a proxy for its stage of financial development. Thus, in order to assess the extent to which the relationship between long-term depth in capital markets and investment in intangible assets holds, we matched stock market capitalisation to GDP from the World Bank Global Financial Development Database, with investment in intangible investments estimated by the INTAN-Invest project [3]. The data covers the US and selected EU countries plus Norway, and spans 1995 to 2010. Figure 1 shows investment in intangible assets as a share of GDP relative to stock market capitalisation to GDP, in each case as country averages during three periods (1995-2000; 2001-07; 2008-10). These mid-term snapshots help with the potential countercyclical behaviour of productivity-enhancing investments (see Aghion et al, 2010).

Figure 1

Although we observe a positive correlation between the two variables, this could be driven by external factors, such as GDP per capita. There are also other reasons why the apparent relationship might be strong: for example that early-seed investment and venture capital help young innovative firms, for which intangible assets are most important, to raise capital and eventually enter the stock markets, thus increasing the size of the market overall relative to countries in which these segments are not well developed. The observed relationship thus would not be driven by the pure effect of financial development on investment in intangible assets in all incumbent firms, but rather by a compositional effect by which, in financially developed markets, young innovative companies, which rely more heavily on intangible assets, are relatively more numerous. Europe’s lack of young leading innovators is now well documented and can explain the gap relative to the US. However, venture capital would not be sufficient to explain the observed relationship, because it is highly developed in the US but quite homogenously limited throughout Europe.

A further explanation could be that listed companies face fewer constraints than companies that rely on credit. Because creditors prefer tangible assets, which are easier to seize, access to equity financing might help listed companies to acquire intangible assets. Empirical research has shown that innovative firms tend to have lower levels of the debt/capital ratio. This is confirmed by Bruegel’s Triggers of Competitiveness, which demonstrates that firms with rapidly increasing productivity are those with low debt/capital ratios.

Capital v. credit markets: how do they compare in supporting innovation?

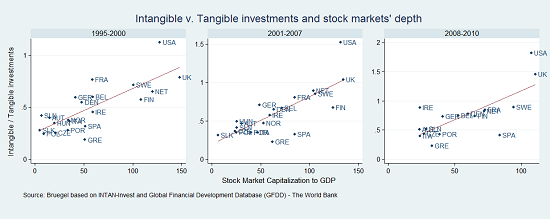

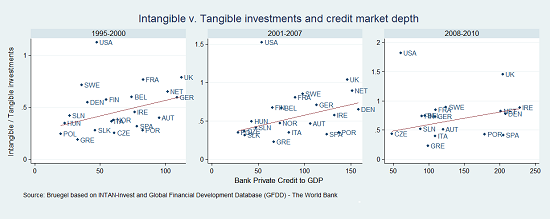

The different appetite for intangibles in capital and credit markets suggests that the tangible versus intangible assets aspect is the key to identifying possible dissimilarities, especially for European countries. Thus, in Figure 2 we report the same plots as Figure 1, with the intangibles over tangibles investment ratio on the vertical axis. The observed relationship is positive, suggesting that a developed capital market might underpin more investment in intangible assets relative to tangible assets. This would not be an obvious conclusion for credit markets, because creditors prefer tangible assets. To further investigate this, in Figure 3 we draw the same plots of Figure 2 using bank private credit to GDP from the same World Bank database on the horizontal axis.

Figure 2

Quite surprisingly, the figures seem to support the view that higher provision of credit to the economy is linked to investment in intangible assets [4]. The reasons for such a relationship can be found in the factors underpinning the expansion of credit to the economy. A first factor is the improvement of risk management, which eases the evaluation of innovative projects. Second is the increase in monitoring activity, which helps banks to follow new projects with limited or no track records. A third and final factor is the reduction in contracting costs, which constrain the spread of more complex financial contracts. The link between these three factors and investment in intangible assets has been found by recent economic research.

Figure 3

Intangible assets and financial markets during the crisis

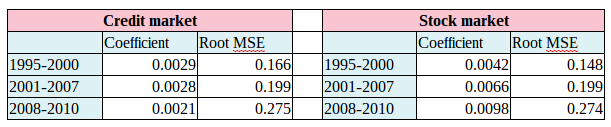

How did the crisis affect the relationship between financial markets and the level of investment in intangible assets? Figure 3 lends some support to the hypothesis that credit markets became less efficient in supporting innovative investment: this seems apparent from the higher dispersion observed around the fitted lines in the crisis panel with respect to pre-crisis panels. To clarify this result, Table 1 displays coefficient and the Root Mean Squared Error (a measure of dispersion around the supposed relationship) for each period’s regression: lower effects and wider dispersion point to a weaker link between investments in intangible assets and credit markets [5]. The varying response of credit markets to the crisis can be detected by comparing countries with similar performances before the crisis but very different performances after the crisis (for example, one could look at the before-after for Portugal and Ireland). The records of the stock markets – also displayed in Table 1 – show a less precise relationship but a stronger effect. The general result seems particularly sensitive to data from the US and UK: if these countries are omitted, the equity/intangibles relationship looks much more similar for the periods under consideration.

Table 1

Policy implications

No matter how difficult it is to develop intangible assets, it has become clear that they are the key to growth in the knowledge economy. Together with the crucial support of capital, one surprising source of support might be the credit market. The crisis has possibly altered this link, not only by drying up credit but also by making credit markets less efficient in supporting innovation. This is especially bad news for Europe, which already lags behind the US in terms of the development of its capital markets and is, conversely, heavily dependent on its credit markets. What could be done? While healing the European banking sector remains a priority for the economy as a whole, governments should go beyond the usual innovation subsidies and encourage intangible-collateralised debt, or support public-private partnerships to act as venture capital funds.

Special thanks go to Giuseppe Daluiso and Alessio Terzi for their useful comments.

***

[1] On the other hand, the stock market euphoria for tech companies, as exemplified by the super-expensive acquisition of Whatsapp by Facebook, is raising concern about a bubble.

[2] To describe the diverse forms of cumulated spending in knowledge creation, economists use the concept of intangible assets: together with software and R&D spending – part of the so-called computerised information and innovative property components – intangible assets also include expenditure on firm-specific human capital and organisational know-how, under the heading economic competencies.

[3] The investment data covers the market sector (NACE sectors A through K, excluding real estate, plus sector O).

[4] In the figure, the US stands out as an outlier, possibly owing to the way private credit is computed by the World Bank, which might leave securitised products aside. The fitted lines are calculated without US data.

[5] Results and interpretation are robust if the UK, which might be seen as an outlier, is excluded.