TPP participation gives Japan a bargaining chip in trade negotiations

Several important economic partnership agreements have moved into the process of trade negotiations for Japan this year. Although the macroeconomic ef

Several important economic partnership agreements have moved into the process of trade negotiations for Japan this year. Although the macroeconomic effects of tariff reduction are not large for Japan, the effects of trade and investment facilitation through the agreements can be substantial. As Japan has a bargaining chip to use in these trade negotiations, there is no need for the country to retreat from the negotiations.

Effect of agreements on the Japanese macroeconomy

Japan this year has started negotiations on four economic agreements — free-trade agreements (FTAs) and economic partnership agreements (EPAs) (Table 1). If Japan can succeed in concluding these agreements within a few years, it will achieve the government’s target of realising a ‘trade FTA ratio above 70 percent by 2018’ and be connected via EPAs with countries that have a 72 percent share of world GDP.Japan's National Institute for Research Advancement (NIRA), along with Chinese and Korean think tanks, has estimated that Japanese GDP would increase by about 0.3 percent because of the China-Japan-Korea trilateral FTA (CJK-FTA). In another study on the Regional Comprehensive Economic Partnership agreement (RCEP) for East Asia, NIRA shows that the agreement would increase Japanese GDP by 0.22 percent. The Japanese government estimates that tariff reduction through the Trans-Pacific Partnership agreement (TPP) would increase the country’s GDP by approximately 0.66 percent. In addition, a study by Petri and Plummer (2012) shows that when the Free-Trade Area for Asia and the Pacific (FTAAP), which includes both TPP and RCEP, is completed, it would boost Japan’s GDP by 4.27 percent.

In fact, tariff reductions through FTAs/EPAs would not have much effect on Japan because the country already has lower tariff rates with the countries in the negotiations. According to NIRA’s estimates on the effect of RCEP (0.22 percent increase in Japan’s GDP), for example, tariff reduction would increase the country’s GDP by only 0.03 percent. On the other hand, trade facilitation could have a greater effect on Japan. This effect includes the reduction of costs because of smoother procedures for exports/imports and adoption of uniform or harmonised trade and business rules, facilitating the efficiency of business activities by optimising supply chains throughout Asia (by introducing the Cumulative Rules of Origin[1] among the member countries and harmonising the relevant rules and regulations), and increasing foreign direct investment in Japan through deregulation or by preferential treatment of member countries' investments.

While EPAs contribute to the member countries’ economy by boosting trade and investment, as described above, a country that does not participate in the agreements will face negative impacts on its economy because it will not only lose an opportunity to increase its GDP but also suffer from a decrease in exports to the countries in the agreements (after concluding the agreement, parties would tend to import more from other parties than from non-parties because of the reduced costs). According to Petri and Plummer (2012), China and the EU (both outside the TPP) would experience a fall in GDP by 0.27 percent and 0.02 percent, respectively, in 2025 if the TPP is concluded. Furthermore, EU GDP would fall by 0.14 percent if the FTAAP is completed. If Japan withdraws from the TPP negotiations and the FTAAP becomes effective thereafter, the Japanese economy would suffer from it, just like the economies of China and the EU.

Chain reactions spreading to other FTA talks

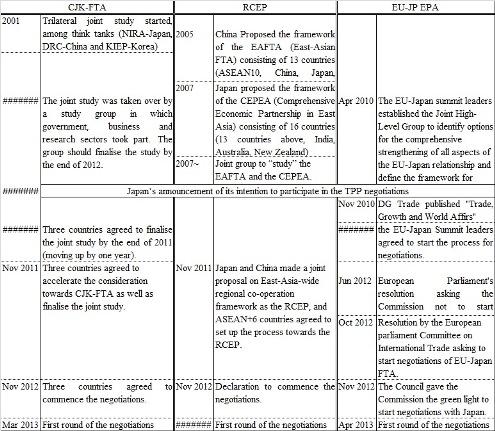

As soon as Japan announced its intention to participate in the TPP negotiations, there was an encouraging movement towards the negotiations of the CJK-FTA and framework of the East-Asia–wide economic partnership. As seen from Table 2, joint study was conducted until 2010 for both cases but there had been no progress towards negotiation. The situation changed after the announcement of Japan’s intention to participate in the TPP negotiations in October 2010. The countries agreed to accelerate negotiations, and China, Japan and Korea started the CJK-FTA negotiation in March this year, and the RCEP negotiations in May this year. This means that the announcement of Japan’s intention to participate in the TPP negotiations generated a ‘chain reaction’ that led to other trade negotiations.

