Blogs review: More inequality, same mobility

What’s at stake: As President Barack Obama finalizes his sixth State of the Union address – which is expected to focus on “the problem […] that a

What’s at stake: As President Barack Obama finalizes his sixth State of the Union address – which is expected to focus on “the problem […] that alongside increased inequality, we’ve seen diminished levels of upward mobility in recent years” (see our previous coverage of his Dec. 4 Center for American Progress speech) – the big economic news in the blogosphere came from a new study by Harvard’s Raj Chetty and Nathaniel Hendren, UC Berkeley’s Patrick Kline and Emmanuel Saez, and the U.S. Treasury Department’s Nicholas Turner, which shows that intergenerational income mobility, although low, has not diminished despite the increase in income inequality.

Upward mobility has not declined

David Leonhart writes that the odds of moving up — or down — the income ladder in the United States have not changed appreciably in the last 20 years, according to a large new academic study that contradicts politicians in both parties who have claimed that income mobility is falling. The new study, based on tens of millions of anonymous tax records, has the potential to alter the way Mr. Obama and other public figures talk about mobility trends. Democrats make the case that the affluent are choking off opportunity from others, and Republicans contend that a large, intrusive government is the culprit.

Raj Chetty, Nathaniel Hendren, Patrick Kline, Emmanuel Saez, and Nicholas Turner write that contrary to the popular perception, we find that percentile rank-based measures of intergenerational mobility have remained extremely stable for the 1971-1993 birth cohorts. For example, the probability that a child reaches the top fifth of the income distribution given parents in the bottom fifth of the income distribution is 8.4% for children born in 1971, compared with 9.0% for those born in 1986. David Leonhart writes that to compare their results to those for earlier decades, the authors report that a previous study of children born from 1952 to 1975 — by Chul-In Lee and Gary Solon — found broadly similar and steady levels of mobility. Taken together, the studies suggest that rates of intergenerational mobility appeared to have held roughly steady over the last half-century.

Jared Bernstein writes that it’s surprising for this stability to be labeled a surprise, or, as the WSJ puts it, a finding that “muddles the debate” on mobility or inequality since the conventional wisdom among economists is that is has neither decreased nor increased.

Inequality and mobility: A challenge to the Great Gatsby curve

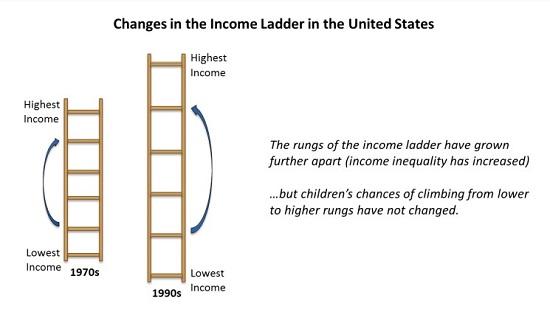

Raj Chetty and al. write that a useful visual analogy is to envision the income distribution as a ladder, with each percentile representing a different rung. The rungs of the ladder have grown further apart (inequality has increased), but children’s chances of climbing from lower to higher rungs have not changed (rank-based mobility has remained stable).

Source: Raj Chetty and al.

Raj Chetty and al. write this result may be surprising in light of the well known cross-country relationship between inequality and mobility, termed the “Great Gatsby Curve” by Krueger (2012). However, much of the increase in inequality has come from the extreme upper tail (e.g., the top 1%) in recent decades, and top 1% income shares are not strongly associated with mobility across countries or across metro areas within the U.S. (Chetty et al. 2014).

Jared Bernstein writes that the widening of the income distribution requires an increased rate of mobility to move from say the 10th to the 50th percentile. In this regard, stable mobility amidst increasing inequality poses its own challenge. You’re no more or less likely to move up and down the income scale relative to your birth cohort, but the distance between you and those above and below you is a lot greater. Part of the higher mobility in low-inequality countries is a function of lower inequality itself. It’s easier to move up and down the income scale when “up” and “down” are shorter trips.

An alarming level of opportunity

Matthew Yglesias writes that the old old conventional wisdom on this was that the United States might be a society of high income inequality, but at least it had a lot of mobility. Then the new old conventional wisdom became that this was wrong – that in international comparisons more egalitarian countries (the Nordics) had more mobility, so as America has become more unequal we've also become less mobile. Now today we get the new conventional wisdom, which says that America is a low-mobility country but has been this way for a while.

Matthew Yglesias reports that the research of UC–Davis economic historian Gregory Clark shows that economic mobility is low almost everywhere. He reaches this conclusion with a different research method that lets him explore much longer-term trends than most of the research you see on this. One notable example is his research on Sweden. It used to be that Sweden created new noble titles and new noble houses, but that process ended in the 17th century. So if you have a noble surname in Sweden today, we know that your father's father's father's father's father's father's father (or whatever) was a member of the Swedish elite more than 300 years ago. By contrast, if you have the last name "Andersson" then that means that your great-great-great-great-great-great-great-great-great-grandfather wasn't a nobleman and probably didn't practice a skilled trade either. That's why he wound up with the generic surname. So we can look at the present-day incomes of people with noble surnames and compare them to the present-day incomes of people named "Andersson" and get a picture of the long-term persistence of the noble/Andersson class gap.

The geography of the American dream

Matthew O’Brien writes that it's a little deceiving to talk about "our" mobility rate. There isn't one or two or even three Americas. There are hundreds. The research team of Raj Chetty, Nathaniel Herndon, Patrick Kline, and Emmanuel Saez looked at each "commuting zone" (CZ) within the U.S., and found that the American Dream is still alive in some parts of the country. Kids born into the bottom 20 percent of households, for example, have a 12.9 percent chance of reaching the top 20 percent if they live in San Jose. That's about as high as it is in the highest mobility countries. But kids born in Charlotte only have a 4.4 percent chance of moving from the bottom to the top 20 percent. That's worse than any developed country we have numbers for.

Kevin Drum writes that mobility is highest in the Midwest, followed by the Northeast and the Pacific Coast. The authors find that there are five main factors that are associated with higher mobility: High mobility areas have (1) less residential segregation, (2) less income inequality, (3) better primary schools, (4) greater social capital, and (5) greater family stability.