Looking ahead at the Commission's imbalances report

The European Commission will release the analysis of its macroeconomic scoreboard on November 15. However, most of the indicators are already availabl

The European Commission will release the analysis of its macroeconomic scoreboard on November 13. However, most of the indicators are already available through Eurostat. In this post, we discuss the broad macroeconomic trends that are likely to be detected by this early-warning procedure.

The Macroeconomic Imbalances Procedure (MIP) was introduced in autumn 2011 as a response to the economic and financial crisis. As part of the ‘six-pack’, the MIP aims to reinforce the surveillance of national macroeconomic policies in the EU and the euro area. The MIP is articulated in 3 steps: i) an early identification of countries presenting potential severe imbalances for which further economic analysis is deemed necessary, ii) the in-depth review (IDR) for the countries identified, and, iii) were excessive imbalances to be confirmed, the decision to open an Excessive Imbalances Procedure, implying corrective action plans and potential sanctions[1].

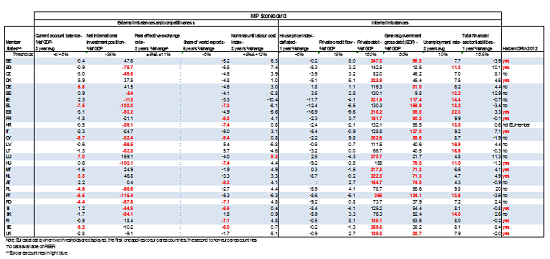

The 2014 MIP is expected to be launched this week with the European Commission’s release of the so-called Alert Mechanism Report (AMR) on November 13th. This early warning system is based on a macroeconomic scoreboard. The scoreboard, as devised by the European Commission services, consists of a set of eleven indicators (i.e. current account balance, net international investment position, real effective exchange rate, export market shares, unit labor costs, house price index, private sector debt, private sector credit flow, general government sector debt, unemployment rate and total financial sector liabilities) and fixes threshold that are supposed to provide “a reliable signaling device for potentially harmful imbalances and competitiveness losses at an early stage of their emergence”[2]. Throughout the year Eurostat updates the relevant national data and makes them partially available.

A comparison with the (revised) 2011 MIP scoreboard allows to detect some interesting trends. Unsurprisingly, given the recession, current account deficits have been broadly correcting across the EU, with Latvia as a notable exception. However, one-sided adjustment might translate in an increasing number of countries being put under observation for excessive surpluses: Luxembourg, The Netherlands, Sweden, and Germany. In this regard, it is worth noting that last year Germany avoided breaking the +6% threshold by 0.1 p.p., only to see the figure later revised to 6.1%.

Like last year, more than half (16) of the EU28 countries display largely imbalanced net international investment profiles. However, this statistic should be interpreted with due care, as it is subject to large revisions: Luxembourg’s net position was corrected by roughly 30p.p. of GDP last year. This also suggests it might not be a great metric for advanced warnings, notwithstanding its importance.

MIP Scoreboard (2012)

On top of illustrating how the correction of labour costs is progressing, the MIP scoreboard displays some notorious EU-wide problems, as the rising unemployment, and the over-indebtedness of households and governments, with half of the EU28 countries breaching the threshold in this respect. Unemployment (3 year average) has worsened in a majority of countries, with Spain and Croatia recording the highest score increase as compared to 2011.

[1] If, following the in-depth review, the gravity of imbalances is deemed to be low, the MIP allows the EC and the Council to adopt preventive recommendations in the context of the European semester (the so-called preventive arm).

[2] Cf. European Commission, Scoreboard for the surveillance of macroeconomic imbalances, European Economy | Occasional Papers | February 2012, p.4