This chain reaction has not only spread to other negotiations in the Asia and the Pacific regions. Itoh (2012) notes a comment of a Japanese government official responsible for trade that Japan’s announcement of its intention to participate in the TPP negotiations resulted in a change in the attitude of the EU. The EU and ASEAN have suspended their negotiations on region-to-region FTAs, and we see no sign of the EU and China starting negotiations on an FTA. On the other hand, Japan has been trying to deepen its economic relationship with Asia and the Pacific region by participating in negotiations on the TPP and by making use (consciously or unconsciously) of the chain reaction. In such a situation, the EU would believe that strengthening its trade relationship with Japan would provide an ideal opportunity to maintain its influence in Asian markets by developing its relationship with Japan before the TPP and RCEP are concluded. In fact, DG Trade published the new strategy for trade in November 2010 (one month after Japan’s announcement) and assessed that “Japan is eagerly seeking economic integration with its main trading partners, including with the EU”. The strategy identified six countries including the US and Japan as strategic economic partners, and at the May 2011 EU-Japan Summit, leaders agreed to start the process of free trade negotiations. Although the European Parliament is reluctant to start free trade negotiations with Japan and asked the Commission in June 2012 not to start the process, the European Parliament Committee on International Trade asked in October 2012 to start negotiations, and the Council gave the Commission the green light to start the negotiations in November 2012. In addition, the chain reaction may also spread to the negotiations between the EU and the US, known as the Trans-Atlantic Trade and Investment Partnership (TTIP), which started in July this year. Petri et al (2013) explain that the expansion of the TPP is a remarkable example of competitive liberalisation that might have also stimulated the launch of the RCEP and the TTIP negotiations. The latest and greater expansion of the TPP is Japan’s participation in the negotiations.

Japan has a bargaining chip that can be used for every trade negotiation

In this way, Asian countries and the EU would think it better to have economic partnership agreements with Japan as long as Japan will continue participation in the TPP negotiations. In other words, the announcement of Japan’s intention to participate in the TPP negotiations has triggered progress on important trade negotiations and has given Japan a bargaining chip that can be used to its advantage in talks on trade negotiations (such as on harmonisation of the rules of trade, investment and business conventions, etc.), not only with Asian countries but also with the EU. The EU also holds a trump card by reserving ‘the right to pull the plug on the negotiations after one year if Japan does not live up to its commitments on removing non-tariff barriers’. Both Japan and the EU should ease the non-tariff barriers between them, but the EU would find it difficult to pull the plug in reality as long as Japan continues participation in the TPP negotiations. If the EU would do so, it would lose the opportunity to boost its GDP by 0.8 percent and create up to 400,000 jobs. In addition, the EU’s GDP would fall by 0.14 percent (Petri and Plummer, 2012) if it fails to maintain influence in Asian markets after the completion of the FTAAP.

Japan would lose its bargaining chip if it decides to withdraw from the TPP negotiations. Once the negotiating countries know that Japan no longer has a bargaining chip, the CJK-FTA negotiations would lose their centripetal force. Fifteen countries would no longer need Japan’s initiative, or would feel reluctant to ask Japan to take the initiative in concluding the RCEP. However, the EU would be in a better position to ask Japan for concessions in EPA negotiations, because the situation in which there is the RCEP but not the TPP would ‘increase’ the EU’s GDP by 0.02 percent (according to Petri and Plummer), and because it could be worth believing that Japan and the US will no longer enter into another economic partnership agreement instead of the TPP. Besides, the threat to ‘pull the plug’ would no longer be an empty threat. If the TTIP is concluded in such a situation, the standard rules of trade, investment, and business conventions would be initiated by Europe and the US without referring to the Japanese terms. This could make it more difficult for Japanese companies to operate in Europe and the US.

There is still strong opposition to the TPP in Japan. However, the TPP negotiations have room for the treatment of sensitive individual goods and services. Disproving a rumour that was widespread before Japan entered the talks, the TPP negotiations may not be a platform of choice on whether two parties like ‘to participate or to exit’. Continued participation in the TPP negotiations is a bargaining chip which can also be used for the TPP negotiation itself, because of the chain reaction with other negotiations. This bargaining chip would make it easier for Japan to realise the Japanese prime minister’s intention to “press forward assertively in areas where we should, while also protect what must be protected” in negotiations. In short, it is indispensable and advantageous for Japan to remain at the table for the TPP negotiations, and to compensate those who are affected by the agreement and to implement the necessary structural reforms of relevant sectors.

[1] Cumulative Rules of Origin (CRO) is a treatment typically seen in multilateral free-trade agreements. FTAs/EPAs in general prescribe the bottom line of the ratio of product of origin when using the preferential customs rate, and the CRO allows accumulating the proportion of the product of origin gained in more than two countries as long as the countries are bound by the same agreement.

Table 1: List of the major economic partnership agreement negotiations for Japan

(*) Japan entered the negotiation talks.

(note) Figures are as of 2012.

(source) Ministry of Foreign Affairs, Japan (website), United Nations Comtrade Database, IMF World Economic Outlook Database October 2013.

Table 2: Chain reactions of the CJK-FTA and RCEP

The original version was released in Japanese by National Institute for Research Advancement on 24 October, 2013.

Akio Egawa is senior researcher at NIRA, Japan / former visiting fellow at Bruegel.