Blogs review: Navigating the open economy trilemma

What’s at stake: The challenge of managing capital flows in and out of emerging countries and the difficulty of transmitting a uniform monetary stance

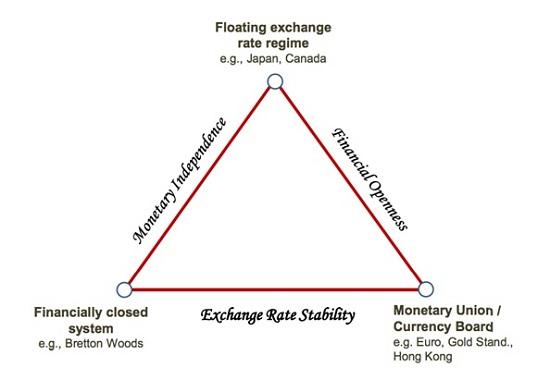

What’s at stake: The challenge of managing capital flows in and out of emerging countries and the difficulty of transmitting a uniform monetary stance across EMU countries have generated renewed interest in the possibility of better navigating the Mundell-Fleming “impossible trinity” of fixed rates, free movement of capital and independent monetary policy. While some authors argue that it depicts an unnecessary restrictive view of the world and that the policy space is, in practice, greater than suggested by the trilemma, others argue that it actually paints a much too rosy picture of the ability of monetary authorities to manage an economy in a world subject the global financial cycles.

Recent challenges to the trilemma

Free Exchange writes that although “the impossible trinity” sounds like new-age theology, it simply posits that an economy can choose at most two of these three: free capital flows, a fixed exchange rate and an autonomous monetary policy. An economy open to free movement of capital can keep a fixed exchange rate, for example, only by subjugating monetary-policy goals to its defense – by raising interest rates sharply, say, when capital outflows put downward pressure on the currency. Yet the trilemma also implies that an economy can enjoy both free capital flows and an independent monetary policy, so long as it gives up worrying about its exchange rate.

Source: Joshua Aizenman and Hiro Ito

Michael Klein and Jay Shambaugh write that the financial trilemma has recently been challenged. Some argue that the policy trilemma depicts too restrictive a view of the world. Governments can 'round the corners' of the triangle representing the policy trilemma with intermediate policies such as softly pegged exchange rates or temporary, narrowly targeted capital controls. Others (see here) attack the policy trilemma from the opposite direction, arguing that it paints too rosy a picture of the ability of monetary authorities to manage an economy.

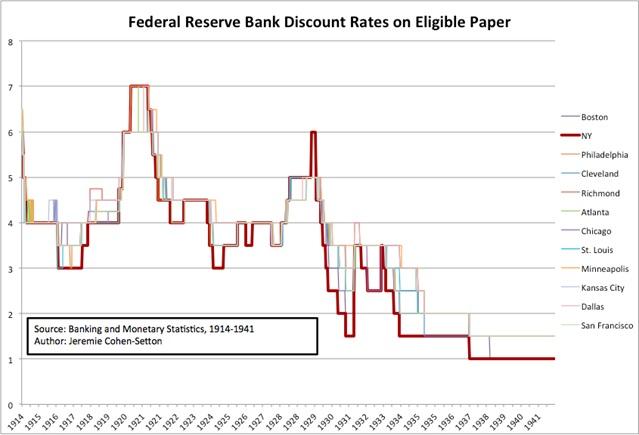

Menzie Chinn notes that the trilemma has made its appearance several times throughout the latest NBER Summer Institute. In Barry Eichengreen's paper on international coordination and crisis management and the Fed, concerns about the balance of payments deficit – implied by attempting to conduct an expansionary monetary policy under fixed exchange rate regime – were noted. In his comments on Eichengreen's paper, Larry Summers explicitly mentioned the constraints imposed by the trilemma.

Interest pass-through predictions of the trilemma

Michael Klein and Jay Shambaugh write that if the peg was fully credible, the risk premium was constant, and there was no time-variation in capital controls, domestic short-term interest rates should move one to one with that of the base country under pegged exchange rates. In other words, the pass-through to pegs should be unity, while the pass-through to pure floats (non-pegs) should be zero.

John Bluedorn and Christopher Bowdler write that while empirical results suggest that exchange rate pegs are associated with constraints on monetary policy, the stronger predictions from the simplest theory of the trilemma, namely that when capital is mobile pass-through to pegs is unity and pass-through to pure floats (non-pegs) is zero, are generally rejected. The difference in interest rate pass-through across pegs and non-pegs, which measures the constraint from pegging, is significantly smaller than this theoretical benchmark. A number of explanations for deviations from unit pass-through to pegs and zero pass-through to non-pegs have been proposed. Obstfeld, Shambaugh, and Taylor (2005) show that narrow target zones for exchange rates (broadly classified as pegs) can induce less than unit pass-through. At the other end of the spectrum, “fear-of-floating” may partially constrain exchange rates under non-pegs, such that pass-through exceeds zero.

Rounding the corners of the trilemma in a monetary union

Harold James writes that a common criticism of monetary union is that it requires a single monetary policy, that thus becomes “one size fits all” and deprives policy-makers of a policy tool in responding to particular national or regional circumstances. When the EC Committee of Central Bank Governors began to draft the ECB statute, it took the principle of indivisibility and centralization of monetary policy as given. But this was not really justified either historically or in terms of economic fundamentals. Think first of the gold standard. A critical part of the gold standard was that individual national central banks set their own interest rates, with the aim of influencing the direction of capital movements. Incidentally the same differentiation of interest rates also occurred in the early history of the Federal Reserve System, with individual Reserve Banks setting their own discount rates. The Eurozone is now moving to a modern equivalent, driven by a new concern with macro-prudential regulation. Bank collateral requirements are being differentiated in different areas.