A needle in a haystack: key terms in official Troika documents

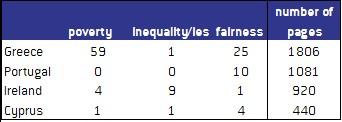

The term “poverty” is essentially absent from Commission documents, except for Greece, where conditionality became increasingly detailed with time and

This blog provides an empirical account of evolving Troika conditionality based on the counting of certain key terms in more than 4000 pages of official financial assistance documents. Fiscal consolidation is clearly the focus of conditionality, but also structural reforms were (more or less) extensively discussed. Privatisations were widely discussed in the programme for Greece and Portugal and, in the former case, this was increasingly the case as the programme progressed. In Ireland, privatisations were not a focus of conditionality. The term “poverty” is essentially absent from Commission documents, except for Greece, where conditionality became increasingly detailed with time and Commission documents are by far the longest compared to those of other programme countries.

Following four months of inquiry, the European Parliament is set to discuss and vote on two resolutions: (i) regarding the Troika and its operations, and (ii) on Troika-inspired reforms and their impact on employment.

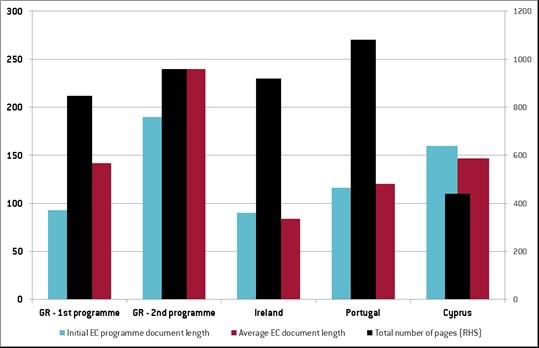

The report on the committee's inquiry into the workings of the Troika, drafted by Othmar Karas (EPP, AT) and Liem Hoang-Ngoc (S&D, FR), criticizes among other things how the Troika took a "one-size fits all" approach, without paying due consideration for differing circumstances in different programme countries. However, due to the detailed nature of conditionality and the copiousness of European Commission documents (without considering the parallel IMF reports), it is very hard to assess whether programmes were broadly framed in different ways, on what issues the attention of the Troika was directed, and how this attention shifted in time, as macroeconomic developments evolved. In Greece alone, the Commission staff produced over 1800 pages, in which it discussed the programme developments and its evolving conditionality.

Figure 1. Number of pages in the adjustment programme documents of the European Commission

Source: Sapir et al. (2014)

In a report we recently wrote for the European Parliament, together with André Sapir and Carlos De Sousa, we produced in-depth tables looking at the major measures requested by the Troika as part of financial assistance conditionality for Greece, Portugal, Ireland, and Cyprus. However, building on techniques extensively used by the political science literature (see for example, Laver, Benoit and Garry; 2003), we also took an innovative approach and looked at the frequency with which certain key words appeared in the programme documents produced and published by DG ECFIN of the Commission. Such a technique, although with severe limitations, allows to grasp trends and have a simplistic – and yet telling – overview of the different programmes’ articulation.

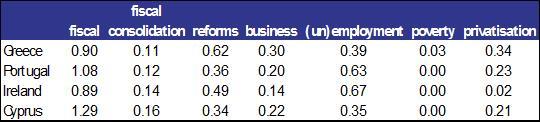

In order to get an idea of where the Troika was focusing its attention, we look at the recurrence of selected terms in Commission documents for the four programme countries. As can be seen in Table 1 below, the term “fiscal” was most used for Cyprus, followed by Portugal (mentioned once per page, on average), while in Greece and Ireland the frequency was almost the same (0.8 times per page). “Privatisation(s)”, on the other hand, received large attention in Greece and almost none in Ireland. Across the board, poverty went largely undiscussed, if not in Greece – where the problem recently became so acute it could not be avoided.

Table 1: Selected terms frequency in Commission programme documents

Note: The term “business” was chosen to cover such expressions as “creating new business opportunities”, “simplified set of business tax accounting rules”, “business environment”, and, creating favourable investment conditions.

Source: Sapir et al. (2014)

Table 2: Word count in Commission programme documents

Source: Sapir et al. (2014)

But how did the extent and focus of conditionality change?

