Large banks relative to GDP: is there a risk beyond Cyprus?

Are other EU countries with large bank balance sheet relative to GDP also running a risk similar to Cyprus? The answer is no. The major reason for the

Are other EU countries with large bank balance sheet relative to GDP also running a risk similar to Cyprus? The answer is no. The major reason for the banking troubles in Cyprus is the massive losses that the two biggest banks have suffered. But in other euro-area countries with big banking sectors this is not the case, as we show below.

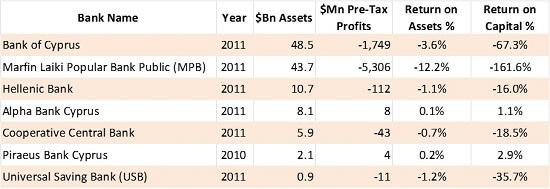

Let’s start with Cyprus. The table below shows the return on assets and equity of the seven largest Cypriot banks in 2011 (and 2010 for one of the banks; more recent data is not available).

Source: The Banker Database

Laiki Bank lost more than $5bn in 2011, which is 12.2 percent of its assets and 162 percent of its equity. This loss is indeed dramatic. Bank of Cyprus lost $1.7bn, which is 3.6% of its assets and 19 percent of its equity in 2011, which are also large figures. However, the returns of the other banks were not that bad, at least in 2011.

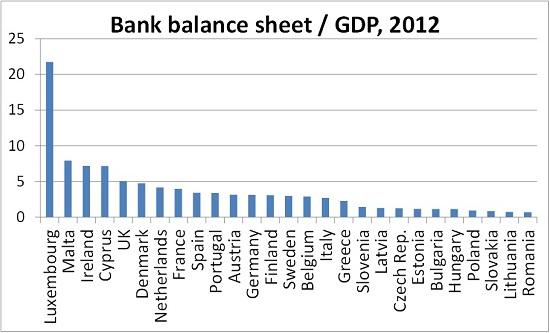

What about other countries? The figure below indicates that compared to Cyprus, Luxembourg has a much larger banking sector relative to GDP, the relative size of banks in Malta and Ireland is similar, and not much smaller in the UK and Denmark. Ireland already has a financial assistance programme, including a programme for restructuring the banking system, so let’s look at the other four countries with large banking sectors relative to GDP.

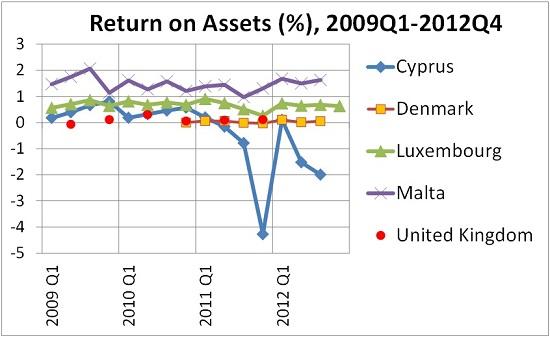

The Figure below shows return on assets of banks. Cyprus is clearly an outlier. Banks in Malta and Luxembourg were rather profitable during the past four years, while Danish and UK banks had close to zero return.

Source: IMF eLIBRARY Data, http://elibrary-data.imf.org/DataExplorer.aspx

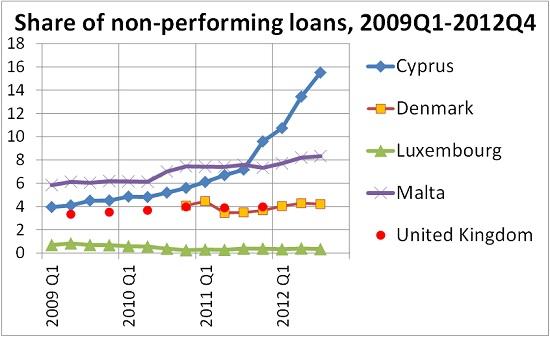

Cypriot banks recorded profits in 2009 and 2010 and their profitability started to deteriorate in 2011. A main reason for Cypriot banks getting into trouble was their exposure to Greece. But the share of non-performing loans also started to skyrocket in Cyprus (see the chart below), suggesting that there are major problems with domestic loans as well. While this share has also increased somewhat in Malta, it is not comparable to the Cypriot problem, and as we pointed out using the previous chart, banks in Malta remained very profitable (how do they do this?). The share of non-performing loans is quite low in Demark and the UK, and almost zero in Luxembourg.

Source: IMF eLIBRARY Data, http://elibrary-data.imf.org/DataExplorer.aspx

Overall, banks in other EU countries with large balance sheet relative to GDP continue to have profits, or close to zero returns, and the current shares of non-performing loans do not suggests that their profitability will deteriorate in the near term. While there is no reason to be complacent, as Cypriot banks were also profitable in 2009 and 2010, but Cyprus is clearly different.