Easing now or later?

There is almost no doubt that the ECB will need to loosen up its monetary stance a bit more, the question is when to do so?

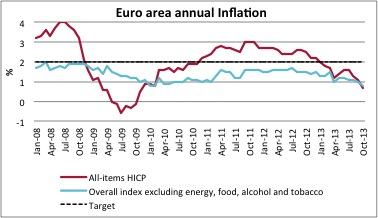

October euro area annual overall inflation is expected to be 0.7% (the lowest in 47 months and down for the fourth consecutive month), while core inflation (excluding energy, food, alcohol and tobacco) is estimated at 0.8%; down from 1.1% and 1.0% in September respectively, according to a flash estimate from Eurostat This is below but far from the 2% target.

Source: ECB

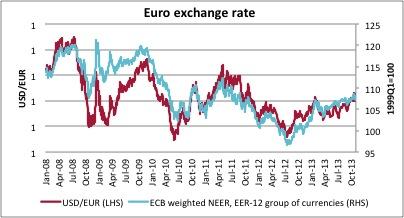

At the same time the euro touched an almost two year maximum against the dollar two weeks ago reaching 1.38 against the dollar (25 months maximum on a weighted basis against its 12 major trading partners[1]); of course the euro is a freely floating currency, thus the resulting loss of competitiveness that weighs on the euro area recovery is not of the ECB’s concern, but an appreciation of the euro puts further downward pressure on inflation as imports become cheaper and there is a pass-through effect.

Source: ECB

Euro area unemployment rate closed at 12.2% in September, GDP growth is expected to contract 0.6% this year and grow by only 1.1% next year, while inflation is expected to close this year at 1.4% and 1.3% in 2014, according to Eurosystem Staff June projections. In this context of sluggish recovery why doesn’t the ECB do more to keep inflation close to the 2% target as its mandate indicates?

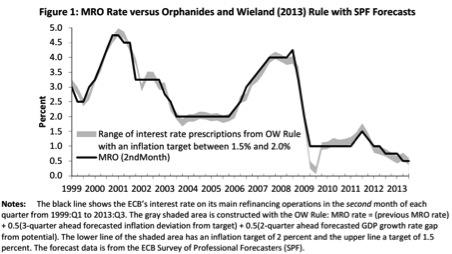

Orphanides and Wieland (2013) developed an interest rate rule that explains with incredible accuracy the ECB’s chosen MRO rates since the beginning of the euro. Using inflation expectations from the latest ECB Survey of Professional Forecasters, forecasted GDP growth from the Eurosystem Staff projections and potential GDP growth from AMECO (as the ECB doesn’t publish its official potential GDP estimations), this interest rate rule suggests that the ECB’s MRO should be between 0.325 and 0.575 to keep annual inflation in the euro area between 1.5% and 2% [2].

Source: Bletzinger and Wieland (2013)

So, if the ECB keeps behaving like it has been doing in the past, the 0.7% inflation in October might not be sufficient to make the ECB staff uncomfortable enough to ease momentary policy a bit more, or at least not for the moment, as inflation expectations are still anchored at 1.5% in the medium term and at 2% in the long term.

The main scenario for most investment banks forecasters is just dovish talk and a rate cut later in December, as more weak data confirms the need for a rate cut.

What are the risks of easing monetary policy in the euro area too late?

If the ECB fails to be aggressive enough this Thursday (and the now usual dovish talk without any immediate action is clearly not going to be enough), the euro is likely to further appreciate and this would put additional downward pressure on prices through cheaper imports and even slower aggregate demand, as European exports would become less competitive in the world markets. This would change expected inflation and growth, forcing the ECB to ease monetary policy later, so it is probably better to do it now and avoid more pain.

If everything is so clear, why is the ECB so reluctant to loosen up its monetary stance a bit more?

There are reasons beyond the usual argument of inflation being just round the corner as few people fear nowadays, but many used to presage when central banks of the advanced economies started using unconventional monetary policy tools at the beginning of the crisis.

The first reason is that the ECB is running out of ammunition in the conventional monetary policy toolkit; cutting the MRO rate once more would be literally hitting the ZLB, only leaving the marginal lending facility rate with some space for further cutting. But as ECB Executive Board member Joerg Asmussen said almost a month ago, they “also have the whole array of non-standard measures left, from the famous LTRO to using reserve requirements to discontinuing the weekly absorption operation”. He also mentioned that the ECB could stop taking weekly deposits to offset money injected into markets via its Securities Markets Programme bond-buying plan.

The second is the broken monetary policy transmission mechanism. Previous rate cuts have proven to be ineffective to bring down borrowing costs where it is most needed (the periphery) because of the non-existence of a banking union and the sovereign-banks linkage, a topic that has been broadly covered in Bruegel’s research. With conventional monetary policy partially effective at most, the ECB could choose to go unconventional this time, with another round of LTRO being a quite popular possibility.

Conclusion

There is almost no doubt that the ECB will need to loosen up its monetary stance a bit more, the question is when to do so? Given the current shape of the economy, the case for keeping the rate unchanged is weak; it would be difficult to argue against a sooner rather than later easing of monetary conditions in the euro area for the sake of faster recovery and price stability.

[1] ECB Nominal effective exch. rate, ECB EER-12 group of currencies (AU, CA, DK, HK, JP, NO, SG, KR, SE, CH, GB, US), changing composition of the euro area against Euro

[2] Updating the Orphanides and Wieland (2013) interest rate rule with the new MRO rate (0.25), the most recent forecasts from the ECB Survey of Professional Forecasters (1.5% inflation one year ahead) and ECB Staff macroeconomic projections (0.9 percent of real GDP growth one year ahead and 0.5 percent of potential GDP growth), give us as result that if the ECB followed the OW rule it would keep the MRO rate between 0.2 and 0.45 percent to keep inflation between 1.5 and 2 percent. We could also interpret from this that given the current conditions the ECB won’t further loose its monetary stance unless another unexpected negative shock (of any kind: real, financial or just agent’s expectations) hits the euro area economy. This does not imply that it will be appropriate not to loosen up the monetary policy a bit more through unconventional monetary policy tools to help the recovery while keeping inflation closer to the target.