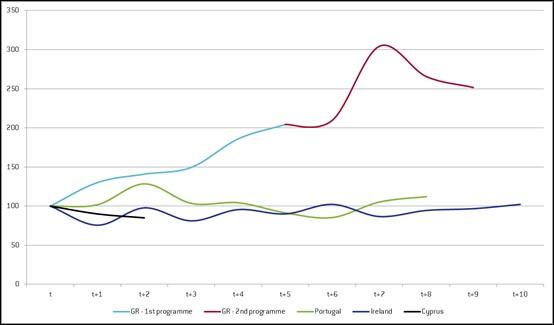

In Pisani-Ferry, Sapir and Wolff (2013), it was reported based on stakeholder interviews that conditionality in Greece became increasingly detailed, as the Troika realised that implementation of conditionality was not working, in part because of the lack of specific guidance to a weak public administration. This is confirmed when taking the number of pages of the Commission programme documents as a proxy for level of detail of conditionality: among the four countries, Greece is the only one to display an unmatched explosion in the page count.

Figure 2: Normalised number of pages of Commission programme documents

Note : t corresponds to the first programme document, t+1 to the first review, and so on.

Source: Sapir et al. (2014)

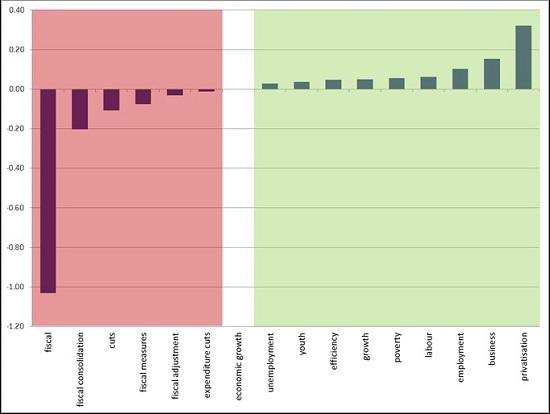

In Greece a shift in tone between the first and the second adjustment programme, from “austerity”- to “growth”-related terms is visible and made tangible by our technique (see Figure 3). Moreover, increasing attention was devoted to privatisations, corroborating the findings of Pisani-Ferry et al. (2013).

Figure 3: Change in term frequency between the first and the second programme for Greece

Note: the comparison is between the First Adjustment Programme for Greece (European Economy, n61) and the Second Adjustment Programme for Greece (European Economy, n94). The vertical axis indicates how many times more (or less) the term is used per page count in the second programme in comparison with the first.

Source: Sapir et al. (2014)

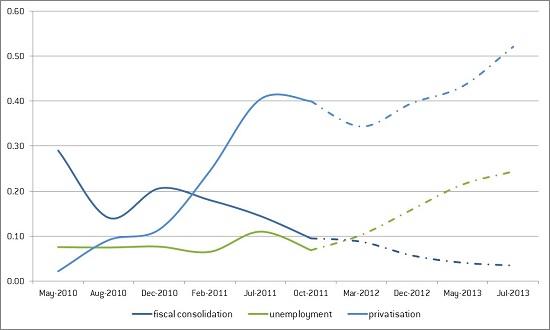

These trends are confirmed when tracking selected terms across all official programme documents. As shown in Figure 4 (below), whereas the attention devoted to privatization(s) soared through time, and (un)employment was increasingly discussed – especially in the second programme – the focus of fiscal consolidation languished.

Figure 4: Term frequency in Commission programme documents for Greece

Note : Dotted lines represent documents belonging to the Second Adjustment Programme for Greece.

Source: Sapir et al. (2014)

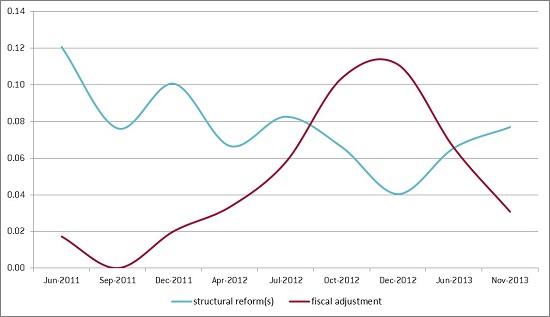

A recent similar shift in tone can be observed in Portugal, where the terms “structural reform(s)” and “fiscal adjustment” took almost a specular path.

Figure 5. Term frequency in Commission programme documents for Portugal

Source: Sapir et al. (2014)

It goes without saying that our empirical approach has several caveats, as it does not account for the position of words within the text, for their exact use within a sentence, and does not test statistically the changes in conditionality focus. The devil, as they say, remains in the details – lost, in this case, in over 4000 pages of official documents.