Blogs review: The minimum wage debate redux

What’s at stake: US President Barack Obama included a raise the minimum wage in last year’s budget in an effort to fight inequality and alleviate

What’s at stake: US President Barack Obama included a raise the minimum wage in last year’s budget in an effort to fight inequality and alleviate poverty, but was unsuccessful in securing its passage. Following his recent speech on inequality and upcoming mid-term elections, Democrats appear determined to redouble their efforts in 2014 to fight for this measure at the Federal level (where the current Democratic bill would raise to $10.10/ hour by 2016), as well as at the State level.

The minimum wage as a national and local priority for 2014

Jonathan Martin and Michael Shear write that Democratic Party leaders, bruised by months of attacks on the new health care program, have found an issue they believe can lift their fortunes both locally and nationally in 2014: an increase in the minimum wage. In a series of strategy meetings and conference calls among them in recent weeks, they have focused on two levels: an effort to raise the federal minimum wage, which will be pushed by President Obama and congressional leaders, and a campaign to place state-level minimum wage proposals on the ballot in states with hotly contested congressional races.

James Politi reports that with the changes taking effect in 2014, 21 states will have minimum wages above the federal threshold of $7.25 an hour. Some cities are going further, with Washington DC, San Francisco and San Jose among those already approving increases to the salary floor above $10 per hour. In SeaTac, outside Seattle in the Pacific Northwest, local authorities recently approved a minimum wage increase to $15 per hour.

The level of the real minimum wage

Laura Tyson writes that adjusted for inflation, today’s federal minimum wage of $7.25 per hour is 23% lower than it was in 1968. If it had kept up with inflation and with average productivity growth, it would be $25 per hour. At the current minimum wage, a worker employed full-time for a full year earns only $15,080 – 19% below the poverty line for a family of three. About 30 million workers would benefit from an increase in the minimum wage to $10.10 per hour, as proposed by Congressional Democrats. Of these, 88% would be at least 20 years old (with an average age of 35); 55% would be working full-time; 56% would be female, and more than 28% would be parents.

Greg Mankiw writes that advocates of a higher minimum wage like to note that the current minimum wage, adjusted for inflation, is low by historical standards. That is true but beside the point. Because the earned-income tax credit has grown over time, the minimum wage is increasingly less relevant.

The minimum wage as a tax on firms that hire low-wage workers

Greg Mankiw writes that raising the minimum wage is the equivalent of subsidizing the incomes of low-wage workers, but financing the subsidies by taxing those companies that hire low-wage workers. If we decide as a nation that we want to augment the income of low-wage workers, it seems only right that we all share that responsibility. Raising the minimum wage concentrates the cost of the wage subsidy on a small subset of businesses and their customers. There is no good reason this group has a special obligation to help those in need.

Jared Bernstein writes that when these firms hire workers low-wage employers are not engaging in philanthropy. They hire the workers they need to maximize profits given demand and the relevant costs they face, like labor and capital. Mankiw may think that because of the existing minimum wage, they’re paying above what the market would dictate. But that’s actually a key point of the minimum wage: the bargaining power of low-wage workers is so weak that Congress steps in to offset a “market wage” that risks being unfairly low.

Dean Baker writes that Mankiw's EITC option has the middle class paying more through higher taxes, while the minimum wage route has much of the cost being met through lower corporate profits and greater efficiency. This distributional impact should be front and center on the table.

The minimum wage and the worst off

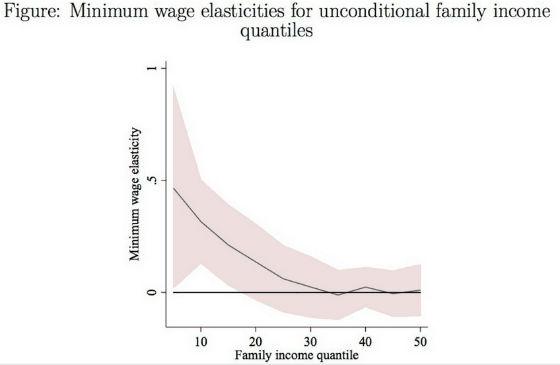

Mike Konczal writes that opponents of a higher minimum wage focus on the idea that it largely won’t benefit the worst off. However, as the figure below illustrates, a higher minimum wage will lead to a significant boost in incomes for the worst off in the bottom 30th percent of income, while having no impact on the median household.

Source: Arindrajit Dube

Laura Tyson writes that inequality of market income before taxes and transfer payments in the US is similar to that in many other developed countries, including those with egalitarian reputations like Sweden and Norway. Britain and even Germany have higher inequality of income before taxes and transfers than the US. Among developed countries, the US does have the most unequal distribution of disposable income after taxes and transfer payments. That is not because the US has the least progressive tax system; indeed, its tax system is considerably more progressive than those of most European countries, Canada, and Australia, all of which rely on regressive value-added taxes as an important source of revenue. But, among developed countries, the US has the least generous and progressive transfer system.