The German trade surplus may widen with the euro-area recovery

An increased demand for German exports may well lead to an increased overall German trade surplus, unless German domestic demand increases significant

The German current account surplus has given rise to much controversy following the recent US Treasury report, which criticised Germany for its persistent surplus (see yesterday’s Bruegel Economic Blogs Review). Let me contribute to the debate by showing two charts on German and Spanish trade developments, which suggest that the German trade surplus may widen further when the euro area’s cyclical position improves.

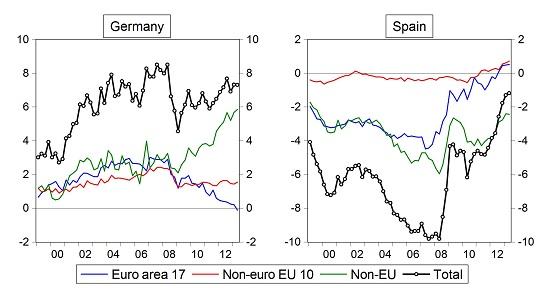

Bilateral current account balances between countries are generally not available, but bilateral trade balances of goods are, which account for a significant portion of the current account balance in Germany and Spain. Here is the geographical composition of the trade balances of Germany and Spain:

Chart 1: German and Spanish trade balances with different regions (% GDP), 1999Q1-2013Q2

Sources: Monthly seasonally adjusted trade balances of goods: Eurostat (“Member States (EU27) trade by BEC product group since 1999 [ext_st_27msbec]”). GDP: Annual current price GDP: AMECO.

Note: We converted monthly trade balances and annual GDP figures to the quarterly frequency. Before calculating the trade balance/GDP ratio, we filtered the GDP series with the Hodrick-Prescott filter (with smoothing parameter 1). Thereby, short-term fluctuations in GDP do not impact the trade balance/GDP ratio we report. In a post last year I showed an earlier version of this chart using annual data up to 2011.

By 2013, Germany’s trade surplus and Spain’s trade deficit with the rest of the euro-area have been eliminated (Spain has a small surplus with the euro area now). At the same time, Germany could increase her surplus with non-EU countries, which helped to keep the overall trade surplus at a high level. The big question is the cause of this increased surplus with non-EU countries: was this just the result of a substitution away from the euro area to the rest of the world at a time when demand in the euro area plummeted? Or has weak German domestic demand played a major role?

A well specified macroeconomic model could help to answer this question, yet we can get an intuition by plotting German export and import data.

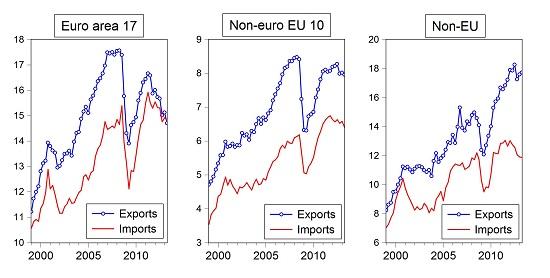

Chart 2: German exports to, and imports from, different regions (% GDP), 1999Q1-2013Q2

Source: see at the previous chart.

With respects to euro-area partners, both German exports and imports have declined significantly during the past three years, reflecting the falling demand in the euro area. With respect to the ten EU countries outside the euro area, there was a small decline in both exports and imports during the past three years, yet it is remarkable that the German trade balance as a percent of GDP has not much changed during the past 5 years, as indicated by the first chart. The economic situation in these ten countries was diverse (e.g. compare the UK and Poland), but on average was somewhat weak, though not as much as in the euro area.

The most interesting panel is the third one, which shows that German exports to countries outside the EU have increased rapidly, but German imports from these countries have fallen recently. This suggests that weak German demand should have played a role.

Going forward, there is a risk that the German trade surplus may widen further. As highlighted by Wolfgang Münchau in the FT, the IMF concluded in its recent World Economic Outlook (see Box 1.3) that cyclical factors explain a significant share of the current account reversals in vulnerable euro-area members and their “current account deficits could widen again significantly when cyclical conditions, including unemployment, improve, unless competitiveness improves further.” The three Baltic countries may provide examples: these countries went through a much faster economic contraction (accompanied by a rapid move from double-digit current account deficits to current account surpluses), but as they started to recover, their current account surpluses turned to (small) deficits. A re-emergence of current account deficits in southern euro-area members, which would be reflected in their worsened trade balances, should be filled with foreign supply of goods and services. Germany is of course a major candidate to fill such a gap, due to geographical closeness and trade links. An increased demand for German exports may well lead to an increased overall German trade surplus, unless German domestic demand increases significantly.